[ad_1]

Going into the fourth quarter, rate of interest markets are pricing in a peak in most main central financial institution financial coverage tightening cycles by the top of this 12 months, if not sooner.

Remarks from coverage makers throughout the spectrum level towards future choices on money charges being depending on the incoming financial knowledge. That is considerably of a return to regular programming for central bankers.

The pandemic-induced ultra-loose coverage stance was adopted by clear messaging of tightening for the foreseeable future to fight accelerating worth pressures. Whereas the inflation genie just isn’t but fully again within the bottle, there’s much less concern than there was at first of this 12 months towards damaging will increase in the price of dwelling. A mushy touchdown could be within the offing.

Get your fingers on the not too long ago launched U.S. Equities This autumn outlook immediately for unique insights into the pivotal catalysts that ought to be on each dealer’s radar.

Advisable by Daniel McCarthy

Get Your Free Equities Forecast

With the uncertainty of the speed path going ahead, many fairness markets have mirrored this unpredictability by being unable to ascertain lasting directional developments. Whereas there have been some short-term developments emerge, they’ve been unable to eclipse the highs and lows of the previous couple of years in lots of circumstances.

For example, trying on the S&P 500 index, it has traded inside an admittedly broad vary of roughly 3500 to 4800 for nearly 3-years.

S&P 500 WEEKLY CHART

Chart ready by Dan McCarthy, created with TradingView

Some extra examples of the image of vary buying and selling throughout fairness indices.

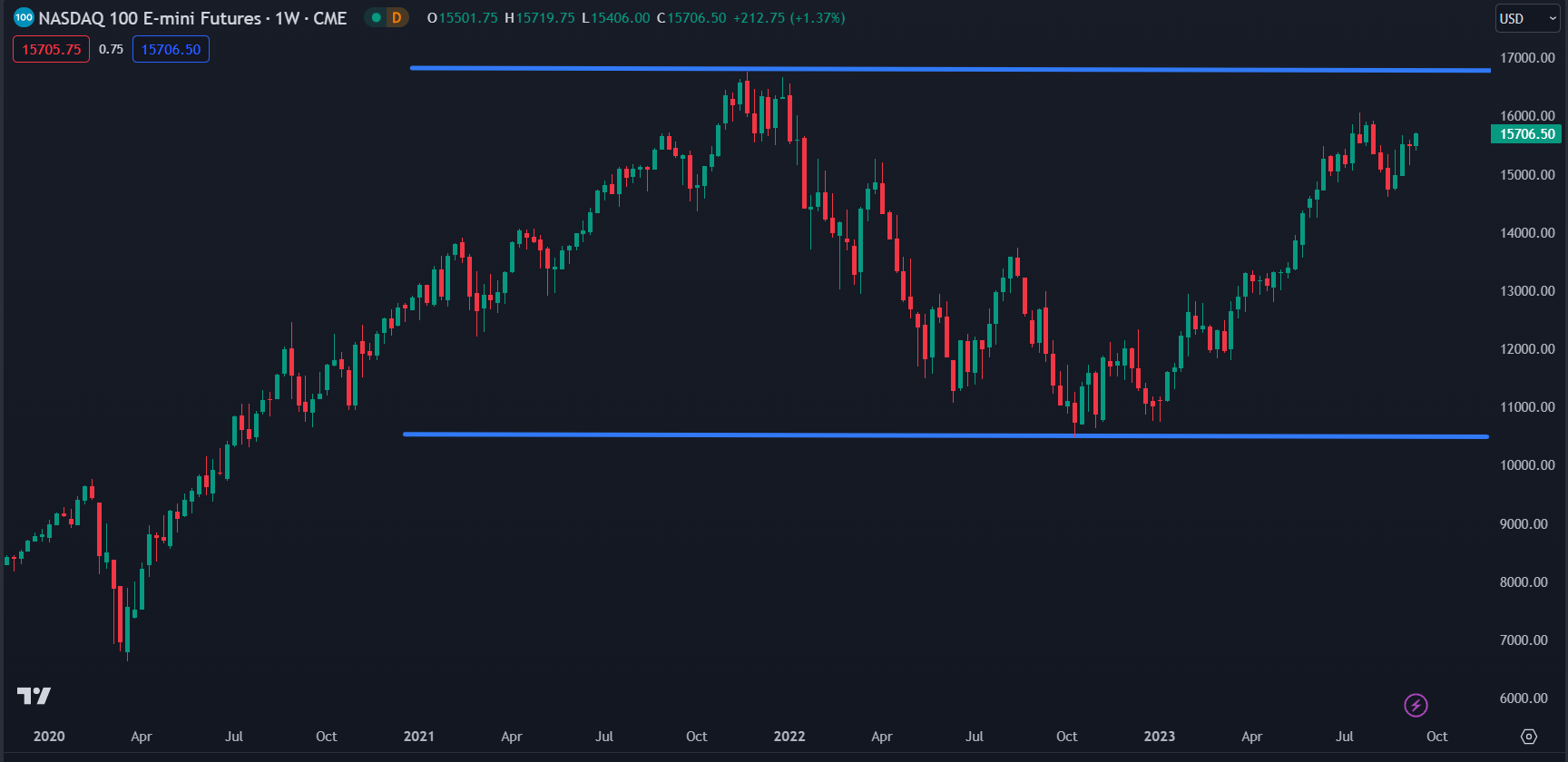

NASDAQ

Chart ready by Dan McCarthy, created with TradingView

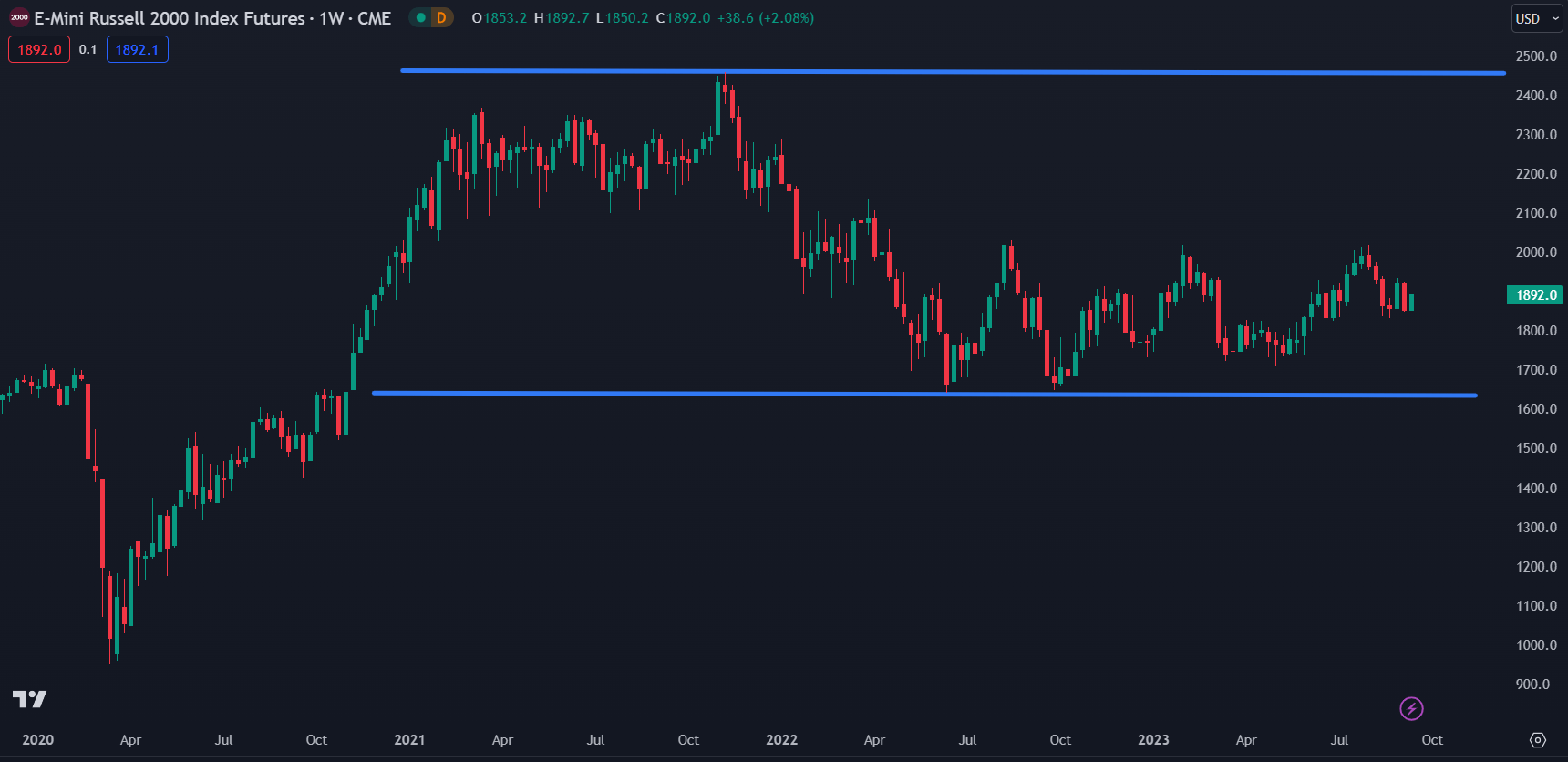

RUSSELL 2000

Chart ready by Dan McCarthy, created with TradingView

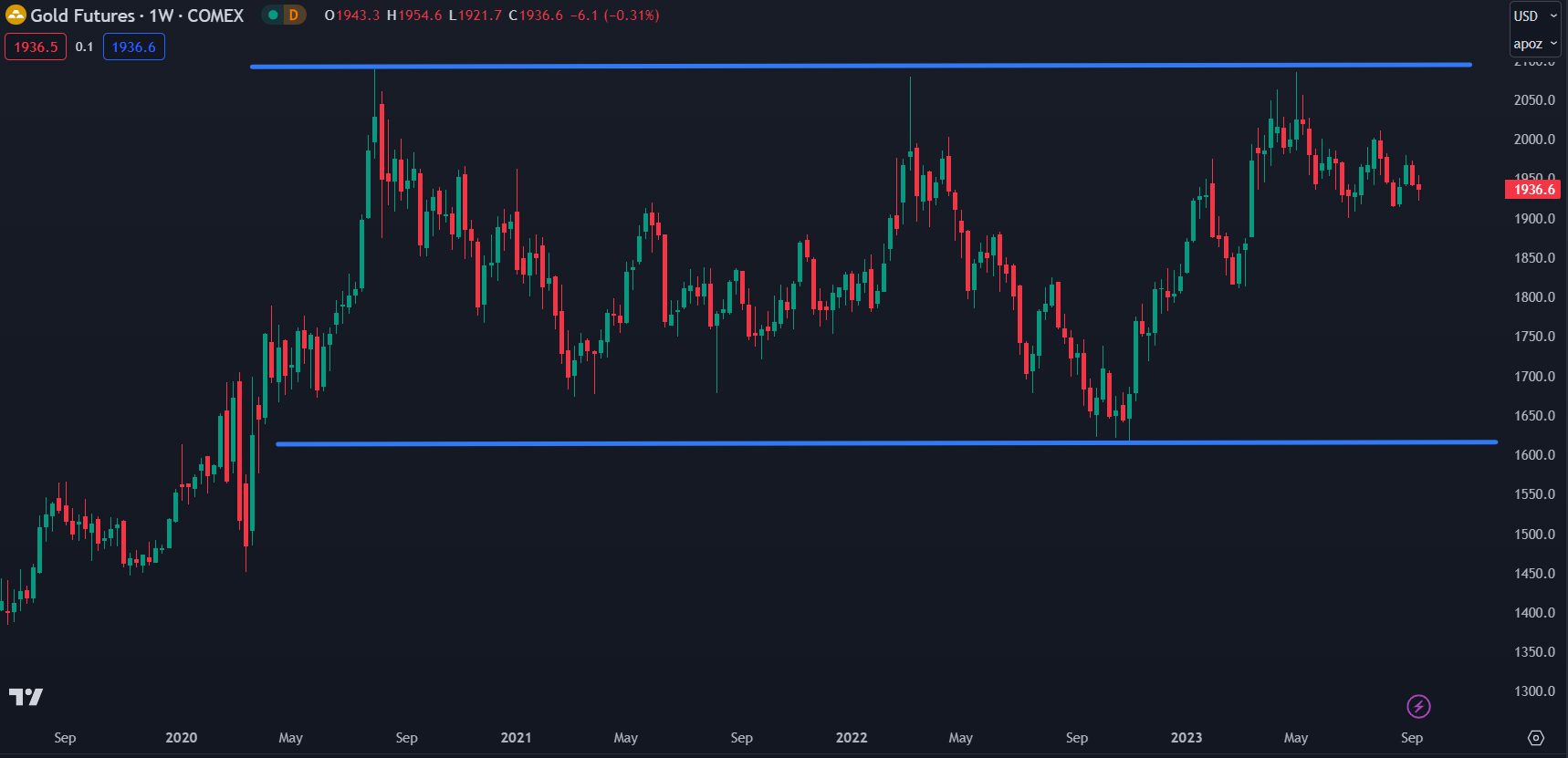

Gold is one other instance.

Chart ready by Dan McCarthy, created with TradingView

There are numerous extra markets which have displayed any such long-term range-bound buying and selling circumstances.

Searching for the very best commerce concepts for This autumn? Look no additional and obtain your complimentary information courtesy of the DailyFX workforce of Analysts and Strategists.

Advisable by Daniel McCarthy

Get Your Free Prime Buying and selling Alternatives Forecast

RANGE TRADING

If the ranges throughout these varied asset courses are to carry, then figuring out the chance is to acknowledge when a reversal has taken place.

There are numerous technical evaluation strategies that may help on this regard. Together with, however not restricted to.

- Candlestick Patterns (e.g., Island Reversal)

- Oscillation Strategies (e.g., RSI)

- Bollinger Bands

- Momentum Measures (e.g., A Golden Cross of Shifting Averages)

A sturdy method entails disciplined threat administration. A single indicator is never constant in precisely anticipating the reversal.

When a mixture of reversal indicators is consistent with one another, it would add weight to the reliability of the view. It ought to be famous although that previous efficiency just isn’t indicative of future outcomes.

Wanting ahead, the commerce alternative could lie within the monitoring of ranges throughout varied markets and being ready for potential reversals. Particularly so when the asset is nearing the sting of the vary.

Additionally it is attainable {that a} short-term false break of the vary could happen. These breaks exterior the established ranges are sometimes accompanied by stop-loss orders being triggered. As soon as these positions have been cleared out, a reversal sign could be value being attentive to.

For extra Suggestions and Methods Round Vary Buying and selling, Really feel Free to Obtain the Complimentary Information Under.

Advisable by Daniel McCarthy

The Fundamentals of Vary Buying and selling

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel through @DanMcCarthyFX on Twitter

[ad_2]

Source link