EUR/USD ANALYSIS

- Fed > ECB final week contributing to euro weak point.

- Euro & US CPI the primary attraction this upcoming week.

- EUR/USD bears eager for draw back breakout.

Elevate your buying and selling expertise and acquire a aggressive edge. Get your arms on the Euro This autumn outlook in the present day for unique insights into key market catalysts that ought to be on each dealer’s radar.

Really helpful by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro has been largely impacted by central financial institution audio system final week with the Federal Reserve profitable the hawkish battle. Fed Chair Jerome Powell pushed again in opposition to dovish speak and left the door open for added rate of interest hikes if mandatory – a internet acquire for the US greenback over the course of the week.

Poor Chinese language financial information has not helped the euro with a seamless downward development negatively impacting an already fading manufacturing sector inside the area. Cash markets have consequently priced in roughly 85bps of cumulative fee cuts by December 2024 vs the Fed’s 75bps, thus taking part in into the arms of the buck by way of the carry commerce. The USD stays favorable due within the present surroundings via a relatively stronger economic system in addition to the continuing battle within the Center East that performs into its secure haven attract.

The week forward (see financial calendar under) is comparatively extra motion packed than final week with each euro space and US releases are scheduled all through the week. Focus will probably be geared toward US CPI and euro CPI respectively. Euro space headline inflation is predicted to drop sharply to 2.9% from 4.3% which may weigh negatively on the euro ought to this actualize.

ECONOMIC CALENDAR (GMT+02:00)

Supply: Refinitiv

Need to keep up to date with probably the most related buying and selling data? Join our bi-weekly e-newsletter and hold abreast of the newest market shifting occasions!

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

TECHNICAL ANALYSIS

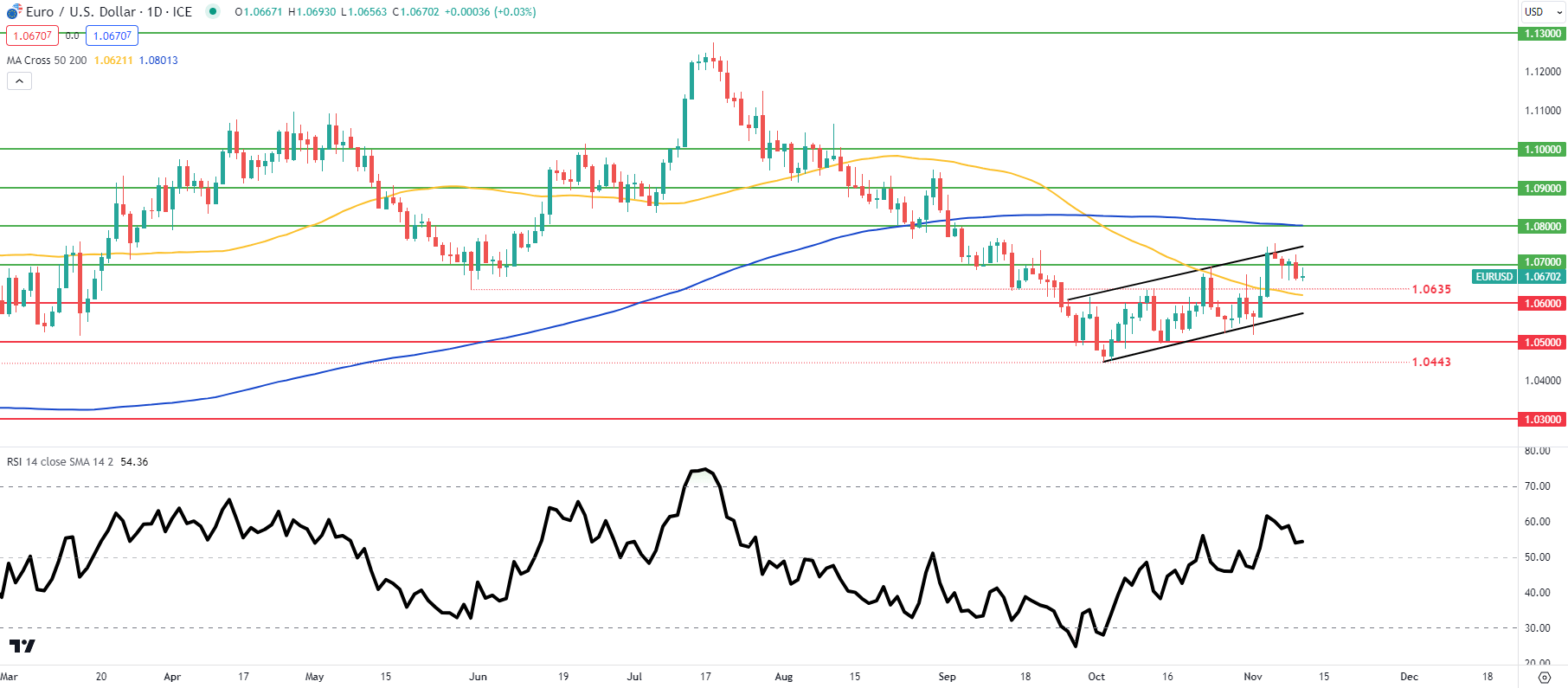

EUR/USD DAILY CHART

Chart ready by Warren Venketas, IG

The every day EUR/USD every day chart has as soon as once more did not breach bear flag resistance and stays sandwiched between the 200-day shifting common (blue) and 50-day shifting common (yellow). Wlthough the pair is presently above the midpoint stage of the Relative Power Index (RSI), the technical sample above suggests a bearish undertone ought to flag assist break.

Resistance ranges:

- 1.0800/200-day MA

- Flag resistance

- 1.0700

Assist ranges:

- 1.0635

- 50-day MA

- 1.0600

- Flag assist

- 1.0500

IG CLIENT SENTIMENT DATA: BEARISH

IGCS reveals retail merchants are presently neither NET LONG on EUR/USD, with 60% of merchants presently holding lengthy positions (as of this writing).

Obtain the newest sentiment information (under) to see how every day and weekly positional adjustments have an effect on EUR/USD sentiment and outlook.

Introduction to Technical Evaluation

Market Sentiment

Really helpful by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas