[ad_1]

Revealed on March twenty first, 2023 by Bob Ciura

Inventory costs are available all sizes. A couple of commerce above $1,000 per share, corresponding to Reserving Holdings (BKNG) and AutoZone (AZO). In the meantime, Warren Buffett’s Berkshire Hathaway (BRK.A) at present trades above $400,000 per share.

Most firms wouldn’t have such excessive share costs. When a share value will get very excessive, many firms will cut up their inventory to decrease the share value. Within the eyes of some, this makes the inventory extra approachable for buyers who could not have hundreds of {dollars} to speculate at a time.

In the identical vein, buyers can display for shares with low share costs. Though, a low share value is just not by itself a measure of an investment-worthy firm.

Generally, we advocate buyers who’re searching for high-quality dividend progress shares begin with the Dividend Aristocrats. Dividend Aristocrats are elite firms that fulfill the next:

- Are within the S&P 500 Index

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

You possibly can obtain an Excel spreadsheet with the total listing of all 68 Dividend Aristocrats (with extra monetary metrics corresponding to price-to-earnings ratios and dividend yields) by clicking the hyperlink under:

However for buyers who could not have an excessive amount of capital to deploy in such a high-priced inventory as Berkshire, there are some shares that may be purchased for below $5 per share.

This text will talk about our high 7 dividend shares below $5 with Dividend Threat Scores of ‘D’ or higher, and constructive anticipated returns, ranked by anticipated returns in accordance with the Positive Evaluation Analysis Database.

Desk of Contents

Prime Inventory Below $5: Banco Bradesco S.A. (BBD)

- 5-year anticipated annual returns: 2.6%

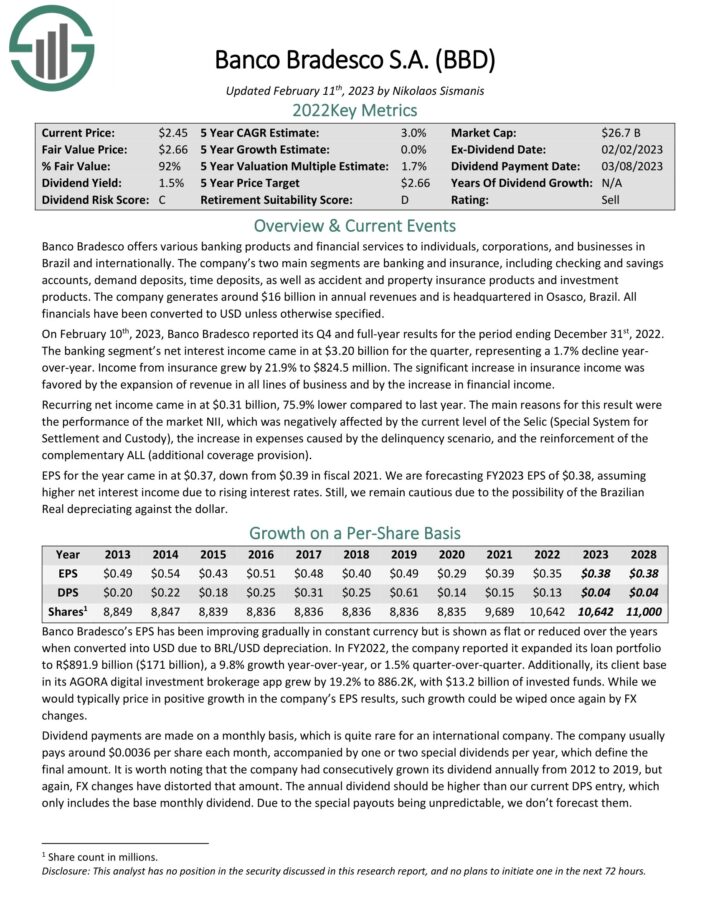

Banco Bradesco gives numerous banking merchandise and monetary providers to people, companies, and companies in Brazil and internationally. The corporate’s two foremost segments are banking and insurance coverage, together with checking and financial savings accounts, demand deposits, time deposits, in addition to accident and property insurance coverage merchandise and funding merchandise. The corporate generates round $20 billion in annual revenues and is headquartered in Osasco, Brazil.

On February tenth, 2023, Banco Bradesco reported its This autumn and full-year outcomes for the interval ending December thirty first, 2022.

Supply: Investor Presentation

The banking section’s internet curiosity earnings got here in at $3.20 billion for the quarter, representing a 1.7% decline year-over-year. Revenue from insurance coverage grew by 21.9% to $824.5 million. The numerous enhance in insurance coverage earnings was favored by the growth of income in all strains of enterprise and by the rise in monetary earnings.

Recurring internet earnings got here in at $0.31 billion, 75.9% decrease in comparison with final 12 months. The principle causes for this end result have been the efficiency of the market NII, which was negatively affected by the present degree of the Selic (Particular System for Settlement and Custody), the rise in bills brought on by the delinquency state of affairs, and the reinforcement of the complementary ALL (extra protection provision). EPS for the 12 months got here in at $0.37, down from $0.39 in fiscal 2021. We’re forecasting FY2023 EPS of $0.38, assuming greater internet curiosity earnings on account of rising rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on BBD (preview of web page 1 of three proven under):

Prime Inventory Below $5: Banco Santander S.A. (SAN)

- 5-year anticipated annual returns: 7.5%

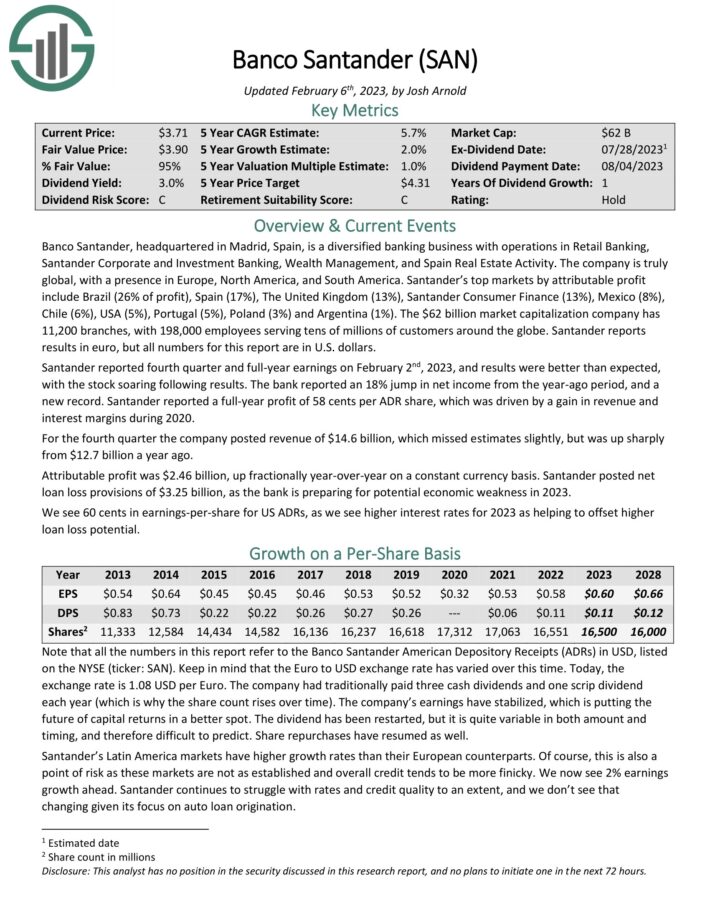

Banco Santander, headquartered in Madrid, Spain, is a diversified banking enterprise with operations in Retail Banking, Santander Company and Funding Banking, Wealth Administration, and Spain Actual Property Exercise. The corporate is international, with a presence in Europe, North America, and South America.

The corporate has 11,200 branches, with 197,000 workers serving tens of tens of millions of consumers across the globe. Santander reviews leads to euro, however all numbers for this report are in U.S. {dollars}.

Santander reported fourth quarter and full-year earnings on February 2nd, 2023, and outcomes have been higher than anticipated, with the inventory hovering following outcomes. The financial institution reported an 18% leap in internet earnings from the year-ago interval, and a brand new file. Santander reported a full-year revenue of 58 cents per ADR share, which was pushed by a acquire in income and curiosity margins throughout 2020.

For the fourth quarter the corporate posted income of $14.6 billion, which missed estimates barely, however was up sharply from $12.7 billion a 12 months in the past. Attributable revenue was $2.46 billion, up fractionally year-over-year on a relentless foreign money foundation. Santander posted internet mortgage loss provisions of $3.25 billion, because the financial institution is getting ready for potential financial weak spot in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on SAN (preview of web page 1 of three proven under):

Prime Inventory Below $5: U.S. World Buyers (GROW)

- 5-year anticipated annual returns: 15.9%

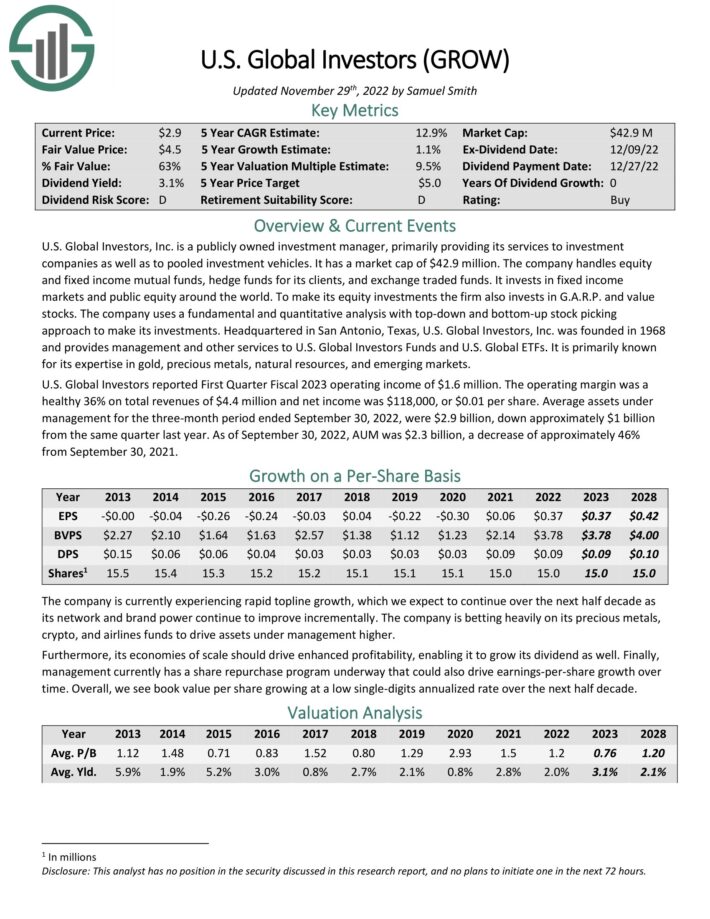

U.S. World Buyers is a publicly-traded registered funding advisor that appears to offer investing alternatives in area of interest markets around the globe. The corporate gives sector-specific exchange-traded funds and mutual funds, in addition to an curiosity within the cryptocurrencies house.

The corporate has various area of interest merchandise in its portfolio of choices, with the breakdown at roughly two-thirds in gold and pure assets, and the steadiness in rising markets, US fairness and glued earnings merchandise.

Certainly, belongings below administration have been considerably unstable, however have moved decidedly within the fallacious route lately. U.S. World Buyers is just not distinctive amongst asset managers in seeing unstable AUM, however its very small scale and total unfavourable development in AUM is regarding from our perspective.

U.S. World Buyers reported First Quarter Fiscal 2023 working earnings of $1.6 million. The working margin was a

wholesome 36% on whole revenues of $4.4 million and internet earnings was $118,000, or $0.01 per share. Common belongings below

administration for the three-month interval ended September 30, 2022, have been $2.9 billion, down roughly $1 billion

from the identical quarter final 12 months. As of September 30, 2022, AUM was $2.3 billion, a lower of roughly 46%

from September 30, 2021.

Click on right here to obtain our most up-to-date Positive Evaluation report on GROW (preview of web page 1 of three proven under):

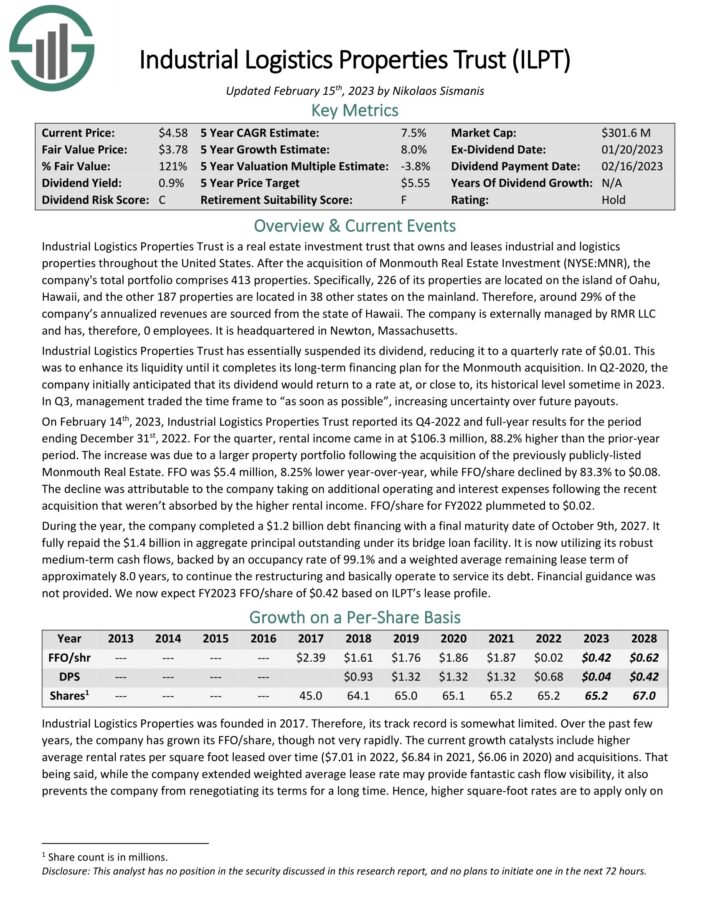

Prime Inventory Below $5: Industrial Logistics Properties Belief (ILPT)

- 5-year anticipated annual returns: 16.9%

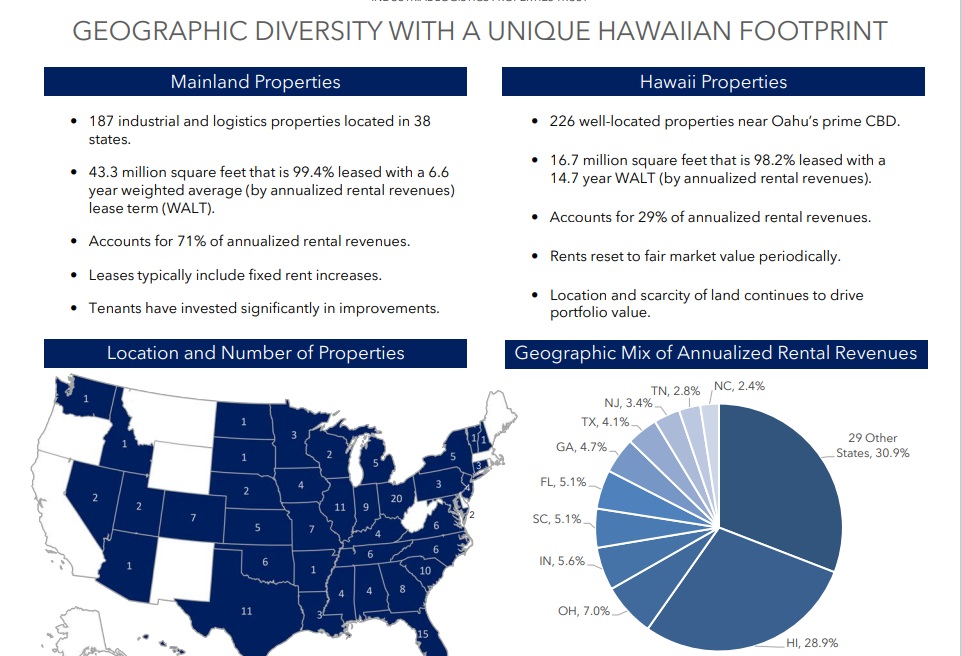

Industrial Logistics Properties Belief is an actual property funding belief that owns and leases industrial and logistics properties all through the US. After the acquisition of Monmouth Actual Property Funding, the corporate’s whole portfolio contains 413 properties. Particularly, 226 of its properties are positioned on the island of Oahu, Hawaii, and the opposite 187 properties are positioned in 38 different states on the mainland. Due to this fact, round 29% of the corporate’s annualized revenues are sourced from the state of Hawaii.

Supply: Investor Presentation

Industrial Logistics Properties Belief has primarily suspended its dividend, decreasing it to a quarterly price of $0.01. This was to boost its liquidity till it completes its long-term financing plan for the Monmouth acquisition. In Q2-2020, the corporate initially anticipated that its dividend would return to a price at, or near, its historic degree someday in 2023.

On February 14th, 2023, Industrial Logistics Properties Belief reported its This autumn-2022 and full-year outcomes for the interval ending December thirty first, 2022. For the quarter, rental earnings got here in at $106.3 million, 88.2% greater than the prior-year interval.

The rise was on account of a bigger property portfolio following the acquisition of the beforehand publicly-listed Monmouth Actual Property. FFO was $5.4 million, 8.25% decrease year-over-year, whereas FFO/share declined by 83.3% to $0.08.

Through the 12 months, the corporate accomplished a $1.2 billion debt financing with a closing maturity date of October ninth, 2027. It totally repaid the $1.4 billion in mixture principal excellent below its bridge mortgage facility. It’s now using its strong medium-term money flows, backed by an occupancy price of 99.1% and a weighted common remaining lease time period of roughly 8.0 years, to proceed the restructuring and principally function to service its debt.

Click on right here to obtain our most up-to-date Positive Evaluation report on ILPT (preview of web page 1 of three proven under):

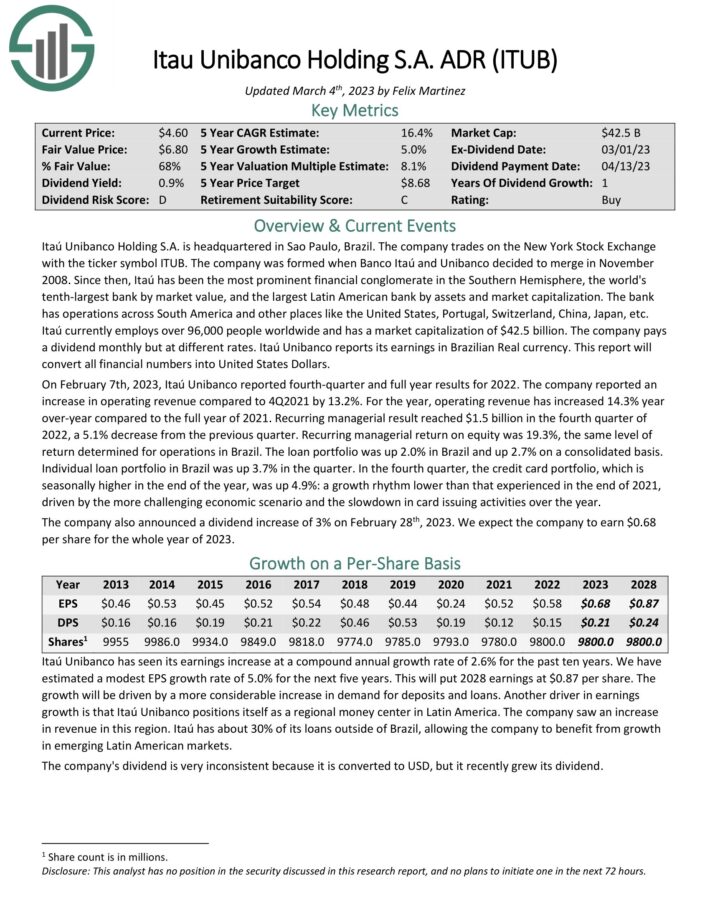

Prime Inventory Below $5: Itau Unibanco (ITUB)

- 5-year anticipated annual returns: 17.4%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. Since then, Itaú has been essentially the most distinguished monetary conglomerate within the Southern Hemisphere, the world’s tenth-largest financial institution by market worth, and the most important Latin American financial institution by belongings and market capitalization. The financial institution has operations throughout South America and different locations like the US, Portugal, Switzerland, China, Japan, and extra.

Itaú Unibanco is a really giant financial institution that’s headquartered in Brazil. ITUB is a big cap inventory with a market capitalization above $40 billion.

Within the fourth quarter of 2022, the recurring managerial end result was R$7.7 billion, a lower of 5.1% in comparison with the earlier quarter. The recurring managerial return on fairness remained the identical at 19.3%, which is the extent decided for operations in Brazil. Excluding this impact, the recurring managerial end result would have been R$8.4 billion, and the recurring managerial return on fairness would have been 21.0% within the fourth quarter.

The mortgage portfolio grew by 2.0% in Brazil and a couple of.7% on a consolidated foundation, whereas the person mortgage portfolio in Brazil grew by 3.7% within the quarter.

Supply: Investor Presentation

Itaú Unibanco has a conservative strategy to paying its dividend. The financial institution pays out dividends to shareholders primarily based on its projected earnings and losses, with the objective being the power to proceed to pay the dividend below numerous financial circumstances.

On the plus aspect, the very small yield affords the financial institution higher dividend protection because the payout ratio is within the teenagers. We, subsequently, don’t see any threat of a unfavourable change within the dividend coverage right this moment, however we’re additionally cautious about future progress given the unsure outlook for Brazil’s economic system.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITUB (preview of web page 1 of three proven under):

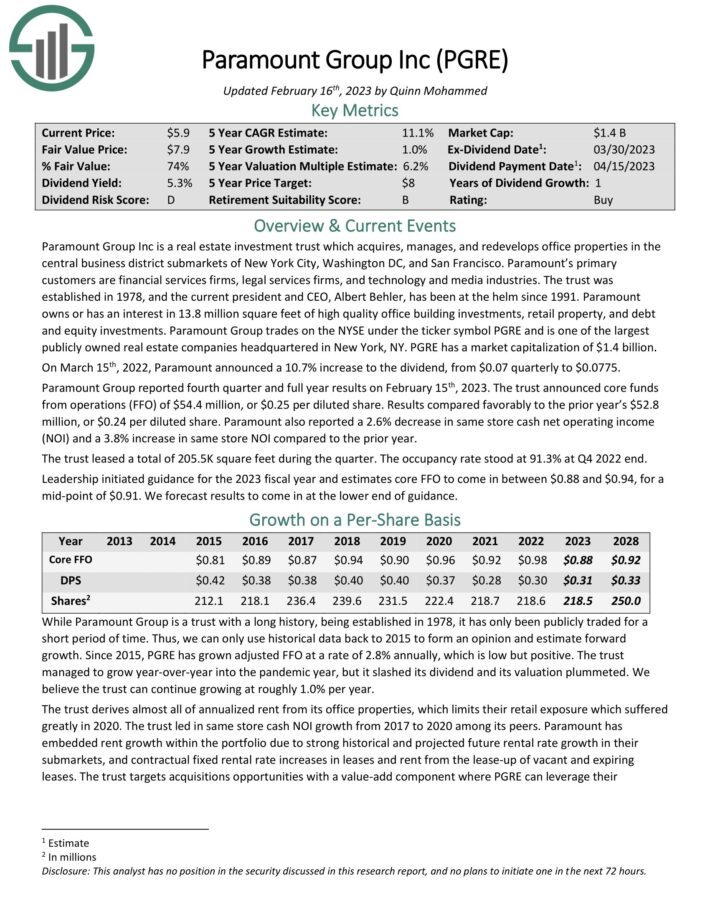

Prime Inventory Below $5: Paramount Group (PGRE)

- 5-year anticipated annual returns: 18.5%

Paramount Group Inc is an actual property funding belief which acquires, manages, and redevelops workplace properties within the central enterprise district sub-markets of New York Metropolis, Washington DC, and San Francisco. Paramount’s major prospects are monetary providers companies, authorized providers companies, and know-how and media industries.

Paramount owns or has an curiosity in 13.8 million sq. toes of top quality workplace constructing investments, retail property, and debt and fairness investments. Paramount Group trades on the NYSE below the ticker image PGRE and is without doubt one of the largest publicly owned actual property firms headquartered in New York, NY.

Supply: Investor Presentation

On March fifteenth, 2022, Paramount introduced a ten.7% enhance to the dividend, from $0.07 quarterly to $0.0775. Paramount Group reported fourth quarter and full 12 months outcomes on February fifteenth, 2023. The belief introduced core funds from operations (FFO) of $54.4 million, or $0.25 per diluted share. Outcomes in contrast favorably to the prior 12 months’s $52.8 million, or $0.24 per diluted share.

Paramount additionally reported a 2.6% lower in similar retailer money internet working earnings (NOI) and a 3.8% enhance in similar retailer NOI in comparison with the prior 12 months. The belief leased a complete of 205.5K sq. toes through the quarter. The occupancy price stood at 91.3% at This autumn 2022 finish.

Management initiated steering for the 2023 fiscal 12 months and estimates core FFO to return in between $0.88 and $0.94, for a mid-point of $0.91.

Click on right here to obtain our most up-to-date Positive Evaluation report on PGRE (preview of web page 1 of three proven under):

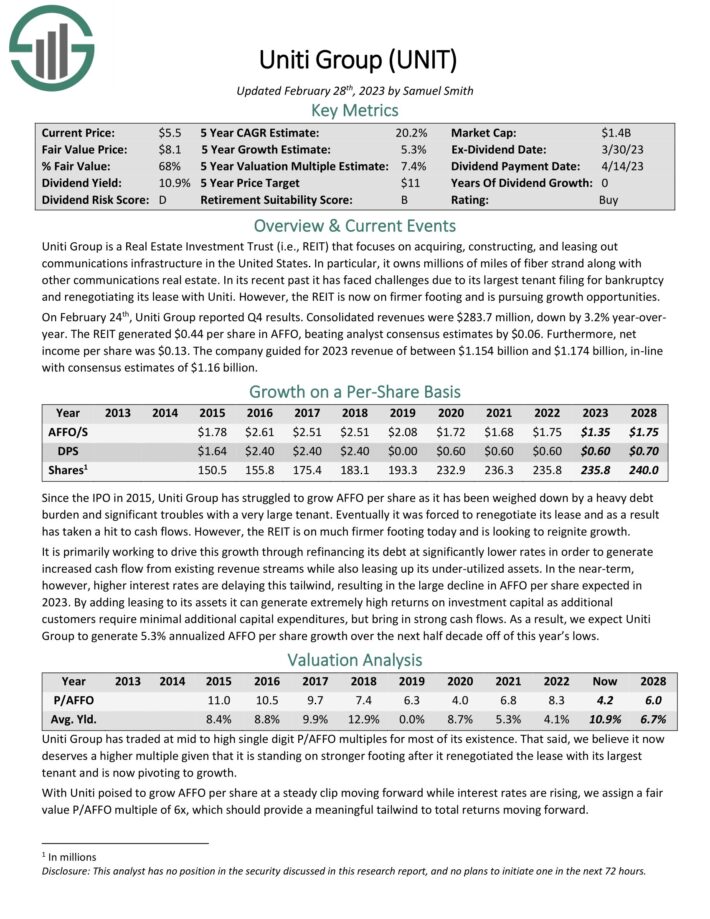

Prime Inventory Below $5: Uniti Group (UNIT)

- 5-year anticipated annual returns: 30.7%

Uniti Group is a Actual Property Funding Belief (i.e., REIT) that focuses on buying, setting up, and leasing out communications infrastructure in the US. Particularly, it owns tens of millions of miles of fiber strand together with different communications actual property. In its current previous it has confronted challenges on account of its largest tenant submitting for chapter and renegotiating its lease with Uniti. Nevertheless, the REIT is now on firmer footing and is pursuing progress alternatives.

On February twenty fourth, Uniti Group reported This autumn outcomes. Consolidated revenues have been $283.7 million, down by 3.2% year-over-year. The REIT generated $0.44 per share in AFFO, beating analyst consensus estimates by $0.06. Moreover, internet earnings per share was $0.13. The corporate guided for 2023 income of between $1.154 billion and $1.174 billion, in-line with consensus estimates of $1.16 billion.

It’s primarily working to drive this progress by refinancing its debt at considerably decrease charges with a purpose to generate

elevated money circulate from current income streams whereas additionally leasing up its under-utilized belongings. Within the near-term,

nevertheless, greater rates of interest are delaying this tailwind, ensuing within the giant decline in AFFO per share anticipated in

2023. By including leasing to its belongings it may possibly generate extraordinarily excessive returns on funding capital as extra

prospects require minimal extra capital expenditures, however herald sturdy money flows.

Click on right here to obtain our most up-to-date Positive Evaluation report on UNIT (preview of web page 1 of three proven under):

Last Ideas

Excessive-priced shares could also be unappealing for buyers who could not have sufficient capital. There are numerous shares with considerably decrease share costs. In fact, a low share value alone doesn’t make a inventory a purchase. Buyers ought to at all times conduct their due diligence earlier than shopping for particular person shares.

At Positive Dividend, we frequently advocate for investing in firms with a excessive likelihood of accelerating their dividends every 12 months.

If that technique appeals to you, it could be helpful to flick thru the next databases of dividend progress shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link