[ad_1]

Wall Road closed Thursday’s buying and selling session [Jan 18] with sharp positive aspects, following the publication of the most recent jobless claims knowledge, which revealed that demand for unemployment advantages within the nation fell to its lowest level since September 2022.

- US weekly preliminary jobless claims unexpectedly fell by -16,000 to a 16-month low of 187,000, indicating a stronger than anticipated labor market of 205,000.

- December new housing begins within the US fell -4.3% m/m to 1.460 million, stronger than expectations of 1.425 million. December constructing permits, which signify future building, rose +1.9% month-on-month to 1.495 million, stronger than expectations of 1.477 million.

- The US Fed’s January enterprise outlook survey in Philadelphia rose +2.2 to -10.6, weaker than expectations of -6.5.

Atlanta Fed President Bostic mentioned he wish to see extra proof, that inflation is on monitor in the direction of the Fed’s goal of two%, and he mentioned his view is that the primary price minimize will happen within the third quarter of this 12 months.

On the closing bell, the USA100 skyrocketed 1.47% and the USA500 jumped 0.88%. The perfect performing firm of each indices was Fastenal Firm whose shares elevated by 7.18%. The USA30 rose 0.54%, whereas Boeing Co rose 4.24% to guide the positive aspects within the Dow Jones Industrials after successful an order for 150 Max jets from India’s Akasa Air. Apple closed up over +3% main gainers within the Dow Jones Industrials, after Financial institution of America upgraded the inventory to purchase from impartial with a $225 value goal.

The USA100 recorded a brand new document excessive (17000.50). A rally in chip shares on Thursday pushed tech shares greater, after Taiwan Semiconductor Manufacturing Co, a serious provider to Apple and Nvidia, mentioned it expects a return to stable progress this quarter. Because of this KLA Corp, Utilized Supplies, ASML Holding NV, Lam Analysis and Qualcomm closed up greater than +4%. Moreover, NXP Semiconductors NV, Micron Expertise, Broadcom and GlobalFoundries closed up over +3%.

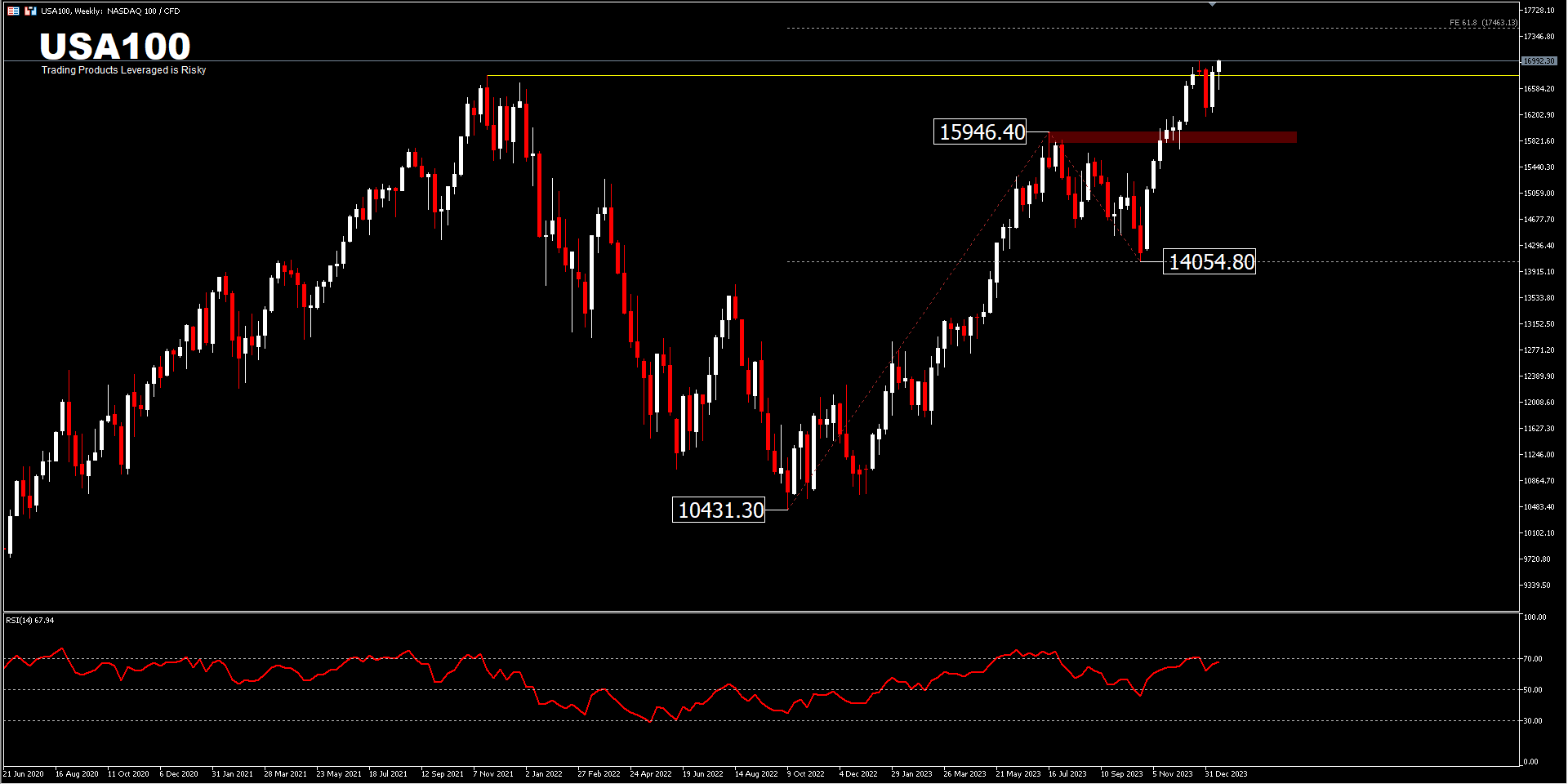

From a technical perspective, the USA100 recorded a brand new historic January 2024 document at 17000.50 in Thursday’s buying and selling [Jan 18] surpassing the document value of 16991.00 final December. Additional rally is but to be capped, however is projected for FE61.8percentFR at 17463 [from 10431.30-15946.40 and 14054.80 pullbacks]. Nevertheless, profit-taking can’t be dominated out going ahead. Interim assist is seen at 15946.40 to comprise future declines.

Inventory outperformance was supported by easing political dangers, after the Senate handed a unbroken decision that might fund the federal government via March and keep away from a shutdown on Saturday. This short-term measure will fund some US companies till March 1 and others till March 8. The Home is anticipated to vote on and go the invoice later at present.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link