VioletaStoimenova/E+ through Getty Photos

By Warren Fisher, CFA, Founder and CEO, Manole Capital Administration

Fee Economics:

Let’s assume you’re a financial institution or monetary establishment offering credit score to shoppers. If you happen to grant a mortgage, you’ll be able to demand 20% money down and you’ve got collateral in a home (to foreclose). If you happen to concern an auto mortgage, you may demand a sure amount of money down, plus you’ve collateral within the automotive (to repossess). If you happen to present a bank card to a client, you don’t get any money down and you’re uncovered to an open line of credit score with no collateral. That is precisely why we don’t put money into the cardboard issuers (i.e., the banks offering bank cards).

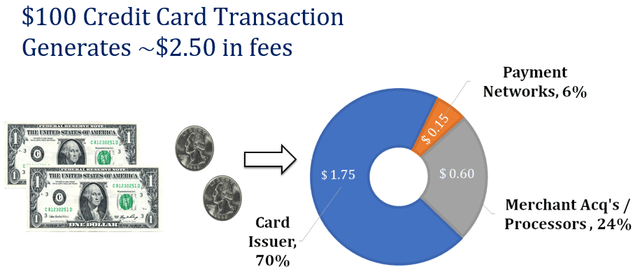

The beneath chart exhibits the charges related to a typical $100 bank card transactions. As you may see, the cardboard issuers earn the overwhelming majority of the economics (70% or $1.75 of the $2.50). That’s totally justified, as they’re taking the shopper and credit score threat.

$100 CC Economics (Manole Capital)

If a client doesn’t pay the quantity charged final month, these entities can get late price penalties and cost excessive APRs (annual proportion charges), starting from the mid-teens into the mid-20%, on unpaid balances. Within the 4th quarter of 2022, the common APR was 19.07%, which is a really giant annual improve (primarily as a result of Fed’s 8 rate of interest hikes).

As this debt accumulates and grows, some shoppers get overwhelmed and declare chapter. In that case, no person wins – the patron will get his/her FICO or credit score rating penalized for 7 to 10 years and the credit score issuer takes a full and complete write-down.

Fee Developments:

After peaking at 18.8% throughout the pandemic, eCommerce as a proportion of all retail purchasing, has declined to 16.4% (per the Nationwide Retail Federation). Nonetheless, we imagine that eCommerce is right here to remain and can proceed to achieve market share over months, quarters, years, and future many years.

Through the 2022 vacation purchasing season, even with a weakening financial system, eCommerce gave the impression to be the principle beneficiary of total buy transactions. In keeping with ACI Worldwide analysis, on-line transactions (from October by way of December) elevated +21% year-over-year. metrics launched by Adobe Digital Insights, US eCommerce gross sales hit an all-time document of $212 billion and exceeded their lofty expectations. Customers love purchasing on-line and recognize worth comparability advantages and comfort.

Different essential cost developments had been +18% annual progress in BOPIS (purchase on-line, pickup in retailer), +87% progress in BNPL (purchase now, pay later), and digital-wallet transactions climbing +32%. In keeping with Deloitte estimates, households with incomes round $50,000 per yr, spent $320 on presents final yr (up +19%), whereas households with annual incomes above $100,000 spent $650 on presents, up 4%.

The takeaway for us was credit score and debit playing cards stay the #1 and #2 funding sources and cost selections. All three of the cost choices we simply talked about (BOPIS, BNPL, and digital wallets) make the most of credit score and/or debit to transact. Through the 2022 vacation purchasing season, credit score and debit card transactions grew +8%.

Credit score vs Debit:

To show this card dominating thesis even additional, if one appears at Visa (V) or Mastercard’s (MA) 4th quarter 2022 outcomes, you will note even larger income and earnings progress. Visa grew income by +12% year-over-year and earnings by +21%. Mastercard skilled +11% high line progress and +13% earnings progress final quarter. The secular progress of the cardboard business stays wholesome and intact.

When it comes to cost card selection, customers say (in a S&P World Market Intelligence analysis report) that 71% of their selection is decided by privateness and safety. We wish to decipher Visa and Mastercard’s earnings and break the enterprise down into geographies (US versus worldwide) after which by card sort (credit score versus debit). The 2 or three key metrics we like to investigate are buy volumes, cost transactions and playing cards issued. Consider, Visa and Mastercard aren’t offering the road of credit score; a financial institution or monetary establishment is granting credit score to a person client. Visa and Mastercard are merely the community these card transactions run upon (i.e., the cost rails).

Visa’s 4th quarter 2022 outcomes, we simply can calculate that the common debit card transaction is beneath $37, and the common bank card transaction is $66. Diving even deeper, one can see that buy volumes are pretty evenly break up between credit score (51%) and debit (49%), in addition to geography, with 51% coming from US and 49% from worldwide international locations. Nonetheless, an actual distinction will get seen when one appears at cost transactions. Visa is closely tilted in the direction of debit, at 63% of its transactions, whereas credit score is simply 37%. The identical noticeable debit tilt could be seen from its embossed Visa playing cards, with 30% being credit score and 70% being debit.

If we analyze Mastercard’s 4th quarter 2022, we see stark variations within the underlying sort of transactions. For instance, 56% of Mastercard’s buy volumes come from credit score and 63% come from outdoors the US. As well as, Mastercard’s cost transactions are 43% credit score and 76% from worldwide sources. Lastly, Mastercard’s card combine is 39% credit score, with 77% outdoors the US.

Whereas many confuse the dominant cost networks and imagine they’re basically interchangeable, there are main variations between Visa and Mastercard. Visa is the market chief, with #1 card market share, nevertheless it leans extra debit and extra US. Mastercard is extra credit score and extra worldwide. Fairly merely, debit is most well-liked if shoppers need predictability, low or no charges, and better ease of managing their cash. Credit score is extra centered on those who recognize and want the credit score line, free float, and timing of re-payments.

Credit score:

In October of final yr, the NY Federal reported that bank card demand was accelerating. In actual fact, the speed that buyers utilized for bank cards rose 27.1%. Regardless of larger purposes, card issuers are getting “pickier”, and the rejection charge modified by 240 foundation factors to 18.5%.

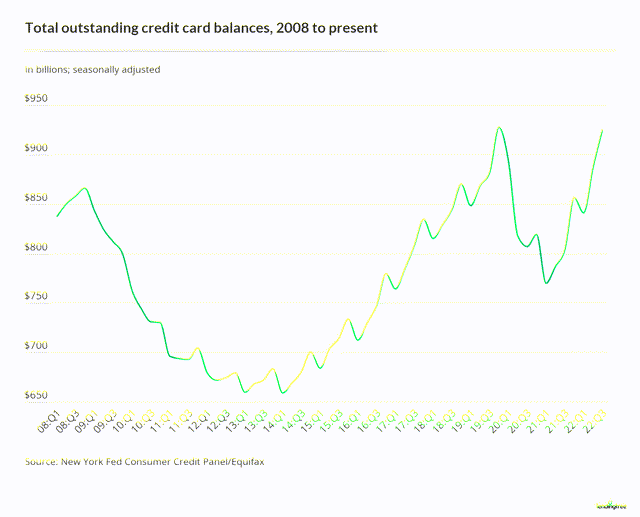

Bank card balances have begun to soar, as extra purchases are occurring and costs for items stay excessive. Within the third quarter of 2022, People’ bank card balances climbed by $38 billion or 15% year-over-year. This was the most important improve in over 2 many years.

As this NY Fed / Equifax / LendingTree chart exhibits, the entire excellent bank card stability has been climbing. Following the Monetary Disaster, extra households relied on debit, to raised handle their funds and stop overspending. Following the financial shock of COVID and the top of presidency stimulus funds, US shoppers appear to be spending extra and leaning on their bank cards. This larger bank card utilization sadly results in larger client and family debt ranges.

CC Excellent (NY Fed, Lending Membership, Equifax)

Debt:

Complete US family debt rose $351 billion within the third quarter and now exceeds $16.5 trillion. For extra perspective, that is $2.36 trillion larger than on the finish of 2019, earlier than the COVID pandemic. A latest GOBankingRates survey discovered that 30% of People have between $1,001 and $5,000 in bank card debt. One other 15% of People have $5,001 or extra in bank card debt and about 6% have greater than $10,000 in bank card debt. Supporting these alarming numbers, a latest Transunion examine discovered that the common bank card person was carrying a stability of $5,474, up +13% versus 2021. Folks clearly don’t look to construct bank card debt, nevertheless it sadly is a pattern that continues to climb. In keeping with Bankrate, the share of bank card customers who carry a stability has elevated to 46% versus 39% a yr in the past.

This isn’t only a lower-income drawback. Whereas lower-income cardholders usually tend to carry a stability from month-to-month, even these making over $100,000 per yr don’t repay their whole stability every month (37% don’t pay in full). As spending continues to speed up, we anticipate a persistent rise in bank card debt excellent. That very same Transunion word estimated that business delinquencies ought to rise from 2.1% (throughout 2022) to 2.6% this yr. One wants to grasp that whereas delinquencies are at present pretty low, they’re completely headed larger. For the primary 6 months of 2023, any charge-offs might be a results of these credit score cardholders that entered the gathering que between July and December of 2022. As these cardholders age, we anticipate a tougher credit score atmosphere. When the cardboard issuers and banks reported 4th quarter 2022 outcomes, many continued so as to add to their reserves as a consequence of an anticipated improve in delinquencies. If the US financial system enters a recession in 2023, we anticipate delinquencies and charge-offs will transfer larger. What’s going to occur to debt repayments if shoppers lose their jobs?

The US unemployment charge is at present at a 54-year low of three.4%, and the Fed continues to lift rates of interest to attempt to offset larger wage progress. Firms are responding to larger prices by reducing and tightening their labor power. instances are getting powerful when Alphabet laid off 12,000 folks – together with 31 of their in-house masseuses (of their perks often known as “Googley Extras”). Don’t inform Deshawn Watson about that Google perk!

The CFPB:

Working counter to the cardboard issuers price ways is the CFPB or Shopper Monetary Safety Bureau. Within the 2010 Dodd-Frank Wall Road Reform and Shopper Safety Act, the CFPB was fashioned. Many Republicans declare the company has develop into too highly effective and that it lacks any actual regulatory oversight. Some politicians have complained that the CFPB wields “unchecked powers” and that it pushes a radical and extremely politicized agenda, with out correct oversight.

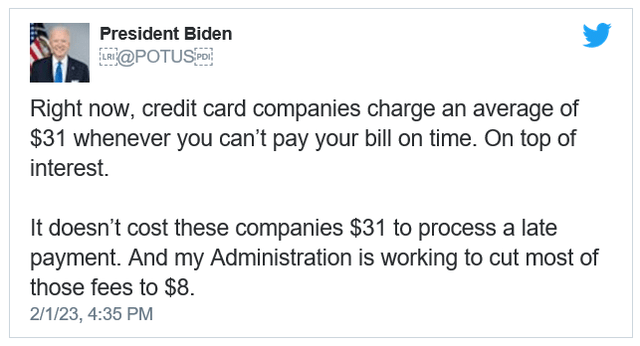

Returning to our important level of charging charges for entry to credit score, one other angle that card issuers have taken is to institute late charges to assist offset the losses they forecast. On February 1st, 2023, the CFPB proposed (click on right here) important adjustments to the Credit score Card Accountability Duty and Disclosure Act of 2009 (typically known as the CARD Act).

Rohit Chopra is the CFPB director, and he believes that card issuers’ late charges quantity to levies which can be deemed by the CFPB to be “unlawful junk charges”. Particularly, the CFPB has now capped these at $8 per prevalence. It decided that this was the right quantity to cowl assortment prices incurred as a consequence of a late cost. For perspective, the Fed regarded into this concern and stated that issuers might cost $41 per prevalence. Clearly, the CFPB thinks it may be finished for much less, which it why, in its preliminarily findings, the CFPB said that late price revenue at present exceeds assortment prices by an element of 5 (i.e., the 5x discount from $40). Diving additional into the CFPB particulars, card issuers would be capable of cost above this $8 threshold, if they will show {that a} larger price is critical to cowl incurred assortment prices. As well as, late charges can be capped at 25% of the required minimal cost whereas the present guidelines enable late charges to equal 100% of the minimal cost. Utilizing their estimates, the CFPB believes it might cut back late charges charged to shoppers by $9 billion per yr (from $12 billion a yr all the way down to $3 billion).

If you happen to simply suppose this can be a client concern and never a political concern, simply have a look at this tweet written by President Biden, on the identical day the CFPB made its announcement. The present administration is clearly a fan of the CFPB.

President Biden tweet (Twitter)

With a GOP-led Home, we might anticipate stricter oversight of CFPB Director Rohit Chopra. In mid-December, Patrick McHenry (R, North Carolina) advised Chopra on the Home Monetary Companies Committee “You possibly can look ahead to some extra of those invites subsequent yr.”

It’s nonetheless very early on this Congress, and they should sort out the looming debt ceiling concern, however we anticipate Republicans will attempt to rein within the CFPB, particularly since so many imagine the company lacks transparency and accountability.

Our Opinion:

We don’t have a “canine on this combat” and admittedly don’t wish to go “down this rabbit gap”. A $9 billion annual financial savings to US shoppers appears like an important concept, particularly if it could assist the bottom revenue earners in our society. Nonetheless, one has to grasp and notice there are penalties to some of these regulatory choices, similar to there have been penalties for the Durbin Modification (click on right here). Don’t get us began on that concern…

William Blair Analysis discovered that subprime and deep subprime accounts signify 12% of all accounts however equate to 42% of complete late charges. What’s going to occur to obtainable credit score to sub-prime shoppers if card points retreat from the market? Will retailers endure with decrease gross sales? Will the cardboard issuers institute annual charges to make-up for misplaced income? Will they now put annual upkeep charges on all shoppers? Will APR’s skyrocket?

Our fast takeaway is that this isn’t good for all card issuers (i.e., American Categorical, Uncover, Capital One), however it’s particularly difficult for personal label card issuers like Bread Monetary and Synchrony Monetary. Most card issuers don’t present particulars on late charges, however Uncover has disclosed that late charges are lower than 4% of its income. Bread Monetary claims that late charges are “immaterial” to its co-branded product, however its inventory is down almost (8%) on the day of the CFPB announcement.

The fact is that the cardboard issuers will work out easy methods to earn their applicable unfold (for the danger they’re taking), or they may cease doing enterprise on this a part of the market. In our opinion, the cardboard issuers will adapt and alter a lot quicker. If credit score issuers can’t earn an honest risk-adjusted unfold, we anticipate charges might be pushed onto retailers. For instance, we anticipate non-public label issuers will look to their retail companions and power them to rebate some charges within their income sharing agreements. Synchrony has disclosed that 60% of its late charges are tied to its income sharing agreements, the place it will possibly earn extra charges from its retailers.

In easy phrases, these entities are not any totally different than a financial institution; simply attempting to earn a selection between their value of capital and the income it will possibly earn from its prospects. The second by-product (of actions like this) typically make credit score more durable to get for the people who want it probably the most.

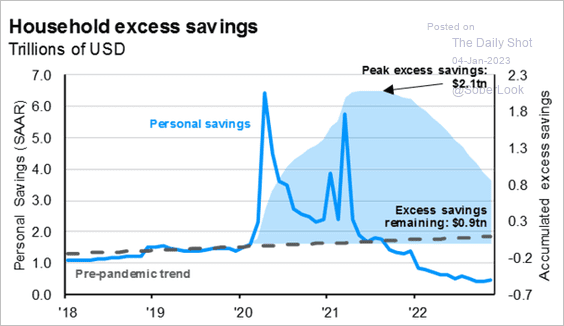

As this chart exhibits, over the past yr or so, the quantity of financial savings or family surplus has materially declined. In actual fact, family financial savings has turned detrimental, and extra shoppers are counting on credit score.

HH Financial savings (The Every day Shot)

Too many US shoppers live paycheck to paycheck. In keeping with a survey by Pymnts.com and LendingClub, 166 million folks or 64% of US shoppers, had been dwelling paycheck to paycheck in 2022.

Center-class and upper-class US households (which have regular and well-paying jobs) don’t have big issues paying their payments. Nonetheless, the decrease class wants credit score to “make ends meet”. In excessive inflationary durations, the price of dwelling is rising a lot quicker than their month-to-month revenue. To offset this CFPB rule, we anticipate minimal cost necessities might be raised. This sadly will put extra stress on decrease revenue and subprime shoppers which can be simply struggling to outlive. These persons are utilizing credit score to remain afloat and the CFPB thinks these guidelines will assist.

Conclusion:

People drive our financial system, and it’s estimated that client spending accounts for 70% of total GDP. We might like to see $9 billion a yr go instantly again into the pockets of subprime US shoppers, as we’re assured, they might spend these funds (like they did with stimulus checks).

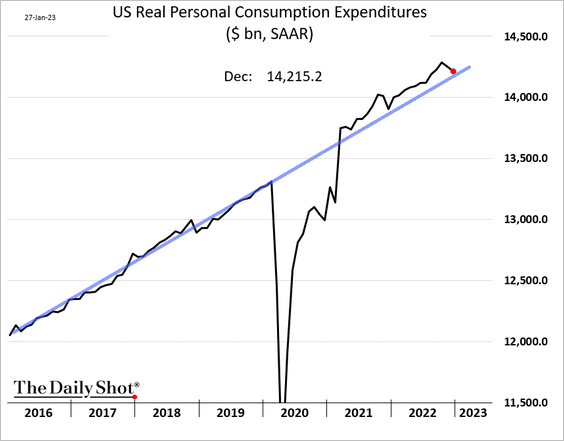

PCE Spending (Every day Shot)

Nonetheless, we imagine this CFPB aim might be circumvented and offset in a number of methods. What isn’t useful, in a well-functioning market, are guidelines launched by authorities entities, that usually do extra hurt than good. Most of these laws typically have secondary impacts that bureaucrats don’t recognize or perceive.

As this chart of PCE (private consumption expenditures) exhibits, spending is constant to climb, following the dramatic drop-off throughout COVID. The pattern line is up and to the proper and we imagine it ought to proceed going ahead.

The questions we’ve got highlighted and talked about are the objects we’re monitoring. The cardboard business has till April third, 2023, to offer commentary on this rule. We anticipate this CFPB proposal on late charges to enter impact in 2024. We’ll be intently expecting the ramifications…