Each couple of years, it appears, the world watches in apprehension because the U.S. president and Congressional leaders play rooster over the nation’s debt restrict. If the so-called ceiling can’t be raised, the U.S. Treasury dangers working out of money, and the nation may default on its money owed.

This is able to end in a collection of doubtless “cataclysmic” occasions, in accordance with a brand new dystopian report by Moody’s Analytics. Credit standing companies would instantly downgrade Treasury debt, adopted by U.S. monetary establishments, non-financial firms, municipalities and extra.

In Moody’s worst-case state of affairs, an financial downturn triggered by a U.S. default would rival that of the worldwide monetary disaster. As many as 7.8 million jobs could possibly be misplaced, and shares would fall by nearly a fifth, erasing $10 trillion in U.S. family debt. The contagion would unfold to world markets.

Oh, and did I point out that President Joe Biden and Speaker Kevin McCarthy have till June 8—lower than a month from now—to seek out widespread floor? That’s when the Treasury’s coffers run dry if no progress is made, primarily based on Moody’s estimates.

My intestine feeling is that an settlement will probably be reached earlier than it’s too late. As was the case in previous showdowns, the political wrangling is extra Kabuki theater than anything. On the identical time, Biden and McCarthy are taking part in with hearth.

Debt Ceiling Reform, Spending Reform

So why does america put itself, and world onlookers, by way of this each few years? The U.S. is among the only a few international locations on the planet that has a debt ceiling, and of people who do, none appear to permit it to threaten financial stability.

Is it time we scrapped the debt restrict altogether?

I might be in favor of debt ceiling reform if it did two issues: 1) take away the intense risk of a authorities default, and a pair of) maintain lawmakers accountable by routinely triggering spending cuts if the ceiling have been reached.

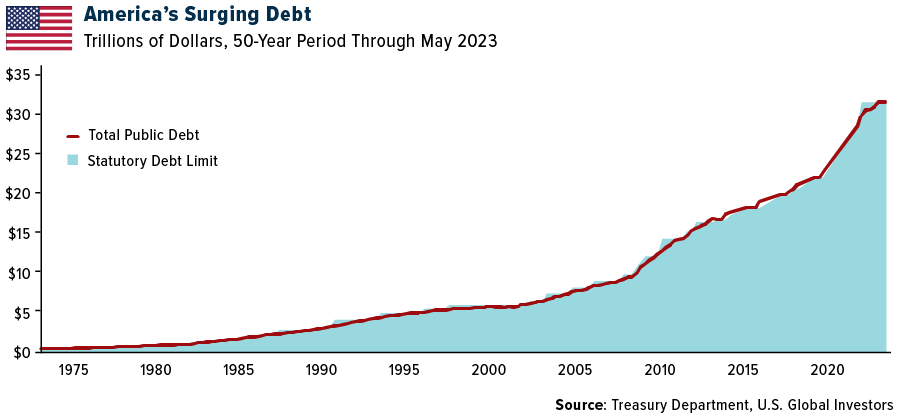

Spending is exactly what must be addressed. As we speak the nationwide debt stands at $31.7 trillion, or 120% of U.S. gross home product (GDP). For the previous 20 years, throughout Republican and Democrat administrations alike, the U.S. authorities has run a mean annual deficit of just about $1 trillion. A lot of that is because of the steep curiosity funds on public debt, which at the moment are as a lot because the nation’s spending on protection.

Merely put, it’s unsustainable.

I urge everybody to learn Stanley Druckmiller’s latest feedback on the nation’s out-of-control spending and, particularly, entitlements. Earlier this month, the billionaire investor spoke on the Pupil Funding Fund Annual Assembly at USC Marshall’s Middle for Funding Research (CIS), the place he shared some startling statistics. As an example, the U.S. spends six instances as a lot per senior because it does per little one, and in 25 years, its spending on seniors will account for 70% of all tax revenues.

“It’s time that we let go of the false pretense that chopping entitlements is a selection. It isn’t,” Druckenmiller mentioned. “Both we reduce them right now, or we must reduce them way more tomorrow.”

You’ll be able to learn his keynote right here.

68% Likelihood of Recession?

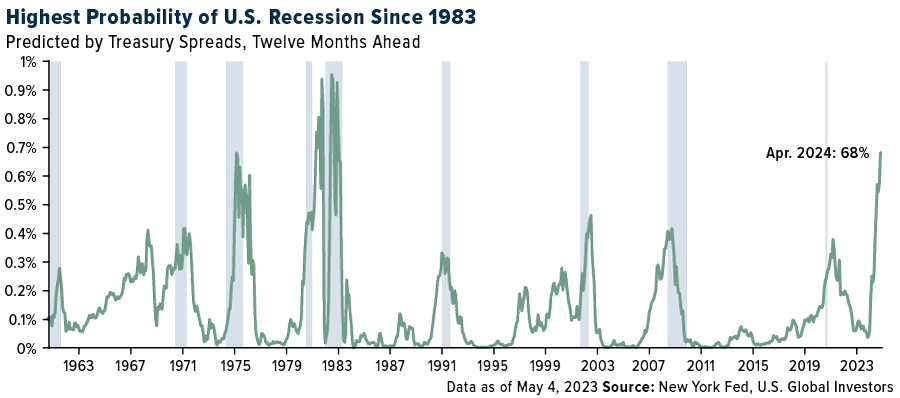

Leaving apart the debt ceiling drama for a second, traders nonetheless have a possible recession to organize for. Based mostly on Treasury , the Federal Reserve Financial institution of New York now places the likelihood of a recession within the subsequent 12 months at 68%. That’s the very best month-to-month studying since 1983.

The Fed’s tightening program seems to be nearing an finish as continues to chill and financial progress slows. That presents its personal dangers, primarily based on historic precedent. Over the previous 70 years, a pause in charge hikes was adopted by an financial recession 75% of the time, with a mean lag of six months.

If we comply with the identical playbook, we could also be a full-blown recession by the tip of the yr. As all the time, getting publicity to and gold mining shares, I consider, is a clever and rational technique to handle this danger.

***

All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all info provided by this/these web site(s) and isn’t answerable for its/their content material.