Greenback bulls take management midweek because the DXY advantages from a broadly risk-averse investor sentiment.

Greenback

The Buck rolls into midweek retreating from a month-to-month low to set the very best value for the month of Might to date. Elements driving this renewed optimism within the US forex will be attributed to stronger than anticipated financial knowledge from April within the type of US Retail Gross sales and Industrial Manufacturing in addition to the constructive developments across the US debt ceiling difficulty, with Joe Biden and Kevin McCarthy agreeing {that a} deal to unravel the problem may be concluded by the tip of this week. Moreover, FED officers have collectively defended and held the narrative that they “aren’t on the maintain charge” as but.

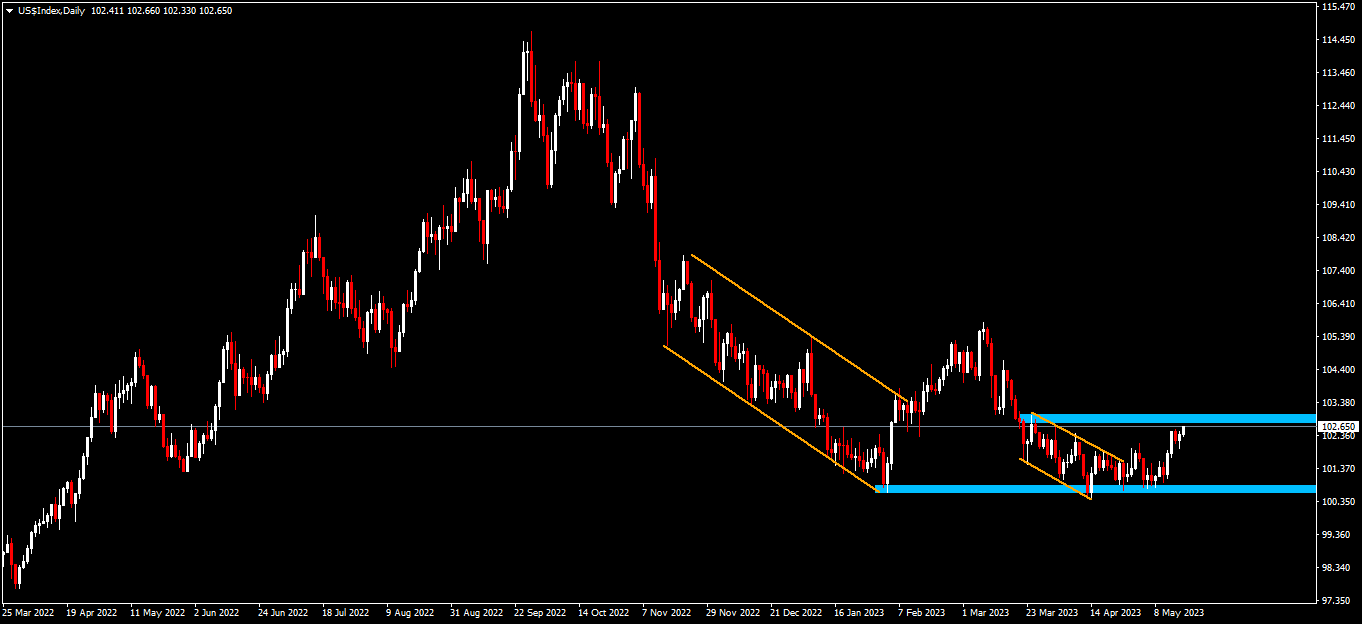

Technical Evaluation (D1)

By way of market construction, Present Value motion may stay bullish if consumers can defend the potential descending channel continuation sample that’s at present being fashioned. A break above the 103 degree will verify bullish momentum. Conversely, if sellers break by means of the help degree round 100.40, the narrative may shift in the direction of the bears and break under the low of the 12 months

Euro

The European frequent forex heads into the center of the week on the again foot because it registers the bottom value to date within the month. Elements driving this promoting stress will be attributed to the elevated danger aversion underpinning the markets, resulting in a rise within the demand for the safe-haven greenback. Including to the promoting stress are feedback from ECB official de Cos, which put forth the narrative that the ECB may very well be nearing the tip of its mountaineering cycle, which put a cap on any bullish impetus on the forex.

Wanting forward, merchants will likely be persevering with to watch the method of the FED in relation to the ECB in addition to the EMU ultimate inflation knowledge due at this time (Wednesday.)

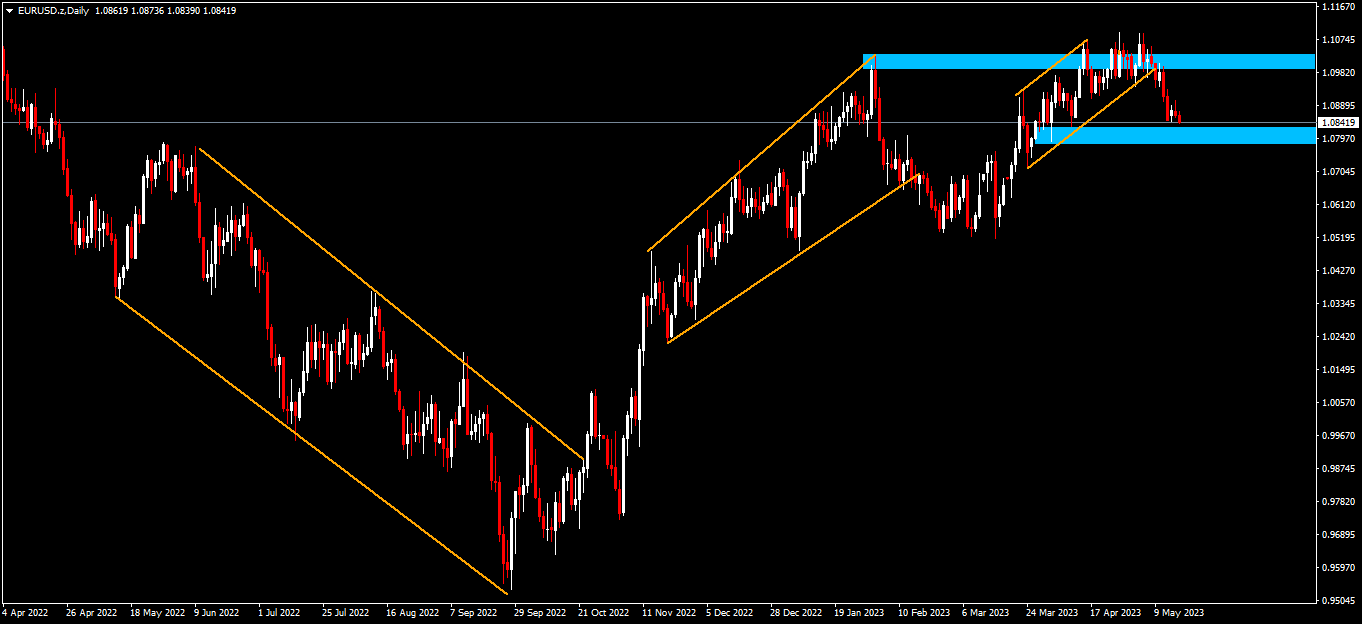

Technical Evaluation (D1)

By way of market construction, Present Value has approached an space with promote facet stress within the type of an ascending channel. This sample provides bears the opportunity of driving value if the present continuation sample performs out efficiently, which might verify the bigger double prime reversal sample doubtlessly forming. A break under the 1.079 space will verify bearish momentum. Conversely if the bulls can maintain the stress, value may break above the double prime and proceed the uptrend if it invalidates the resistance space in an impulsive wave.

Pound

The Pound heads into the center of the week licking its wounds as value dives to a three-week low. Elements driving this promoting stress will be attributed to weak employment knowledge from the UK on Tuesday, which has elevated the narrative that the BoE may implement fewer than anticipated charge will increase to carry down inflation, as indicators of a weaker jobs market are starting to enter the spectrum, which is what financial coverage choice makers need to see earlier than the speed pausing begins.

Technical Evaluation (D1)

By way of market construction, the bulls have been in command of the narrative and value has examined the important thing 1.244 degree and has since pulled again forming a possible bearish triple prime inside a decent buying and selling vary. As value retests this peak formation once more, within the type of a possible rising wedge reversal sample, two eventualities current themselves. Particularly, if the realm is defended by sellers it may lead to value making its strategy to the decrease finish of the vary. Conversely, if consumers break above the realm, value will proceed to stay bullish within the close to time period.

Gold

Gold heads into the center of the week underneath some important stress because it approaches the low of the month across the $1 976 degree. Elements driving this enthusiasm from the bears will be linked to greenback dynamics, within the type of upbeat US financial knowledge which has additional fuelled the hawkish narrative from some FED officers and led to a risk-off temper which has been to the good thing about the greenback in opposition to the yellow steel.

Wanting forward, the US financial docket appears gentle and will permit gold to rebound barely, however second-tier housing knowledge, mixed with headlines across the US debt ceiling debacle, may doubtlessly carry bears again into the fray.

Technical Evaluation (D1)

By way of market construction, value motion has been principally bullish, with clear higher-highs and higher-lows being printed out. Present Value motion is approaching the Feb 2022 excessive in a corrective wave related to a possible rising channel reversal sample. Henceforth value motion ought to be given the prospect to print itself out to both validate the reversal sample or to invalidate it by persevering with to maneuver up impulsively in the direction of the aforementioned excessive.

Click on right here to entry our Financial Calendar

Ofentse Waisi

Monetary Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.