[ad_1]

Up to date on December twenty sixth, 2022 by Quinn Mohammed

The healthcare sector is a good place to search out high-quality dividend development shares. Look no additional than the record of Dividend Aristocrats for proof of this.

The Dividend Aristocrats are a choose group of 64 shares within the S&P 500 Index with a minimum of 25 consecutive years of dividend will increase. There are at the moment 8 Dividend Aristocrats that come from the healthcare sector.

The healthcare sector has a long-term development catalyst going ahead, which is growing old populations around the globe. Healthcare spending in lots of developed international locations is prone to develop over the long run in consequence.

With this in thoughts, we’ve compiled an inventory of over 200 healthcare shares (together with vital investing metrics like price-to-earnings ratios and dividend yields) which you’ll obtain beneath:

It’s simple to see why healthcare shares make for glorious long-term investments. The U.S. healthcare sector extensively enjoys excessive profitability with strong money flows. In any case, folks typically can not go with out well being care, even in difficult financial climates.

The rankings on this article are derived primarily from our anticipated whole return estimates for each healthcare dividend inventory discovered within the Positive Evaluation Analysis Database.

For buyers all in favour of high-quality dividend development shares, this text will talk about the highest 7 dividend-paying healthcare shares to purchase now.

Desk Of Contents

The seven greatest healthcare shares are listed beneath so as of whole anticipated returns over the subsequent 5 years, from lowest to highest. You possibly can immediately soar to any particular person inventory evaluation by clicking on the hyperlinks beneath:

Well being Care Inventory #7: Humana Inc. (HUM)

- 5-year anticipated annual returns: 12.8%

Humana is without doubt one of the largest personal well being insurers within the U.S., specializing in administering Medicare Benefit plans. The agency has constructed a distinct segment specializing in government-sponsored packages, with practically all its medical membership stemming from particular person and group Medicare Benefit, Medicaid, and the navy’s Tricare program.

On September 30th, 2022, the corporate had roughly 17 million members in medical profit plans and roughly 5 million members in specialty merchandise. In 2021, 83% of premiums and providers income have been from contracts with the federal authorities.

On November 2nd, 2022, Humana reported third quarter 2022 outcomes for the interval ending September 30th, 2022. For the quarter, the corporate reported revenues of $22.8 billion and adjusted earnings per share of $6.88, which in comparison with income of $20.7 billion and adjusted earnings per share of $4.83 within the third quarter of 2021. Increased revenues within the quarter have been supported by membership development and better Medicare Benefit premiums per member.

The corporate additionally elevated its 2022 earnings steering for the third time this 12 months. Adjusted EPS is now anticipated to be $25.00, up from the earlier estimate of $24.75, representing a rise of roughly 21% in comparison with 2021 adjusted EPS of $20.64.

Click on right here to obtain our most up-to-date Positive Evaluation report on Humana (preview of web page 1 of three proven beneath):

Well being Care Inventory #6: GlaxoSmithKline ADR (GSK)

- 5-year anticipated annual returns: 12.8%

GlaxoSmithKline develops, manufactures, and markets healthcare merchandise within the areas of prescription drugs, vaccines, and shopper merchandise. GlaxoSmithKline’s pharmaceutical choices tackle the next illness classes: central nervous system, cardiovascular, respiratory, and immune inflation. The corporate generates about $35 billion in annual gross sales.

On July 18th, 2022, GlaxoSmithKline introduced that the corporate had accomplished the spinoff of it its shopper healthcare enterprise into Haleon PLC (HLN). Haleon is anticipated to generate 4% to six% natural development yearly.

On November 2nd, 2022, GlaxoSmithKline reported third quarter 2022 outcomes for the interval ending September thirtieth, 2022. All figures are listed in U.S. {dollars} and in fixed change charges. Income decreased by 29% for the quarter, whereas adjusted earnings per share fell 15% to $1.07.

Specialty medicines proceed to carry out effectively, with these merchandise rising 24% year-over-year. Respiratory grew 17% on account of excessive demand each within the U.S. and worldwide. Benlysta and Nucala each had double-digit development. Income for HIV merchandise grew 7% attributable to sturdy demand for brand new merchandise, akin to Dovato and Juluca. Established Prescription drugs elevated by 1%. Vaccines grew by 5% attributable to power in Shingrix gross sales.

GlaxoSmithKline additionally raised its outlook for 2022, with the corporate now anticipating gross sales development of 8% to 10% for the 12 months, up from 6% to eight% and 5% to 7% beforehand. Earnings per share are actually anticipated to be $3.13 per ADR share this 12 months, in comparison with $3.10 and $3.24 beforehand.

Click on right here to obtain our most up-to-date Positive Evaluation report on GlaxoSmithKline (preview of web page 1 of three proven beneath):

Well being Care Inventory #5: Pfizer Inc. (PFE)

- 5-year anticipated annual returns: 13.9%

Pfizer Inc. is a world pharmaceutical firm specializing in pharmaceuticals and vaccines. The inventory has a market capitalization of $291 billion, making Pfizer a mega-cap inventory.

Pfizer’s new CEO accomplished a sequence of transactions, considerably altering the corporate construction and technique. Pfizer fashioned the GSK Shopper Healthcare Joint Enterprise in 2019 with GlaxoSmithKline plc (GSK), which incorporates Pfizer’s over-the-counter enterprise. Pfizer owns 32% of the JV. The corporate additionally spun off its Upjohn phase and merged it with Mylan to kind Viatris for its off-patent, branded, and generic medicines in 2020.

Pfizer’s prime merchandise are Eliquis, Ibrance, Prevnar 13, Enebrel (worldwide), Sutent, Xtandi, Vyndaqel/ Vyndamax, Inlyta, Xeljanz, Plaxlovid, and Comiranty.

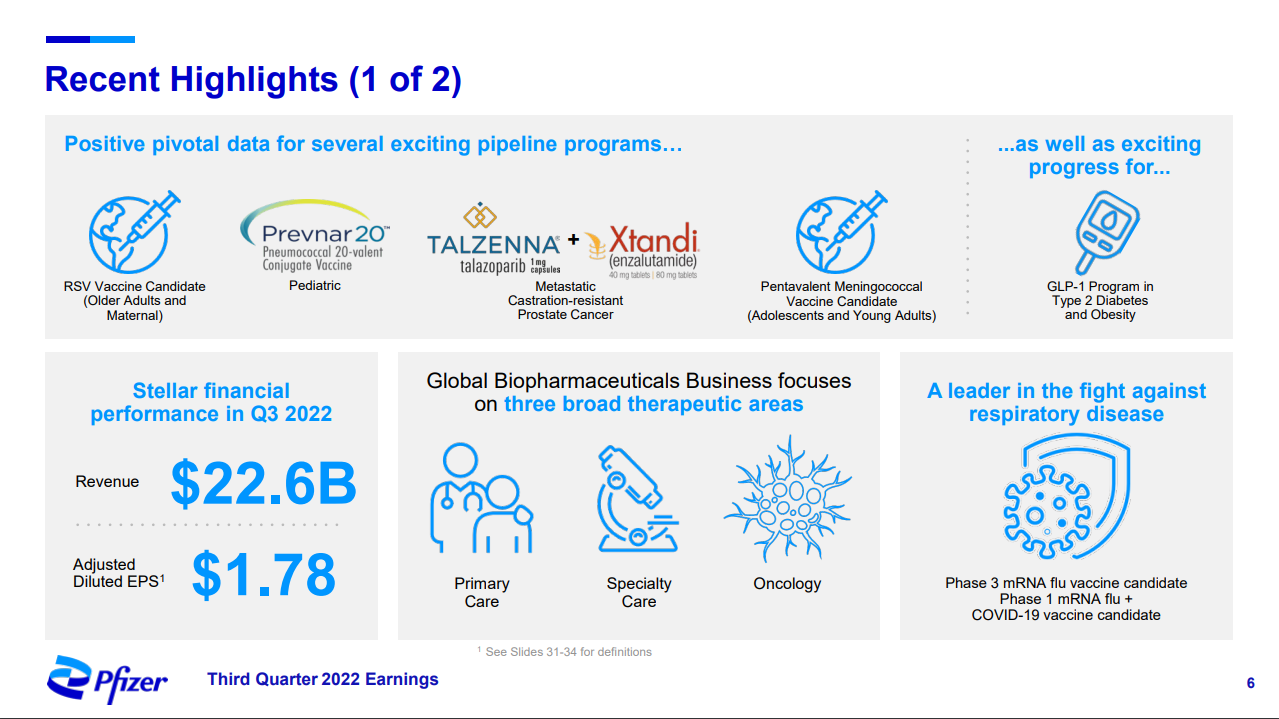

Pfizer reported Q3 2022 outcomes on November 1st, 2022.

Supply: Investor Presentation

Companywide income decreased by 6% to $22.6 billion from $24.0 billion, and adjusted diluted earnings per share grew by 40% to $1.78 in comparison with $1.27 a 12 months in the past. Pfizer elevated income steering to $99.5 billion to $102.0 billion and adjusted diluted EPS steering to $6.40 to$6.50 for 2022.

Pfizer is a Kevin O’Leary dividend inventory.

Click on right here to obtain our most up-to-date Positive Evaluation report on Pfizer (preview of web page 1 of three proven beneath):

Well being Care Inventory #4: Sanofi SA (SNY)

- 5-year anticipated annual returns: 15.1%

Sanofi is a world pharmaceutical firm. The corporate develops and markets a wide range of therapeutic therapies and vaccines. Prescription drugs account for about 72% of gross sales, vaccines make up roughly 15% of gross sales, and shopper healthcare contributes the rest of gross sales.

Sanofi is really a world chief, with a 3rd of gross sales coming from the U.S., just a little greater than 1 / 4 coming from Western Europe, and the rest of gross sales coming from rising markets/the remainder of the world. Sanofi produces annual revenues of about $43 billion.

On October 28th, 2022, Sanofi reported third-quarter outcomes for the interval ending September thirtieth, 2022. Income elevated by 2.0% to $12.4 billion, surpassing estimates by $432 million. The corporate’s earnings per share per ADR of $1.44 in contrast favorably to $1.23 within the prior 12 months and was 10 cents forward of expectations.

Pharmaceutical revenues have been larger by 5.1% through the quarter. Specialty Care had a wonderful quarter, with 19.9% income development. Oncology, nonetheless, fell 8.4%, primarily attributable to a 13.3% decline in Jevtana, which treats prostate most cancers that has unfold to different physique elements.

The rest of the portfolio continues to point out strong development charges. Uncommon Illnesses grew 7.7%. Vaccine income surged 23.5% as good points have been seen in nearly all areas, with explicit power in influenza and journey and endemic vaccines. And Shopper Healthcare was up 1.9% as power in cough and chilly and digestive wellness have been practically offset by bodily and psychological wellness, allergy, ache care, and private care.

Sanofi revised its outlook for 2022 as effectively. The corporate now expects earnings per share development of roughly 16% for the 12 months, to equal about $4.45 per ADR.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sanofi (preview of web page 1 of three proven beneath):

Well being Care Inventory #3: Baxter Worldwide (BAX)

- 5-year anticipated annual returns: 19.2%

Baxter Worldwide develops and sells numerous healthcare merchandise, together with organic merchandise, medical units, and linked care units used to watch sufferers. Its merchandise are utilized in hospitals, kidney dialysis facilities, nursing properties, medical doctors’ workplaces, and for sufferers at dwelling underneath doctor supervision.

On December thirteenth, 2021, Baxter introduced the acquisition of Hillrom to pursue its imaginative and prescient to remodel healthcare by way of know-how. Hillrom makes good know-how, like affected person beds and good pumps, for hospitals, which helps to enhance Baxter’s main choices.

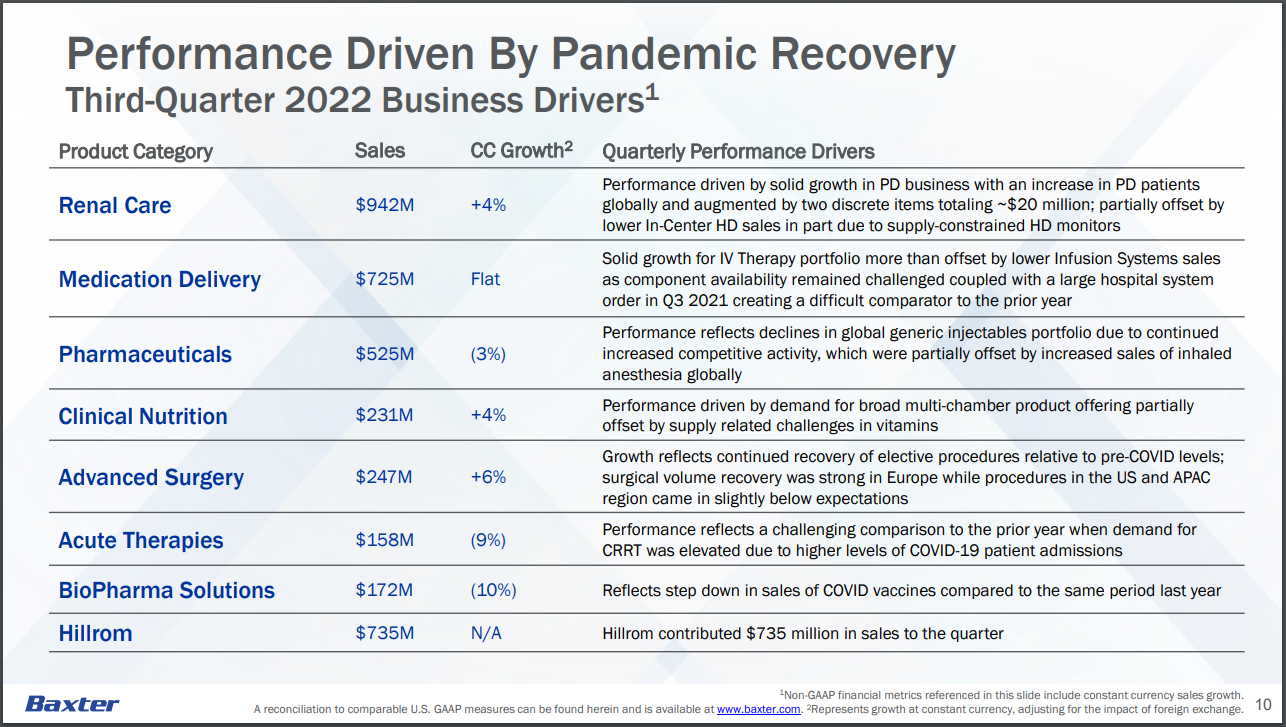

On October 27th, 2022, Baxter Worldwide reported third-quarter 2022 outcomes for the interval ending September 30th, 2022. The corporate beat consensus income estimates by $30 million, reporting a 17.6% year-over-year income enhance to $3.8 billion.

Supply: Investor Presentation

Baxter noticed $0.82 in adjusted earnings per share for the quarter, which was in keeping with analysts’ estimates and equaled a 19.6% year-over-year lower. Gross sales within the U.S. decreased by 1% year-over-year on an operational foundation to $1.8 billion, and Worldwide gross sales grew 2% year-over-year on an operational foundation to $1.9 billion.

We’re forecasting 2022 earnings per share to be roughly $3.50 in 2022, pushed by a full 12 months of outcomes from the Hillrom acquisition. Moreover, we forecast a ten% development price in EPS and the dividend per share over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Baxter (preview of web page 1 of three proven beneath):

Well being Care Inventory #2: Royalty Pharma (RPRX)

- 5-year anticipated annual returns: 19.6%

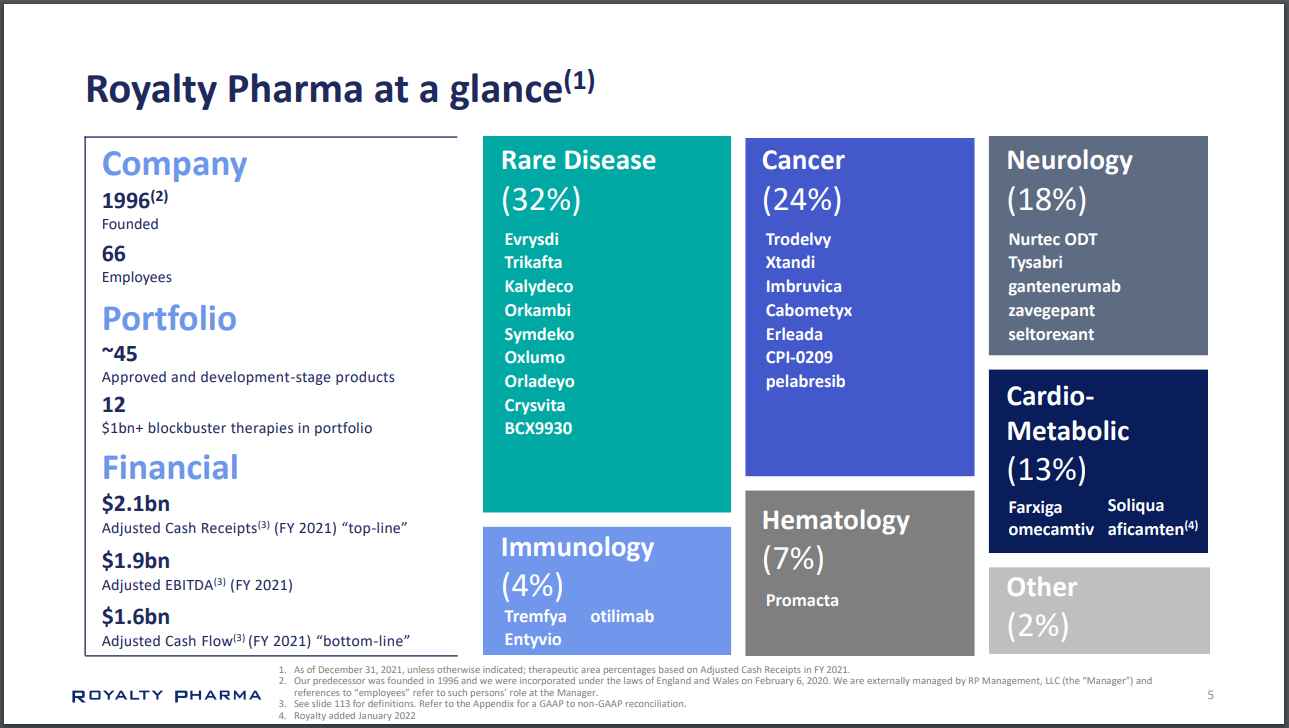

Royalty Pharma owns biopharmaceutical royalties and funds innovation within the biopharmaceutical business within the U.S. The corporate’s portfolio holds royalties on roughly 35 marketed therapies and 11 development-stage product candidates, addressing areas akin to uncommon illnesses, most cancers, neurology, infectious illness, hematology, and diabetes.

A few of Royalty Pharma’s royalties entitle them to funds linked to the top-line gross sales of some main therapies, akin to AbbVie and Johnson & Johnson’s Imbruvica, Astellas and Pfizer’s Xtandi, Gildea’s Trodelvy, and Novartis’ Promacta, plus many extra.

Supply: Investor Presentation

On November 8th, 2022, Royalty Pharma reported third quarter 2022 outcomes for the interval ending September 30th, 2022. The corporate noticed adjusted earnings per share of $0.73, which beat analysts’ estimates by 2 cents and was unchanged in comparison with final 12 months. Income decreased by 2.2% year-over-year to $573 million and missed analysts’ estimates by $37 million.

As a holding of Berkshire Hathaway (BRK.A)(BRK.B), Royalty Pharma is a Warren Buffett inventory.

Click on right here to obtain our most up-to-date Positive Evaluation report on RPRX (preview of web page 1 of three proven beneath):

Well being Care Inventory #1: Koninklijke Philips N.V. (PHG)

- 5-year anticipated annual returns: 20.5%

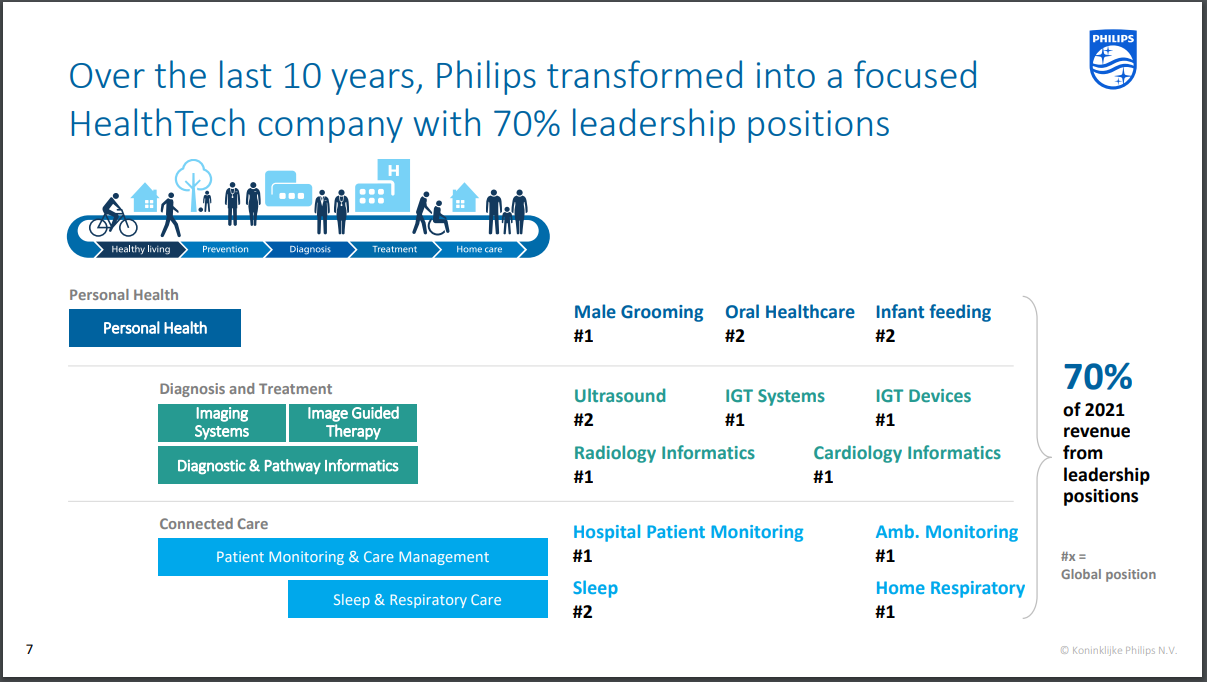

Philips Electronics NV is a world producer of digital merchandise for healthcare, lighting, and different shopper merchandise. The corporate used to generate about half of its gross sales from lighting, TV, and way of life leisure merchandise however has undergone a major transformation in recent times and has turn into a well being tech chief.

The corporate now has 4 working segments: Prognosis & Therapy (42% of whole gross sales), Private Well being (28% of gross sales), Related Care & Well being Informatics (29% of gross sales), and Legacy Objects (1% of gross sales).

Supply: Investor Presentation

On October 24th, 2022, Philips Electronics reported monetary outcomes for the third quarter of fiscal 2022. Comparable gross sales fell by 6% attributable to provide chain points and the sustained impact of the recall of respiratory units. Because of this, the adjusted EBITDA margin shrank from 12.3% to 4.8%.

The poor efficiency resulted primarily from the sustained impact of the recall of 4 million respiratory units in 2021. Over 100 accidents have been reported from a foam a part of the units, which may degrade and trigger most cancers. The FDA has categorized the recall as “probably the most critical kind.” The corporate not too long ago modified its CEO to show across the firm. Whereas this headwind is non-recurring, it could price many billions of {dollars} and has elevated the inventory threat.

On account of the short-term impression of this headwind, now we have lowered our forecast for earnings per share in 2022 from $1.30 to $1.05. It additionally seems to be taking for much longer than anticipated for the corporate to recuperate from this disaster, whereas administration is blaming macro headwinds, akin to provide chain disruptions and the battle in Ukraine, for the poor outcomes.

Click on right here to obtain our most up-to-date Positive Evaluation report on Koninklijke Philips N.V. (preview of web page 1 of three proven beneath):

Ultimate Ideas

There are many high quality dividend shares to be discovered within the healthcare sector. Many giant healthcare firms are extremely worthwhile, with long-term development up forward attributable to growing old populations.

Shareholders of many healthcare shares are prone to obtain dividend will increase every year. These seven healthcare shares pay dividends to shareholders and are nearly all fairly valued, resulting in excessive anticipated returns over the subsequent 5 years.

Different Studying

The Dividend Aristocrats record will not be the one solution to shortly display for shares that frequently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link