[ad_1]

Indices Speaking Factors:

- US equities put in a pullback this morning with the S&P 500 discovering assist on the 200-day transferring common. The Nasdaq is holding trendline resistance with the subsequent important spot of resistance on the 200-day transferring common. And the bullish pattern within the Dow that led the best way increased in This fall stays on its again foot, with the 200 dma as a key invalidation stage for bulls.

- The S&P and Nasdaq have each put in indicators of energy currently, however we’re stepping into the thick of earnings season now and this afternoon brings Tesla’s quarterly earnings announcement, which can assist to maintain tech very a lot within the highlight.

- The evaluation contained in article depends on value motion and chart formations. To be taught extra about value motion or chart patterns, take a look at our DailyFX Schooling part.

Advisable by James Stanley

Get Your Free Equities Forecast

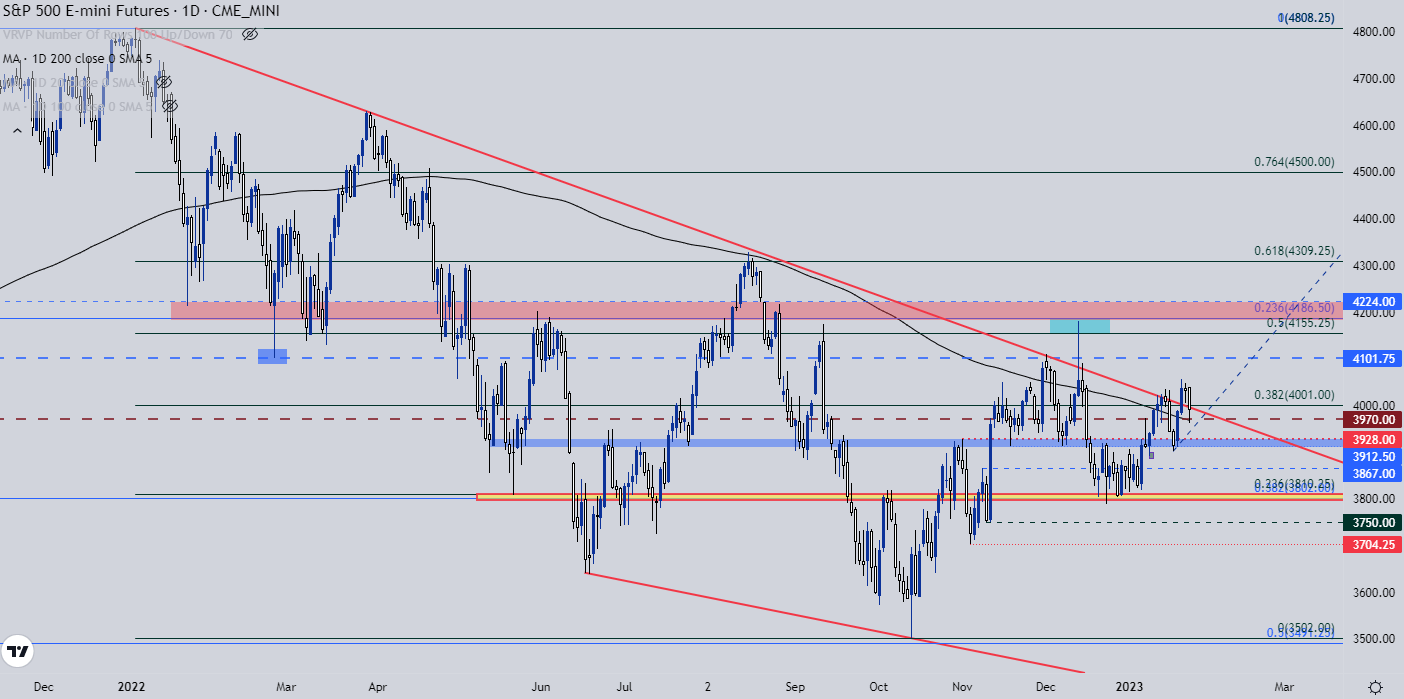

The S&P 500 began this week by pushing as much as a recent month-to-month excessive on Monday however, since then, bulls haven’t been in a position to do a lot. Yesterday’s each day candle in S&P 500 futures printed as a doji and an inside bar and in early commerce this morning, costs have continued to tug again, with assist exhibiting round a well-recognized spot at 3970.

At difficulty within the S&P 500 proper now could be the 200 day transferring common, which is confluent with that spot of prior resistance-turned-support on the 3970 stage. That has thus far helped to carry the lows right this moment and after the higher-high on Monday, this retains short-term bullish pattern qualities.

S&P 500 4-Hour Value Chart

Chart ready by James Stanley; S&P 500 on Tradingview

Longer-Time period

On a longer-term foundation there’s appreciable resistance sitting overhead, and bulls could have their work lower out for them if they’ll push up for one more re-test of the 4100 stage. Nonetheless, the short-term extension of higher-highs and lows retains bulls within the driver’s seat for now, and the 3912-3928 zone that helped to carry final week’s lows turns into an space of curiosity for these seeking to gauge when/if bulls is likely to be shedding management of the matter. Beneath that zone, 3867 is of word, after which the identical 3802-3810 zone that held the lows into the yearly open comes again into view.

Advisable by James Stanley

Enhance your buying and selling with IG Shopper Sentiment Information

S&P 500 Day by day Value Chart

Chart ready by James Stanley; S&P 500 on Tradingview

Nasdaq

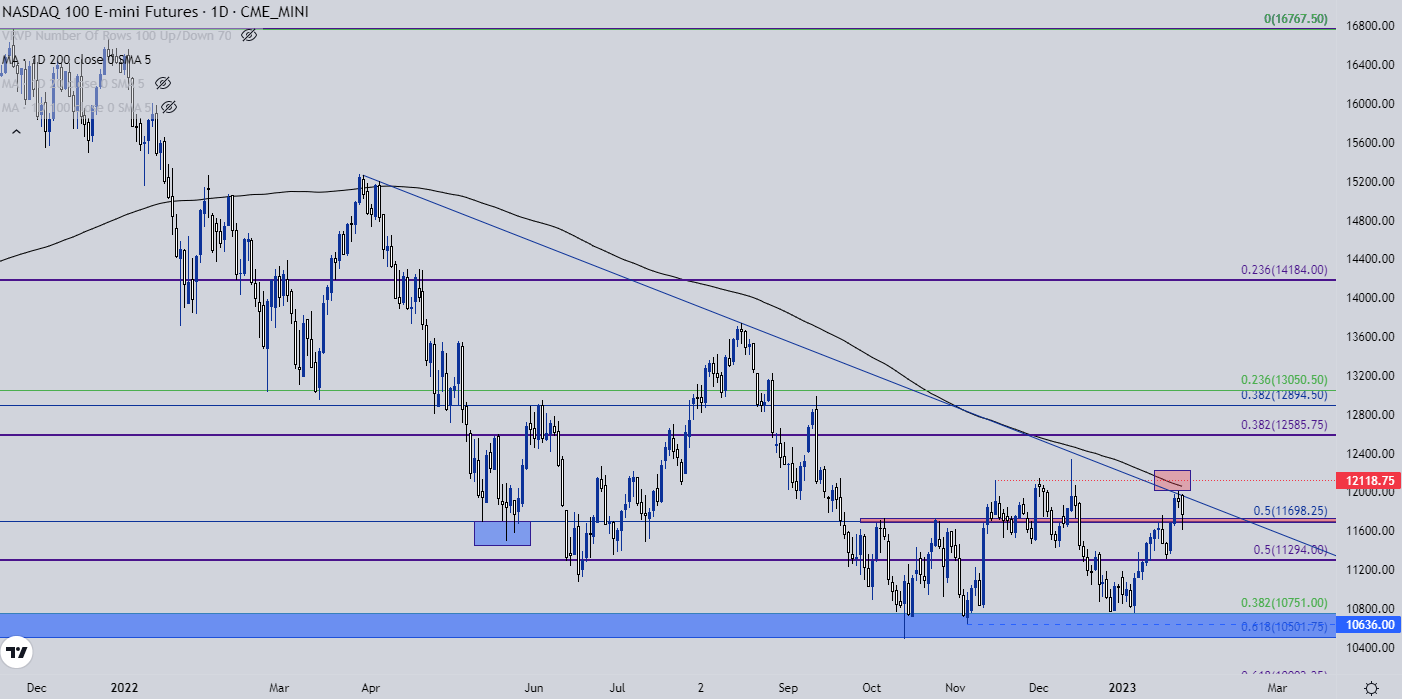

The Nasdaq is exhibiting a really related setup because the S&P 500 above, with a breakout to a month-to-month excessive on Monday main into indecision yesterday, which was adopted by a bearish push this morning.

This units up the potential of a night star formation however that’s contingent on sellers holding right this moment’s transfer and, at this level, there’s some bounce exhibiting from the acquainted Fibonacci stage at 11,700.

Resistance at this level is exhibiting from a trendline taken from final March/April and August highs, which got here into play to carry the highs once more yesterday. We’re getting some essential tech earnings bulletins over the subsequent couple of days, and this could very a lot hold the Nasdaq within the highlight.

Subsequent resistance sitting overhead is on the 200-day transferring common which is confluent with the latest group of value swings within the 12,118 space. For assist, the 11,700 stage is in-play right this moment and beneath that, the subsequent main stage is the 11,294 spot.

Advisable by James Stanley

Constructing Confidence in Buying and selling

Nasdaq 100 Day by day Value Chart

Chart ready by James Stanley; Nasdaq 100 on Tradingview

Dow Jones

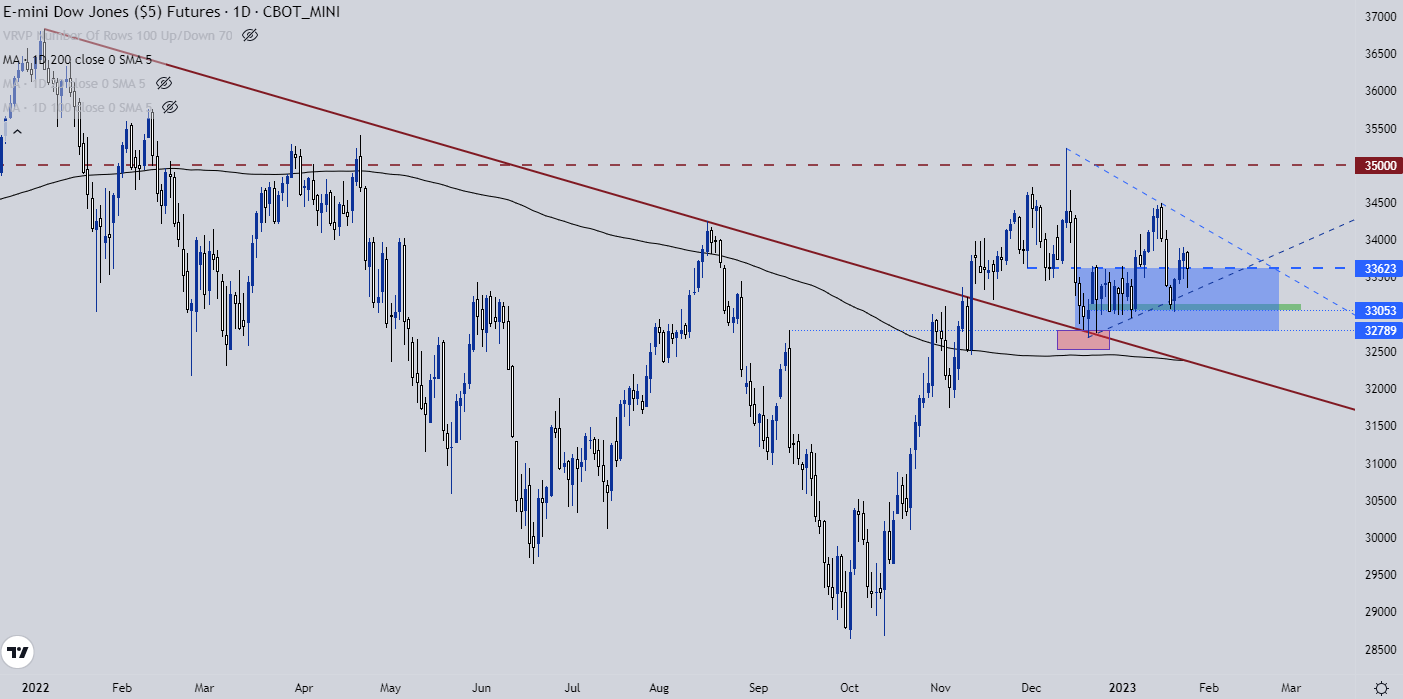

Notably, whereas each the S&P and Nasdaq set recent month-to-month highs yesterday, the Dow didn’t. After all, we’re in earnings season and the index accommodates solely 30 corporations so it’s probably that there’s been some damaging pull given a decrease diversification profile within the index versus the Nasdaq (with 100 corporations) or the S&P 500 (with 500).

However, one of many key causes for specializing in charts and knowledge is to modulate the anecdotes, and the truth that the Dow very a lot led the way-higher when shares have been rallying in This fall and is now on its backfoot is notable, and even perhaps an indication of a doable shift as earnings takes a heavier function in US fairness value motion.

From the each day chart beneath, we are able to see a symmetrical triangle exhibiting up with each higher-lows and lower-highs over the previous month-and-change. Value may be very close to the mid-line of that formation in the intervening time, which is a spot of support-turned-resistance-turned-support once more, plotted at 33623.

Topside resistance is at 34,500, after which the 35k psychological stage comes into play. Help plots at 33,053, with 32,789 slightly below that and if sellers can evoke a push beneath that stage, the 200 day transferring common comes into the image as the subsequent main impediment, presently plotted across the 32,500 space.

Dow Jones Day by day Value Chart

Chart ready by James Stanley; Dow Jones on Tradingview

— Written by James Stanley

Contact and comply with James on Twitter: @JStanleyFX

[ad_2]

Source link