Inventory costs stay very risky, because the Ukraine battle retains dominating headlines. Will the market reverse its downtrend?

The gained 2.57% on Wednesday, Mar. 9, because it retraced a number of the latest decline. The broad inventory market’s gauge acquired again to the 4,300 stage after bouncing from its Tuesday’s low of 4,157.87. On Feb. 24 the index fell to the native low of 4,114.65 and it was 704 factors or 14.6% under the January 4 document excessive of 4,818.62. There’s nonetheless lots of uncertainty regarding the ongoing Ukraine battle.

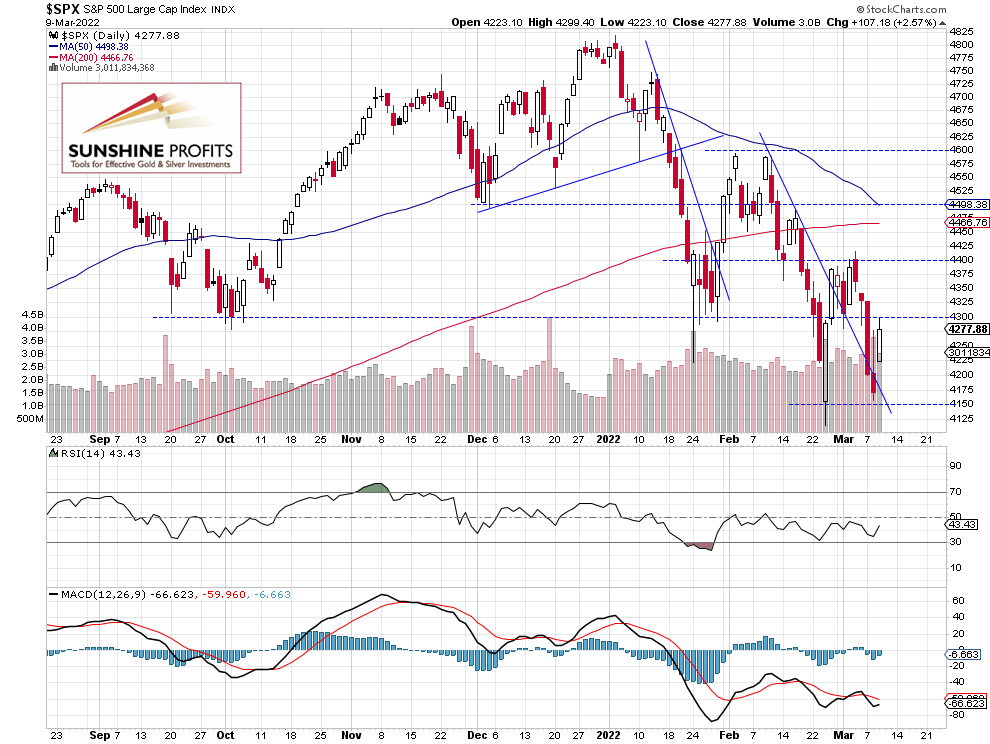

The closest necessary resistance stage is now at 4,300, and the subsequent resistance stage is at 4,350-4,400, amongst others. However, the help stage stays at 4,150-4,200. The S&P 500 index continues to commerce above the not too long ago damaged downward pattern line, as we will see on the every day chart (chart by courtesy of http://stockcharts.com):

Futures Contract – Extra Consolidation

Let’s check out the hourly chart of the contract. Not too long ago it broke under the short-term consolidation. On Tuesday it fell to round 4,150, earlier than bouncing again to the 4,200-4,250 stage.

We’re nonetheless sustaining our lengthy place, as we predict an upward correction from the present ranges (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index bounced yesterday, however this morning it’s anticipated to open decrease. We are going to doubtless see some extra news-driven volatility. For now, it appears like an upward correction however it might even be a extra significant upward reversal.

Right here’s the breakdown:

- The S&P 500 index retraced a number of the latest decline, however we might even see extra volatility.

- We’re sustaining our lengthy place.

- We predict an upward correction from the present ranges.

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or injury because of reliance on the data together with information, quotes, charts and purchase/promote alerts contained inside this web site. Please be totally knowledgeable relating to the dangers and prices related to buying and selling the monetary markets, it is likely one of the riskiest funding types potential.