Over the weekend, Russian President Vladimir Putin put his nation’s nuclear forces on excessive alert as Ukraine sees elevated army help from the North Atlantic Treaty Group (NATO). Russia can also be experiencing elevated sanctions as a rising variety of nations are blocking Russian banks and companies from utilizing the Society for Worldwide Interbank Monetary Telecommunications (SWIFT), which makes it troublesome for Russian corporations to do enterprise with international entities. Nonetheless, based on Briefing.com, corporations that deal in power are usually not being eliminated.

Russia closed its inventory market at the moment after seeing giant promoting final week. The misplaced about 1,000 factors final week—almost 30% of its worth. Russian shares aren’t the one issues falling; the fell arduous final week too, inflicting the Financial institution of Russia to boost charges from 9.5% to twenty% in an try to help the forex.

Russian and Ukrainian officers are assembly on the Belarus border at the moment to start out peace talks. Ukrainian President Volodymyr Zelensky stated the following 24 hours could be essential for the way forward for Ukraine. Zelensky is searching for a direct ceasefire and withdrawal of troops, nevertheless it’s troublesome to undertaking what would possibly occur.

have been up huge in a single day in response to the developments between Russia and Ukraine, leaping greater than 9%. Nonetheless, they have been nicely off their highs earlier than the market open, buying and selling 4.18% greater. As anticipated, the turmoil has heightened investor concern; the Cboe Market Volatility Index () rose almost 18% earlier than the open. The have been down about 3% in a single day however had reduce these losses in half earlier than the opening bell.

Whereas Russia is inflicting plenty of concern for American buyers, it’s one other merchandise on an extended checklist of considerations that features inflation and rates of interest. This week, Fed Chair Jerome Powell will testify earlier than Congress and can possible see strain to disclose the Fed’s plans to curb faster-than-expected inflation.

Together with listening to Powell, buyers will get a number of reviews regarding the labor market this week. The large Employment State of affairs report comes out on Friday. The recent labor market is an space of power for the US financial system and permits the Fed to be extra aggressive in addressing inflation in the event that they select.

Trying extra particularly at shares, CEO of Berkshire Hathaway (NYSE:) and one of many richest individuals on the planet, Warren Buffett, launched his annual shareholder letter. Within the letter, Buffett stated he’s not discovering good locations to take a position cash due to poor long-term prospects.

Friday’s Motion

Final week’s buying and selling had extra jumps and turns than a Russian ballet and ended a tragic week that included the bombing of Ukrainian services and cities with a shocking come again on Thursday and a rally on Friday. The noticed the largest features, closing 2.51% greater on Friday. The rallied 2.24%. And the that led Thursday’s rally rose 1.64% on Friday.

Traders seemed to be glad with the response given by the North Atlantic Treaty Group (NATO) had towards Russia invading Ukraine as a result of they weren’t afraid to carry positions by the weekend. The USA and NATO outlined a lot of sanctions on Russian banks and elites however made certain to not hinder Russian commodities from going to market. Whereas there’s plenty of uncertainty of what Russia could do subsequent, buyers seem to assume that Russian President Vladimir Putin isn’t going to push a lot additional into Ukraine.

The Cboe Market Volatility Index (VIX) dropped greater than 9% as buyers grew to become much less involved about Russia and extra keen to do some discount searching. Some buyers left their protected havens by promoting bonds, which pushed the (TNX) greater, and promoting , inflicting it fall 1.86%.

Sector Cross Part

Each sector completed within the inexperienced on Friday with supplies, shopper staples, and financials on the prime. Nonetheless, actual property was the week’s top-performing sector adopted by well being care. Utilities simply barely edged out know-how for third place. Seeing actual property, utilities, and know-how lead the week, though a shortened week, suggests buyers expect a extra subdued Fed within the March assembly. In different phrases, buyers are possible feeling extra assured that the Fed will hike charges only a quarter of a %.

Actual property may gain advantage from slower charge hikes as a result of financing prices ought to stay comparatively low for an extended time. Utilities provide excessive dividends that are inclined to compete with bond yields so a slower rise in yields will possible favor greater yield dividends. Lastly, know-how shares have been harm by the expectation of rising rates of interest due to the position rates of interest play in inventory valuations.

Whereas these one-week traits are attention-grabbing, if the February Shopper Worth Index (CPI) is greater than anticipate on March 10, then rate of interest sentiment could change. Or, if St. Louis Fed President James Bullard is extra influential than anticipated, a nasty shock might come to those sectors. The month of February has been a testomony to how rapidly the market can change.

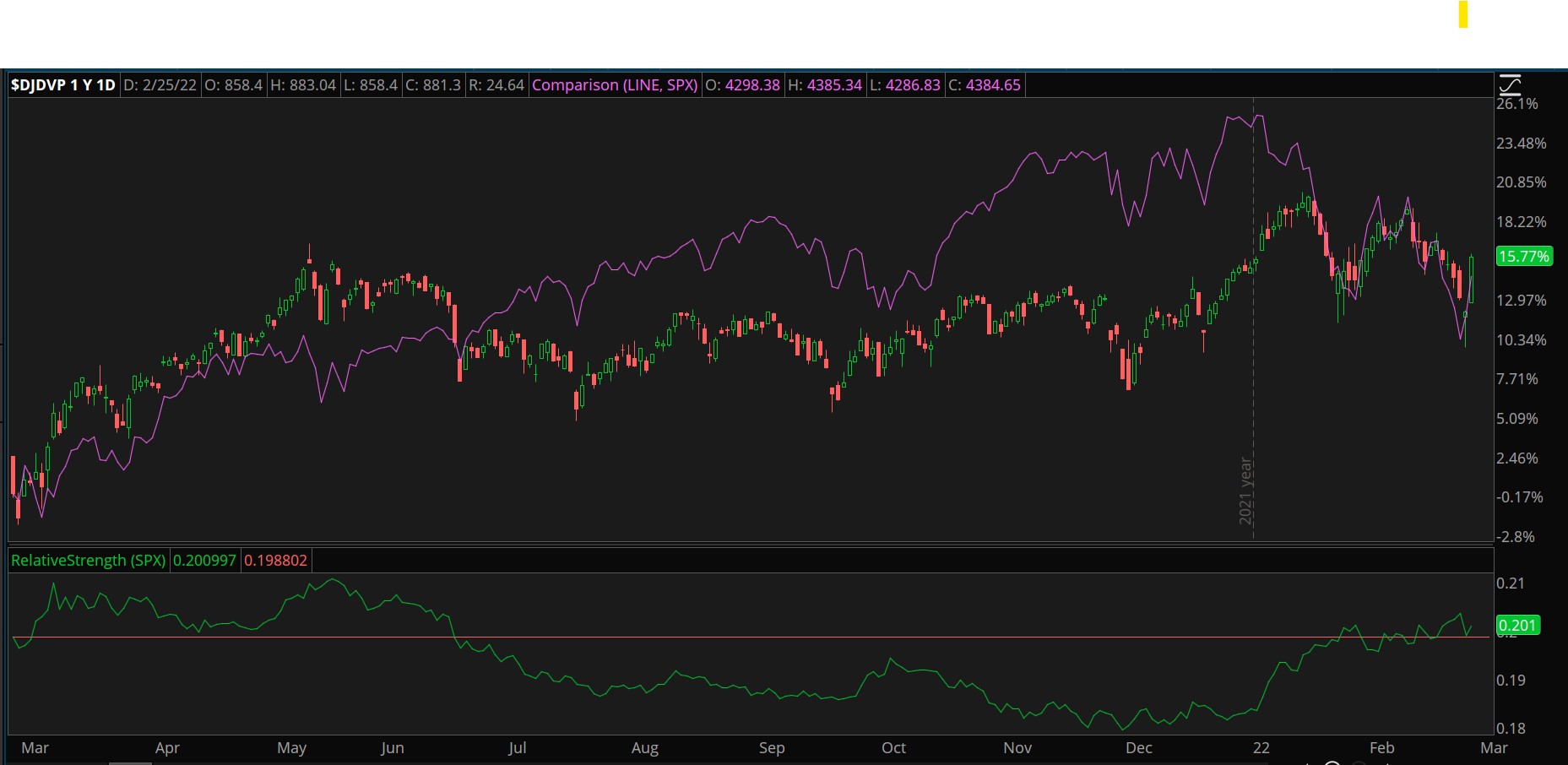

CHART OF THE DAY: DIVIDEND DIVIDE. The Dow Jones U.S. Choose Dividend Index ($DJDVP—left) underperformed the S&P 500 (SPX—pink) most of 2021 however has exhibited relative power (inexperienced) towards the S&P 500 to this point in 2022. Knowledge Sources: ICE, S&P Dow Jones Indices. Knowledge Sources: ICE (NYSE:), S&P Dow Jones Indices. Chart supply: The thinkorswim® platform. For illustrative functions solely. Previous efficiency doesn’t assure future outcomes.

Odd Man Out: Typically the controversy between progress investing and worth investing ignores one other essential model, which is revenue investing. Traders have a tendency to think about bonds once they consider revenue, however shares that pay dividends or higher-than-average dividends are sometimes engaging funding decisions. Dividends simply aren’t horny. They solely appear to matter when rates of interest are rising, and buyers are compelled to re-evaluate inventory valuations. The revenue investing technique isn’t a market chief besides throughout bear markets.

With that stated, revenue is usually a stabilizing affect on a portfolio and may also help cut back volatility. Whereas retirees are extra usually involved about stability and revenue, dividends might be simply reinvested to purchase extra shares and create compounding curiosity. Many corporations perceive the significance of dividends and work actually arduous to persistently pay and lift their dividends annually. In truth, they’ll usually work arduous to stay on lists just like the Dividend Aristocrats.

Whereas shares for revenue might not be acceptable for all portfolios, shares for progress and revenue can often discover a place in most portfolios. These kinds of shares could not have actually huge dividend yields and including a dividend could cut back a number of the progress potential, however they’ll present a steadiness that permits buyers to share in earnings and firm progress.

Disclaimer: TD Ameritrade® commentary for academic functions solely. Member SIPC. Choices contain dangers and are usually not appropriate for all buyers. Please learn Traits and Dangers of Standardized Choices.