[ad_1]

Updated on June 9th, 2022 by Aristofanis Papadatos

In general, energy stocks are highly regarded among income investors for their high dividends. This makes the sector a favorite of income investors looking for potential high yield stocks.

There are many energy stocks that fall on our list of high-dividend stocks. You can download your full list of all 100+ stocks with 5%+ yields, along with financial metrics like dividend yield and payout ratios, by clicking on the link below:

Oil stocks incurred a fierce downturn in 2020 due to the impact of the pandemic on global oil consumption. However, thanks to the massive distribution of vaccines worldwide, consumption of oil is recovering strongly.

In addition, the invasion of Russia in Ukraine has led western countries to impose sanctions on Russia. As Russia produces 10% of global oil output and about one-third of the natural gas consumed in Europe, the oil and gas markets have tightened to the extreme. As a result, the prices of oil and gas have rallied to 13-year highs.

In other words, oil stocks are thriving thanks to the exceptionally favorable conditions prevailing right now. As long as the sanctions remain in place, oil stocks will keep enjoying excessive profits.

On the other hand, investors should always be aware of the high cyclicality of the oil industry, which is characterized by dramatic boom-and-bust cycles. Given the steep rally of all the oil stocks in the last 12 months, investors should be especially careful in their choices in the sector.

This article will discuss the 6 biggest global oil supermajors, ranked from best to worst.

Table of Contents

The terms “Big Oil” and “super-majors” are interchangable, and refer to the 6 largest oil companies that aren’t state owned. The 6 Big Oil supermajors are:

In this article, we will rank the six oil supermajors based on their expected 5-year returns. We calculate expected returns based on the combination of valuation changes, expected earnings growth, and dividend yields. The stocks are listed in order of annual expected return, from highest to lowest.

Big Oil Supermajor #1: TotalEnergies SE (TTE)

In 2021, Total SA (TOT) changed its name to TotalEnergies SE (TTE) to emphasize its efforts to transform in the changing energy landscape. TotalEnergies is the fourth-largest oil and gas company in the world based on market capitalization. Like the other oil and gas super majors, it is a fully integrated company. TotalEnergies operates in four segments: upstream, downstream (mostly refining), marketing & services and gas, renewables & power.

The coronavirus crisis caused an unprecedented collapse in the demand for oil products in 2020 but global oil consumption has been recovering strongly since then thanks to the massive vaccine rollout. International Energy Administration (IEA) expects the global demand for oil products to grow from 97.4 million barrels per day in 2021 to 99.6 million barrels per day this year and recover to its pre-pandemic level of 101.0 million barrels per day next year.

Even better for oil and gas producers, the aforementioned sanctions of western countries on Russia have led the prices of oil and gas to skyrocket to 13-year highs this year. This is an extremely strong tailwind for all the oil producers, including TotalEnergies.

In late April, TotalEnergies reported (4/26/22) financial results for the first quarter of 2022. It posted flat output vs. last year’s quarter but thrived thanks to favorable prices. The price of oil rallied to a 13-year high due to the aforementioned sanctions of western countries on Russia. Gas prices in Asia and Europe remained around all-time highs amid low inventories. As a result, TotalEnergies grew its earnings per share 33% sequentially, from $2.55 to an all-time high of $3.40, and beat the analysts’ consensus by an impressive $0.61.

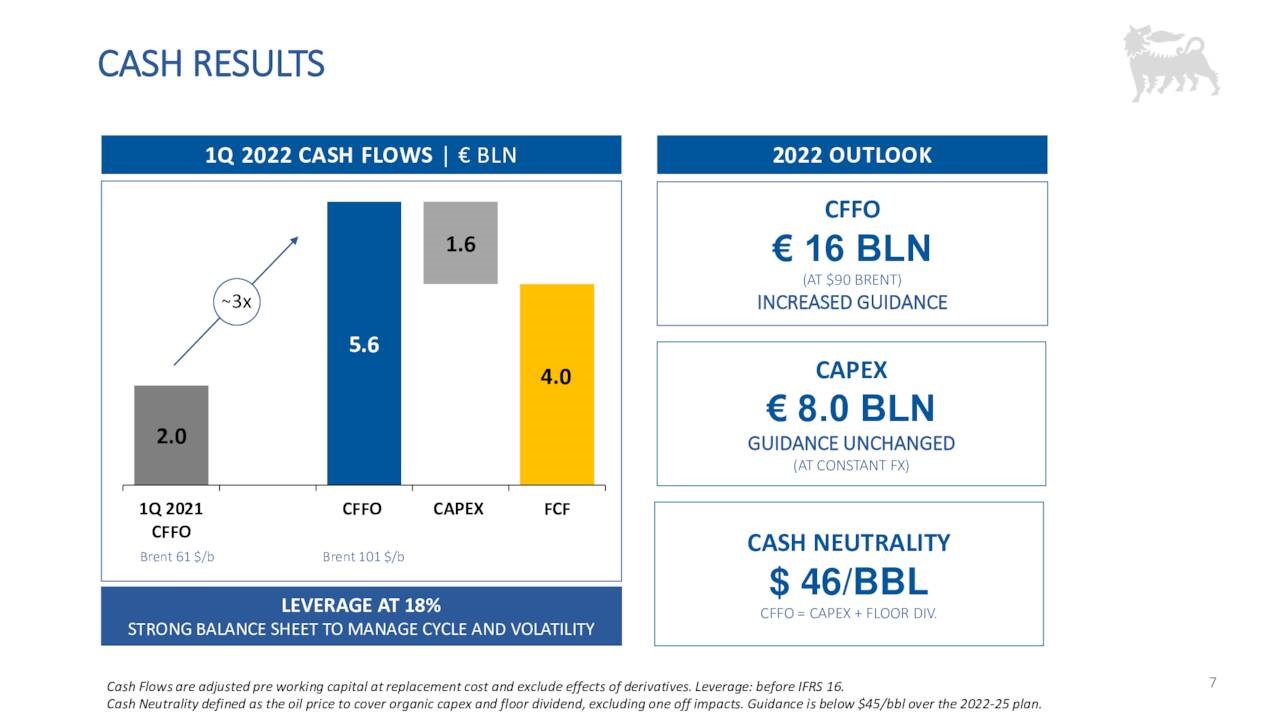

It is also remarkable that TotalEnergies has greatly improved the quality of its asset portfolio and its resilience since the previous downturn of the energy sector, in 2014. It has reduced its operating cost by nearly 50% and its cash breakeven point from more than $100 to $25 per barrel.

Source: Investor Presentation

As a result, the oil major has stated that its dividend is sustainable even at Brent prices around $40. Thanks to its high-quality, defensive asset portfolio, TotalEnergies has proved the most resilient oil major to downturns. This proved to be the case during the coronavirus crisis in 2020, as TotalEnergies and Shell were the only oil majors that remained profitable. It is also important to note that TotalEnergies has not cut its dividend in recent years, whereas Shell and BP cut their dividends due to the pandemic in 2020.

Moreover, on April 26th, 2022, TotalEnergies reported a significant discovery of oil and gas offshore Namibia. According to a report, the find could exceed 13 billion barrels and thus it could be the largest deep-water oil field in the world, surpassing the discovery of Exxon Mobil offshore Guyana. TotalEnergies stated that it will provide details at a later stage. If the share of TotalEnergies is at least 6 billion barrels, it will be worth at least $100 billion, which is ~2/3 of the market cap of the stock. The stock could have significant upside.

TotalEnergies is currently offering a 4.8% dividend, which is exceptionally attractive for investors focused on the energy sector thanks to the defensive nature of the stock and the wide margin of safety of the dividend. U.S. investors should note they may be subject to dividend withholding taxes as TotalEnergies is based in France.

Given the high comparison base formed by the all-time high expected earnings per share of $12.00 of TotalEnergies this year, we expect a 12% average annual decline of earnings per share over the next five years. On the other hand, TotalEnergies is currently trading at a price-to-earnings ratio of 5.1, which is much lower than our fair value estimate of 12. If the stock reaches our fair valuation level in five years, it will enjoy an 18.7% annualized expansion of its earnings multiple. Given also its 4.8% forward dividend yield, we believe the stock can offer an 8.6% average annual return over the next five years.

Big Oil Supermajor #2: Eni (E)

Eni is a major oil and gas producer based in Italy. It has exploration activity in more than 40 countries and operates in three segments: exploration & production, gas & power, and refining & marketing. Its upstream segment is by far the largest. In 2018, 2019 and 2021, this segment generated 92%, 93% and 89% of total operating income, respectively. This is a major difference between Eni and the other energy super majors; Eni’s business is much less diversified.

In late April, Eni reported (4/29/22) financial results for the first quarter of 2022. Its production dipped 5% sequentially due to the natural decline of fields. However, the aforementioned rally of oil and gas prices led Eni to nearly double its adjusted profit per share sequentially, from €0.47 to €0.91.

Thanks to its nearly pure upstream nature, Eni outperformed its more diversified peers Exxon and Chevron, which grew their earnings modestly versus the previous quarter. Eni posted a 10-year high profit in the quarter. Given the tailwind from the war in Ukraine and the resultant rally of oil and gas prices, Eni is on track to post 10-year high earnings per share of about $5.10 this year.

Eni expects to grow its output by approximately 3.5% per year on average until 2025. One of the growth drivers will be the ramp-up of the Zohr field in Egypt, the largest gas field in the Mediterranean, which holds about 30 trillion cubic feet of gas. Eni has a 50% stake in this field.

On the other hand, Eni has about 7.2 billion barrels of oil equivalent in proved reserves, which are sufficient for 10.4 years of production given the current production rate of the company. The duration of its reserves is lower than the ~12-year duration of the reserves of certain peers.

Eni has a breakeven point of $46 per barrel.

Source: Investor Presentation

This is much higher than the breakeven point of most oil majors, which have cut their expenses and reshaped their portfolios more drastically than Eni. For perspective, TotalEnergies has a breakeven point around $25.

The high breakeven point of Eni helps explain its 70% dividend cut in 2020. Regarding the dividend, U.S. investors should note that they may be responsible for dividend withholding taxes because Eni is based in Italy.

The high breakeven point of Eni is also a testament to the much higher vulnerability of Eni to the downturns of the energy sector. This is an important risk factor for investors to consider before initiating a position in this almost pure upstream oil major.

Given the high comparison base formed by the 10-year high expected earnings per share of $5.10 of Eni this year, we expect a 10% average annual decline of earnings per share over the next five years. On the other hand, Eni is currently trading at a price-to-earnings ratio of 6.1, which is much lower than our fair value estimate of 12.5.

If the stock reaches our fair valuation level in five years, it will enjoy a 15.4% annualized expansion of its earnings multiple. Given also its 5.9% dividend yield, we believe the stock can offer an 8.6% average annual return over the next five years.

Big Oil Supermajor #3: BP plc (BP)

BP has gone through extreme challenges since its major accident in 2010. It has paid approximately $70 billion for this accident so far. This amount is almost equal to all its earnings since. Even in 2019, nine years after the accident, BP paid $2.4 billion (24% of its earnings) for it. The company expects to pay $1.4 billion for the accident this year.

BP has greatly improved its portfolio via the addition of low-cost reserves and has markedly increased its production in the last six years. Last year, BP completed its 6- year growth program, which delivered 900,000 barrels of oil equivalent per day.

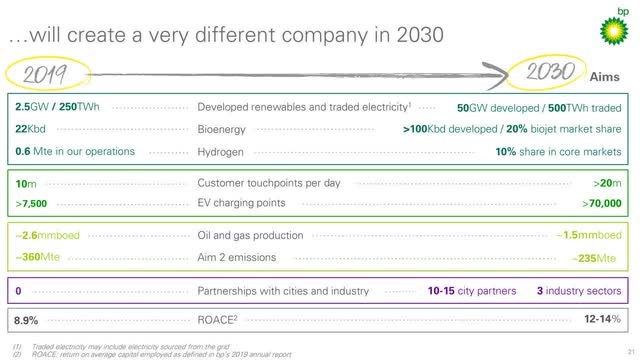

However, it announced a major shift in its strategy in 2020. BP will boost its investment in renewable energy sources 10-fold, and it will simultaneously reduce its investment in oil and gas projects so much that it expects to reduce its oil and gas production by -42%, from 2.6 million barrels per day now to 1.5 million barrels per day in 2030.

Source: Investor Presentation

This historical strategic shift from its core business has greatly raised the uncertainty of future performance of BP. A shift from the core business is always a red flag for any stock, particularly for BP, which has always been infamous for its aversion of renewable energy projects.

Moreover, BP has posted remarkably low reserve replacement ratios in recent years. It is thus evident that the company has already begun its transition at a fast pace. On the bright side, BP is thriving right now.

In early May, BP reported (5/3/22) financial results for the first quarter of 2022. The oil major greatly benefited from the rally of the prices of oil and gas to 13-year highs and sky-high refining margins thanks to the war in Ukraine. As a result, BP grew its earnings per share 56%, from $1.23 in the fourth quarter to $1.92. This level of earnings per share, which is the highest of BP in the last decade, exceeded the analysts’ consensus by an eye-opening $0.53.

BP outperformed Exxon and Chevron, which posted essentially flat sequential earnings. BP also reduced its debt for an eighth consecutive quarter and stated that it expects to keep raising its dividend by 4% per year if the price of oil remains around $60 or higher. In such a scenario, BP also expects to repurchase $4 billion of shares per year (~4%).

BP was caught in the coronavirus crisis with a huge debt load. The oil major defended its dividend in the previous downturn of the energy market, in 2014-2016, but slashed its dividend by 50% in 2020 due to its leveraged balance sheet and the excessive losses incurred in that year.

While BP has raised its dividend since 2020, it is currently offering a 10-year low dividend yield of 3.9%. The low yield has resulted from the dividend cut in 2020 and the 25% rally of the stock this year amid favorable commodity prices.

Given the high comparison base formed by the 10-year high expected earnings per share of $6.50 of BP this year, we expect a 12% average annual decline of earnings per share over the next five years. On the other hand, BP is currently trading at a price-to-earnings ratio of 5.2, which is much lower than our fair value estimate of 12.

If the stock reaches our fair valuation level in five years, it will enjoy an 18.1% annualized expansion of its earnings multiple. Given also its 3.9% dividend yield, we believe the stock can offer a 7.3% average annual return over the next five years.

Big Oil Supermajor #4: Shell (SHEL)

Shell is an oil and gas supermajor, the second largest behind Exxon Mobil in terms of annual production volumes. Shell is headquartered in London (UK).

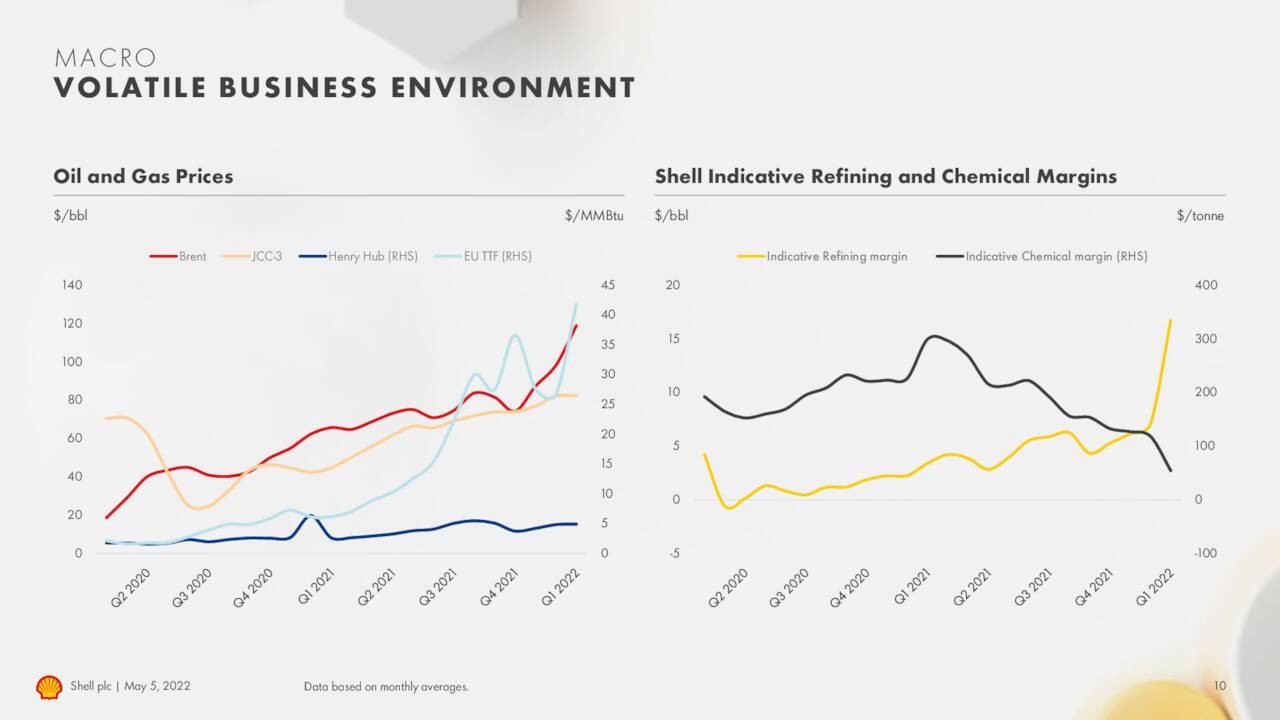

In early May, Shell reported (5/5/22) financial results for the first quarter of 2022. Thanks to the impressive rally of oil and gas prices, Shell grew its adjusted earnings 43% sequentially, from $6.4 billion to $9.1 billion. Notably it outperformed its peers Exxon and Chevron, which posted essentially flat earnings vs. the previous quarter. Shell also continued reducing its debt load, from $52.6 billion at the end of 2021 to $48.5 billion. Moreover, it expects to repurchase shares worth of $8.5 billion (~4% of the share count) in the first half of 2022.

Not only have the prices of oil and gas skyrocketed, but also the refining margins have jumped to record levels, as the sanctions on Russia have an even greater impact on the global supply of some distillates. As a result, both the upstream and the downstream segments of Shell are thriving right now.

Source: Investor Presentation

In 2020, due to the uncertainty caused by the onset of the pandemic, Shell cut its dividend by 66%. It was the first dividend cut for Shell since World War II. However, thanks to its recovery from the pandemic, the oil major has raised its dividend three times since then and the stock is now offering a 3.3% dividend yield. Notably, this is a 10-year low dividend yield of the stock, which has resulted primarily from the steep rally of the stock amid favorable commodity prices.

Shell acquired BG Group, a deep-water natural gas focused upstream company in 2015, in a $53 billion deal. Shell grew its output considerably thanks to that acquisition, but its output has remained flat in the last five years due to the natural decline of its fields and the asset sales executed to fund that immense acquisition. These two factors have also caused the duration of the reserves of Shell to fall for six years in a row and reach 7.9 years, which is much shorter than the average duration of the peer group (~11 years).

Moreover, Shell has announced a major transformation plan, which involves a transition from oil and gas to renewable energy sources. The company will transform its refining portfolio from 14 sites to 6 energy and chemicals parks and will reduce its upstream portfolio to 9 core positions, which will generate more than 80% of the cash flows of the upstream segment. It also expects to produce ~75% of its proved reserves until 2030. This historic transition from fossil fuels to clean energy sources makes it hard to forecast future results.

On the other hand, during the previous downturn of the energy sector, between 2014 and 2016, Shell drastically reduced its operating expenses and invested in high-quality, low-cost reserves, which have rendered the company more profitable than in the past at a given oil price. Shell posted record organic free cash flows of $31 billion in 2018 even though Brent was about -40% lower than it was before the previous downturn.

While Shell is thriving right now, investors should never forget the dramatic cyclicality of the oil and gas industry. Given the high comparison base formed by the expected 10-year high earnings per share of $9.50 of Shell this year, we expect a 9% average annual decline of earnings per share over the next five years.

On the other hand, Shell is currently trading at a price-to-earnings ratio of 6.4, which is much lower than our fair value estimate of 12. If the stock reaches our fair valuation level in five years, it will enjoy a 13.3% annualized expansion of its earnings multiple. Given also its 3.3% forward dividend yield, we believe the stock can offer a 6.6% average annual return over the next five years.

Big Oil Supermajor #5: ExxonMobil (XOM)

Exxon Mobil is an integrated super-major, with operations across the oil and gas industry. In 2021, the oil major generated 62% of its earnings from its upstream segment, with the remainder from its downstream (mostly refining) segment and its chemicals segment.

In late April, Exxon reported (4/29/22) financial results for the first quarter of 2022. Its production dipped 4% sequentially due to weather and maintenance but the oil giant benefited from the rally of the prices of oil and gas to 13-year highs. Nevertheless, it grew its adjusted earnings per share only 1% sequentially, from $2.05 to $2.07, and missed the analysts’ consensus by $0.16. The disappointing performance was caused mostly by losses from hedges in the downstream business.

However, given the 13-year high prices of oil and gas, we expect Exxon to post much higher earnings in the upcoming quarters and thus we expect Exxon to post all-time high earnings per share of about $10.10 this year. In contrast to previous rallies of the oil price, producers have boosted their production conservatively, fearing that the rally will prove short-lived due to the secular shift of most countries from fossil fuels to clean energy sources. As long as producers remain cautious, the oil price is likely to remain high.

Exxon has two exciting growth projects in place right now. The Permian Basin will be a major growth driver, as the oil giant has about 10 billion barrels of oil equivalent in the area and expects to reach production of more than 1.0 million barrels per day in the area by 2024.

Guyana, one of the most exciting growth projects in the energy sector, will be another major growth driver. Since 2019, Exxon Mobil has made several major deep-water discoveries in Guyana and has an enviable ~90% success rate.

Source: Investor Presentation

Thanks to the discoveries Exxon has achieved offshore Guyana, it has more than tripled its estimated reserves in the area, from 3.2 billion barrels in early 2018 to nearly 11.0 billion barrels now.

On the other hand, Exxon has withdrawn its previous guidance for ~25% growth of production until 2025. In order to preserve funds, it has cut its capital expenses and thus it now expects flat output until at least 2025. As the oil giant has not grown its production since 2008, the new guidance is certainly disappointing.

As long as the prices of oil and gas remain high, Exxon will keep posting excessive profits but the stock will probably come under pressure whenever the next downcycle shows up. This is especially true given the 65% rally of the stock this year, to a new all-time high.

Given the high comparison base formed by the expected all-time high earnings per share of $10.10 of Exxon this year, we expect a 9% average annual decline of earnings per share over the next five years. On the other hand, Exxon is currently trading at a price-to-earnings ratio of 10.4, which is lower than our fair value estimate of 13.

If the stock reaches our fair valuation level in five years, it will enjoy a 4.6% annualized expansion of its earnings multiple. Given also its 3.4% dividend yield, we expect the stock to offer a -1.0% average annual return over the next five years.

Big Oil Supermajor #6: Chevron (CVX)

Chevron is the second-largest U.S.-based oil company, behind Exxon Mobil. And like Exxon, Chevron is on the list of Dividend Aristocrats.

In 2018, 2019 and 2021, Chevron generated 78%, 78% and 84% of its earnings from its upstream segment, respectively. In addition, Chevron produces oil and natural gas at a 61/39 ratio but a portion of its gas output is priced based on the oil price. As a result, about 75% of the production of Chevron is priced based on the oil price.

In late April, Chevron reported (4/29/22) financial results for the first quarter of 2022. The oil major reduced its production by 2% over last year’s quarter but greatly benefited from the rally of oil and gas prices to 13-year highs. As a result, it grew its adjusted earnings per share 31% sequentially, from $2.56 to $3.36, a nearly all-time high.

Chevron outperformed Exxon by a wide margin, as the latter posted essentially flat earnings due to losses from price hedges. As we do not expect the sanctions of western countries on Russia to be withdrawn anytime soon, we expect oil and gas prices to remain excessive this year and thus we expect Chevron to post record earnings per share of $16.40 this year.

Chevron grew its output by 5% in 2017, 7% in 2018, 4% in 2019, but only 1% in 2020 and 0.5% in 2021 due to the pandemic. Chevron has now returned to growth mode thanks to its sustained growth in the Permian Basin and in Australia. The company has more than doubled the value of its assets in the Permian in the last three years thanks to new discoveries and technological advances.

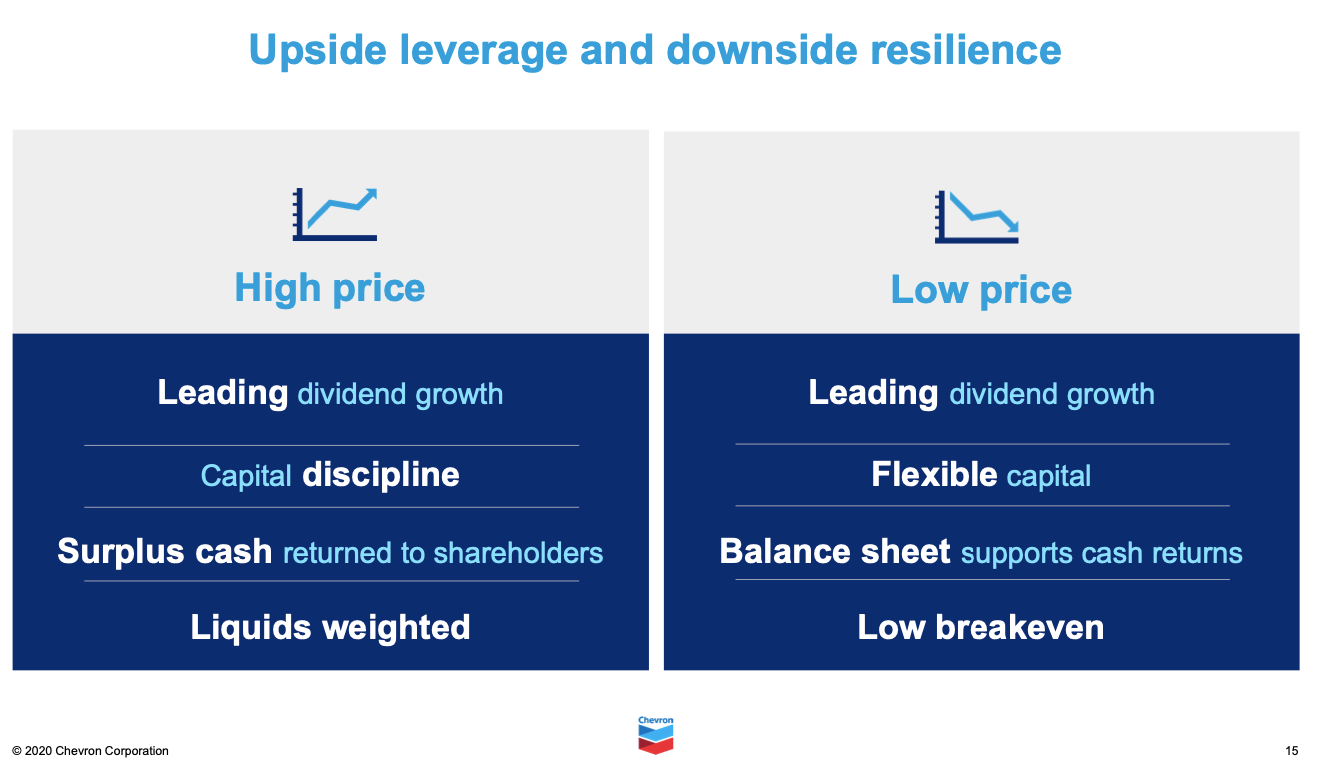

Moreover, Chevron learned its lesson from the previous downturn of the energy sector, in 2014-2016, and now invests most of its funds in projects that begin delivering cash flows within two years. In addition, thanks to the high grading of its asset portfolio, Chevron can fund its dividend even at a WTI price around $45, which corresponds to a Brent price around $50 under normal conditions.

Source: Investor Presentation

Therefore, the dividend of Chevron has a wide margin of safety. On the other hand, due to the 67% rally of the stock in the last 12 months, to a new all-time high, the stock is currently offering a 10-year low dividend yield of 3.1%.

Given the high comparison base formed by the expected all-time high earnings per share of $16.40 of Chevron this year, we expect a 10% average annual decline of earnings per share over the next five years. On the other hand, Chevron is currently trading at a price-to-earnings ratio of 11.0, which is lower than our fair value estimate of 14.

If the stock reaches our fair valuation level in five years, it will enjoy a 4.9% annualized expansion of its earnings multiple. Given also its 3.1% dividend yield, we expect the stock to offer a -1.9% average annual return over the next five years.

Final Thoughts

The oil majors are thriving thanks to the rally of the prices of oil and gas to 13-year highs this year. As the western countries are not likely to withdraw their sanctions on Russia anytime soon, the short-term outlook is undoubtedly bright for the oil majors.

The current boom also has another special characteristic. During past rallies of commodity prices, oil producers used to boost their production at a fast pace to take advantage of the high prices. In this way, they greatly increased global oil supply and thus they gave rise to a subsequent downturn.

However, this is not the case in the current boom of the energy sector. Despite the 13-year high prices, most companies are unable to increase their output due to the lack of investments in new growth projects in recent years amid the pandemic. Oil producers are also reluctant to spend great amounts on new growth projects, fearing that the secular shift of the world from fossil fuels to clean energy sources will render such investments unprofitable in the future. Therefore, the current boom of the energy sector may last longer than usual.

However, it is unreasonable to expect the boom to last for many years. Due to the high prices of oil and gas, most countries are investing in renewable energy projects at a record pace. This trend will take its toll on the oil industry at some point in the future. Therefore, investors should be especially careful in their choices among oil stocks.

TotalEnergies seems to be the most attractive oil major right now, though it was much more attractive a few weeks ago. This exemplary oil major has the highest expected return while it has also proved to be by far the most resilient oil major to downturns.

Related: The Best Oil Refiner: Analyzing The Big 4 U.S. Oil Refiner Stocks

Further Reading

The following Sure Dividend databases contain the most reliable dividend stocks in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link