[ad_1]

Maxxa_Satori

REIT Efficiency

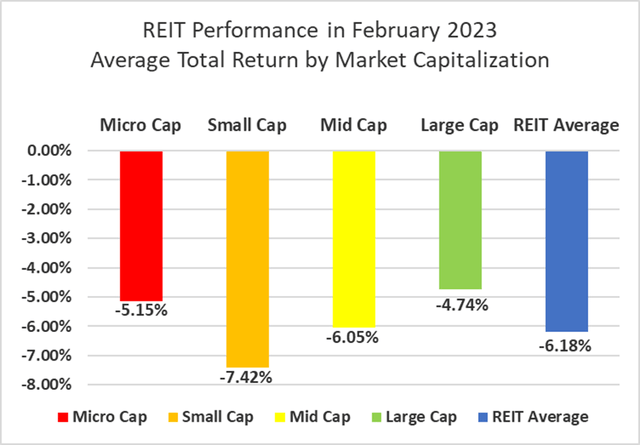

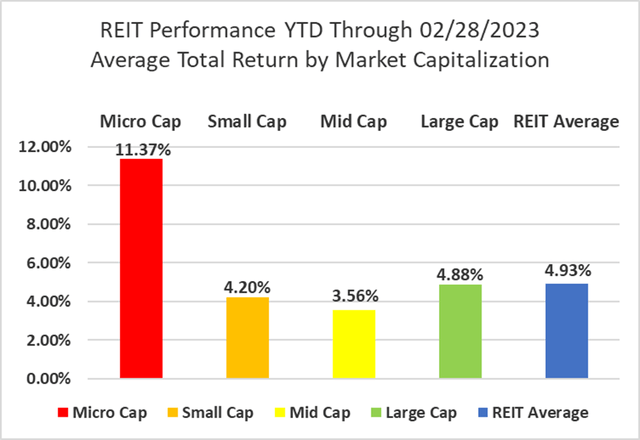

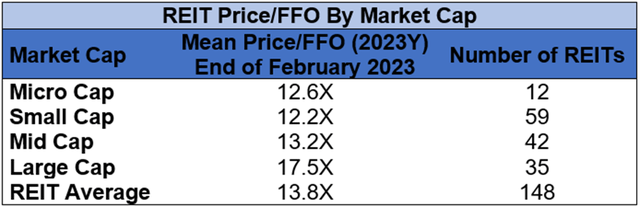

The REIT sector began robust in 2023 with an +11.77% whole return in January, however shortly gave up nearly all of these beneficial properties in February with a disappointing -6.18% return in February. REITs underperformed the Dow Jones Industrial Common (-3.9%), S&P 500 (-2.4%) and NASDAQ (-1.0%). The market cap weighted Vanguard Actual Property ETF (VNQ) had a greater whole return than the typical REIT in February (-5.86% vs. -6.18%), however is underperforming YTD (+3.93% vs. +4.88%). The unfold between the 2023 FFO multiples of enormous cap REITs (17.5x) and small cap REITs (12.2x) narrowed in February as multiples contracted by 0.7 turns for giant caps and 0.2 turns for small caps. Buyers at the moment have to pay a median of 43.4% extra for every greenback of FFO from giant cap REITs relative to small cap REITs. On this month-to-month publication, I’ll present REIT information on quite a few metrics to assist readers determine which property sorts and particular person securities at the moment supply the perfect alternatives to realize their funding objectives.

Supply: Graph by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

There was not a major correlation between whole return and market cap in February. Giant cap (-4.74%), micro cap (-5.15%), mid cap (-6.05%) and small cap (-7.42%) REITs averaged mid single-digit adverse returns. Giant cap REITs (+4.88%) are outperforming small caps (+4.20%) by 68 foundation factors on YTD 2023 whole return.

Supply: Graph by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

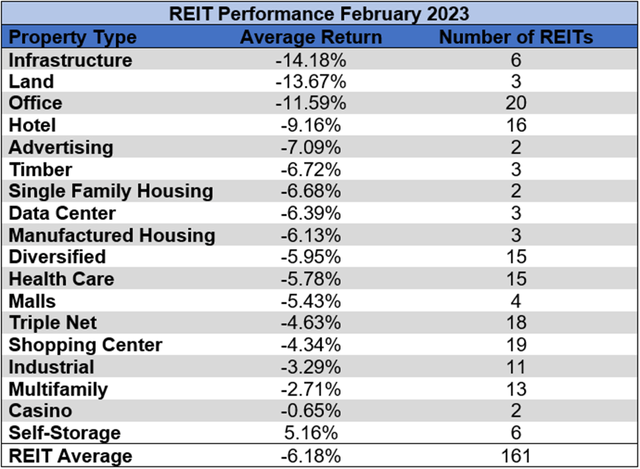

1 out of 18 Property Sorts Yielded Optimistic Complete Returns in February

Solely 5.56% p.c of REIT property sorts averaged a constructive whole return in February, with a 19.34% whole return unfold between the perfect and worst performing property sorts. Self Storage (+5.16%) was the one property kind within the black in February, led by Life Storage (LSI) and International Self Storage (SELF), which achieved double digit whole returns of +11.55% and +10.57% respectively.

Infrastructure (-14.18%), Land (-13.67%) and Workplace (-11.59%) REITs fell the furthest throughout a tough February for REITs. All 20 Workplace REITs completed February in adverse territory and accounted for 4 of the worst 8 performing REITs in February. Franklin Road Properties (FSP) (-21.43%), Hudson Pacific Properties (HPP) (-18.96%), Vornado Realty Belief (VNO) (-18.90%) and Paramount Group (PGRE) (-18.29%) suffered notably giant share value declines.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

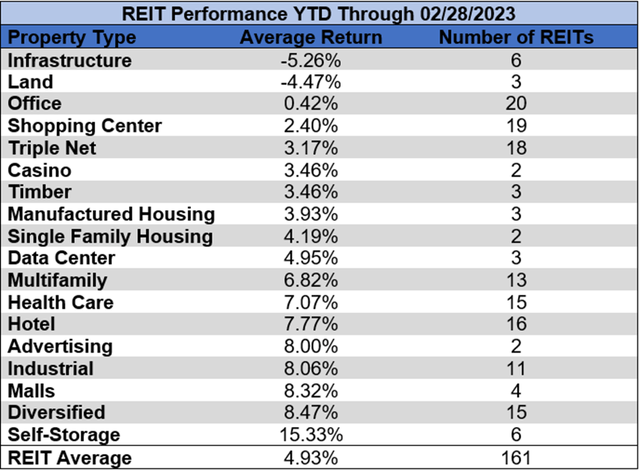

Infrastructure (-5.26%) and Land REITs (-4.47%) have considerably underperformed all different property sorts over the primary two months of the yr and are the one property sorts within the crimson YTD. All different REIT property sorts have averaged beneficial properties YTD led by Self Storage (+15.33%), Diversified (+8.47%), Malls (+8.32%), Industrial (+8.06%) and Promoting (+8.00%).

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

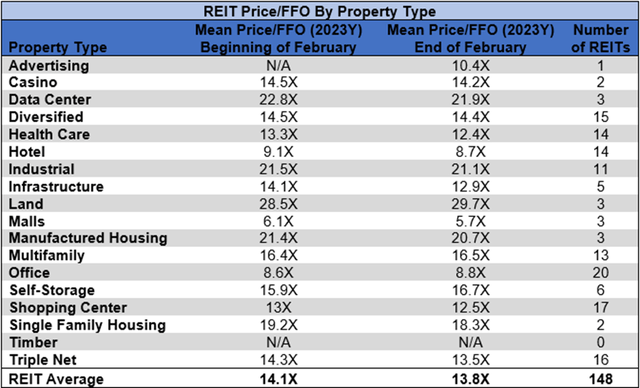

The REIT sector as a complete noticed the typical P/FFO (2023Y) lower 0.3 turns in February (from 14.1x right down to 13.8x). The common FFO a number of expanded for 25% of property sorts and contracted for 75%. There aren’t any latest 2023 FFO/share estimates for any of the Timber REITs. Land (29.7x) Information Facilities (21.9x), Industrial (21.1x) and Manufactured Housing (20.7x) proceed to commerce on the highest multiples amongst REIT property sorts. Mall (5.7x), Resort (8.7x) and Workplace (8.8x) REITs are the one REITs at the moment buying and selling at single digit multiples.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

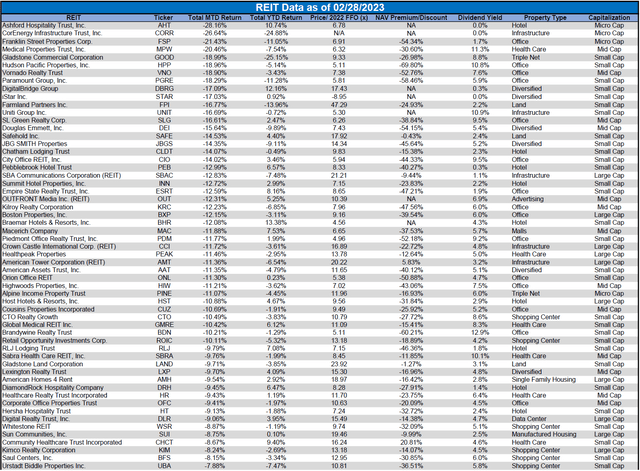

Efficiency of Particular person Securities

STORE Capital (STOR) was acquired by GIC and Oak Road on February 3rd, at which period STOR was delisted. Shareholders of STOR acquired $32.25/share.

Diversified Healthcare Belief (DHC) (+23.83%) was a significant beneficiary of ABP Acquisition’s buy of AlerisLife (ALR). DHC owns 31.9% of ALR and stands to learn from the substantial value premium at which ALR is being acquired. The transaction is anticipated to shut by the tip of the primary half of 2023.

Ashford Hospitality Belief (AHT) (-28.16%) gave up most of January’s massive acquire in February. This marks a return to the longstanding downward share value pattern for AHT which has left shareholders with whole returns of lower than -50% in every of the previous 3 years.

Solely 13.04% of REITs had a constructive whole return in February with 76.4% within the black yr up to now. Throughout the first two months of final yr the typical REIT had a -5.83% return, whereas this yr the typical REIT has seen a +4.93% whole return.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

For the comfort of studying this desk in a bigger font, the desk above is on the market as a PDF as properly.

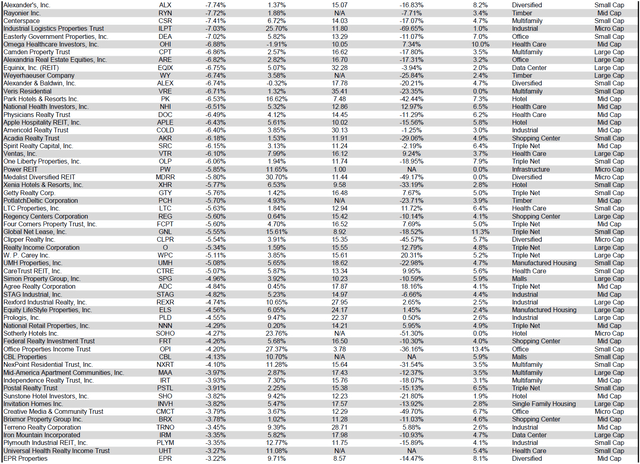

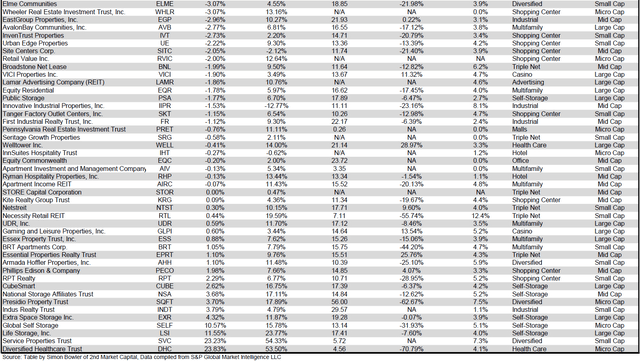

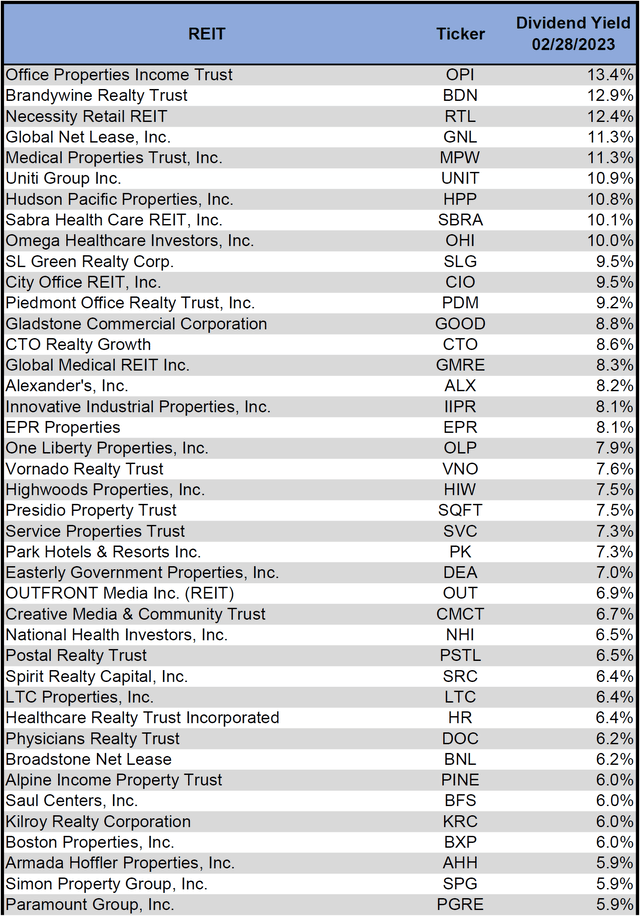

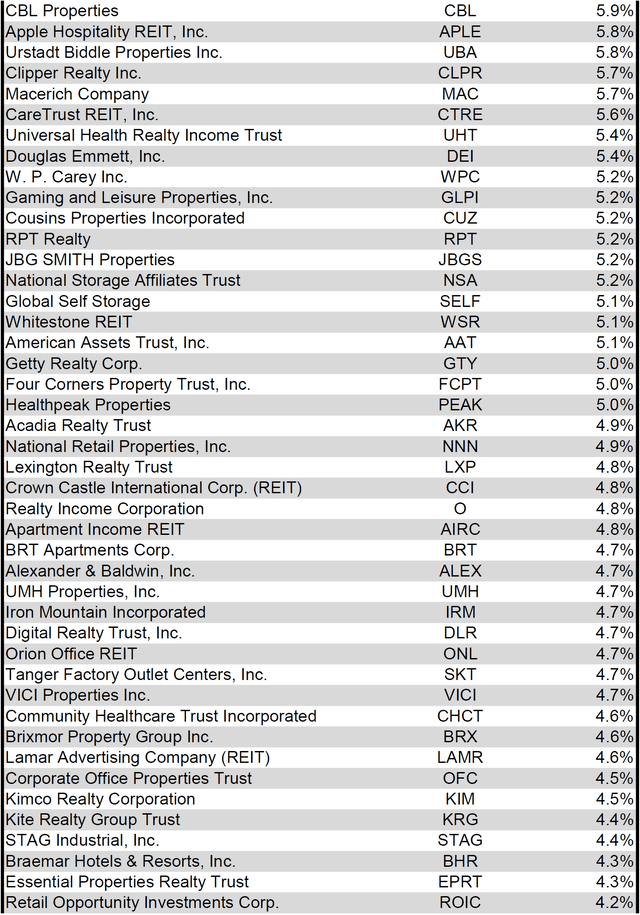

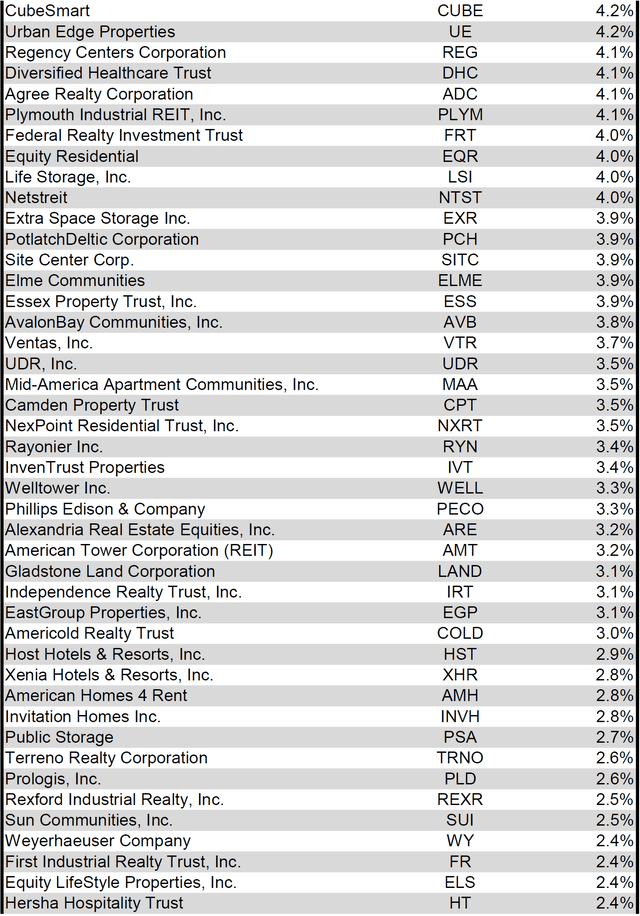

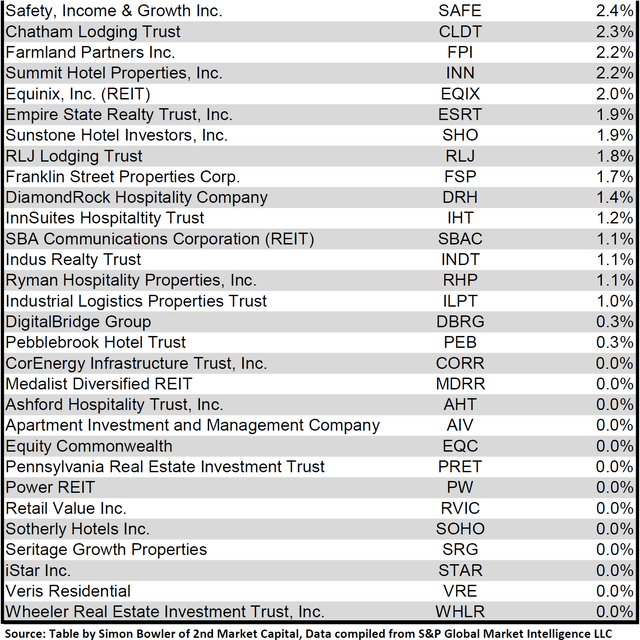

Dividend Yield

Dividend yield is a vital element of a REIT’s whole return. The notably excessive dividend yields of the REIT sector are, for a lot of buyers, the first purpose for funding on this sector. As many REITs are at the moment buying and selling at share costs properly under their NAV, yields are at the moment fairly excessive for a lot of REITs throughout the sector. Though a very excessive yield for a REIT could generally replicate a disproportionately excessive danger, there exist alternatives in some instances to capitalize on dividend yields which are sufficiently enticing to justify the underlying dangers of the funding. I’ve included under a desk rating fairness REITs from highest dividend yield (as of 02/28/2023) to lowest dividend yield.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

For the comfort of studying this desk in a bigger font, the desk above is on the market as a PDF as properly.

Though a REIT’s determination concerning whether or not to pay a quarterly dividend or a month-to-month dividend doesn’t replicate on the standard of the corporate’s fundamentals or operations, a month-to-month dividend permits for a smoother money circulation to the investor. Beneath is a listing of fairness REITs that pay month-to-month dividends ranked from highest yield to lowest yield.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Valuation

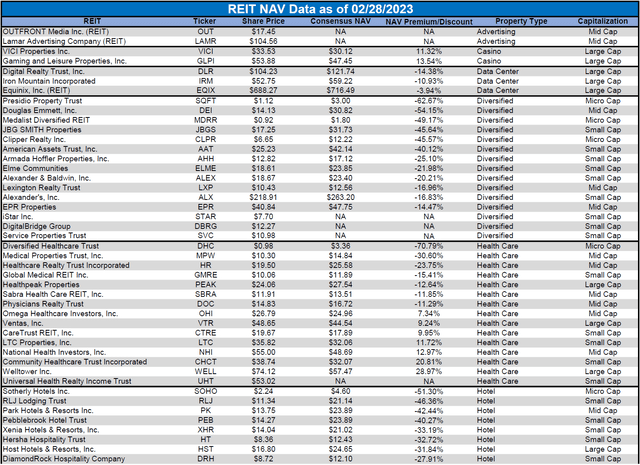

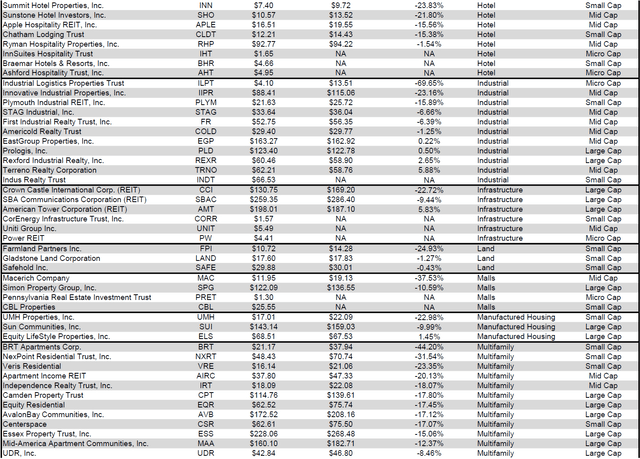

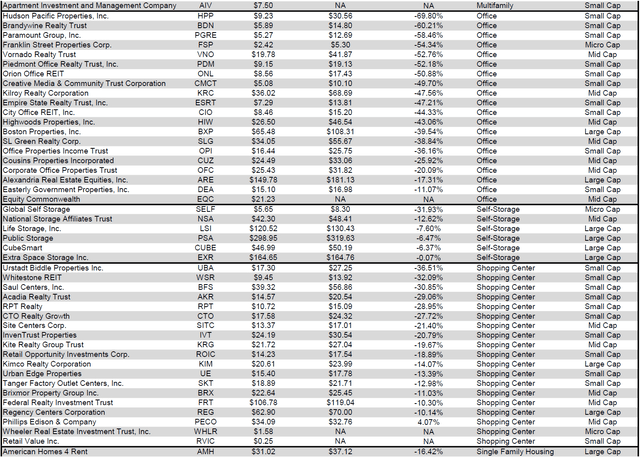

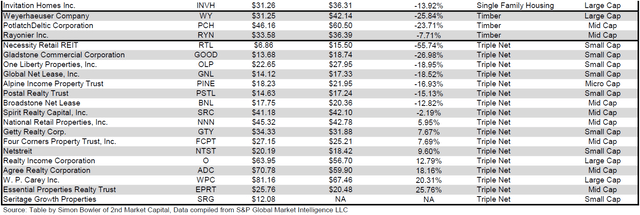

REIT Premium/Low cost to NAV by Property Kind

Beneath is a downloadable information desk, which ranks REITs inside every property kind from the most important low cost to the most important premium to NAV. The consensus NAV used for this desk is the typical of analyst NAV estimates for every REIT. Each the NAV and the share value will change over time, so I’ll proceed to incorporate this desk in upcoming problems with The State of REITs with up to date consensus NAV estimates for every REIT for which such an estimate is on the market.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

For the comfort of studying this desk in a bigger font, the desk above is on the market as a PDF as properly.

Takeaway

The big cap REIT premium (relative to small cap REITs) narrowed in February and buyers are actually paying on common about 43% extra for every greenback of 2023 FFO/share to purchase giant cap REITs than small cap REITs (17.5x/12.2x – 1 = 43.4%). As may be seen within the desk under, there’s presently a robust constructive correlation between market cap and FFO a number of.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

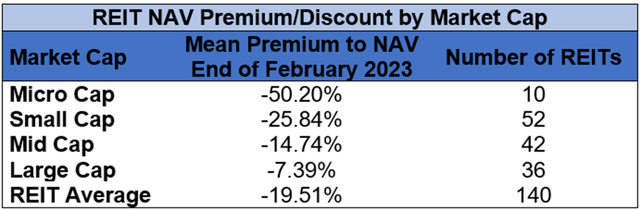

The desk under exhibits the typical premium/low cost of REITs of every market cap bucket. This information, very similar to the info for value/FFO, exhibits a robust, constructive correlation between market cap and Worth/NAV. The common giant cap REIT (-7.39%) trades at a single digit low cost to NAV, whereas mid cap REITs (-14.74%) commerce at a low double-digit low cost to NAV. Small cap REITs (-25.84%) commerce at about 3/4 of NAV. Micro caps on common commerce at slightly below half of their respective NAVs (-50.20%).

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

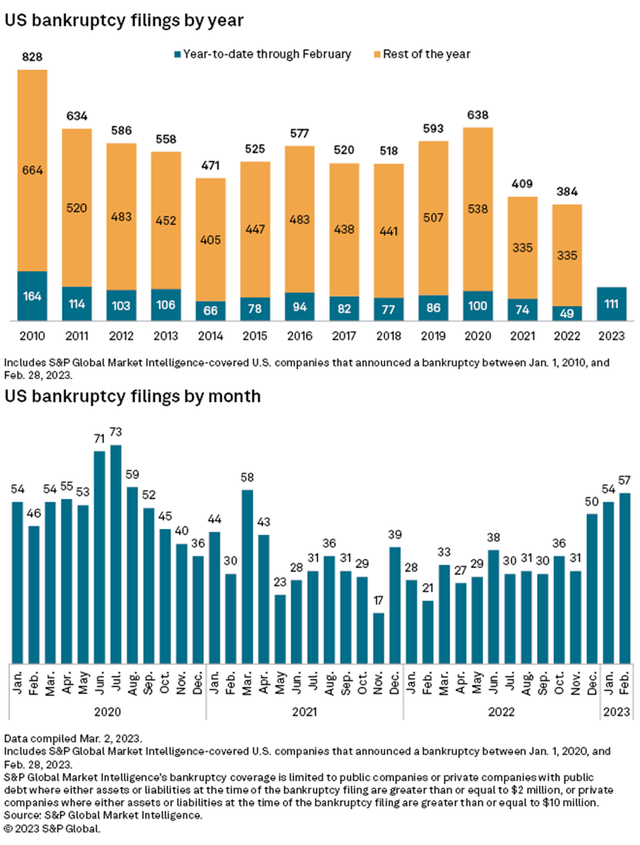

The sharp uptick in bankruptcies in December and January continued into February. The 111 bankruptcies within the first two months of 2023 is an enormous enhance over the 49 bankruptcies within the first two months of 2022. 2023 has seen extra bankruptcies within the first two months of the yr than any yr since 2011. With the fast enhance in rates of interest, this chapter pattern is more likely to proceed over upcoming months and will even proceed to choose up pace.

Supply: S&P International Market Intelligence

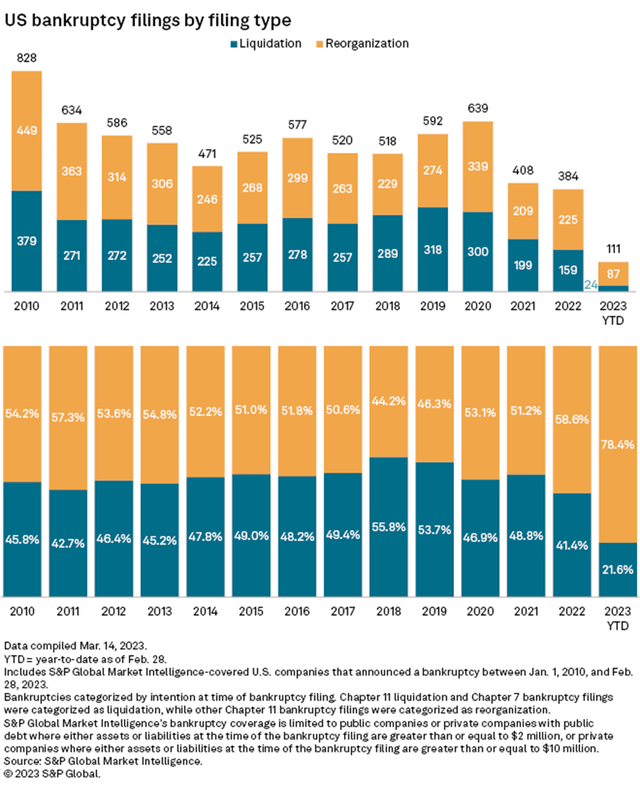

In comparison with prior years, 2023 bankruptcies have been closely skewed towards reorganizations slightly than liquidations. Chapter 11 reorganizations have accounted for 78.4% of bankruptcies and Chapter 7 liquidations have solely accounted for 21.6%.

Supply: S&P International Market Intelligence

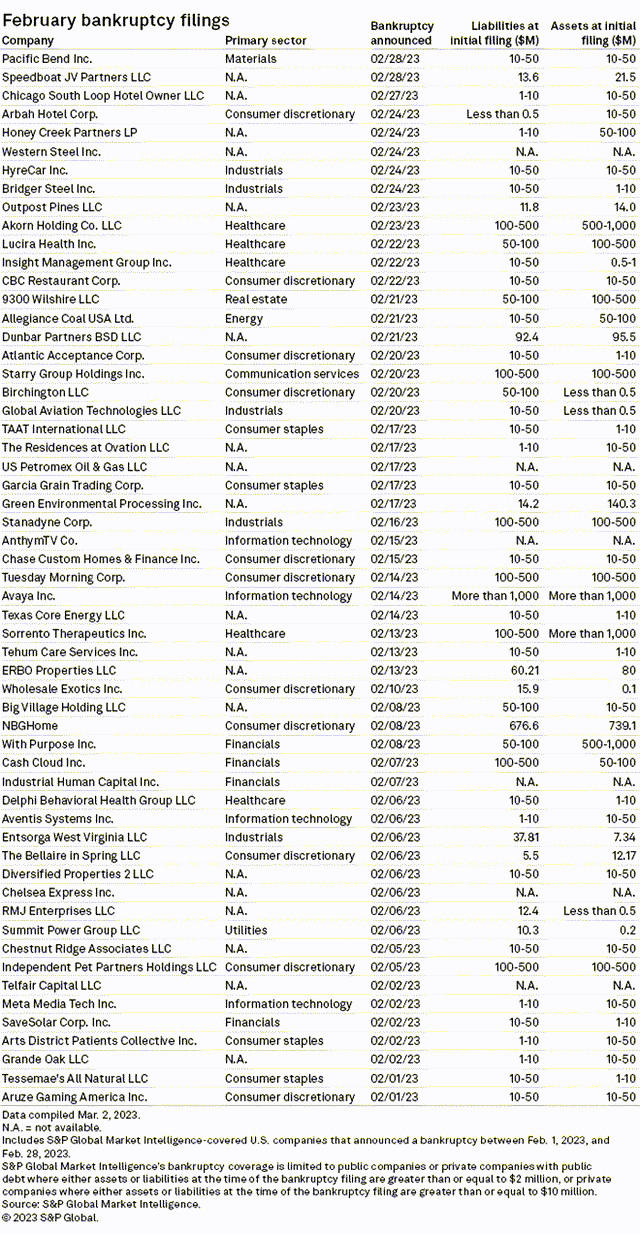

Beneath is the entire listing of 57 firms inside S&P International Market Intelligence’s chapter protection that filed chapter in February:

Supply: S&P International Market Intelligence

Along with the prolonged listing of February bankruptcies listed above, the latest collapse of Silicon Valley Financial institution has despatched shockwaves via the monetary sector and the whole influence remains to be being decided. A latest evaluation by S&P International Market Intelligence recognized that the fairness REIT sector has restricted direct publicity to Silicon Valley Financial institution (SIVB), which not too long ago grew to become the twond largest financial institution failure within the historical past of the US. The next REITs have been discovered to have publicity:

- Cousins Properties (CUZ) is arguably essentially the most impacted REIT with 204,751 sq. toes leased to SVB at Hayden Ferry property. As of the tip of 2022, Silicon Valley Financial institution was Cousin’s 9th largest tenant accounting for about 1.2% of annualized hire.

- Boston Properties (BXP) is the owner for SVB’s Seattle workplace, which is throughout the Madison Centre property that BXP acquired in Could 2022. BXP has not but reported what portion of that property is leased to SVB.

- Paramount Group (PGRE) is the owner of SVB Securities LLC, which is a subsidiary of SVB Monetary Group. SVB Securities LLC leases workplace house in PGRE’s 1301 Avenue of the America’s property.

- Alexandria Actual Property Equities (ARE) has a lease to an affiliate of SVB that accounts for under 0.08% of ARE’s whole annual rental income. Moreover, nonetheless, ARE’s tenants have $108.3M of letters of credit score from both SVB or associates of SVB. Alexandria is partnering with these tenants to get substitute safety deposits.

- Hudson Pacific Properties (HPP) has no direct relationship with SVB, however 11 out of 900 tenants have letters of credit score that have been issued by SVB or associates of SVB. These leases account for about 2% of Hudson’s workplace sq. footage. Very similar to ARE, HPP is partnering with these tenants to interchange the letters of credit score with an alternate safety deposit.

Bankruptcies and financial institution failures disproportionately influence sure firms over others, so there’s large alternative to realize alpha by carefully monitoring which REITs are impacted essentially vs. the REITs which are merely dealing with a share value influence attributable to a change on the whole market sentiment.

[ad_2]

Source link