[ad_1]

2022.12.13

Silver, like gold, is a valuable steel that provides traders safety throughout instances of financial and political uncertainty.

After Russia’s invasion of Ukraine earlier this yr, the flight to security subsequently despatched silver costs previous the $26/ouncesmark, which was final seen in August, 2021.

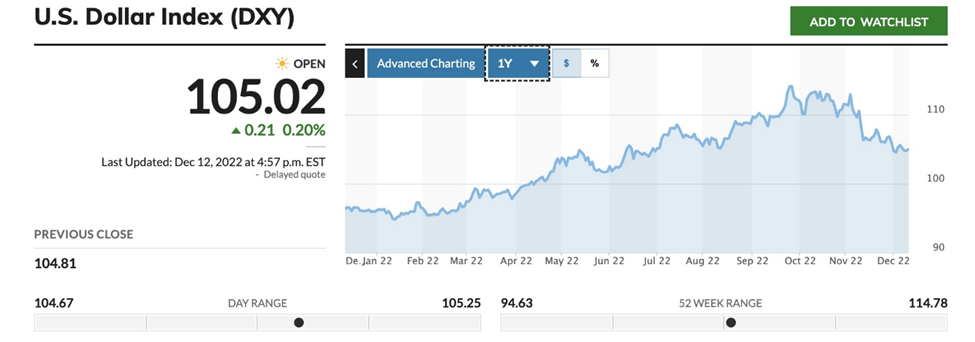

This silver rally proved to be a flash within the pan, nonetheless. An aggressive rate of interest hike marketing campaign by the US Federal Reserve, together with a excessive US greenback, has stored the safe-haven steel in verify.

Nonetheless, there are a number of causes to consider that long term, silver will rebound — presumably returning to ranges final seen in the course of the early 2021 Reddit-fueled silver frenzy.

Spot silver has already gained 20% over the past three months.

The potential forces behind silver’s subsequent rally embrace: financial demand, industrial demand, low inventories, bodily market tightness, peak silver, and the gold-silver ratio.

Financial demand

Hovering bond yields point out that traders assume the US Federal Reserve will do no matter is critical to convey down inflation, and can succeed, with out crashing the economic system. However, as soon as the Fed can now not deny that it’s mistaken about with the ability to management inflation, and that the economic system is weaker than they assume, it can return to unfastened financial coverage, i.e., quantitative easing (good for gold & silver).

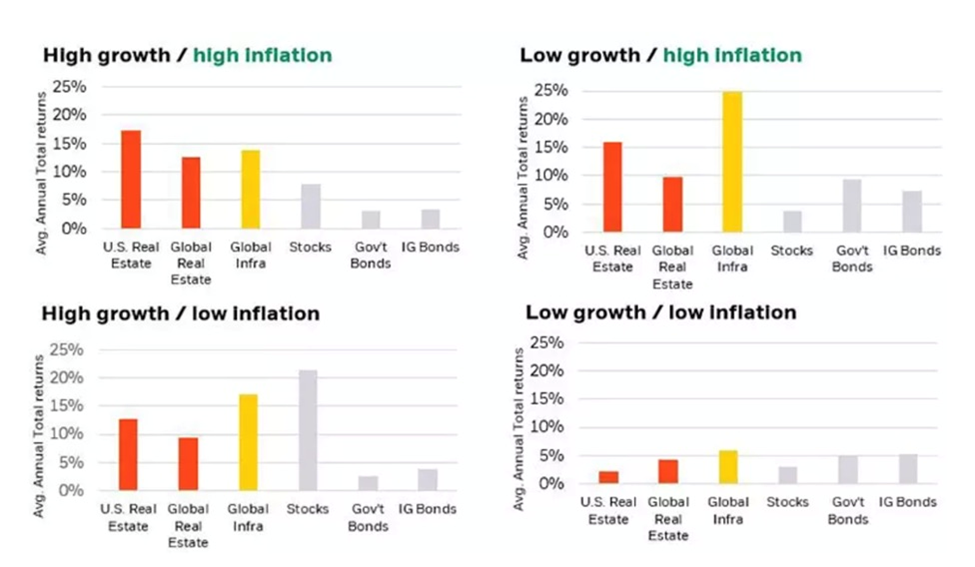

Gold is usually touted as a sensible technique of portfolio diversification, past conventional shares and bonds. Nevertheless, new analysis by Oxford Economics advises that silver must also be included inside a multi-asset funding portfolio.

The agency discovered traders would profit from a 4 to six% silver allocation, which is considerably increased than present holdings of silver by most institutional and retail traders.

Now, imo, can be an particularly good time to start out accumulating silver, or including to an current place, contemplating the inflationary surroundings we discover ourselves in. Silver, like gold, is taken into account a wonderful inflation hedge; in contrast to fiat currencies, silver doesn’t lose its worth when inflation erodes the buying energy of a unit of foreign money.

Inflation is the fourth horseman

We’re additionally on the point of a recession, which is dangerous information for inventory costs, however excellent news for valuable metals. Silver and gold bulls like nothing greater than an financial disaster, or geopolitical turmoil, to look at the worth of their bullion develop. And whereas shares loved a November carry, technical evaluation reveals it was in all probability a dead-cat bounce.

The mom of all financial crises

In a latest letter to traders, Mark Spiegel of Stanphyl Capital mentioned he believes the most important indexes, although not all particular person shares, have significantly extra draw back — “the inevitable hangover from the largest asset bubble in US historical past.”

Spiegel by way of Quoth the Raven (Zero Hedge) additionally observes that the US inventory market’s valuation as a proportion of GDP (the “Buffett Indicator”) may be very excessive, and thus valuations have a great distance to go earlier than reaching “normalcy”. The indicator is at present sitting at 162%, 26% increased than the historic development of 128%.

As for the Federal Reserve’s rate of interest will increase, and their impact on silver, the Fed will probably be guided by November’s inflation numbers that are due out Tuesday, proper earlier than the subsequent FOMC assembly, on Dec. 14.

The pervasiveness of value pressures is problematic, and it’ll possible take two or extra months of decreases for the Fed to contemplate pivoting from hawkish to dovish, which means reducing rates of interest and returning to its program of sovereign bond shopping for often known as quantitative easing, or QE — that will be nice for gold and silver.

The November CPI forecast, in line with consensus estimates from FactSet, is for a slight lessening of the benchmark inflation indicator:

- CPI, yr over yr, to rise 7.3% versus 7.7% in October.

- CPI to rise 0.35% for the month versus 0.4% in October.

- Core CPI (excluding meals and power) to rise 0.3% for the month versus 0.3% in October.

- Core CPI, yr over yr, to rise 6.1% versus 6.3% in October.

One other key inflation measure, the Producer Value Index, rose 7.4% in November in comparison with 8.1% in October, the Bureau of Labor Statistics reported final Friday, by way of CNN. The PPI measures costs paid for items and providers by companies earlier than they attain customers.

Nevertheless, “Any significant aid for family budgets continues to be someplace over the horizon,” Greg McBride, chief monetary analyst at Bankrate, was quoted by CNBC following the discharge of the October inflation figures.

“The areas posting declines are for essentially the most half both irregular or extra discretionary in nature — airfare, used vehicles, and attire,” he added.

Inflation

Tune by Earnest Jackson & Sugar Daddy and the Gumbo Roux

That means all of the stuff you purchase each day continues to be going up, whereas the stuff you often purchase, and might do with out for for much longer intervals, goes down. Households are more and more having to self-discipline themselves into discretionary spending versus necessities.

For my part, valuable metals’ optimistic response to decrease inflation, in early November, backs up what we’ve been saying about commodities for fairly a while. It’s a prelude to what’s going to occur throughout all the commodities spectrum when the greenback lastly weakens after months of energy. (commodities have a tendency to maneuver increased when the greenback falls). The US greenback index hit a one-year excessive of 114.10 on Sept. 27, nevertheless it has since fallen again to 105.01, a drop of 8.6%.

Treasured metals bounce is a style of what’s to return

Commodities are the commerce for driving out the Fed-caused recession

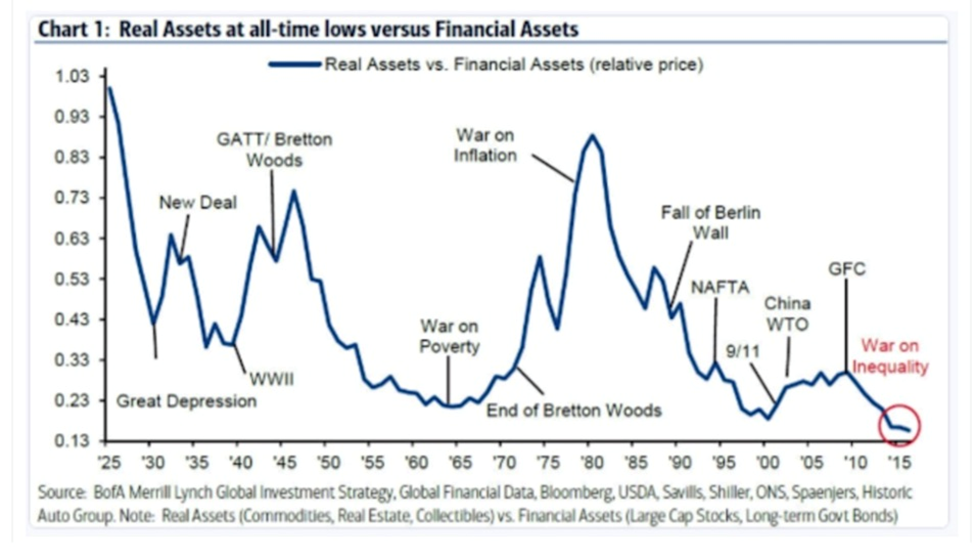

Our perception in silver can also be a mirrored image of our religion in actual belongings versus monetary belongings.

Why actual belongings are higher at defending wealth than monetary belongings

Investopedia defines actual belongings as bodily belongings which have an intrinsic price as a result of their substance and properties. They embrace commodities, pure sources, tools and actual property. Actual belongings present portfolio diversification as they usually transfer in the other way as monetary belongings, which embrace shares, bonds, mutual funds, financial savings and money.

Inflation, modifications in foreign money values, and different macro-economic elements have an effect on actual belongings lower than monetary belongings, making them extra steady, and good investments in periods of excessive inflation.

The chart under, by way of Harvest, graphs the worth of actual assts versus monetary belongings over time. We discover that actual belongings explode in relative worth in periods of inflation and conflict. This is sensible as a result of extra sources are wanted, or commodities are scarce, relative to cash.

The chart under reveals a large dispersion between asset value inflation and actual economic system inflation. Whereas actual economic system costs barely moved from 2009-18, asset costs exploded. Harvest states: The capital features, dividends, or carry has favored these belongings over investing in the true economic system. Extra money has used monetary belongings as a retailer of worth. That is the collateral used for a levered economic system.

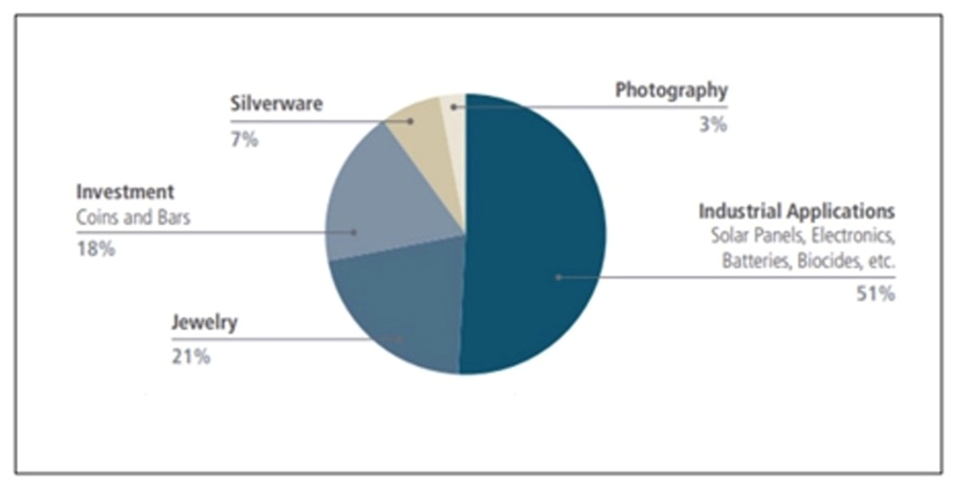

Whereas silver is a financial steel, a lot of its worth is derived from industrial demand. It’s estimated round 60% of silver is utilized in industrial functions, like photo voltaic and electronics, leaving solely 40% for investing.

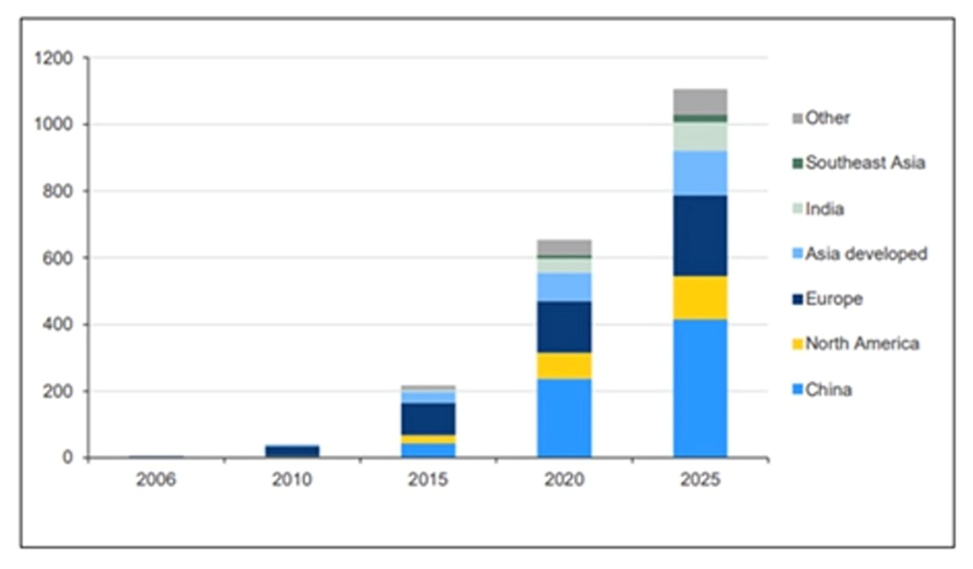

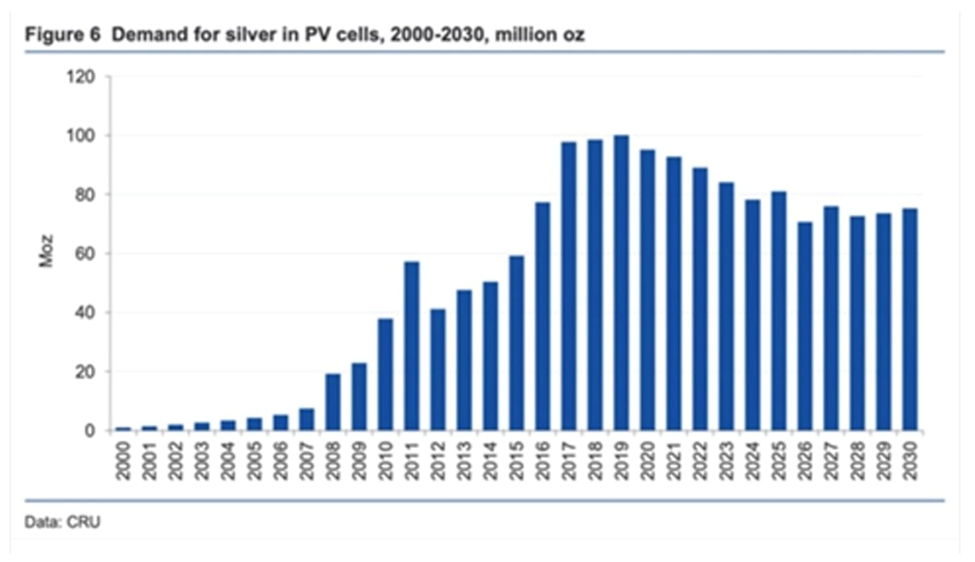

Photo voltaic

Because the steel with the very best electrical and thermal conductivity, silver is ideally suited to photo voltaic panels. About 100 million ounces of silver are consumed per yr for this objective alone.

This determine is predicted to rise within the coming years, with continued development of electrical energy demand and renewable power aspirations all pointing to rising solar energy penetration.

One projection has annual silver consumption by the photo voltaic business rising 85% to about 185 million ounces inside a decade, in line with a report by BMO Capital Markets.

5G

5G know-how is about to develop into one other massive new driver of silver demand. Among the many 5G parts requiring silver, are semiconductor chips, cabling, microelectromechanical programs (MEMS), and Web of issues (IoT)-enabled gadgets.

The Silver Institute expects silver demanded by 5G to greater than double, from its present ~7.5 million ounces, to round 16Moz by 2025 and as a lot as 23Moz by 2030, which might symbolize a 206% enhance from present ranges.

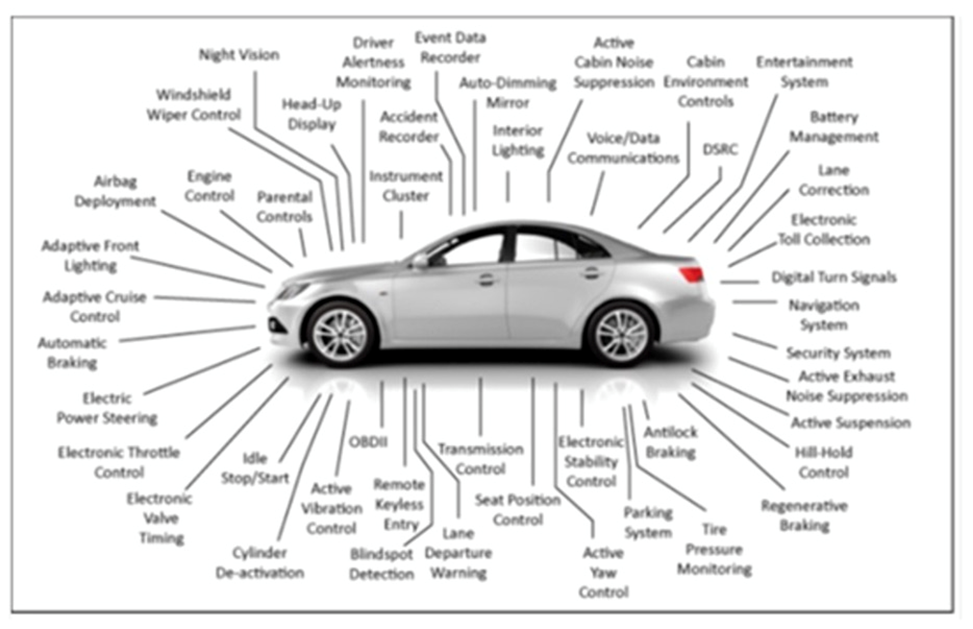

Automotive

A 3rd main industrial demand driver for silver is the automotive business. Silver can also be discovered in lots of automotive parts all through autos’ digital programs, and regardless of not being utilized in batteries, its superior electrical properties make it exhausting to interchange throughout a large and rising vary of automotive functions.

Battery electrical autos comprise as much as twice as a lot silver as ICE-powered autos. A latest Silver Institute report says the auto sector’s demand for silver will rise to 88Moz in 5 years because the transition from conventional vehicles and vans to EVs accelerates. Others estimate that by 2040, electrical autos might demand almost half of annual silver provide.

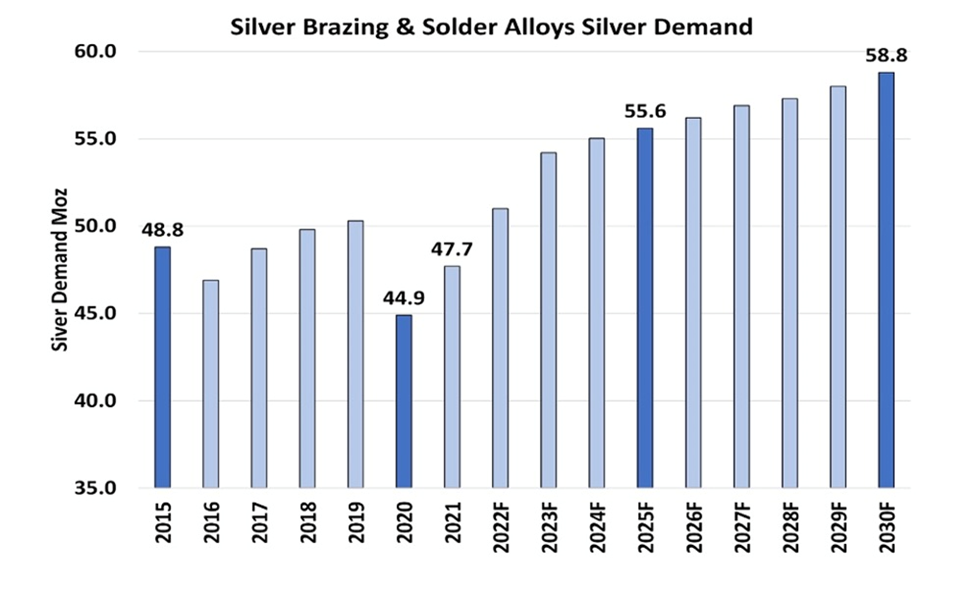

Brazing and soldering

In 2021, brazing and soldering alloys used 47.7Moz of silver, representing 9.3% of the full industrial demand for silver that yr. By 2030, the demand for silver utilized in brazing and soldering is forecast to succeed in 58.8Moz, a 23% over 2021, in line with a Silver Institute report launched in June, titled ‘Silver in Brazing and Solder Alloy Supplies’.

Electronics

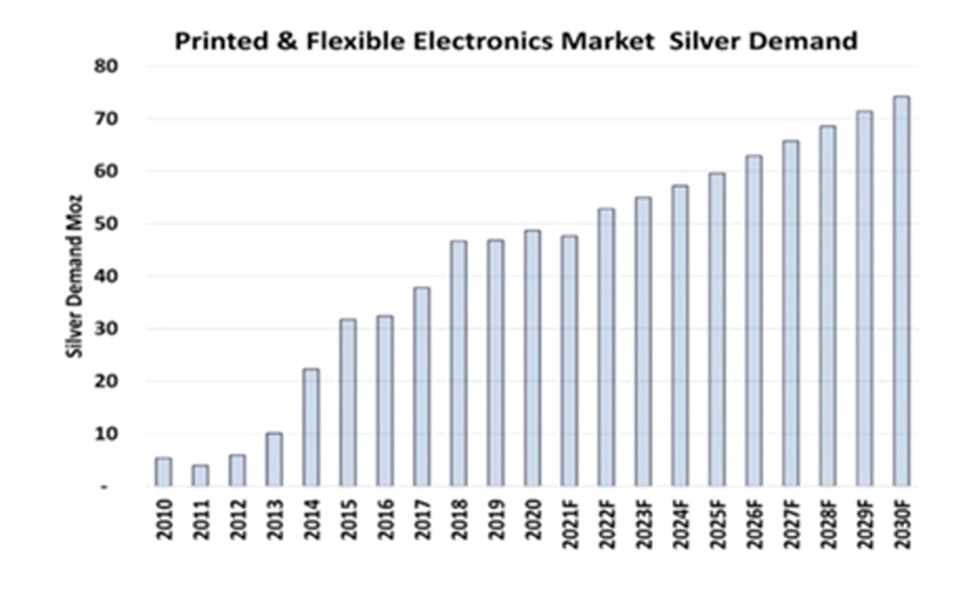

Lastly, silver demand for “printed and versatile electronics” is forecast to extend 54% over the subsequent 9 years, rising from 48Moz in 2021 to 74Moz in 2030, which means a consumption of 615Moz throughout this time-frame.

A Silver Institute information launch describes them as “mainstays” in a wide range of digital merchandise, together with sensors that measure every part from temperature, strain and movement, to moisture, relative humidity and carbon monoxide. They’re additionally utilized in medical gadgets, cell phones, equipment shows and client electronics.

Silver as crucial steel

The “inexperienced economic system” rejects soiled sources of power and transportation, particularly coal, oil, and pure gasoline. As an alternative, it depends on carbon-friendly modes of transport and power manufacturing, together with electrical autos, renewable energy, and power storage, in addition to cellular know-how (5G) and fast adoption of synthetic intelligence (AI) applied sciences needing elevated computing energy.

Transportation makes up 29% of world emissions, so transitioning from gas-powered vehicles and vans to plug-in autos, in addition to high-speed rail, is a vital a part of the plan to wean ourselves off fossil fuels.

Nevertheless, to perform the entire above would require a colossal enhance within the manufacturing of mined supplies, together with silver, copper, zinc, nickel, lithium, graphite and palladium.

The transfer away from fossil-fuel-powered autos to EVs run on batteries is occurring in virtually each nation. Governments are spending billions on EV charging infrastructure and subsidies to incentivize customers to change to hybrids and plug-in electrical vehicles, vans and vans. Giant automakers like Volkswagen, Mercedes Benz, GM and Ford are popping out with new EV fashions, and are planning new EV manufacturing/ meeting crops in North America and Europe.

US battery and EV crops galore

On tempo for report yr

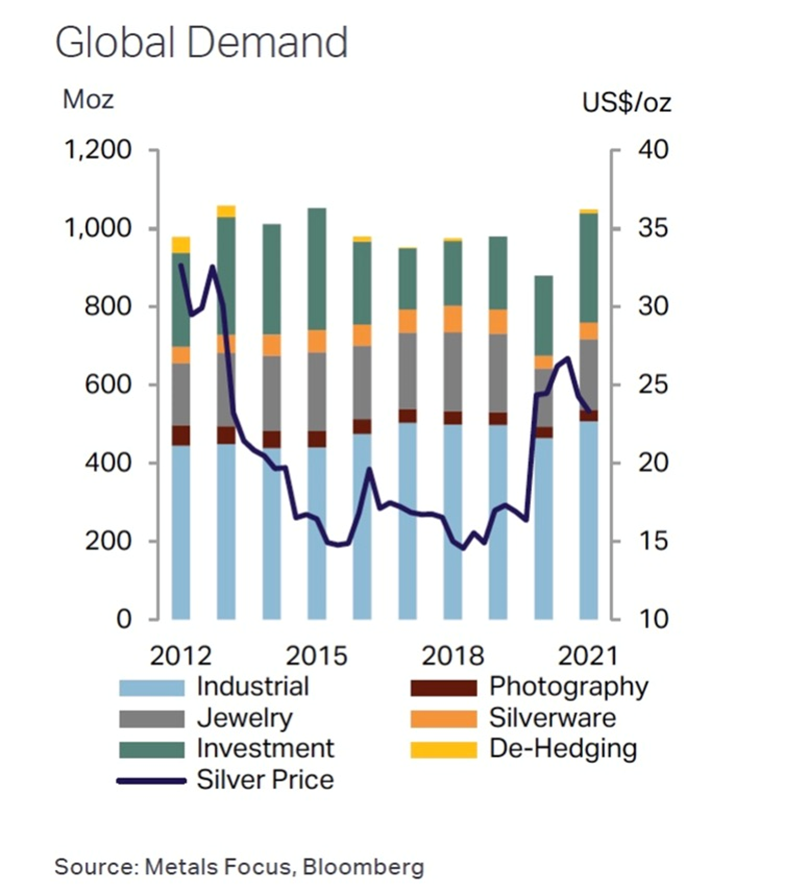

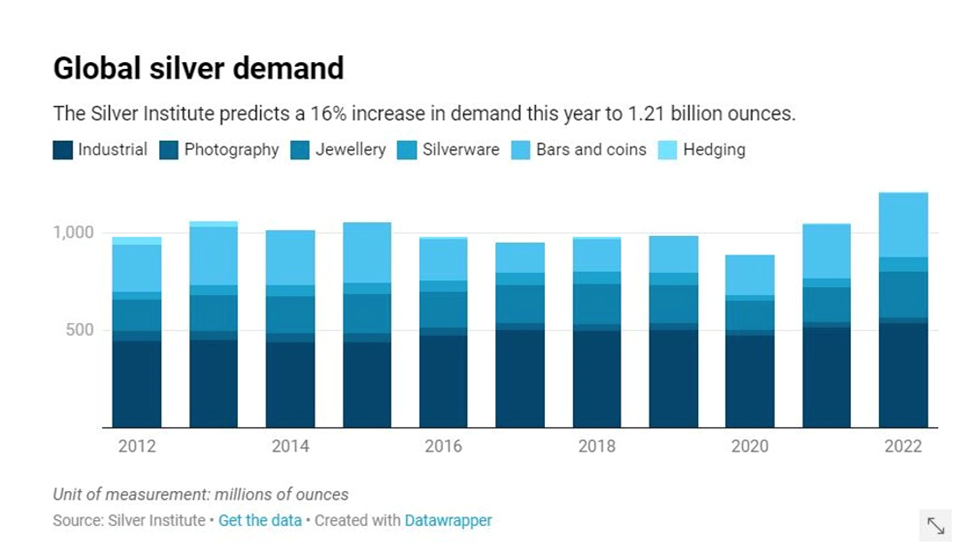

In line with the Silver Institute’s 2022 Interim Silver Market Overview, launched on Nov. 17, international demand for silver this yr is forecast to hit a report 1.21 billion ounces, a 16% enhance from 2021 demand. New highs are predicted for bodily funding, industrial demand, jewellery and silverware manufacturing.

Whereas institutional demand for silver has confronted headwinds, as a result of rising rates of interest resulting in a lower in silver ETF holdings, this has been countered by a surge in bodily funding, which is on tempo to leap by 18% to 329Moz this yr.

In line with the Silver Institute, “Assist has come from investor fears of excessive inflation, the Russia-Ukraine conflict, recessionary considerations, distrust in authorities, and shopping for on value dips. The rise was boosted additional by a (near-doubling) of Indian demand, a restoration from a droop final yr, with traders usually benefiting from decrease rupee costs.”

India shopping for

The Indian market is especially sturdy for silver. Silver consumption there may be forecast to surge by round 80% this yr, Bloomberg mentioned, as warehouse inventories are drawn down after two years of covid.

A latest article says that, whereas Indians purchased low quantities of silver in 2020 and 2021, as a result of hits to produce chains and demand, this yr silver gross sales are again on monitor:

Native purchases could surpass 8,000 tons in 2022 from about 4,500 tons final yr, mentioned Chirag Sheth, principal guide at Metals Focus Ltd. That’s up from an April estimate of 5,900 tons.

Panelists on the LBMA gold convention in Lisbon agreed that bodily demand for gold and silver stays exceptionally sturdy, significantly in Asia and the Center East.

West to East gold migration

Report-low inventories

The quantity of silver saved in vaults in London (London Bullion Market Affiliation) and New York (Comex trade) has fallen by about 370 million ounces, or 25% this yr. (Reuters, Nov. 17, 2022)

Inventories of silver held in vaults throughout London dropped to a report low in October, in line with knowledge from the LBMA. Kitco Information reported that Silver holdings dropped to 26,502 tonnes, down 2.2% from the earlier month. The worth of holdings stood at $16.3 billion, which is about 883,417 silver bars.

“That is the bottom quantity of silver held within the vaults since reporting began in July 2016,” the LBMA mentioned in its report this week [Nov. 7-11].

The drop in silver holdings is defined by the sturdy demand for the bodily steel. “The decline mirrored the continuing energy of coin and bar demand, particularly in the important thing U.S. and German markets,” mentioned Philip Newman, the Managing Director at Steel Focus.

Bullion Star mentioned an necessary contributor to this unprecedented demand for bodily silver is India. The nation’s silver imports for the primary 9 months of 2022 totaled 8,217 tonnes. When annualized, this quantities to just about 11,000 tonnes, representing one-third of the world’s silver provide.

India’s large silver demand slicing world’s warehouse shares

Bodily market tightness

In line with one market analyst quoted by Kitco Information, there’s a vital disconnect within the silver market between funding demand in “paper” (silver ETFs) and bodily bullion.

Peter Krauth, founding father of the Silver Inventory Investor publication and creator of ‘The Nice Silver Bull’, says the availability and demand imbalance is acutely felt amongst bodily silver traders pressured to pay report premiums for bullion as a result of there isn’t sufficient provide.

A latest article by SB&C notes gold and silver costs are strongly influenced by the shopping for and promoting of futures contracts. Not like “paper” gold and silver, there’s a restricted amount of bodily steel:

Consequently, it’s typical for the spot value of gold and silver to take some time to meet up with the realities of bodily demand. It’s solely a matter of time earlier than that hole is reconciled…

The whole valuable metals business is struggling to maintain up with the skyrocketing demand for bodily gold and silver. This extraordinary rush in direction of bodily metals has resulted in market huge provide shortages and supply delays of some gold and silver cash, gold bars, and silver bars. The mixture of fewer folks seeking to promote gold and silver and a rising variety of consumers is squeezing the provision of bodily valuable metals…

Report deficit forecast

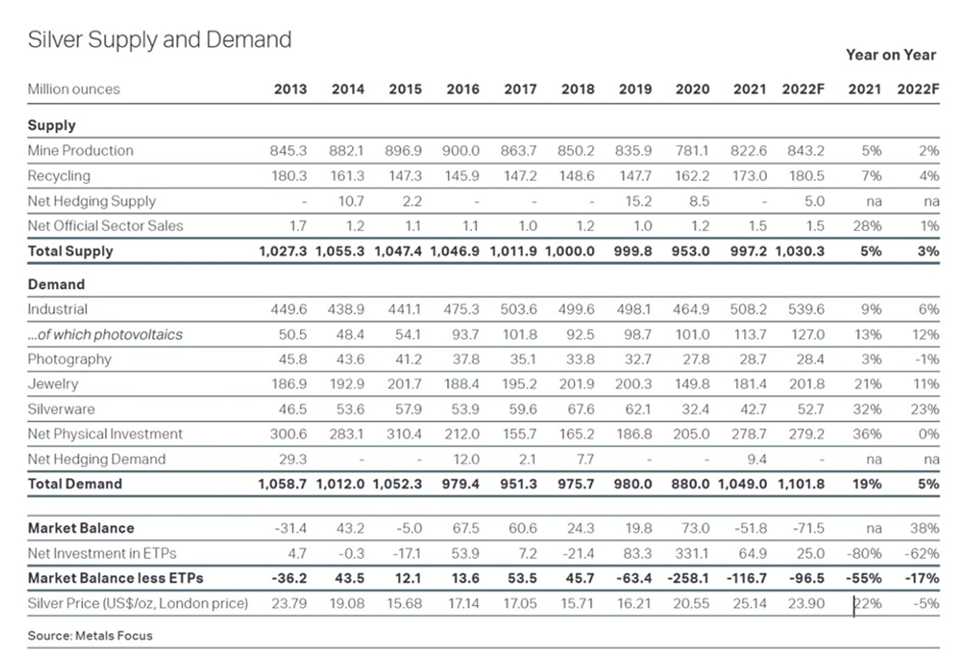

Whole mined silver provide in 2021 was 25,587 tonnes, or 822.6 million ounces. The Silver Institute expects mine manufacturing in 2022 to extend by 2.5%, to 843.2Moz, with the largest rise occurring in Mexico.

After shifting to a deficit in 2021 for the primary time in six years, the silver market is predicted to put up a second, and report shortfall this yr.

The 194-million-ounce deficit compares to 48Moz in 2021 and can be a multi-decade excessive, in line with an article by Schiff Gold.

Peak silver

Like gold, we will research the supply-demand image for silver to get a way of whether or not we’ve reached peak mine provide.

At AOTH we differentiate between the full silver provide, which lumps in recycled silver with mined silver, versus mine provide by itself. (most recycled silver is industrial grade)

In line with the 2022 World Silver Survey, in 2021 international mine manufacturing elevated 5.3% yoy to 822.6 million ounces, or 25,587 tonnes. It was the largest rise in manufacturing since 2013, largely as a result of financial restoration following a down yr in 2020, when loads of silver mines had been disrupted as a result of pandemic.

Helped by increased costs, silver recycling rose for a second yr in a row, up 7% in 2021 to an 8-year excessive of 173Moz, or 5,382 tonnes.

Mixed, due to this fact, we now have whole silver provide reaching 997.2Moz in 2021.

How about demand? In line with the World Silver Survey, after a droop in 2020, international silver demand climbed by 19% final yr to 1.05 billion ounces, surpassing pre-pandemic volumes and reaching its highest degree since 2015.

(Bear in mind: Whereas a lot of the mined gold continues to be round, both forged as jewellery, or smelted into bullion and saved for funding functions, the identical can’t be mentioned for silver. It’s estimated round 60% of silver is utilized in industrial functions, like photo voltaic panels and electronics, leaving solely 40% for investing.)

All of the demand classes noticed features, the biggest being bar and coin purchases, adopted by industrial demand. Bodily funding (bars and cash) demand skyrocketed by 35% to 278.7Moz, the very best degree since 2015’s report, as traders hoovered up the white steel in response to inflation uncertainty and detrimental actual rates of interest. Gross sales of silver bars and cash in India greater than tripled.

2021 demand of 1.049 billion ounces outstripped provide of 997.2Moz, by 51.8Moz. However bear in mind, recycling is included within the whole provide. Once we take recycling out, 173Moz, we get an excellent higher deficit of 224.8Moz. (1,049,000,000 minus 824,200,000 = 224,800,000)

That is vital, as a result of it’s saying despite the fact that mined silver provide final yr rebounded from 2020, to 822.2Moz, the very best since 2013, it was unable to fulfill whole demand, industrial plus funding, of 1.05 billion ounces, which was the very best demand for silver since 2015. It fell quick by 51.8Moz, and that was together with recycling.

That is our definition of peak mined silver. Will the silver mining business be capable to produce, or uncover, sufficient silver that it’s in a position to meet demand with out having to recycle? If the numbers mirror that, peak mined silver can be debunked.

It didn’t occur in 2021, (or 2020) and in line with the Silver Institute, it received’t occur in 2022 both.

Once more, let’s take a look at the numbers.

The Silver Institute expects silver output in 2022 to exceed final yr’s whole by 2.5%, yr on yr, hitting 843.2Moz, or 26,226t. However once more, this contains recycling; it’s set to extend for a 3rd straight yr, with a 4% achieve forecast, or 180,500,000 oz.

Taking 180,500,000 ouncesof forecasted recycling out of the equation, we now have mined provide of 662,700,000 oz, in opposition to the Silver Institute’s 2022 demand forecast of 1,101,800,000 oz (1.101Boz), leaving one other forecasted deficit, and one that’s almost twice as bigger as 2021’s, when recycling is excluded, of 439.1Moz.

The case for peak gold, silver and copper

Silver undervalued

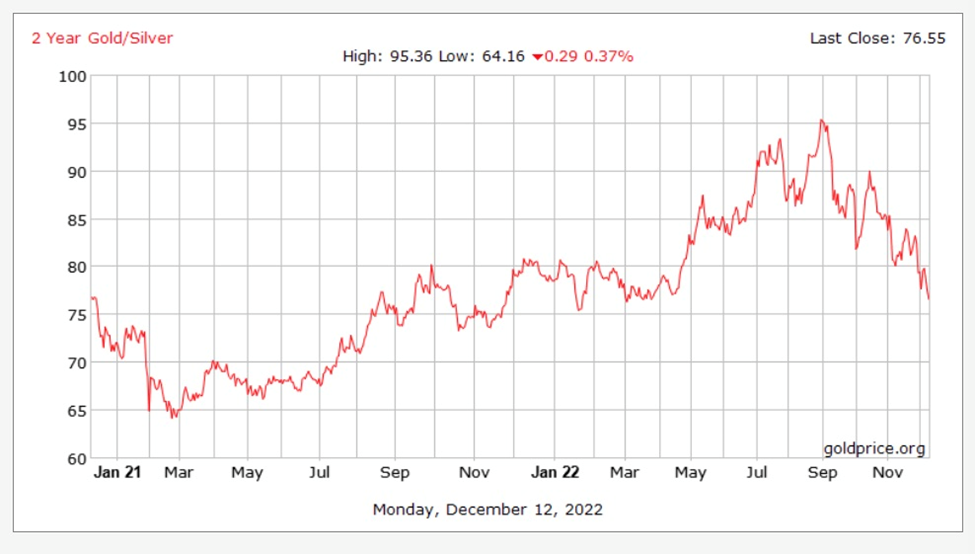

We use the gold-silver ratio to learn how silver costs examine to gold. The ratio is the quantity of silver one should buy with an oz of gold. Merely divide the present gold value by the worth of silver.

The upper the quantity, the extra undervalued is silver or, to place it one other approach, the farther gold is pulling away from silver, valued in {dollars} per ounce.

When gold is over-valued in comparison with silver, traders benefit from the arbitrage alternative, by promoting a few of their gold holdings to purchase silver. The other happens when silver is over-valued in comparison with gold. In that scenario, they promote silver to purchase gold.

Because the chart under reveals, the gold-silver ratio over the previous two years has been everywhere in the map, reaching a low of 64 in March, 2021, and hitting a excessive of 95 in September, 2022.

For the previous month the ratio fluctuated between 84.0 and 76.5. That is nonetheless out of whack from the historic ratio of 40 to 50, which means that silver is on sale.

Traditionally, the ratio has at all times returned to the imply.

See the chart under, and linked commentary by Schiffgold.com, exhibiting that Traditionally, when the unfold will get this huge, silver doesn’t simply outperform gold, it goes on an enormous run in a brief time period. Since January 2000, this has occurred 4 instances. As this chart reveals, the snapback is swift and robust.

Conclusion

Now is an effective time to be stocking up on comparatively low cost gold and silver, though for me, the higher funding is in junior useful resource firms, who’re exploring for and growing the world’s future mines.

A latest Silver Institute report says electrical autos comprise as much as twice as a lot silver as gas-powered autos. Charging factors and charging stations are additionally anticipated to demand much more silver.

It estimates the auto sector’s demand for silver will rise to 88Moz in 5 years because the transition from conventional vehicles and vans to EVs accelerates. Others estimate that by 2040, electrical autos might demand almost half of annual silver provide.

In line with Adamas Intelligence’s State of Cost report, EV registrations rose by 42% within the first half of 2022, in comparison with the identical interval final yr. This quantities to six.23 million models, up from 4.4 million in H1, 2021. For spherical numbers, let’s simply say that electrification is rising at 2 million models a yr. How a lot silver will probably be wanted for that degree of demand? And bear in mind, the mining business nonetheless must mine sufficient silver for financial and all the opposite industrial makes use of.

The hovering demand for silver, matched in opposition to the approaching provide crunch — bear in mind we’re already at peak silver and this yr’s forecasted deficit is 4 instances increased than final yr’s — all however ensures the silver value is shifting increased.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free publication

Authorized Discover / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter often known as AOTH.

Please learn all the Disclaimer rigorously earlier than you utilize this web site or learn the publication. If you don’t conform to all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/publication/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/publication/article, and whether or not you really learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc will not be, and shouldn’t be, construed as a proposal to promote or the solicitation of a proposal to buy or subscribe for any funding.

AOTH/Richard Mills has based mostly this doc on data obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no accountability or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any data supplied inside this Report and won’t be held accountable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or harm for misplaced revenue, which you will incur on account of the use and existence of the knowledge supplied inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be performing at your OWN RISK. In no occasion ought to AOTH/Richard Mills accountable for any direct or oblique buying and selling losses attributable to any data contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles will not be a proposal to promote or a solicitation of a proposal to purchase any safety. AOTH/Richard Mills will not be suggesting the transacting of any monetary devices.

Our publications are usually not a advice to purchase or promote a safety – no data posted on this website is to be thought of funding recommendation or a advice to do something involving finance or cash apart from performing your individual due diligence and consulting together with your private registered dealer/monetary advisor.

AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with an expert monetary planner or advisor, and that you must conduct a whole and unbiased investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd will not be a registered dealer, supplier, analyst, or advisor. We maintain no funding licenses and should not promote, provide to promote, or provide to purchase any safety.

[ad_2]

Source link