[ad_1]

Visitor Contribution by ValueWalk

New buyers are cautioned to train due diligence over the approaching months, because the inventory market is being challenged by rising rates of interest, and the potential for slowing financial exercise.

This comes towards a backdrop of a number of bearish developments, comparable to central banks tightening their financial coverage, which has now began filtering by way of to actual property markets.

A number of components at the moment are driving a risky market.

Positive Dividend recommends new buyers think about high-quality dividend shares such because the Dividend Aristocrats, a choose group of 67 S&P 500 shares with 25+ years of consecutive dividend will increase.

There are presently 67 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 67 (with metrics that matter comparable to dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

As buyers proceed to hunt recession-proof shares, these 5 dividend payers will present their portfolios with substantial buoyancy within the coming months.

JPMorgan Chase & Co (JPM)

As the most important financial institution within the U.S. with greater than $417 billion in market capitalization, JPMorgan Chase & Co has exhibited sturdy efficiency all through a lot of the yr.

For starters, the financial institution reported $35.71 billion in revenues for the quarter ending June 2023, which represented a 20.58% improve from the identical interval final yr. Whole web earnings skilled related development, with the financial institution seeing greater than $14.47 billion in complete web earnings for the interval ending June 2023, marking a 67.33% year-over-year improve.

JPM is presently buying and selling 8.98% under its earlier peak within the yr, nevertheless, year-to-date efficiency has remained regular at 6.40% at first of October. As a trailblazer within the banking and monetary sector, JPM holds a gradual dividend yield of two.92%.

Why select JPM as a starting investor? Nicely, for any new investor who needs to attenuate danger, JPM continues to outpace market volatility and stays largely unaffected by rising rates of interest and infation.

Consolidated Edison (ED)

Newcomers which are on the lookout for a easy, but dependable dividend earnings can look in direction of U.S. utility firms, a lot of which proceed to see regional monopolies because of rising demand, and better utility prices.

Consolidated Edison (ED) is among the utilities dividing picks on the extra inexpensive aspect, with a present yr vary of $78.10 – $100.92 per share. When it comes to dividend yield, ED gives a gradual 3.97% return, which stays in step with different distinguished utility dividend choices.

On a year-to-date efficiency foundation, costs have slipped just below 15% already, which may assist play in favor of latest buyers who wish to decrease their danger publicity to risky inventory choices in the mean time.

Whereas total market efficiency has remained considerably stagnant this yr, Consolidated Edison has a robust monitor report of elevating dividend yields.

It has raised dividends for 46 consecutive years, making it some of the dependable Dividend Aristocrats for short-term earnings buyers.

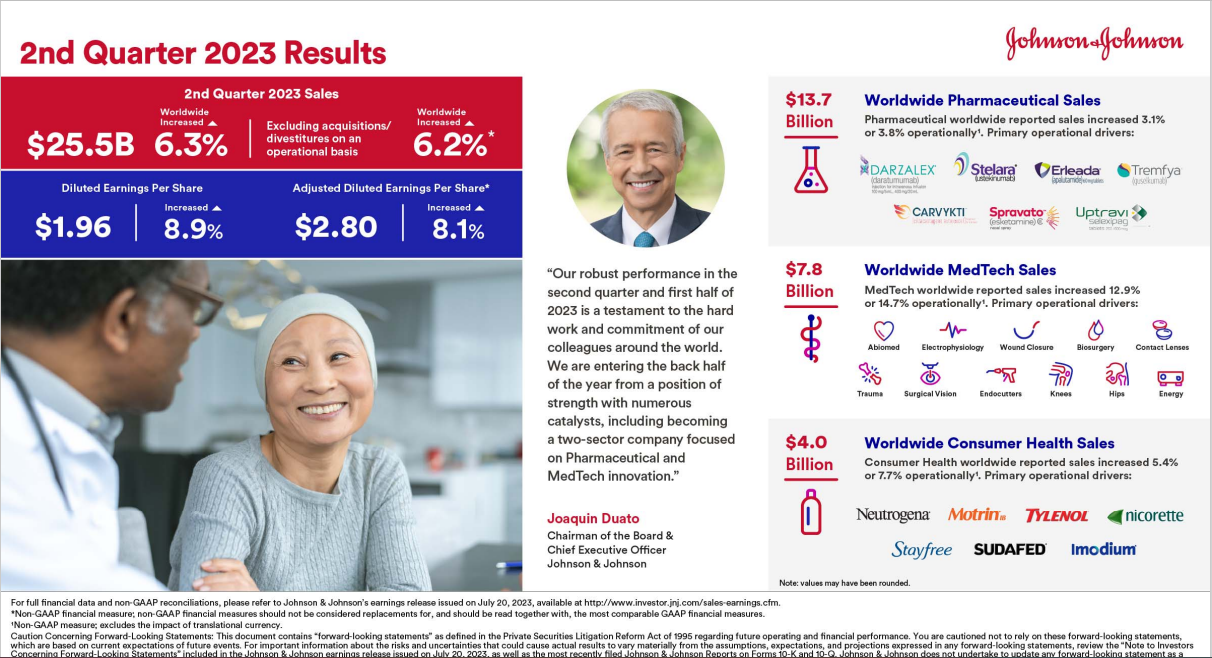

Johnson & Johnson (JNJ)

The American multinational pharmaceutical firm, Johnson & Johnson has come underneath the magnifying glass throughout a lot of final yr because of a lawsuit settlement case, and this yr already, new laws to decrease the price of prescribed drugs may hamper JNJ within the U.S.

Nevertheless, JNJ stays a strong behemoth that presently operates three enterprise segments, together with shopper well being, prescription drugs, and medtech.

Supply: Investor Presentation

Every of those has confirmed to supply the corporate with each close to and long-term success, because of their international footprint, regardless of the corporate now edging nearer to dropping a few of its exclusivity for a few of its greatest medicine within the U.S. market.

Nonetheless, JNJ stays one of many greatest healthcare-focused firms, with all three key enterprise segments producing greater than $79 billion in income final yr, regardless of demand for COVID-19 vaccines now reaching an all-time low.

J&J inventory gives a possibility to enter the big-pharma and MedTech market at a extra cheap tempo, that gives them with trusted efficiency, and ongoing firm growth.

Wells Fargo (WFC)

Because the second financial institution on our watch record, Wells Fargo & Co is presently buying and selling at nearly 20% above its lowest level of the yr, which noticed shares plummet to a low of $36.23 per share again in March.

Since tumbling by greater than 22.30% earlier within the yr, inventory efficiency has managed to form up, peaking once more in July at round $47.13 per share earlier than sliding in direction of its present vary of $39.44 – $40.76 per share.

Present dividend yields of three.53% stay considerably increased than the likes of JPM, nevertheless, buyers have slower development potential when it comes to the financial institution’s long-term outlook, regardless of WFC having reported constructive quarterly earnings for the interval ending June 2023.

Total, the financial institution generated $18.82 billion in revenues, a 14.34% year-over-year enchancment. Extra importantly, the financial institution, and mortgage lender have managed to make the most of the upper rate of interest surroundings over the past two quarters, additional surpassing analysts’ estimates.

For the latest quarter, WFC reported earnings of $1.25 per share, outpacing the anticipated $1.15 per share, shocking estimates by 8.70%. WFC shares have a constructive score, and analysts look to maintain a “Purchase” consensus on Wells Fargo, seeing because it gives buyers with a constructive upside and higher earnings within the close to time period.

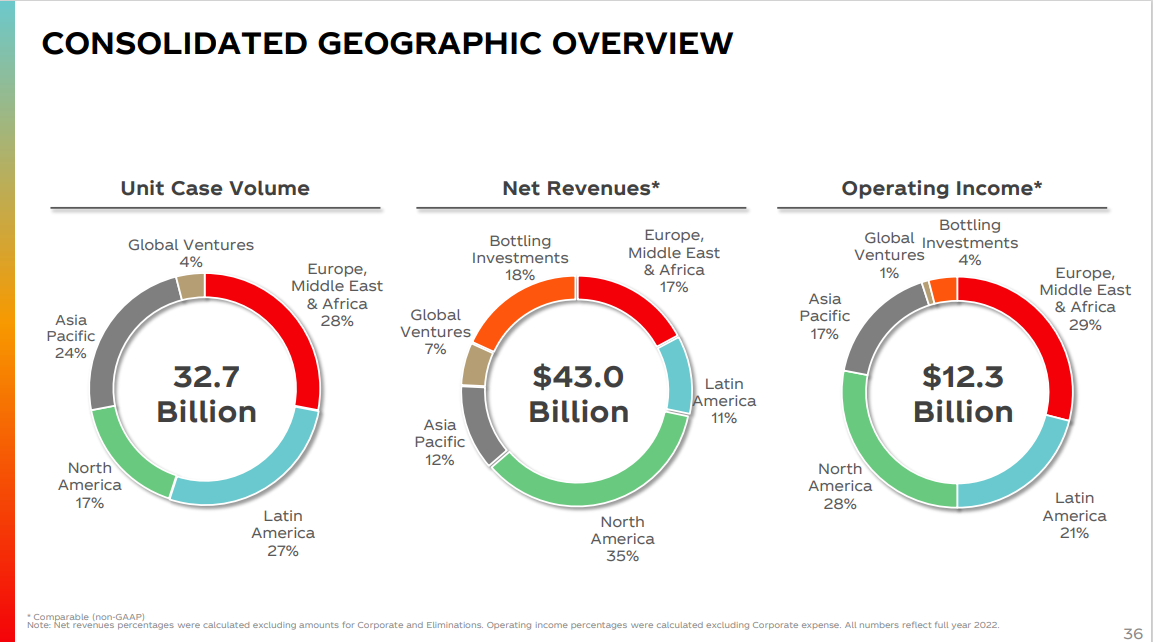

Coca Cola (KO)

Maybe some of the recognizable, and broadly obtainable manufacturers on the planet, Coca-Cola has raised its base annual dividend earnings for greater than 61 consecutive years, making it some of the distinguished Dividend Kings.

Supply: Investor Presentation

Whereas many buyers have traditionally shifted their consideration away from shopper firms comparable to Coca-Cola throughout slower development intervals, and slightly concentrate on development shares in tech and software program, KO has remained unaffected by risky headwinds, and fewer worth delicate to increased rates of interest because of low borrowing charges.

KO has a gradual dividend yield of three.32%, and present share costs are buying and selling 13% under their earlier peak of the yr. This yr, inventory efficiency has slipped by 11.87% yr so far, because of inflationary stress inflicting the corporate to boost costs throughout quite a few markets.

Whereas KO could usually be impacted by decrease shopper spending, and fluctuating foreign money actions in overseas markets, these near-term developments stay a smaller challenge for the corporate contemplating the long-turn upside potential.

Working round 26 manufacturers in its portfolio, these generated greater than $1 billion in annual gross sales final yr, and through its most up-to-date quarter, the corporate reported $11.79 billion in income, which represented a 5.71% improve from the identical interval final yr. Not unhealthy for a corporation that primarily sells shopper drinks.

Concluding Ideas

New buyers have to be aware of how market circumstances are unfolding and the influence it’s driving on dividend shares. As well as, new buyers want to contemplate their long-term efficiency and earnings development upside.

Some shares present new buyers with extraordinarily excessive dividends, however their monetary efficiency has been something however extraordinary, which means their dividends could possibly be lower.

As a substitute of taking a stake in excessive high-yield shares, new buyers ought to weigh the dangers and rewards to find out how nicely these shares will complement your portfolio over the long term.

That is why new buyers could be clever to contemplate high-quality dividend development shares comparable to these talked about on this article.

In case you are fascinated by discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

- The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per yr.

- The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.

Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have extra necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link