[ad_1]

- The NASDAQ appreciated in worth for a fifth consecutive week whatever the stronger employment knowledge. Buyers flip their consideration to world inflation releases.

- Analysts count on US inflation to say no to its lowest degree since April 2021. In accordance with predictions, inflation has fallen from 3.4% to 2.9%.

- Bitcoin witnesses one among its strongest bullish worth actions in virtually a 12 months. Over the previous week, Bitcoin has risen greater than 12%.

- Analysts advise the longer-term outlook for the GBPJPY is for the Yen to finish greater in 2024. Although, the Pound continues to acquire primarily purchase indicators within the meantime.

USA100 – How can Inflation affect the USA100?

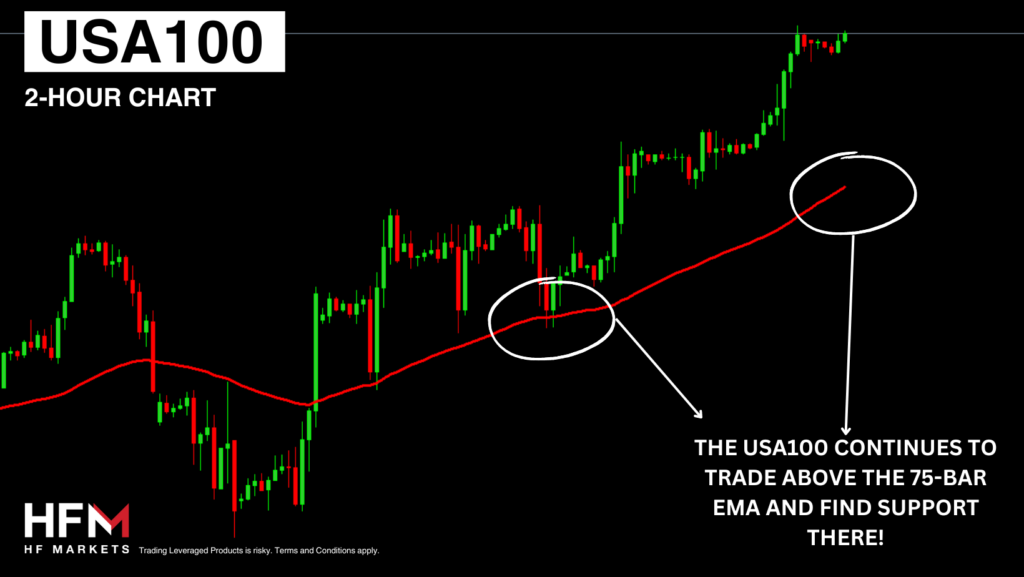

The USA100 is buying and selling at its highest level in historical past having risen 43% in 12 months and eight.57% in 2024. On the two-hour chart, utilizing the 75-bar EMA and the varied oscillators, the asset has not acquired a bearish sign for the reason that 1st of the month. Buyers modified their outlook for financial coverage because the employment sector continues to stay unbalanced. Nevertheless, even with an rate of interest lower in March being unlikely, traders proceed to cost in a lower as early as Might 2024. Because of this, the inventory market continues to rise as earnings knowledge is usually effectively acquired.

In accordance with Bloomberg, any decline in inflation will likely be effectively acquired by inventory traders even when it’s at a decrease magnitude. In accordance with some analysts, for a unfavourable inventory response, inflation might want to learn 3.3% and above. If inflation does certainly decline to three.0% or beneath, traders will worth in a charge lower as early as March, or Might on the newest.

In accordance with Fibonacci ranges, if inflation does certainly decline and the USA100 is to rise, the longer-term goal will likely be $20,443 and the medium-term goal $18,935. In accordance with Elementary Analysts, a bullish pattern is feasible seeing that rates of interest are falling, and financial development continues.

On Friday, from the highest 20 most influential shares, solely 3 declined that means 85% of the “vital” shares rose in worth. The very best performing inventory from the “high 10” was NVIDIA which is approaching their earnings launch (21st February). Analysts count on NVIDIA’s earnings per share to rise from $4.02 to $4.53, which is doubtlessly why traders proceed to closely expose funds to the semiconductor. NVIDIA shares have risen 49% in 2024 alone and have change into the fifth most influential inventory.

Bitcoin’s Spot Change-Traded Funds Acquired an Extra $146 Million!

Bitcoin has been rising in worth for 5 consecutive days however is now near its earlier level of collapse. The upward worth motion is being pushed by the upper threat urge for food and the most recent Bitcoin ETFs. The market share of Bitcoin has risen 0.28% over the previous 24-hours though the whole cryptocurrency market capitalization has barely fallen. The worth this morning opened on a big worth hole and continues to primarily see purchase indicators to this point.

The market is supported by an inflow of funds from the lately launched Bitcoin ETFs, in addition to amid expectations of the subsequent halving, which is due in April. This week, BTC-based spot exchange-traded funds acquired a further $146 million in response to studies. Bitcoin has risen greater than 9% in 2024.

GBPJPY – Extra Unhealthy Information for the UK Economic system?

In accordance with analysts, the Japanese Yen is prone to rise in worth in opposition to most main forex pairs in 2024. Nevertheless, in opposition to the Pound the currencies proceed to weaken and obtain indicators in favour of the GBP. If the worth declines beneath 188.211, promote indicators are prone to materialize.

The worth of the Pound will likely be influenced by its upcoming employment knowledge, inflation charge and Gross Home Product. Analysts count on UK inflation to extend from 4% to 4.1% and for month-to-month GDP knowledge to indicate a decline of 0.2%. If the inflation charge reads decrease than 4.1% and GDP does certainly decline 0.2% or extra, the Pound might witness stress throughout the board.

The Yen however will not be prone to be influenced by any occasions in Japan, however as an alternative the Greenback. If the Greenback declines, the Yen might even see a rise in demand because the Greenback’s predominant competitor.

Michalis Efthymiou

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link