[ad_1]

By Graham Summers, MBA

The situation in the United Kingdom (U.K) is accelerating now.

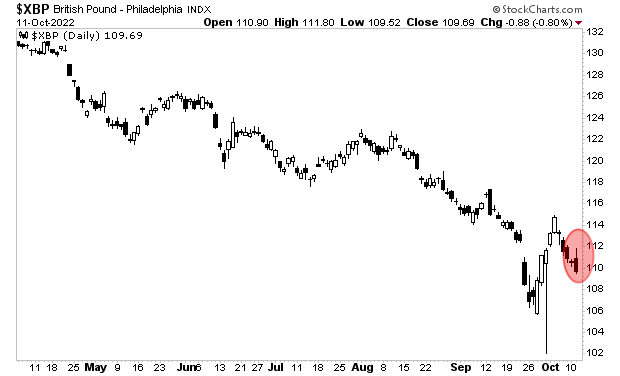

Several weeks ago, the new government in the UK introduced a tax cut. The financial system revolted, with the British pound collapsing…

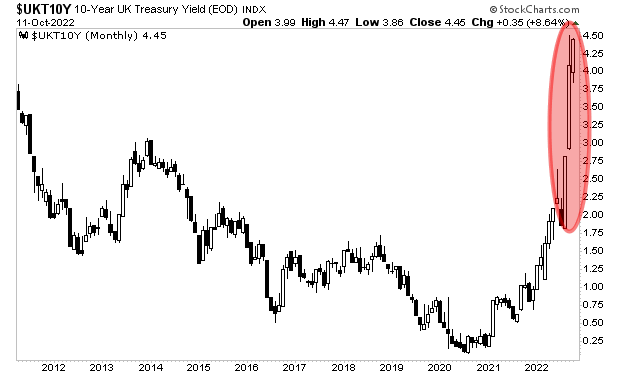

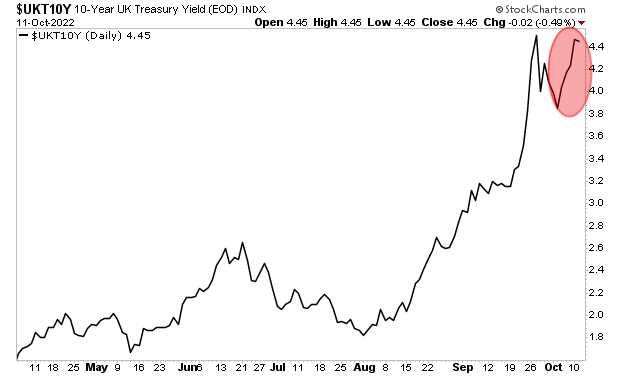

And British government bond yields spiking…

The central bank, the Bank of England, or BoE, intervened to stabilize things by re-introducing an emergency, “unlimited” Quantitative Easing (QE) program.

Bear in mind, the BoE had yet to even being introducing Quantitative Tightening (QT) or the process of shrinking its balance sheet, when this emergency hit, and it was forced to start easing again. This only confirms the central thesis of bestselling book The Everything Bubble, that once a central bank launches extraordinary monetary policy, it can never normalize.

Well, fast forward to yesterday, when the BoE announced that its emergency interventions would end this Friday. What do you think happened?

The British Pound rolled over again…

And British government bond yields starting spiking.

Simply put, the BoE is trapped. If it attempts to stop its interventions, it risks blowing up the U.K.’s financial system.

Bear in mind, we’re not talking about an emerging market here… this is the FIFTH LARGEST ECONOMY IN THE WORLD. And its currency and bond markets are imploding!

As I keep stating, the Great Crisis… the one to which 2008 was a warm-up, has finally arrived. In 2008 entire banks went bust. In 2022, entire countries will do so.

And smart investors are already preparing for what’s coming…

[ad_2]

Source link