Most People battle with monetary literacy and lack entry to high quality funding instruments, whereas the monetary business reserves personalised steering for these with vital wealth. Regardless of many fintech apps getting into the market, on a regular basis People stay underserved when constructing long-term wealth by means of constant investing and sound monetary habits. Stash tackles this downside with its subscription-based platform that makes investing, banking, and monetary training accessible to everybody, no matter their place to begin. The corporate presents modern options just like the Inventory-Again® Card, which turns on a regular basis purchases into small possession stakes in corporations, and Good Portfolio, which gives professionally managed investments. These instruments have already helped tens of millions of People start their wealth-building journey. Their newly launched Cash Coach AI delivers personalised monetary steering that adapts to every consumer’s particular targets and challenges, successfully democratizing skilled recommendation beforehand accessible solely to the rich.

AlleyWatch sat down with Brandon Krieg, Cofounder and Co-CEO of Stash, to be taught extra concerning the enterprise, its future plans, and the corporate’s current funding Sequence H spherical, which brings the entire funding raised to $666M.

Who had been your buyers and the way a lot did you elevate?

We’ve simply closed an oversubscribed $146M Sequence H spherical, led by Goodwater Capital. What’s significantly significant is the continued confidence from our present buyers, together with New York’s Union Sq. Ventures, StepStone Group, Serengeti, and the College of Illinois Basis, together with funds and accounts suggested by T. Rowe Value Funding Administration, Inc. This spherical lets us broaden our personalised monetary steering powered by AI.

Please inform us concerning the services or products that Stash presents.

Stash is a private finance platform that makes investing and banking accessible to on a regular basis People. We imagine anybody could be an investor, not simply the rich. Our instruments assist individuals construct wealth over time, no matter their place to begin. In contrast to apps that concentrate on buying and selling and fast wins, Stash helps individuals construct wholesome cash habits for the long term.

With 1.3M paying subscribers and over $4B in belongings underneath administration, we’ve proven that our method works. Most of our clients (86%) are new to investing and by no means had personalised monetary assist earlier than. They keep on with us too – we maintain 79% of consumers with smaller accounts and as much as 87% of these with bigger balances. Our clients sometimes deposit about $45 weekly – small, common contributions that develop over time. We’re now money movement optimistic, which implies we’ve grown from startup to sustainable enterprise.

Our latest function, Cash Coach AI, provides personalised monetary steering that was beforehand solely accessible to rich individuals – now accessible to tens of millions of on a regular basis People who want it most.

You stepped away from Stash for a bit and just lately returned. Please inform us about that.

My cofounder Ed Robinson and I constructed Stash from scratch, rising it to serve tens of millions of consumers. After seven intense years, we each wanted to step again, get some perspective, and recharge. That break gave us actual readability on Stash’s subsequent chapter. Coming again as co-CEOs has been energizing. Issues have modified quite a bit – AI, private finance providers constructed into on a regular basis apps, and what shoppers anticipate at the moment have all created new prospects.

However the core downside stays that tens of millions of People nonetheless don’t have the steering, instruments, and confidence to construct monetary safety. The time away helped us see what wanted to alter, but additionally what elements of our tradition and mission we wanted to guard as we develop.

The monetary system nonetheless isn’t working for on a regular basis People. Too many individuals live paycheck to paycheck with out a security web. We got here again as a result of we imagine Stash is uniquely positioned to unravel this downside at scale. We’re now laser-focused on making good monetary selections easy and accessible for everybody. This implies constructing extra personalised steering that meets individuals the place they’re, simplifying our product expertise, and strengthening the foundations which have already helped tens of millions save and make investments for his or her futures.

How is Stash totally different?

Stash is constructed for individuals who need to make good monetary selections however don’t have the time, information, or confidence to go it alone. We don’t simply give individuals entry to investing—we provide training, automation, and real-time recommendation, multi function place, serving to individuals construct good habits, not simply open accounts.

First, our Inventory-Again® Card turns on a regular basis spending into small possession stakes within the corporations clients store with – you’re constructing wealth simply by shopping for groceries or espresso. Purchase bread at Kroger, get Kroger inventory. Seize one thing at Complete Meals, get Amazon inventory.

Second, we design every part with actual human psychology in thoughts. Our platform helps overcome the psychological blocks to good cash habits by means of automated saving, small-dollar investing, and well timed nudges.

Third, Cash Coach AI provides personalised cash recommendation by means of a easy dialog that adapts to every particular person’s state of affairs. This isn’t generic cash suggestions – it’s steering tailor-made to individuals’s particular targets and challenges. In actual fact, practically one in 4 clients have taken a step towards diversifying their portfolio, shopping for, or depositing after partaking with this product.

What market does Stash goal and the way large is it?

We’re targeted on the tens of tens of millions of People who’re neglected by conventional monetary establishments—on a regular basis individuals incomes between $50,000 and $150,000 a 12 months who need to make investments and save however really feel shut out or confused by conventional banks and investing corporations. This group has over ~$450B in cash they might make investments, but most monetary corporations ignore them.

What makes this market particular is that these individuals are of their prime working years however don’t manage to pay for saved to get consideration from conventional monetary advisors. They’re usually stretched skinny financially however have targets and desires – precisely the group that will get probably the most worth from our easy-to-use instruments, easy training, and personalised steering.

What’s what you are promoting mannequin?

We function a subscription-based mannequin that begins at simply $3/month. That pricing unlocks entry to a full suite of instruments, together with investing, banking, budgeting, and retirement planning. We additionally generate income by means of our debit card interchange, inventory rewards, and belongings underneath administration—however our focus is at all times on alignment with our clients. After they develop, we develop.

How has the corporate and business developed because the founding of Stash?

Since beginning Stash 10 years in the past, the dialog has shifted from “can I begin investing?” to “how do I do it effectively?” That’s the place instruments like Cash Coach AI are available – bridging entry with actionable recommendation. The fintech business has exploded with entry and automation, however too few corporations assist clients know what to do, when, and why. What units corporations aside is belief and the power to assist individuals construct actual monetary habits.

Perhaps most significantly, individuals are actually extra targeted on constructing wealth for the long term relatively than making fast income. As markets have turn out to be extra unpredictable and the financial system extra unsure, our regular, academic method has related much more strongly with clients on the lookout for monetary stability.

How are you getting ready for a possible financial slowdown?

Powerful financial instances truly make what we provide much more invaluable. When issues get tough, individuals want good monetary steering greater than ever, and our subscription mannequin provides us regular income even when markets are down.

We’ve constructed Stash to be resilient – holding wholesome money reserves, ensuring every buyer we usher in is worthwhile, and balancing development with being profitable. Our current funding provides us further power, so we are able to maintain bettering our product and bringing in new clients even when the financial system slows down.

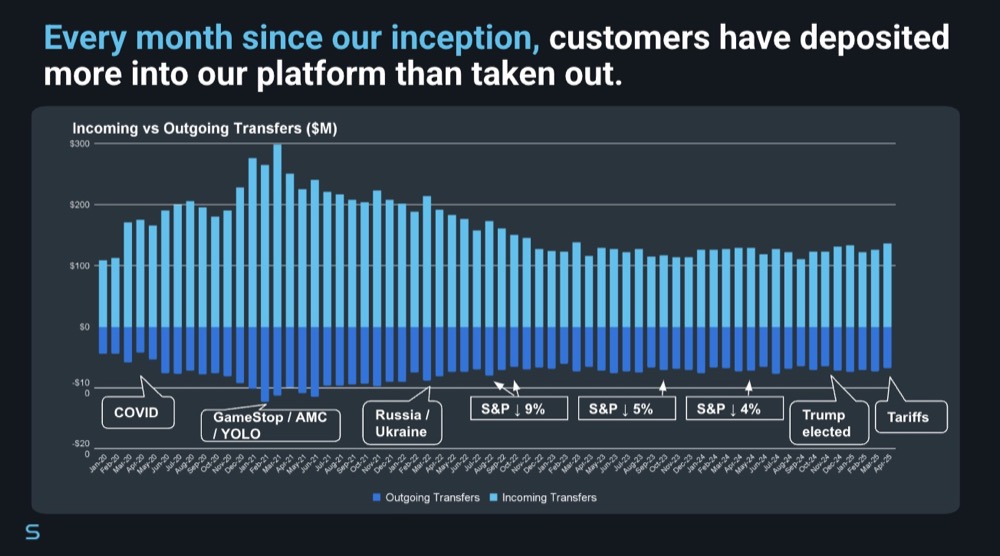

Most significantly, we’re specializing in giving extra worth to our present clients to maintain them engaged. Our information exhibits that in previous market downturns, our clients proceed to repeatedly deposit and make investments, as we’ve each month since our inception with web inflows (extra inflows on the platform than outflows from the platform, even throughout down markets).

What are the milestones you intend to attain within the subsequent six months?

Over the following six months, we’re targeted on two major targets:

First, we’re investing extra in Cash Coach AI and increasing its capabilities, with new options that make it simpler to entry recommendation resembling diversification suggestions and funding picks tailor-made to your pursuits.

Second, we’re increasing our Inventory Rewards program – which supplies clients precise shares of inventory as an alternative of conventional money again once they store at collaborating corporations. For instance, once you purchase one thing from a retailer, you’ll earn fractional shares in that firm’s inventory relatively than money again factors.

What recommendation are you able to supply corporations in New York that would not have a contemporary injection of capital within the financial institution?

As somebody who’s constructed an organization by means of each good and hard instances in New York, my recommendation focuses on utilizing what makes this metropolis particular whereas being good with cash.

First, take a tough take a look at your unit economics. If these numbers don’t work, repair that earlier than the rest relatively than hoping extra capital will clear up the issue. Second, faucet into New York’s unimaginable expertise pool. Town’s mixture of abilities and backgrounds is unimaginable – from finance specialists to inventive thinkers to tech innovators – letting you construct groups of downside solvers. Third, maintain your present clients and your group. We ensure that our group understands our place and feels safe, whereas additionally guaranteeing our clients obtain as a lot worth as potential from us. A motivated group delivers higher service, and happy clients turn out to be your strongest entrepreneurs. Lastly, this can be a time to sharpen your story for buyers. New York VCs respect corporations that may develop effectively. Between funding rounds, we constructed clear dashboards displaying our bettering economics, which turned highly effective instruments once we went again to lift extra money.

What’s your favourite spring vacation spot in and across the metropolis?

Stone Avenue! It’s common, however each time I’m there it’s like discovering a secret European hangout proper in the midst of the Monetary District.