[ad_1]

Tesla, Inc. is an organization which engages within the design, growth, manufacture, and gross sales of totally electrical autos, in addition to energy storage and photovoltaic techniques. It’s ranked the 9th most precious firm on the planet by market cap at over $670B. The corporate is scheduled to launch its This fall 2023 earnings outcome on 24th January (Wednesday), after market shut.

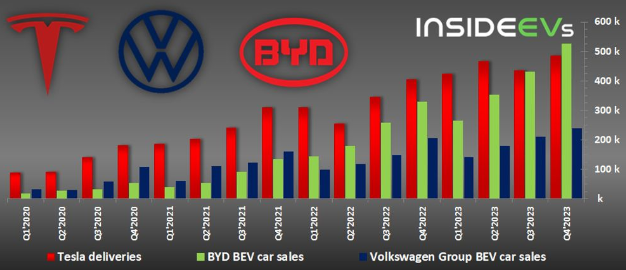

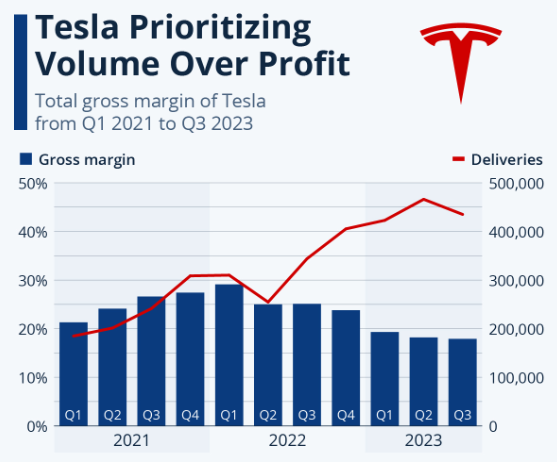

Final Decembere Tesla reported whole car manufacturing at 494,989, up 13% in comparison with the identical interval the earlier 12 months. Then again, whole deliveries hit 484,507, up 20% from the identical interval the earlier 12 months. Mannequin 3/Y reported manufacturing and deliveries up +14% (y/y) and +19% (y/y), to 476,777 and 461,538, whereas different fashions (together with Mannequin S/X, Cybertruck and probably the Semi) reported manufacturing and deliveries down -12% (y/y) and up 34% (y/y) respectively, to 18,212 and 22,969. All through 2023, Tesla produced over 1.84 million (up almost +35% y/y) electrical vehicles worldwide and delivered over 1.80 million (up almost +38% y/y, however in need of the corporate’s goal which was 2 million) electrical vehicles. Typically, regardless of a big worth discount being deployed, the common development price in This fall has noticeably slowed down, behind the long run goal of fifty%.

EV adoption is seen flattening following macroeconomic headwinds comparable to excessive rates of interest and elevated competitors from the Chinese language automakers. In actual fact, the Chinese language EV makers have expanded their market share within the EU market to eight% (might probably attain 15% by 2025, based on Reuters), benefiting from decrease imposed tariffs within the area (10% versus 27.5% in US). Then again, beginning early 2024, among the EVs made by Tesla could now not fulfill the requirement for subsidies within the US and in some European international locations – this might additional dampen the demand outlook. As of Q3 2023, Tesla’s market share within the world market has fallen to 50% (was 65% in 2022).

One other worrying subject was the depreciating gross margin of Tesla, which was under 20% all through 2023. This was attributed to the implementation of large worth cuts for a number of rounds, underutilization of recent factories and a rise in working bills on just a few initiatives together with Cybertruck, AI, self-driving know-how and many others.

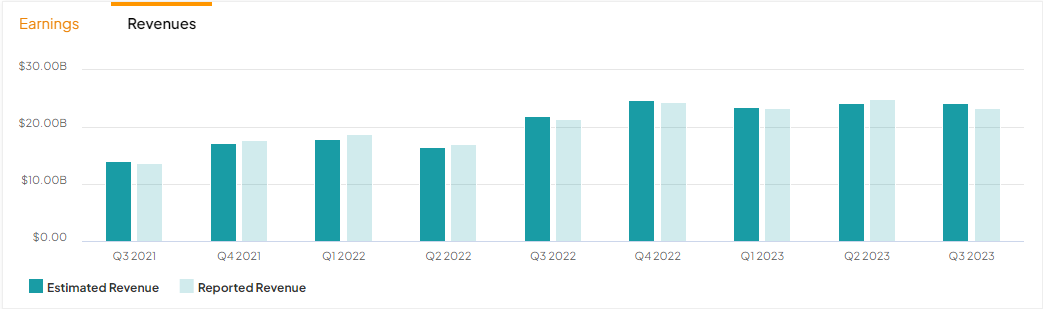

“Income is anticipated to grow to be stronger, at $25.5B; EPS projected downward at $0.74; margins more likely to stay examined… predicted to enhance barely to round 18%, from 17.89% in Q3” – Refinitiv

Market contributors stay impartial on Tesla. Regardless of much less satisfying supply outcomes, the corporate identified that its vitality and providers companies stay strong, which contributed greater than $500 million in mixed gross revenue within the quarter. Its NACS charging port and in depth community of Superchargers function an enormous plus level for the corporate, that are anticipated to be adopted by different automakers by late 2024, or early 2025.

Technical Evaluation:

#Tesla shares have been on a promoting spree since mid December final 12 months, closing bearish for five consecutive weeks. This equates to round an 80% retrace from the bullish rebound in This fall 2023. Nearest help is seen at $208.50, an FR 61.8% prolonged from the lows of April 2023 to the highs of July 2023. A decisive shut under the extent shall encourage extra promoting stress, in the direction of the lows of October 2023, at $194.62 and $184 (FR 78.6%). Quite the opposite, $225.90, or the FR 50.0% serves as the closest resistance, adopted by the dynamic resistance 100-day SMA.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link