In our earlier from late October, we discovered for the (SPX) utilizing the Elliott Wave Precept (EWP) that:

“if the index holds above the early October low [of SPX5674], our purple warning stage for the Bulls, we are able to permit it to observe a extra direct path to nearly SPX6500. Nonetheless, a break beneath final week’s low [of SPX5762] can set off the choice choice, which has the index revisit SP5600+/-50 first earlier than rallying once more.”

The index broke beneath the SPX5762 low three days after writing however held above the early October low because it bottomed out on November 4 at SPX5696. From there, it staged a robust rally, primarily after the US Presidential Election final result.

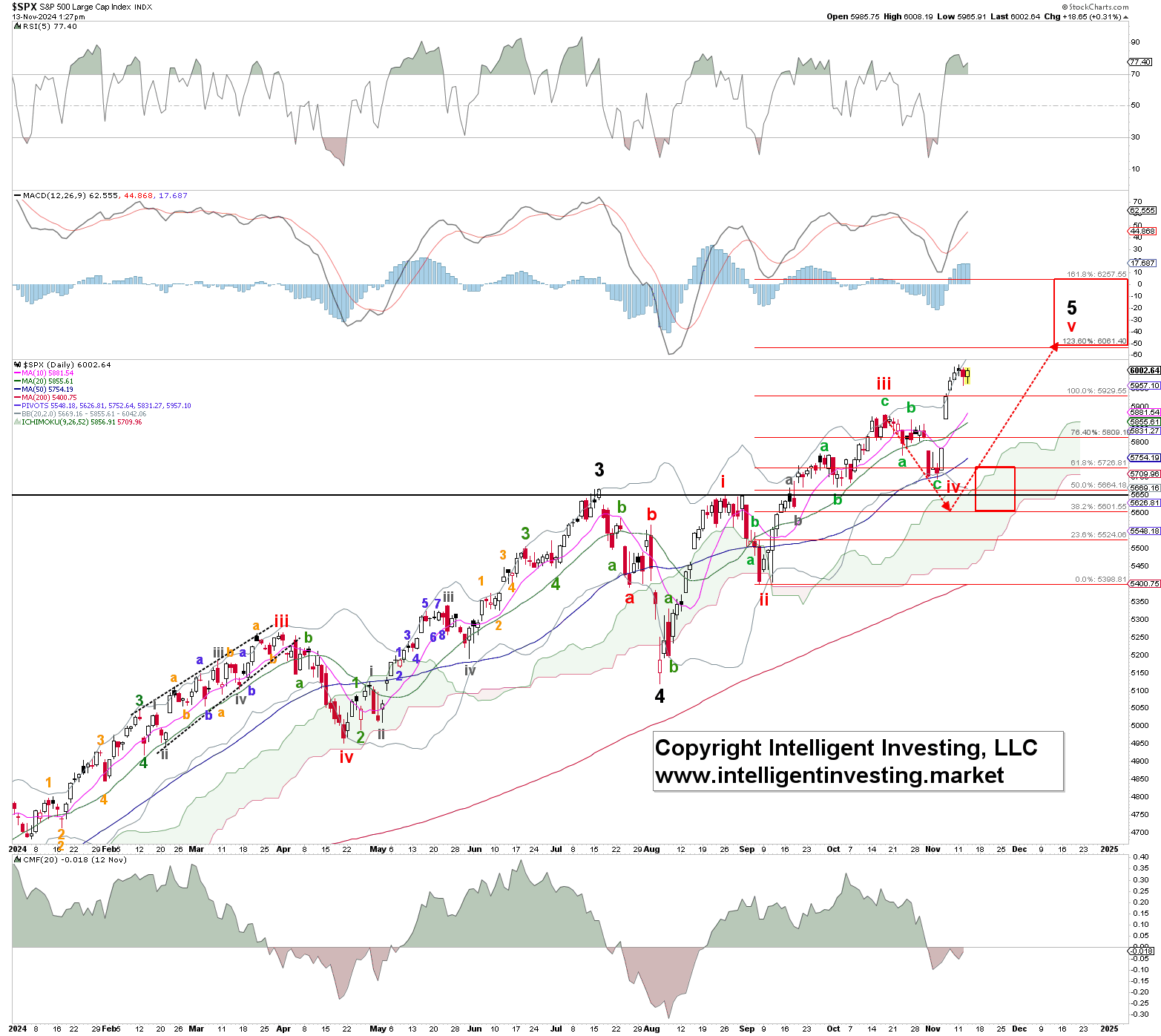

Nonetheless, because of the drop into early November, the subdividing impulse we shared with you, i.e., “a extra direct path to nearly SPX6500,” has morphed (again) into the Ending Diagonal construction now we have been prior. See determine 1 beneath.

Ending Diagonals (EDs) are tough as a result of all their waves (i-ii-iii-iv-v) comprise three waves: 3-3-3-3-3 = abc-abc-abc-abc-abc. Apart from, W-iii sometimes targets the 123.60% extension of W-i, measured from W-ii. The W-iv then tends to right again to the 61.80% extension, after which the final W-v targets the 161.80% extension. On this case, we’re W-iii to succeed in not less than SPX6060, W-iv ought to backside round SPX5725, and W-v can attain not less than SPX6260.

Thus, the purple W-iii remains to be underway and subdividing into the inexperienced Waves a, b, and c, with the W-c now underway. This could attain the everyday c=a extension at SPX6175ish. Thus, based mostly on the usual EDs highway map, which the market can deviate from, we count on the purple W-iii to succeed in SPX6060-6175, the place the purple W-iv can materialize.

Our various EWP depend is proven in Determine 2 beneath. It postulates that the October 31 low was already the purple W-iv, however it might make for an unorthodox brief W-iii. Particularly, W-iii can be shorter than W-i, which is allowed provided that W-v shall be shorter than W-iii.

Thus, it might be very unusual. Apart from, the purple W-iv low didn’t overlap with the purple W-i excessive; see the black horizontal line. Additionally, this isn’t essentially disallowed as a 4th wave doesn’t must overlap with a 1st wave in an ED, however it might even be very unusual. Therefore, why that is our low-odds various

Thus, for now, if the index can keep not less than above SPX5880, and particularly final week’s low at SPX5696, we should permit it to ideally goal SPX6060, probably as excessive as SPX6175 earlier than the following correction of round 5-7% can begin.