[ad_1]

hapabapa

In our earlier evaluation of Texas Devices Integrated (NASDAQ:TXN), we anticipated the corporate’s development outlook to stay sturdy, significantly within the automotive section (21% publicity) with improved stock ranges. Furthermore, we anticipated the corporate to profit from the US CHIPS Act advantages on its FCFs.

On this evaluation, we centered on the corporate’s dividends to determine their sustainability. Our preliminary step concerned evaluating the corporate’s standing as a dividend-oriented entity by carefully inspecting its capital allocation, significantly by way of its financing money stream breakdown. Moreover, we explored the corporate’s historic dividend yield and payout, figuring out the particular dividend technique it employs. Transferring past, we analyzed elements reminiscent of money stream technology, income development, and total monetary standing, projecting the trajectory of its dividend efficiency. Lastly, we assessed the impression of dividends on the corporate’s valuation, using a Dividend Low cost Mannequin (DDM) and explaining the implications for our portfolio.

Significance of Dividends to The Firm

Firstly, we examined the corporate’s capital allocation and its dividend historical past in addition to figuring out its dividend technique to find out whether or not it’s a dividend inventory.

Capital Allocation

In our earlier evaluation of Intel, our standards for a corporation to be deemed a dividend inventory is:

To be thought-about as dividend shares, we require that firms’ dividend yields be increased than their annualized inventory return. Moreover, we require the 5-year dividend yield to even be increased than the 5-year bond yield of the respective international locations of every firm. – Khaveen Investments

|

Firms |

Dividend Yield (5-year Common) |

Inventory Return (5 years) |

5-yr Annualized |

|

Intel (INTC) |

2.99% |

-21.53% |

-4.73% |

|

Monolithic Energy Programs (MPWR) |

0.72% |

265.41% |

29.59% |

|

Lattice (LSCC) |

NA |

837.44% |

56.45% |

|

NVIDIA (NVDA) |

0.17% |

648.88% |

49.58% |

|

Marvell (MRVL) |

0.68% |

182.04% |

23.04% |

|

AMD (AMD) |

NA |

305.78% |

32.33% |

|

Analog Gadgets (ADI) |

1.83% |

101.48% |

15.04% |

|

Broadcom (AVGO) |

3.01% |

272.68% |

30.10% |

|

Microchip (MCHP) |

1.46% |

124.22% |

17.53% |

|

TI |

2.57% |

47.44% |

8.07% |

|

NXP (NXPI) |

1.25% |

139.01% |

19.04% |

|

QUALCOMM (QCOM) |

2.58% |

63.65% |

10.35% |

|

ON Semi (ON) |

NA |

427.22% |

39.44% |

|

Skyworks (SWKS) |

1.76% |

9.33% |

1.80% |

|

Infineon (OTCQX:IFNNF) |

1.09% |

54.86% |

9.14% |

|

STMicro (STM) |

0.78% |

150.44% |

20.15% |

|

Renesas (OTCPK:RNECF) |

NA |

187.87% |

23.55% |

|

Qorvo (QRVO) |

NA |

24.48% |

4.48% |

|

MediaTek |

4.77% |

306.44% |

32.37% |

|

ams-OSRAM (OTCPK:AMSSY) |

NA |

-79.23% |

-26.97% |

|

Micron (MU) |

NA |

73.78% |

11.69% |

|

Samsung (OTCPK:SSNLF) |

2.91% |

66.83% |

10.78% |

|

SK Hynix |

1.67% |

85.07% |

13.10% |

|

Common |

1.89% |

185.81% |

18.52% |

Supply: Firm Knowledge, Khaveen Investments

We assessed 17 chipmaker firms and in contrast their dividend yield with their annualized inventory return (5-years). We up to date the desk above and located Intel stays the one firm with a dividend yield above its annualized inventory return. Nevertheless, as its dividend yield is decrease in comparison with the 5-year US authorities treasury yield of 4.44%, it fails to satisfy our standards as a dividend inventory. Thus, not one of the firms together with TI certified as dividend shares.

Nevertheless, whereas the corporate doesn’t meet our definition of a dividend inventory, different definitions of a dividend inventory embody:

A dividend inventory is an possession share in an organization that usually distributes a portion of its income to its shareholders, permitting them to construct long-term wealth by a gradual stream of earnings on a scientific foundation. – MAC

We compiled the corporate’s dividends within the desk beneath in addition to its debt issued and repaid and share issuance and repurchases.

|

TI ($ mln) |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Dividends Paid |

(1,175) |

(1,323) |

(1,444) |

(1,646) |

(2,104) |

(2,555) |

(3,008) |

(3,426) |

(3,886) |

(4,297) |

Supply: Firm Knowledge, Khaveen Investments

Based mostly on the desk, up to now 10 years, the corporate has constantly paid dividends yearly, which highlights its common dividend distribution standards definition as a dividend inventory.

Dividend Insurance policies

In keeping with the CFA Institute, there are 3 varieties of dividend payout insurance policies that are:

- Secure Dividend Coverage: A secure dividend coverage maintains constant dividend funds, counting on long-term sustainable earnings forecasts to make sure gradual development. This coverage goals to keep up a constant and regular development charge in dividend funds by adjusting dividends steadily in response to adjustments in earnings. “A secure dividend coverage is one the place the dividends paid don’t mirror short-term volatility in earnings.”

- Fixed Dividend Payout Ratio Coverage: Entails utilizing a hard and fast goal dividend payout ratio based mostly on present earnings, leading to extra variable dividend funds in comparison with a secure dividend coverage. This strategy ensures that dividends are solely paid when there are income and usually are not withheld when income are earned, however it leads to extra uncertainty for shareholders relating to anticipated dividends.

- Residual Dividend Method: Entails setting a goal payout ratio for long-term fairness necessities utilizing retained earnings and is extra unstable than Secure Dividend Coverage. Dividends are disbursed when earnings surpass the optimum capital finances, permitting the agency to uphold its desired capital construction on the best value of capital. Nonetheless, this strategy could lead to erratic dividends because of fluctuations in each funding alternatives and earnings over time.

TI Dividend Goal

TI

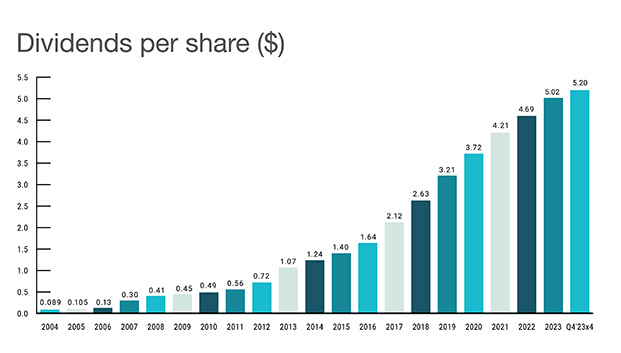

On its web site, the corporate said its dividend goals focus each on development and sustainability. Its rising development in dividends per share can be highlighted. Up to now 20 years, the corporate has elevated its dividends per share yearly as seen within the chart beneath.

TI

To find out whether or not the corporate has a secure dividend coverage, we in contrast its dividend development with its gross sales and earnings development beneath.

|

Texas Devices |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023F |

2024F |

|

Dividends Paid ($ mln) |

1,323 |

1,444 |

1,646 |

2,104 |

2,555 |

3,008 |

3,426 |

3,886 |

4,297 |

4,559 |

4,628 |

|

Progress % |

12.6% |

9.1% |

14.0% |

27.8% |

21.4% |

17.7% |

13.9% |

13.4% |

10.6% |

6.1% |

1.5% |

|

Dividend per Share $ |

1.24 |

1.4 |

1.64 |

2.12 |

2.63 |

3.21 |

3.72 |

4.21 |

4.69 |

5.02 |

5.2 |

|

Progress % |

15.9% |

12.9% |

17.1% |

29.3% |

24.1% |

22.1% |

15.9% |

13.2% |

11.4% |

7.0% |

3.6% |

|

Income ($ mln) |

13,045 |

13,000 |

13,370 |

14,961 |

15,784 |

14,383 |

14,461 |

18,344 |

20,028 |

17,923 |

19,069 |

|

Gross sales Progress % |

6.9% |

-0.3% |

2.8% |

11.9% |

5.5% |

-8.9% |

0.5% |

26.9% |

9.2% |

-10.5% |

6.4% |

|

Web Revenue ($ mln) |

2,821 |

2,986 |

3,595 |

3,682 |

5,580 |

5,017 |

5,595 |

7,769 |

8,749 |

5,998 |

7,461 |

|

Earnings Progress % |

30.5% |

5.8% |

20.4% |

2.4% |

51.5% |

-10.1% |

11.5% |

38.9% |

12.6% |

-31.4% |

24.4% |

Supply: Firm Knowledge, Khaveen Investments

Based mostly on the desk above, we compiled the previous 10 years’ information in addition to our forecasts in 2023 and 2024 for income and earnings development. The dividend per share in 2024 is predicated on the prorated $1.3 quarterly dividend declared by administration. We estimated its complete dividend paid in 2023 and 2024 based mostly on dividend per share multiplied by our variety of shares excellent forecast based mostly on a 10-year common development.

Its dividend paid and dividend per share development have been optimistic in all years up to now 10 years and are anticipated to be optimistic as properly in each 2023 and 2024. This contrasts with its income and earnings development development, which had intervals of unfavourable development. For instance, its income development was unfavourable in 2015 and 2019 however its dividend development was nonetheless optimistic in these years. Moreover, its earnings declined in 2019 however its dividend development was optimistic. Moreover, in 2023, we forecasted each income and earnings development to say no by 10.5% and 31% whereas dividend development remained optimistic. Within the complete interval analyzed, its common dividend development is increased (15.7%) in comparison with its common earnings development (14.2%). Furthermore, the vary of its earnings development (-31.4% to 51.5%) is far wider (83%) in comparison with the vary of its dividend per share development of three.6% to 29.3% (25.7%). Thus, we consider the corporate doesn’t undertake the secure dividend coverage strategy.

|

Dividend vs Inventory Value |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023F |

|

Inventory Value Change |

21.76% |

2.52% |

33.13% |

43.13% |

-9.52% |

35.76% |

27.94% |

14.83% |

-12.34% |

4.32% |

|

Common Inventory Value ($) |

37.38 |

43.69 |

52.50 |

71.97 |

92.68 |

103.47 |

121.45 |

175.41 |

163.98 |

171.1 |

|

Dividend per Share $ |

1.24 |

1.4 |

1.64 |

2.12 |

2.63 |

3.21 |

3.72 |

4.21 |

4.69 |

5.02 |

|

Progress % |

15.9% |

12.9% |

17.1% |

29.3% |

24.1% |

22.1% |

15.9% |

13.2% |

11.4% |

7.0% |

Supply: Firm Knowledge, Macrotrends, Yahoo Finance, Khaveen Investments

Moreover, evaluating the corporate’s dividend development with its inventory value change, the corporate’s dividend development had been optimistic in all years up to now 10 years whereas its inventory value change was unfavourable in 2 years that are 2018 and 2022. Total, its dividend development doesn’t mirror its inventory value change with a mean dividend per share development of 16.88% which is far increased than its inventory value change (2.98%).

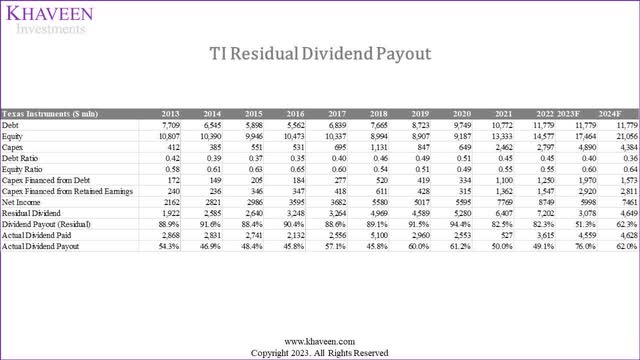

We then examined whether or not the corporate adopts a Residual Dividend strategy by calculating its residual dividend and payout ratio based mostly on its debt-to-equity ratio and evaluating it with its precise dividend paid and payout ratio. To do that, we first compiled its debt and fairness up to now 10 years in addition to its capex. We calculated its fairness ratio based mostly on its fairness divided by the full capital (debt and fairness). Based mostly on this, we multiplied its capex with the fairness ratio to derive the capex financed from retained earnings. Residual earnings is calculated by deducting capital expenditures from retained earnings, subtracted from internet earnings.

Firm Knowledge, Khaveen Investments

As seen from the desk, we calculated the corporate’s residual dividend and dividend payout ratio as increased than its precise dividend paid and payout ratio constantly up to now 10 years.

Nevertheless, for 2023 and 2024, we calculated its residual dividend payout ratio to lower considerably. In 2023, we estimate its precise dividend payout ratio to be increased than its residual dividend payout ratio for the primary time in 10 years.

That is because of the firm’s aggressive enhance in capex which elevated by 49.6% YoY based mostly on its Q2 TTM capex for fab expansions in Texas and Utah which the corporate highlighted are to assist its capability enhance of 300mm wafers for Automotive and Industrial segments development. The corporate can be increasing its backend meeting and take a look at amenities in Malaysia with a purpose of 90% of meeting and take a look at actions being in-house by 2030 for higher provide chain management based on the corporate. From its newest earnings briefing, administration expects to proceed spending round $5 bln in capex per yr however earlier than accounting for subsidies reminiscent of from the CHIPS Act.

To assist these buildouts and allow future development, we proceed to count on related capital expenditures to be about $5 billion per yr by 2026. – Dave Pahl, Vice President, Investor Relations

Furthermore, one more reason for the lower in residual dividend payout ratio is the lower in earnings in 2023, the place we forecasted the corporate’s earnings contract by 31% for the complete yr with a slowdown in income development to -10.5% because the semicon business had declined by 17.7% YoY in YTD Aug 2023 amid the market weak spot in PC, smartphone, server, and automotive finish markets, thus resulting in decrease economies of scale and enhance in COGS as % of income by 2.8% based mostly on Q3 TTM. One other issue for our decrease forecast gross margins (63.8% in 2023 vs 68.76% in 2022) is the next depreciation expense of 19% YoY in Q3 TTM as its fastened belongings enhance by 20% in 2022 because of a rise in PPE. Moreover, we forecast its working bills to extend based mostly on its Q3 TTM the place its SG&A and R&D % of income had elevated by 1.4% and 1.8% respectively, thus contributing to our forecast of a decline in internet margins from 43.7% to 33.4% in 2023.

Total, regardless of the decrease estimated residual dividend payout ratio in 2023 and 2024 that brings it extra according to its precise payout ratio, we consider this doesn’t mirror that the corporate had modified its dividend payout mannequin strategy however as an alternative because of the surge in capex and decline in earnings.

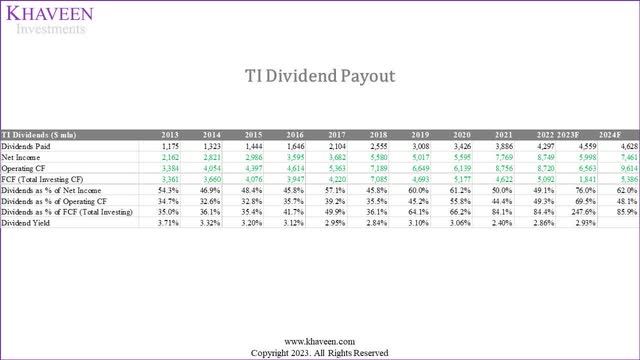

Lastly, we compiled the corporate’s dividends and calculated its dividends as a % of internet earnings, working CF and FCF.

Firm Knowledge, Khaveen Investments

Based mostly on the desk, firstly, its dividend as % of internet earnings seems to be very secure up to now 10 years however we estimated it to extend considerably in 2023, as an outlier because of our forecasted lower in internet earnings of 31%, however we see the ratio moderating down in 2024 as earnings development get well. Alternatively, its dividends as % of working earnings and FCF had been on an rising development. Furthermore, the typical dividend % of internet earnings of TI is 52.8% and the vary can be a lot narrower between 45.8% to 61.2% (15.4%) within the complete interval excluding 2023. As compared, the dividend as % of working earnings is wider between 32.6% and 55.8% whereas the vary for dividend as % of FCF is wider, between 35% to 85.9%. Thus, we consider that the corporate adopts a Fixed Dividend Payout Ratio Coverage based mostly on its dividends as a % of internet earnings.

Moreover, its dividend yield had been on a reducing development from 3.71% to 2.86% in 2022, and our forecasted yield of two.93%. Thus, we consider the corporate doesn’t undertake a dividend payout mannequin to keep up its yield.

|

Texas Devices |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023F |

2024F |

|

Dividend per Share $ (Adjusted) |

1.2 |

1.36 |

1.52 |

2 |

2.48 |

3.08 |

3.6 |

4.08 |

4.6 |

4.96 |

5.2 |

|

Dividend per Share Improve $ |

0.16 |

0.16 |

0.48 |

0.48 |

0.6 |

0.52 |

0.48 |

0.52 |

0.36 |

0.24 |

|

|

Dividends as % of Web Revenue (Dividend Payout Ratio) |

46.9% |

48.4% |

45.8% |

57.1% |

45.8% |

60.0% |

61.2% |

50.0% |

49.1% |

76.0% |

62.0% |

Supply: Firm Knowledge, Khaveen Investments

Moreover, observing the corporate’s dividend per share enhance in $, the corporate had been elevating its dividend enhance annually to extend its dividend payout ratio till 2019 when it had achieved a excessive payout ratio of above 60%, which it then lowered the rise in dividends in 2020 and subsequently once more in 2021 which we consider is because of the firm attempting to keep up the vary of its dividend payout ratio. Moreover, in 2023, the corporate considerably lowered its dividend per share enhance as we forecasted the ratio to extend and once more in 2024.

Abstract

Total, we consider the corporate’s extremely secure dividend payout ratio signifies that it adopts a Fixed Dividend Payout Ratio coverage with a mean ratio of 52.8% quite than the 2 different approaches that are Secure Dividend Coverage (its dividend development doesn’t mirror earnings development) and Residual Dividend Method (precise dividend payout decrease than residual dividend payout). One of many foremost standards for a corporation to undertake a Fixed Dividend Payout Ratio coverage is it will need to have optimistic earnings, which we study beneath to find out the sustainability of its dividend outlook.

Sustainability of Dividends

On this part, we decide whether or not TI’s dividends are sustainable and whether or not it may proceed to extend going ahead. Firstly, we study the corporate’s enterprise mannequin and its income and earnings development.

Enterprise Mannequin (Income)

|

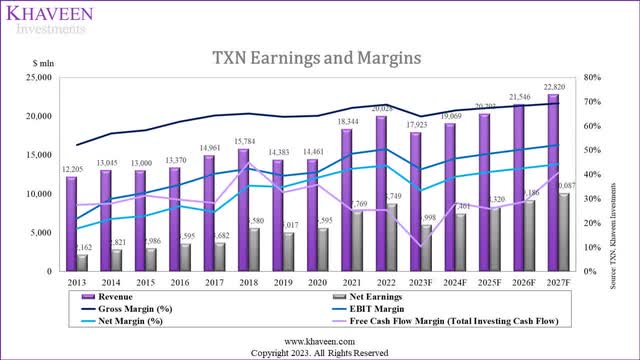

Earnings & Margins |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Income |

12,205 |

13,045 |

13,000 |

13,370 |

14,961 |

15,784 |

14,383 |

14,461 |

18,344 |

20,028 |

|

Income Progress |

-4.83% |

6.88% |

-0.34% |

2.85% |

11.90% |

5.50% |

-8.88% |

0.54% |

26.85% |

9.18% |

Supply: Firm Knowledge, Khaveen Investments

The corporate’s income development had been optimistic in most years besides in 2013, 2015, and 2019. Nonetheless, it had a mean income development of 4.96% up to now 10 years. The optimistic development development signifies that it’s optimistic for stability to generate earnings to be paid out as dividends and keep its payout ratio.

|

TI Revenues Progress % |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

8-year Common |

|

Industrial |

4,030 |

4,412 |

5,236 |

5,682 |

5,178 |

5,351 |

7,521 |

8,011 |

|

|

Progress % |

-0.3% |

9.5% |

18.7% |

8.5% |

-8.9% |

3.3% |

40.6% |

6.5% |

9.7% |

|

Auto |

1,950 |

2,407 |

2,843 |

3,157 |

3,020 |

2,892 |

3,852 |

5,007 |

|

|

Progress % |

15.0% |

23.4% |

18.1% |

11.1% |

-4.3% |

-4.2% |

33.2% |

30.0% |

15.3% |

|

Private Electronics |

3,900 |

3,476 |

3,740 |

3,630 |

3,308 |

3,904 |

4,403 |

4,006 |

|

|

Progress % |

3.1% |

-10.9% |

7.6% |

-2.9% |

-8.9% |

18.0% |

12.8% |

-9.0% |

1.2% |

|

Communications Gear |

1,690 |

1,738 |

1,795 |

1,736 |

1,582 |

1,157 |

1,101 |

1,402 |

|

|

Progress % |

-23.8% |

2.8% |

3.3% |

-3.3% |

-8.9% |

-26.9% |

-4.9% |

27.4% |

-4.3% |

|

Enterprise Programs |

780 |

802 |

898 |

1,105 |

863 |

868 |

1,101 |

1,202 |

|

|

Progress % |

-0.3% |

2.8% |

11.9% |

23.1% |

-21.9% |

0.5% |

26.9% |

9.2% |

6.5% |

|

Different |

650 |

535 |

449 |

474 |

431 |

289 |

367 |

401 |

|

|

Progress % |

24.6% |

-17.7% |

-16.1% |

5.5% |

-8.9% |

-33.0% |

26.9% |

9.2% |

-1.2% |

|

Whole |

13,000 |

13,370 |

14,961 |

15,784 |

14,383 |

14,461 |

18,344 |

20,028 |

|

|

Progress % |

-0.3% |

2.8% |

11.9% |

5.5% |

-8.9% |

0.5% |

26.9% |

9.2% |

5.9% |

Supply: Firm Knowledge, Khaveen Investments

Moreover, based mostly on the corporate’s income by section, its development had been principally optimistic for all segments aside from Communications Gear and the Different class which each have unfavourable common development. Nevertheless, its foremost segments Industrial and Auto, had increased development than the corporate’s common and as we coated in our earlier evaluation because of the brighter outlook of Industrial and Automotive finish markets, may bode properly for TI’s development outlook and assist its dividend sustainability and development.

IC Insights, Firm Knowledge, Khaveen Investments

Moreover, as seen by our analog market share chart, the corporate had constantly maintained its management place till 2022 when it was tied with ADI (its share elevated because of its acquisition of Maxim). Thus, we consider this displays the corporate’s aggressive positioning power, which may bode properly for its future income prospects and assist its dividend sustainability.

|

Texas Devices ($ bln) |

2022 |

2023F |

2024F |

2025F |

2026F |

2027F |

|

Asset Turnover |

0.81x |

0.85x |

0.85x |

0.85x |

0.85x |

0.85x |

|

Property |

27,207 |

30,017 |

33,418 |

37,437 |

41,872 |

46,739 |

|

Income (Provide) |

20,028 |

23,136 |

25,526 |

28,418 |

31,835 |

35,607 |

|

Progress % |

9.2% |

15.5% |

10.3% |

11.3% |

12.0% |

11.8% |

|

Income (Demand) |

20,028 |

17,923 |

19,069 |

20,293 |

21,546 |

22,820 |

|

Progress |

9.2% |

-10.5% |

6.4% |

6.4% |

6.2% |

5.9% |

|

Income Projection |

20,028 |

17,923 |

19,069 |

20,293 |

21,546 |

22,820 |

|

Progress |

9.2% |

-10.5% |

6.4% |

6.4% |

6.2% |

5.9% |

Supply: Firm Knowledge, Khaveen Investments

Nonetheless, we up to date our income projections from our earlier evaluation in 2023, which is predicated on prorated Q1 to Q3 revenues for a complete development decline of -10.5% in 2023. Nevertheless, we forecast its income development to get well in 2024 and past pushed by demand from its Auto and Industrial segments.

Total, the corporate’s income development with a mean of 6.2% is lots decrease than the corporate’s dividend per share development (18% common), thus it has to depend on increased earnings development to assist the rise in dividends which we study additional beneath.

Earnings and Margins

Firm Knowledge, Khaveen Investments

Regardless of the intervals with income contraction, its earnings had risen yearly aside from 2019 up to now 10 years with rising profitability margins reminiscent of gross, EBIT, and internet margins as seen within the chart above. Its internet earnings development had grown by a mean of 18.2%, according to its dividend per share development of 18%, thus its earnings development was sufficient to assist its dividend development.

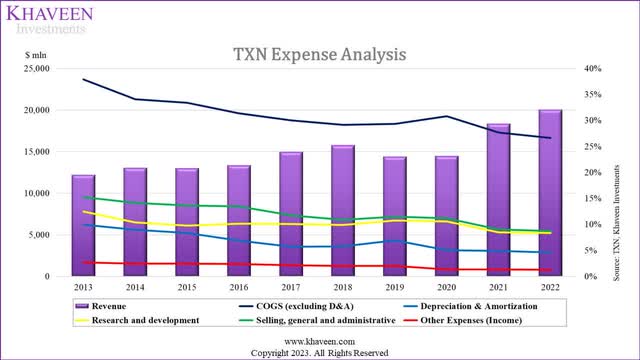

Firm Knowledge, Khaveen Investments

Based mostly on the corporate’s expense evaluation, its margin enchancment had been largely attributed to the decline in COGS as a % of income. As seen from the chart, its revenues correlate with its COGS as % of revenues, indicating the development in COGS as % of income because of economies of scale. Furthermore, we additionally beforehand recognized the corporate’s shift in the direction of 300mm wafers that are decrease value than 200mm wafers helps its margins. Apart from that, its working bills reminiscent of SG&A and R&D in addition to depreciation as % of income had been reducing barely.

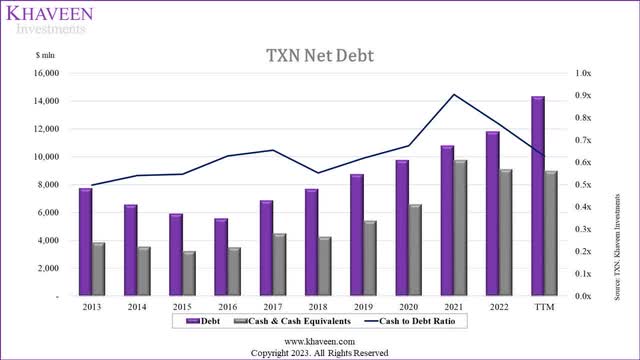

Monetary Place

Lastly, we additionally examined the corporate’s monetary place by evaluating its debt to money up to now 10 years beneath as dividends are paid from the corporate’s money steadiness.

Firm Knowledge, Khaveen Investments

Whereas the corporate’s debt had risen up to now 10 years, so had its money balances. Its cash-to-debt ratio has trended upward up to now 10 years, which we consider bodes properly for its sustainability of dividend funds.

Sustainable Progress Fee

|

Sustainable Progress Fee |

|

|

Dividend Payout Ratio |

52.7% |

|

ROE |

49.9% |

|

Sustainable Progress Fee* |

23.6% |

*(1-Payout Ratio) x ROE

Supply: Firm Knowledge, Khaveen Investments

Moreover, we calculated the sustainable development charge of the corporate, which is the very best charge an organization can maintain its development with out elevating fairness or debt, at 23.6% based mostly on its dividend payout ratio and 10-year common ROE. In comparison with its previous dividend development, our derived sustainable development charge of TI (23.6%) is increased than its common dividend development (18%), thus we consider its dividends and development are sustainable.

Outlook

|

Dividend Forecast |

2023F |

2024F |

2025F |

2026F |

2027F |

2028F |

2029F |

2030F |

2031F |

2032F |

|

Anticipated Earnings ($ mln) |

5,998 |

7,461 |

8,320 |

9,186 |

10,087 |

10,630 |

11,144 |

11,629 |

12,085 |

12,426 |

|

Shares Excellent (mln) |

908.2 |

890.0 |

873.0 |

857.7 |

842.9 |

827.7 |

813.1 |

800.4 |

789.2 |

777.0 |

|

Anticipated Earnings per Share ($) |

6.60 |

8.38 |

9.53 |

10.71 |

11.97 |

12.84 |

13.71 |

14.53 |

15.31 |

15.99 |

|

Estimated Payout Ratio |

76.0% |

62.0% |

58.8% |

56.1% |

53.6% |

53.1% |

52.7% |

52.5% |

52.5% |

52.8% |

|

Dividend per Share ($) |

5.02 |

5.2 |

5.61 |

6.01 |

6.42 |

6.82 |

7.23 |

7.63 |

8.04 |

8.44 |

Supply: Firm Knowledge, Khaveen Investments

Total, regardless of the short-term development headwinds in 2023 for the corporate, we consider its long-term income and earnings development stay optimistic pushed by its secure market positioning in DAO, excessive development automotive and industrial segments, and enhancing margins because of economies of scale. Subsequently, we consider its dividend sustainability and development stay sustainable in the long run. Within the desk, we added TI’s 2023 dividend per share ($5.02) and its prorated 2024 dividends ($5.2). We assumed the corporate would attain its common dividend payout ratio of 52.8% by 2032 and forecasted its dividend per share of $8.44 in that yr. Based mostly on our 2032 forecast, we calculated the goal ratio based mostly on a prorated dividend per share enhance from 2024 to 2032 which is $0.41, thus leading to a complete ahead common development charge of 6%. Nevertheless, our ahead development is low compared to the corporate’s historic dividend per share development common of 15.7% and its SGR of 23.6%. However, our forecast reveals a constant dividend development annually within the forecast interval.

Affect of The Firm as A Dividend Inventory

As we decided TI as a dividend inventory regardless of not fulfilling our standards, however quite because of its constant dividend distribution observe file, we examined the potential impression the corporate has on our portfolio being categorised as a dividend inventory.

Conduct of Dividend Buyers

Some traits of a dividend investor embody long-term focus, risk-averse, income-oriented, value-oriented, and conservative. With a long-term focus, dividend traders maintain the dividend inventory for a protracted interval because of advantages reminiscent of accumulating dividends over time. One other attribute of dividend traders is risk-averse people preferring secure dividends, requiring them to carry onto their shares. Dividend traders are additionally characterised as income-oriented people, receiving dividend earnings over time for reminiscent of retirement planning. Moreover, dividend traders additionally give attention to worth and should select to carry onto their shares throughout a market selloff. In keeping with Merrill Lynch, dividend shares are much less unstable. Lastly, dividend traders are additionally conservative in investing, preferring to put money into well-established firms which have a observe file of constant dividends, thus holding onto their shares for an extended interval.

Affect of TI on Portfolio

As we recognized dividends investor’s habits corresponds to the long-term holding of a inventory, we study how this impacts the inventory traits, and the way that advantages our diversified portfolio of investments. we in contrast the corporate with the semicon business and the US market index to find out the impression based mostly on volatility (commonplace deviation based mostly on their 10-year common value change), liquidity by way of common quantity of shares and worth of shares traded, share value assist by measuring the typical inventory decline in main market drawdowns and risk-adjusted return based mostly on annualized 10-year returns divided by commonplace deviation.

|

Comparability |

TI |

Semicon Trade (SOXX) |

US Inventory Market (VTI) |

|

Threat (Customary Deviation) (10-years) |

6.2% |

7.2% |

4.5% |

|

Liquidity (Common Quantity of Shares) |

4,691,460 |

886,789 |

3,034,853 |

|

Liquidity (Common Worth Traded) ($ mln) |

693.44 |

405.52 |

632.68 |

|

Liquidity (Common Unfold) |

0.03% |

0.03% |

0.01% |

|

Common Drawdown (Previous 10-years) |

-16.13% |

-27.18% |

-21.28% |

|

Common Threat-adjusted Return |

3.99 |

5.29 |

3.36 |

Supply: Looking for Alpha, Yahoo Finance, Khaveen Investments

As seen within the desk, TI has displayed a decrease danger with a normal deviation of 6.2% in comparison with the semicon business which has the next commonplace deviation at 7.2% however is increased in comparison with the general US inventory market danger. The inclusion of TI in our portfolio’s semicon publicity subsequently advantages it with decrease danger.

Equally, the efficiency of TI’s inventory had been extra resilient up to now 10 years throughout market selloff intervals with a mean drawdown in inventory value of -16%, outperforming not solely the general semicon business common but in addition the US market common. Thus, the inclusion of TI in our portfolio advantages it with decrease volatility.

By way of liquidity, TI has the very best common quantity of shares traded adopted by the US inventory market and the semicon business VTI. Nevertheless, VTI has a narrower common unfold of 0.01% in comparison with TI and SOXX that are each tied. Thus, we consider it’s unlikely TI as a dividend inventory offers liquidity benefits regardless of its increased quantity and worth of shares traded.

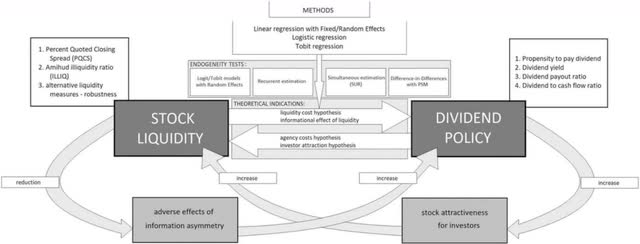

Analysis in Worldwide Enterprise and Finance

Moreover, the diagram from Analysis in Worldwide Enterprise and Finance illustrates the connection between an organization’s inventory liquidity and its dividend coverage. It highlights the connection between liquidity and dividend coverage, attributing it to decreased data asymmetry. Moreover, it underscores the optimistic impression of dividend coverage on inventory liquidity. Nevertheless, the research additionally highlighted the unfavourable relationship between dividend coverage and liquidity reminiscent of within the case of a selfmade dividend the place traders promote their inventory for money stream which will increase liquidity. Therefore, as these elements counterbalance one another, the affiliation between dividend coverage and liquidity stays inconclusive. Subsequently, whereas TI having a comparatively excessive liquidity is a optimistic, we can’t attribute the rationale for this because of it being a dividend inventory.

Furthermore, TI has the next common risk-adjusted return at 3.99 than the US inventory market common however continues to be decrease than the semicon common, thus we consider it as a dividend inventory doesn’t present a bonus by way of risk-adjusted returns.

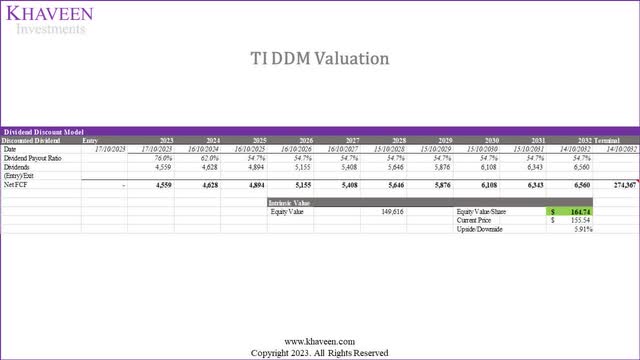

DDM

Based mostly on the primary level, we consider the corporate adopts a Fixed Dividend Payout Ratio coverage by sustaining its dividend payout ratio based mostly on internet earnings, we valued the corporate based mostly on a DDM mannequin beneath based mostly on our dividend forecasts.

Khaveen Investments

As the corporate’s sustainable development charge of 24% is increased than its value of fairness (10.3%), we couldn’t calculate its terminal worth based mostly on its sustainable development charge because of a unfavourable low cost charge. Subsequently, we as an alternative utilized a terminal worth based mostly on the chipmaker’s common P/B a number of of 4.41x multiplied by our 2032 e book worth forecasts for the corporate ($62.2 bln), which is $274.4 bln. Thus, our DDM mannequin reveals an upside of 5.91% with a reduction charge of 10.3% (value of fairness).

Abstract

Total, we consider there are a number of advantages that TI as a dividend inventory on our portfolio together with providing decrease danger (volatility) in comparison with the semiconductor business, in addition to decrease drawdown than each SOXX and the general US inventory market because of its higher resilience over the previous decade throughout market selloffs. Moreover, our DDM valuation reveals its shares are undervalued with a terminal worth based mostly on e book worth and business common P/B.

Threat: Market Headwinds

As talked about, we count on the corporate’s full-year income development to say no by 10% in 2023 amid the weak semicon market development. Based mostly on its earnings briefing, administration highlighted that it continued “to function in a weak setting” and guided its This fall 2023 revenues to be down 12% YoY. Particularly, the corporate highlighted “industrial weak spot broadened” through the quarter, which is its largest section (40% of income). Alternatively, a few of its key opponents reminiscent of ADI (2.19%) and STMicro (7.5%) are anticipated to have optimistic development in 2023 based mostly on analysts’ income consensus, indicating the corporate may lose market share in opposition to these opponents.

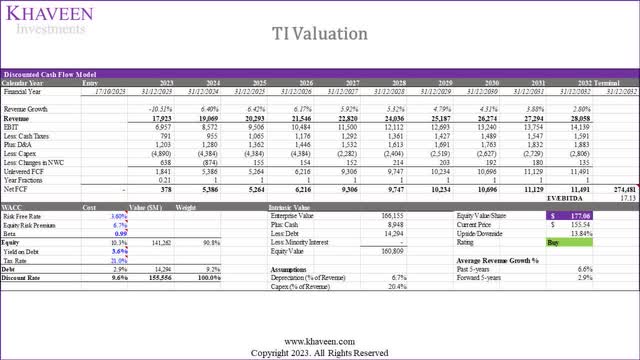

Valuation

DCF

Khaveen Investments

However our DDM mannequin, we proceed to worth the corporate with a DCF valuation as we don’t primarily put money into the corporate for its dividends. As an alternative, the corporate has sturdy FCFs with a mean FCF margin of 30.9% up to now 10 years. Nonetheless, we consider the advantages of TI’s inventory in our portfolio reminiscent of decrease danger and lowered volatility are optimistic elements for holding its inventory. Based mostly on a reduction charge of 9.6% (firm’s WACC) and terminal worth based mostly on the typical chipmaker EV/EBITDA of 17.13x, our mannequin reveals an upside of 13.84%.

|

Valuation |

Value Goal ($) |

Upside % |

|

DDM Valuation |

164.74 |

5.91% |

|

DCF Valuation |

177.06 |

13.84% |

Supply: Khaveen Investments

Verdict

In abstract, we consider the corporate follows a Fixed Dividend Payout Ratio coverage, sustaining a secure dividend payout ratio of 52.8% on common which we used as our long-term dividend payout ratio goal as an assumption to mission its dividends. Regardless of short-term challenges in 2023, we consider the corporate’s long-term outlook stays optimistic, pushed by its sturdy place within the DAO market, development in automotive and industrial segments, and enhancing margins from economies of scale. Consequently, we count on its long-term dividend sustainability and development to proceed, with a projected ahead common dividend per share development of 6%. Moreover, we consider TI provides advantages in our portfolio, together with decrease danger and lowered volatility in comparison with the semiconductor business and robust fundamentals. Whereas we worth the corporate by DDM and DCF fashions, we consider the first attraction is not only dividends but in addition its sturdy FCFs and optimistic attributes reminiscent of decrease danger and volatility. Subsequently, we charge the corporate as a Purchase with a value goal of $177.06, which is decrease in comparison with our earlier evaluation because of a barely decrease ahead development common, however nonetheless offers a 14% value upside

[ad_2]

Source link