[ad_1]

LUNAMARINA/iStock by way of Getty Photos

Over the past 12 months, Sylvamo Company (NYSE:SLVM), which produces and provides printing paper, has been buying and selling extra like a high-growth tech inventory than a provider of paper merchandise.

In early October 2021 it was buying and selling at roughly $23.00 per share, and began a unstable however upward run, ultimately reaching the latest 52-week excessive of $57.38, earlier than barely pulling again to the mid-$56s.

TradingView

It continues to place out stable numbers, however after its large upward run, and a few commentary from administration in its latest earnings name, the corporate seems to be poised for a correction someday within the subsequent couple of months, as typical seasonal quantity, a few upkeep outages, provide chain restraints, rising prices and contractor delays will most likely greater than offset some pricing energy going ahead.

Whereas I imagine the corporate has loads of progress left in it, within the close to time period it is extremely possible its share value goes to take a success.

On this article we’ll take a look at among the latest earnings numbers, the mix of headwinds that may quickly decelerate the corporate’s momentum, and how one can assume if SLVM over the long run.

Some latest numbers

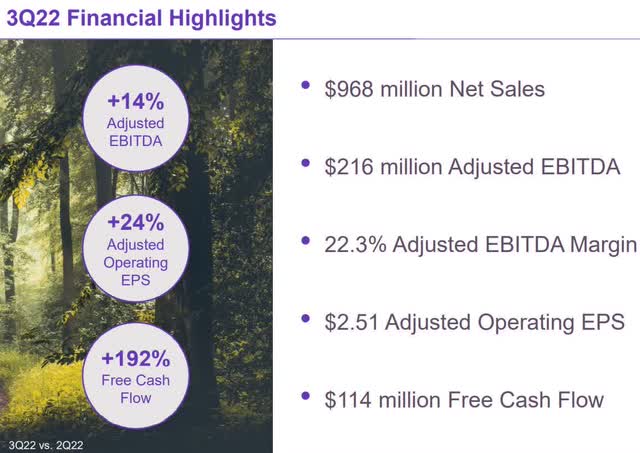

Income within the third quarter was $968 million, up 6.61 % year-over-year, beating by $68.63 million. Web revenue within the reporting interval was $109 million, or $2.44 per share, up from internet revenue of $84 million or $1.89 per diluted share within the second quarter of 2022.

Adjusted earnings within the third quarter was $112 million, or $2.51 per share, up $22 million from the adjusted earnings of $90 million, or $2.02 per share within the prior quarter.

Adjusted EBITDA within the quarter was $216 million, with a margin of twenty-two.3 %. That was in comparison with adjusted EBITDA of $189 million, and a margin of 20.7 % sequentially.

Investor Presentation

Of the three main markets it competes in (Europe, Latin America and North America), Latin American adjusted EBITDA generated the very best margins within the quarter, ending at 27 %, adopted by North America with 20 %, and Europe with 18 %.

Free money move soared from $39 million within the second quarter of 2022 to $114 million within the third quarter of 2022.

The corporate lower debt to underneath $1 billion within the reporting interval, with a gross debt-to-adjusted EBITDA ratio now underneath 1.5x for the final 12 months, as of the tip of the third quarter.

Within the fourth quarter the corporate guides for adjusted EBITDA to drop to $180 million to $190 million, confirming among the weak point I see within the close to time period.

Brief-term headwinds

Under are listed the assorted headwinds the corporate faces within the fourth quarter and the primary quarter of 2023. They’re:

Decrease seasonal quantity, rising seasonal prices, Fx influence, two upkeep outages, compensation accruals, provide chain constraints, and contractor delays.

The place the problem lies, and the place traders ought to primarily give attention to are, the value and blend within the close to time period versus enter prices.

Within the third quarter the corporate did properly as a result of value and blend was up $60 million in comparison with the second quarter of 2022. So despite the fact that enter prices jumped by $46 million within the third quarter, value and blend greater than offset that, ensuing within the good numbers. The corporate is not going to have the identical leads to the subsequent couple of quarters.

Value and blend within the fourth quarter are anticipated to extend from $30 million to $35 million. On the identical time inputs are projected to come back in at a variety of $35 million to $40 million, based mostly upon Fx results and seasonably larger prices within the European and North American markets. Add to that the estimated $21 million in upkeep prices coming from bills related to outage, and it exhibits the corporate is not going to benefit from the numbers it has been producing during the last 12 months. One other think about play is the delay in sure tasks in 2022 that will likely be pulled ahead to the fourth quarter and into 2023. Contractor delays and provide chain constraints have been the rationale for that, so the corporate guides for an extra $20 million in spending in 2023.

With that in thoughts, it means among the numbers for 2022 would have been considerably decrease, though the tasks would have been boosting efficiency for the corporate faster, in order that delay and elevated spend will most likely lead to some downward strain on earnings in 2023, though if pricing and blend maintain up within the latter half of 2023, it ought to offset that.

However within the close to time period it may have an effect on the corporate’s outcomes, which when mixed with a share value that has been hovering, is more likely to convey a correction that it has been due for, even when it wasn’t going through the headwinds in entrance of it.

The ultimate headwind is compensation accruals, which wasn’t included in prior steerage.

Conclusion

SLVM has a powerful administration group in place that has the dedication, dedication, and talent to execute on its technique. It has carried out very properly during the last 12 months in rising the enterprise, and after a brief interval of headwinds, by which I imply the fourth quarter of 2022 and first quarter of 2023, the corporate is positioned to proceed its upward climb.

I am not suggesting it will not begin earlier than the second quarter of 2023, solely that the likelihood is powerful that will probably be underneath strain in a single or each of the quarters talked about above. The timing of it’s after all unknown as to specifics.

For traders within the firm, I do assume it is prudent to attend till the headwinds have their short-term impact on the corporate earlier than taking a place. As talked about earlier, it has been buying and selling extra like a tech inventory than a printing paper firm, so is vulnerable to broad swings in its share value.

And earlier in 2022 it had a giant drop of about $24 per share to its 52-week low. And whereas it has been transferring up in a stair-step sample since then, it’s due for a correction even with the headwinds talked about within the article. However the mixture of the headwinds and excessive share value factors to a possible deep correction someday quickly.

I’d wait until it bottoms out and confirms it is sustainably off its backside earlier than taking a place.

Additional out, I like what I see with the corporate, and after the anticipated correction it ought to take one other run at its 52-week excessive, and possibly break by it into the mid to excessive $60s in 2023, greater than doubtless within the second half.

The one factor is see stopping that could be a extended and deep recession that power firms to chop again on spending

[ad_2]

Source link