I need to say that writing today is an actual problem, and yesterday was a type of days, largely as a result of it was simply extra of the identical with the troubling three persevering with to steer the cost.

There’s simply nothing else to say there.

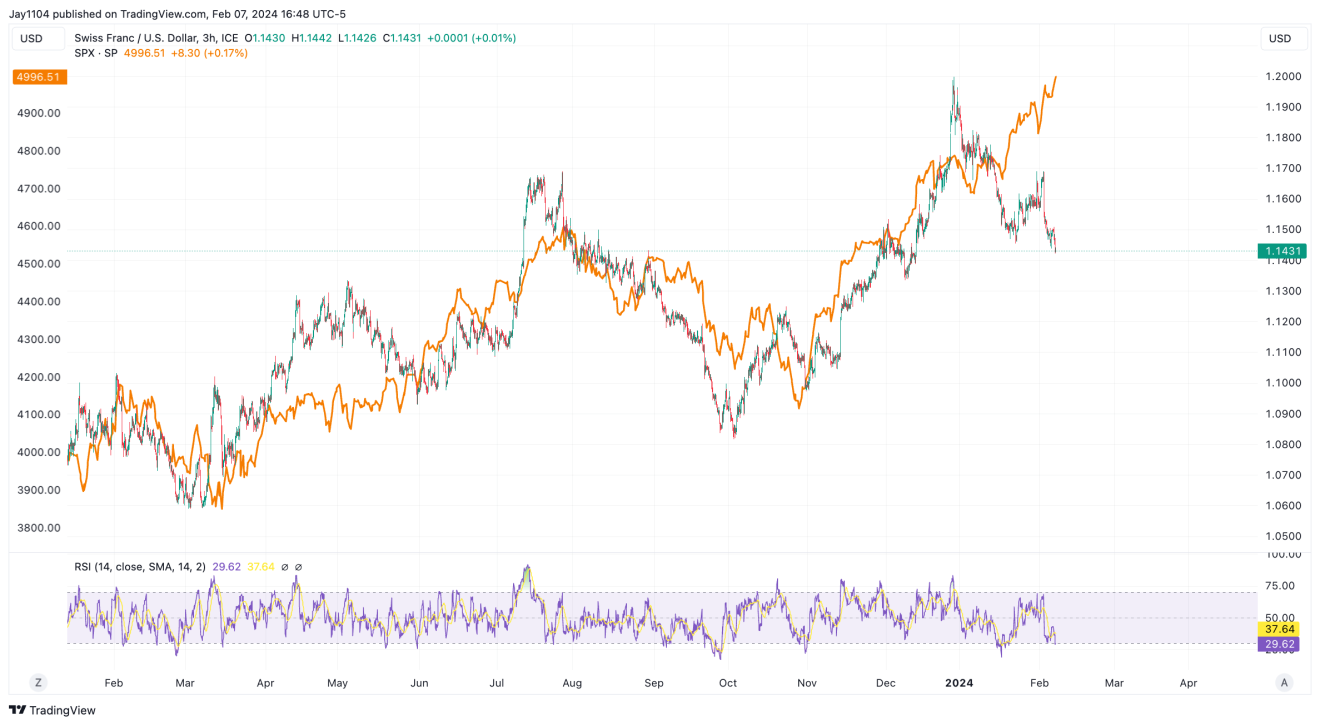

Is it a rising wedge that’s forming within the ? It seems like one. Does it imply something? Undecided.

The definition of a rising wedge is a bearish sample that begins large on the backside and contracts because it strikes greater. So, it matches that definition.

On high of that, we now have divergences in every single place, most notably within the . It has actually been the case when wanting on the inverse of the .

The inverse of the 1-month implied correlation index can be getting into the wrong way of the S&P 500.

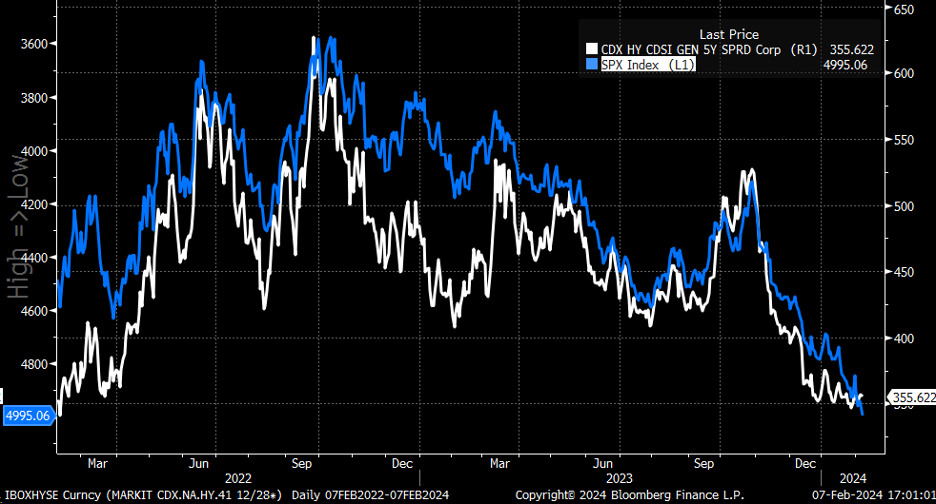

In the meantime, there was a divergence between the S&P 500 and junk bond ETF.

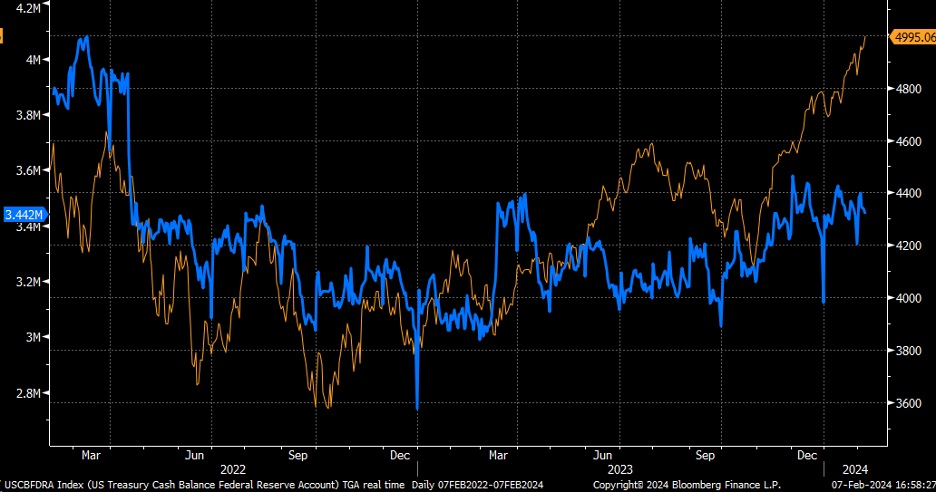

There was a time when reserve balances even mattered, and up to now, these have stopped going greater as properly.

Monetary situations have even stopped easing.

Even the variety of shares above their 50-day shifting common has been diverging.

So, except the fairness market has discovered a solution to decouple itself from charges, the greenback, monetary situations, and every part else, the madness of the final 4 months ought to be about over. I’ve nothing left so as to add.

YouTube Video –

Unique Publish