After blasting via 20-day and 50-day shifting averages with little fanfare, the , , and () all completed with topping doji.

This opens up the chance for gaps down right now amid bearish “night star” candlestick formations.

Nevertheless, the S&P 500 retains knocking on the door to interrupt via and problem all-time highs. Supporting technicals are web bullish and the index has finished properly to reclaim prior losses.

As a reminder, triple tops are uncommon, so when markets return to resistance (or help) for a 3rd time, then the almost definitely final result is a breakout.

We are going to need to see a pick-up in quantity on such a transfer. Ought to this index ship will probably be an vital marker for different indexes.

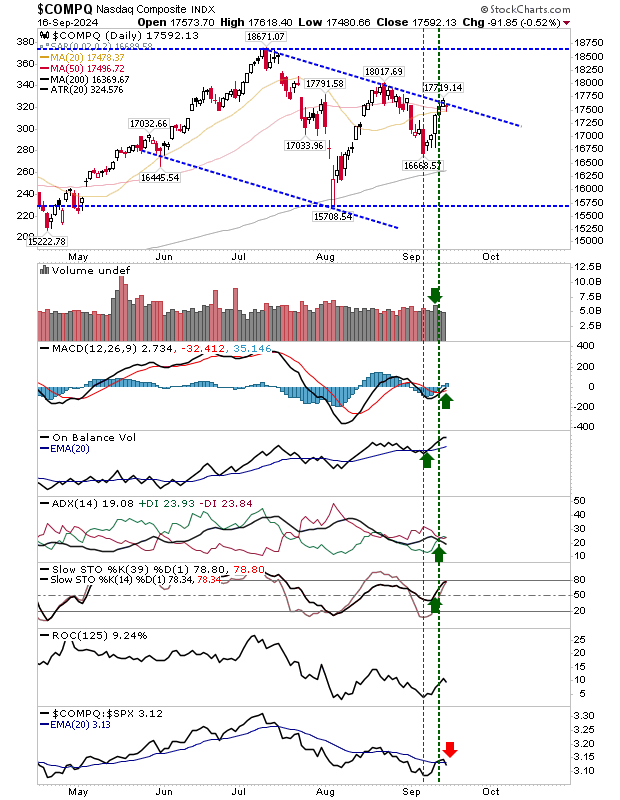

The Nasdaq is trying essentially the most bearish of those indexes because it stalls out at channel resistance. Its 20-day and 50-day MAs are additionally close by, and the tight motion of the previous couple of days has left the index clinging to this shifting common help.

Technicals are web constructive, opening up for a breakout within the downward channel and a problem of July highs, however worth motion is vital.

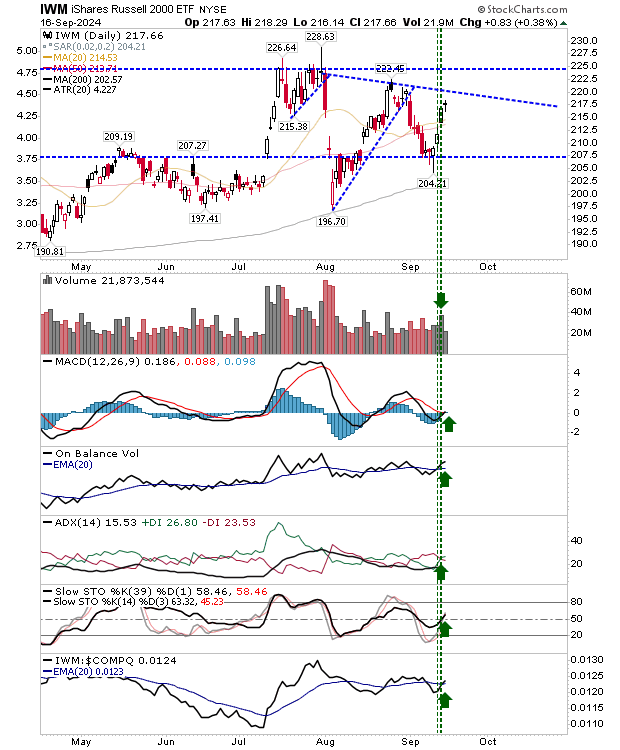

The index that gives shorts the most effective alternative is the Russell 2000 ($IWM). It has tapped out earlier than it managed to achieve resistance. And its bullish flip in technicals remains to be weak to whipsaw, though it is vital to notice, all technicals are bullish.

The index can be working in direction of a relative outperformance in opposition to the Nasdaq, so whereas issues look weak for the close to time period, it may very well be establishing for a management position quickly.

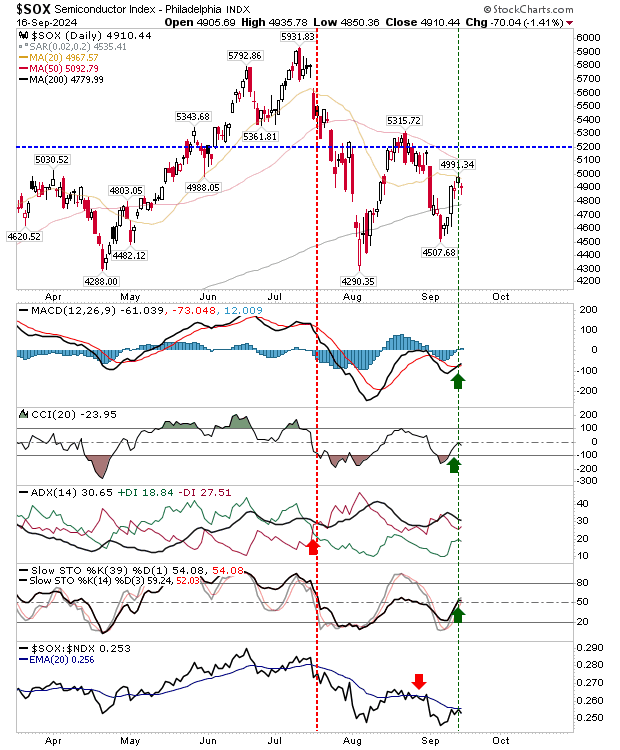

The place bulls do have to be cautious is the . It hasn’t delivered the restoration of the Nasdaq and is struggling to carry on to its 200-day MA with an overhead squeeze from the 20-day and 50-day MAs. If there’s to be a bearish reversal – and what we’re seeing in lead indexes is fake – then that is the index to steer issues decrease.

We now have a story of two cities. Bulls can look to the S&P 500 to play the position of leadout and convey the Nasdaq and Russell 2000 together with it. Bears can observe the struggles in Semiconductors, that would contribute to a reversal off channel resistance within the Nasdaq and see promoting aggression return to the Russell 2000.