In investing, contemplating all out there components could be the distinction between a loss and a revenue. The September Impact is a kind of components that sits within the background noise of market indicators. Typically, notion performs a task in market dynamics as expectations feed again into investor motion. Whether or not actual or not, how does the “month to keep away from inventory” play out this time?

What’s the September Impact?

In the USA, the fiscal yr ends on September 30. That is the time for making ready monetary statements throughout the federal authorities and lots of organizations. In such a interval, traders restructure property to lock in tax losses and income, which can result in inventory liquidations. It could then be no accident that this era coincides with the perceived September impact, later adopted by the January impact.

As market anomalies, each results manifest as downturns with out obvious trigger that may be simply quantified. Being neither predictive nor constant, the September Impact is one other imprecise sign that asset underperformance could possibly be anticipated.

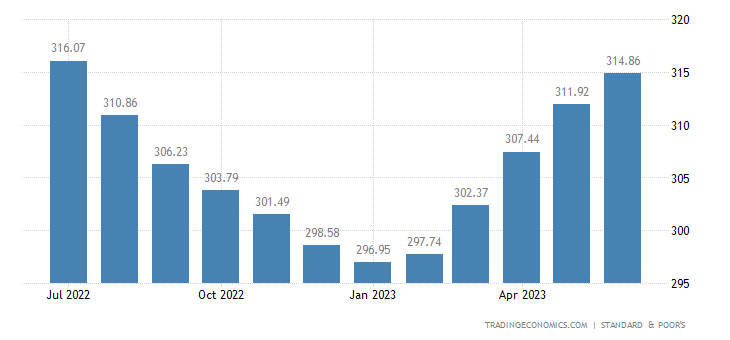

Jeremy Siegel of the Wharton College of Enterprise Administration tried to quantify the September Impact within the paper “September: A Month to Keep away from Shares”. The finance professor concluded that the dropped in 63 September’s from 1890 to 1994, solely to rise throughout 41 September’s.

Nevertheless, it can’t be conclusively acknowledged that September is the worst-performing month. Furthermore, in current many years, the perceived impact is additional waning in consistency. A lot in order that Siegel himself, in final Friday’s Behind the Markets podcast, is optimistic for this September.

Macro Elements that Defy September Expectations

In any other case referred to as the “Wizard of Wharton,” the retired professor cited a number of components for a bullish outlook. One of many indicators comes from resilient housing costs, that are definitely extra resilient than anticipated.

This may increasingly appear uncommon provided that mortgage charges surpassed 7%, however most housing market has charges locked in underneath 5%. In flip, homes are locked in, conserving the provision decrease than demand in the intervening time. Siegel believes traders are actually treating each shares and houses as inflation hedges.

Relating to the underlying dynamic between the Fed’s rates of interest and inflation, Siegel famous that the inflation price is now sufficiently low for the Fed to stay in standby mode.

“The probability that the Fed will elevate in September is now virtually nil, and in reality it places the November improve doubtful”

This probability will increase if the labor market continues to loosen up, a concurrent theme throughout all FOMC conferences because the mountain climbing cycle started in March 2022. Inflation can solely sustainably lower if individuals have much less cash to pay for items and providers.

“The labor market is especially robust, however it’s clearly out of stability, with demand for employees considerably exceeding the provision of obtainable employees.”

Jerome Powell on the annual Jackson Gap convention in August 2023

The newest JOLTS information for July reveals a drop of 338,000 job openings; this indicators the Fed to remain the course with out extra price hikes. This is able to sign to the market that capital won’t get much more costly.

Tweaked Knowledge Goes Towards September Impact

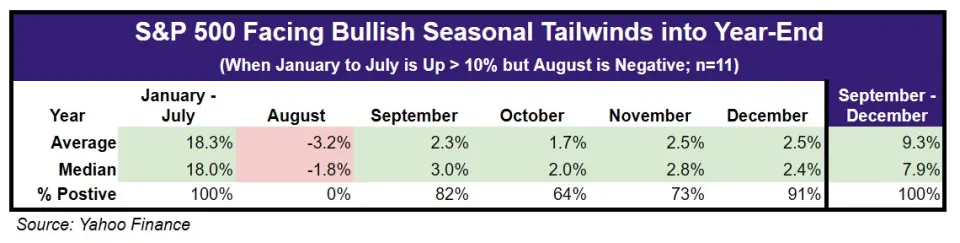

If the September Impact is taken as a right, what if the development considers this yr’s paradigm exactly? The inventory market went up till July, solely to weaken in August. Accounting for 11 such historic cases, September doesn’t look that totally different from different months.

Apple is but to shock the market with its AI providing, presently underneath works as Ajax generative AI. This can be introduced alongside the revealing of recent main Apple merchandise on September twelfth in Cupertino, California. Buyers anticipate these to be Apple Watch Sequence 9 and iPhone 15 Professional/Max. The sentiment will seemingly spill over sufficient to countervail September Impact expectations if the market reception is optimistic.