- The S&P 500 and Nasdaq noticed sharp losses two weeks in the past, adopted by their greatest weekly performances of the yr final week.

- Key indicators like Bitcoin’s restoration, surging Treasury bonds, and report highs in gold counsel a powerful bullish market, with the Fed getting ready to chop charges.

- With disinflation and potential Fed charge cuts forward, resilient macroeconomic situations are anticipated to maintain the bullish market by potential corrections.

We have really been on a curler coaster these previous two weeks:

- Two weeks in the past: The had its worst week since March 2023, whereas the posted its worst since June 2022.

- Final week: The S&P 500’s greatest week of the yr, up 4% with day by day positive factors throughout all periods, and the Nasdaq additionally had its greatest, rising 6%.

Moreover, the had its second-highest day by day shut ever, is making a comeback, Treasury bonds are surging, is reaching all-time highs, and the is getting ready to .

What do these indicators inform us concerning the strenght of the present long-term bull market?

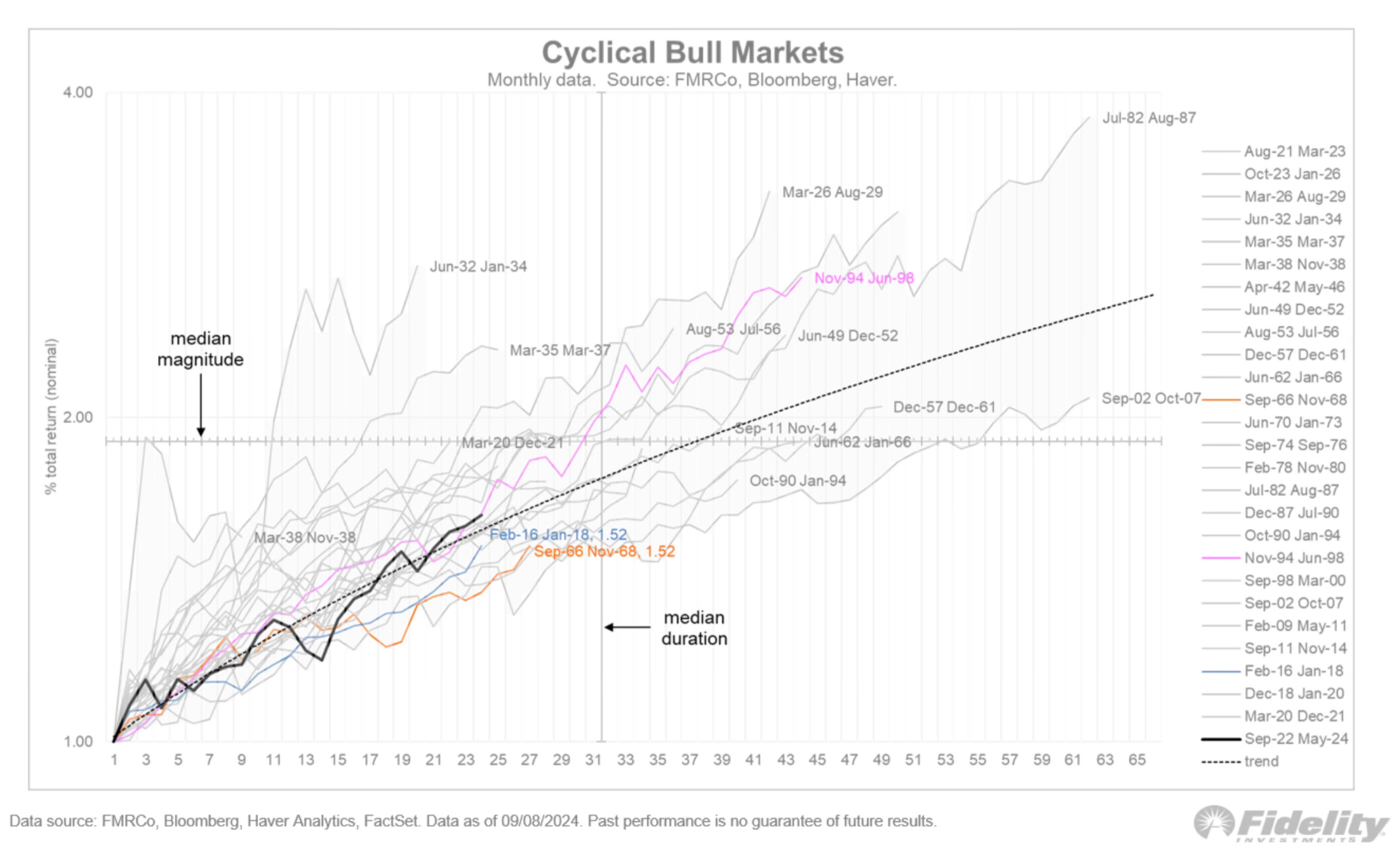

At the moment, the length of this bullish market (21 months) matches the shortest on report, with the final one ending in January 2022. Nevertheless, the typical size of a bullish market is 33 months, suggesting this cycle might lengthen till Could 2025.

Traditionally, below related situations, the typical achieve throughout a bullish market is 63.6%, which might put the S&P 500 at 5,852 factors.

The chart above exhibits precisely the place we stand inside a typical bullish cycle. After 21 months, it would not appear “previous” sufficient for me to consider it is over. Fortuitously, these developments should not shock anybody (I hope).

Moreover, I anticipate present situations to persist: resilient, dynamic macroeconomic knowledge driving the bullish pattern, alongside a disinflationary atmosphere and robust earnings development.

This could help a sustained upward motion. In fact, inside this atmosphere, asset costs will face corrections. We have simply skilled one, and it seems the indexes are as soon as once more heading for brand new highs, as seen in latest quarters.

With that in thoughts, beneath are two key knowledge factors to keep watch over proper now for assessing the inventory market’s energy.

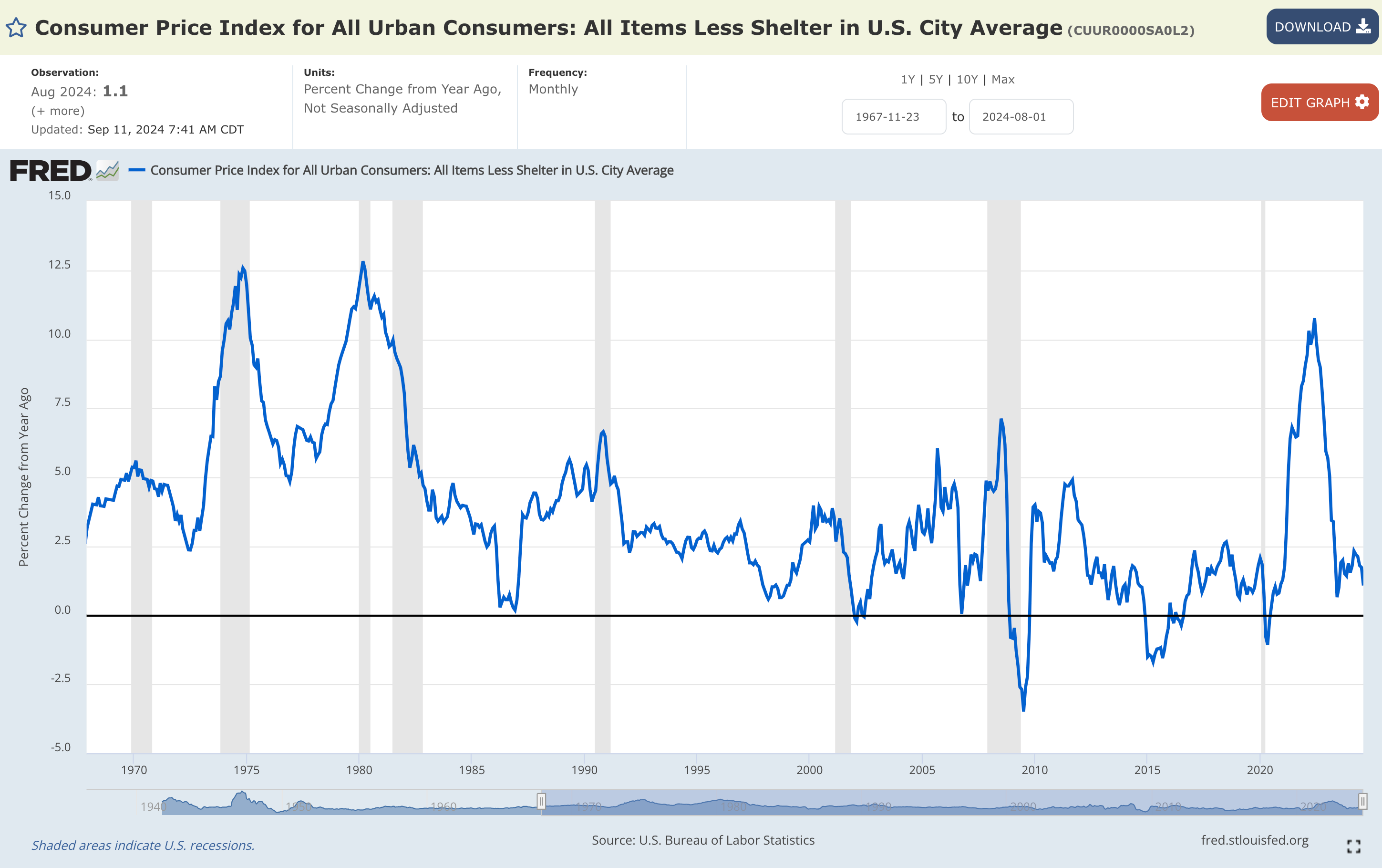

1. CPI ex-Shelter inflation was +1.07% yr/yr as of August 2024

These figures present clear disinflation, slowing from +1.73% year-over-year in July 2024.

Furthermore, the chart highlights how the combination non-Shelter inflation charge is nicely beneath the Fed’s 2% goal, which is essential given it’s the biggest and most lagging part of the CPI basket.

That is not solely beneath the Fed’s goal but in addition decrease than the historic vary from over 50 years in the past.

2. Relationship between the yield on 6-month Treasury bonds and Fed Funds

The chart exhibits the probability of Fed charge cuts totaling round 100 foundation factors over the following six months.

The unfold between the 6-month yield and Fed Funds, at present round -0.7%, might maintain regular after the upcoming 0.25% minimize, signaling that an extra 0.7% discount could observe within the subsequent six months. Altogether, this factors to a possible charge minimize of about 1.0% over the following semester.

In conclusion, these indicators might show the following bullish catalyst if macroeconomic situations stay resilient.

“This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or advice to speculate as such it isn’t meant to incentivize the acquisition of belongings in any approach. I want to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding choice and the related danger stays with the investor.”