[ad_1]

Updated on April 27th, 2022 by Quinn Mohammed

For investors seeking yield, the real estate industry is a great place to look. Intuitively, this is not surprising. Real estate owners collect predictable income from their tenants. Thus, the real estate business is qualitatively geared for business owners that want to collect periodic income.

One of the best ways for investors to gain exposure to the real estate industry is through Real estate Investment Trusts – or REITs, for short.

STAG Industrial (STAG) is a commercial REIT that focuses on leasing single-tenant industrial properties throughout the US. The stock’s current dividend yield of 3.6% is more than 2x the average yield in the S&P 500.

Further, STAG Industrial pays monthly dividends (rather than quarterly). This is highly beneficial for retirees and other investors who rely on their dividend income to cover life’s expenses. There are currently 51 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Because of the high yield and its monthly dividend payments, STAG Industrial has the potential to be a great investment for income investors, particularly since the company has a long runway of growth up ahead.

Business Overview

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has ~544 buildings across 40 states in the United States. The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant.

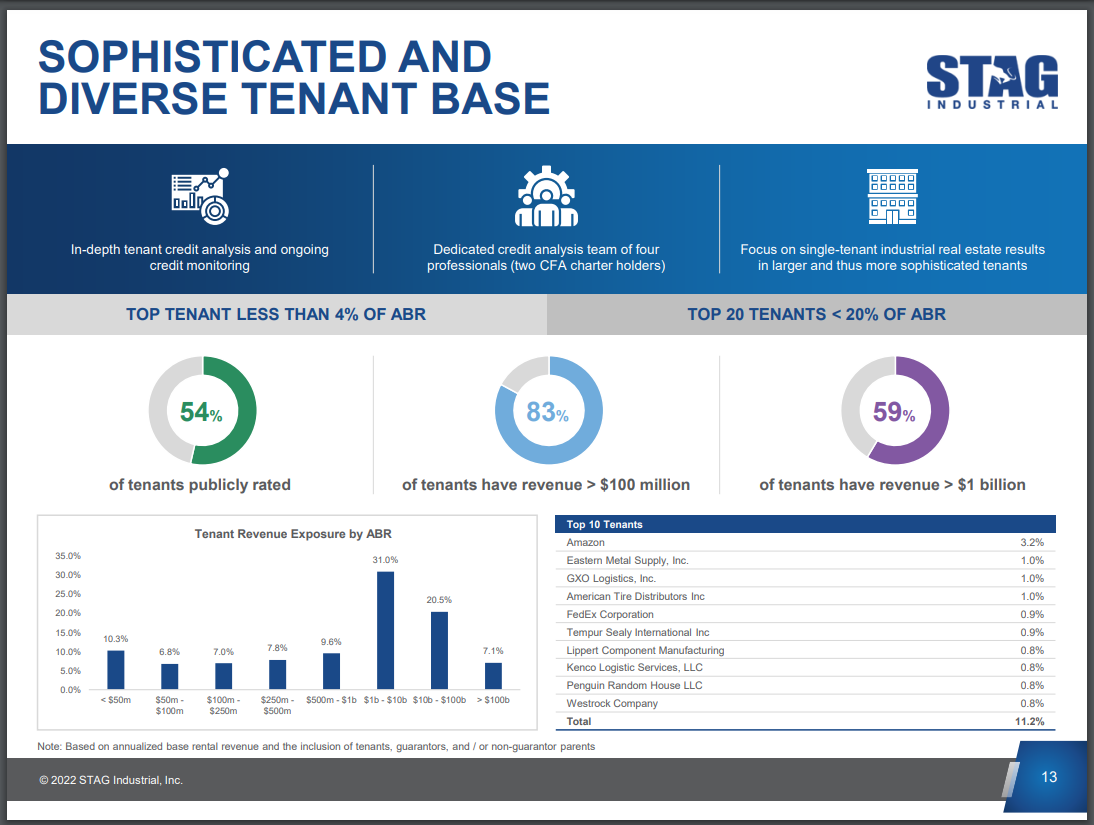

However, STAG Industrial executes a deep quantitative and qualitative analysis on its tenants. As a result, it has incurred credit losses that have been less than 0.1% of its revenues since its IPO. As per the latest data, 54% of the tenants are publicly rated and 54% of the tenants generate over $1 billion in revenue. The company typically does business with established tenants to reduce risk.

STAG has an added advantage due to the company’s exposure to e-commerce properties, which gives it access to a key growth segment in real estate.

Source: Investor Presentation

STAG Industrial is facing a headwind due to the pandemic. However, the effect of the pandemic on the REIT has been limited so far thanks to the high credit profile of its tenants. The REIT collected approximately 99% of its base rental billings in 2021.

Some REITs view single-tenant properties as risky because the properties are viewed as a binary proposition; they are either fully leased or empty. However, focusing on single-tenant properties creates mispriced assets, which STAG can then add to their portfolio at attractive valuations. This is central to STAG’s strategy and is a key differentiator among competitors. In addition, STAG sees a continued rise in e-commerce as a percentage of retail sales as central to its strategy, as seen below.

STAG’s addressable market is in excess of $1 trillion, a significant portion of which is made up of single tenant properties. The sector is highly fragmented, meaning that no particular entity would have a significant scale advantage. This is why STAG believes it can purchase mispriced assets.

STAG finds this to be an attractive mix of assets and combined with relatively low capex and high retention rates, it has created a strong portfolio of industrial real estate.

STAG’s tenant profile reflects the vast diversification it has built into its portfolio, which the trust believes diversifies away much of the risk of owning single tenant properties. STAG has done a nice job of taking a relatively risky sector of real estate – single tenant properties – and building a portfolio in such a way that it diversifies away much of that risk.

Growth Prospects

STAG Industrial’s growth since its IPO in 2011 has been impressive from both a fundamental and an investor return perspective. Fortunately, this real estate trust still has a strong growth runway.

In mid-February, STAG Industrial reported (2/16/22) financial results for the fourth quarter of fiscal 2021. Core FFO grew 19% over the prior year’s quarter thanks to the sustained strength of the REIT’s tenants and material hikes in rent rates. Core FFO per share grew at a slower rate (4%), from $0.49 to $0.51, due to the issuance of new units.

Net operating income grew 14% over the prior year’s quarter and the occupancy rate improved, from 95.9% to 96.9%. STAG Industrial is facing a headwind due to the pandemic. However, the effect of the pandemic on the REIT has been limited so far thanks to the high credit profile of its tenants. It is exceptional that the REIT has collected approximately 99% of its rental income in the last four quarters.

The trust continues to invest heavily in new properties as it expands its portfolio, and much of that financing is done with new common stock. We expect the trust will continue to issue new shares for the foreseeable future to expand its portfolio.

We believe STAG will likely continue to grow at a similar mid-single-digit rate. Indeed, we forecast 5% annual FFO-per-share growth in the next five years. The trust still has a very small market share in its target market of real estate assets, leaving plenty of room for expansion.

Source: Investor Presentation

STAG has a highly-diversified tenant base with nearly the entire portfolio comprised of tenants with at least $100 million in annual revenue. Further, the trust has very little exposure to any particular industry or tenant. Diversification will help shelter the trust from the impacts of the next economic downturn.

The market dynamics of the sector are favorable as well and have improved meaningfully in recent years.

With continued adoption of digital selling channels from retailers, we expect these metrics to continue to move higher for the industry, and indeed STAG specifically. This will help support its growth in the years to come.

Dividend Analysis

STAG’s dividend is obviously very important, as investors generally own REITs for their payouts. STAG’s payout has grown every year since its IPO and stands today at $1.46 per share. However, growth since 2015 has been very slight, as the payout was $1.36 in that year, and has grown by just $0.10 in the years since.

We do not see material growth in the dividend moving forward, but STAG’s payout ratio, which currently stands at 66% of FFO-per-share, is quite safe. We think STAG will produce very small increases for the foreseeable future, so that it does not end up in a tight spot like it has in the earlier half of the trailing decade.

The current payout ratio is down significantly from previous levels near 100% as STAG has made a concerted effort to reduce the vulnerability of its dividend. That effort is still underway, however, so we see meaningful payout growth as unlikely in the near-term.

The current payout ratio, combined with what we see as mid-single-digit FFO-per-share growth in the coming years, should gradually improve the safety of STAG’s dividend. The trust has also made divestitures when pricing is favorable, an option it could turn to temporarily cover dividend shortfalls. In short, we think the 3.6% yield is fairly safe at this point.

Final Thoughts

STAG Industrial has two characteristics that will immediately appeal to income investors: a 3.6% dividend yield and regular monthly dividend payments. While the REIT’s yield is attractive, the share price appears to be slightly overvalued according to our fair value estimate.

We like the trust’s strategy for long-term growth in a sector of real estate that is sometimes ignored by investors because of its perceived riskiness. Thus, STAG Industrial makes a good potential addition to a high-yield portfolio because of its high dividend yield, monthly dividend payments, and leadership in the single-tenant industrial real estate market. However, the overvaluation in the share price today reduces overall expected returns and reduces the attractiveness of the stock.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

[ad_2]

Source link