[ad_1]

Shares completed yesterday’s session decrease forward of CPI report. Expectations are for headline CPI to extend by 0.1% and three.3% , down from September’s improve of 0.4% m/m and three.7% y/y studying. Core CPI is predicted to rise by 0.3% and 4.1% , according to final month’s studying.

The core CPI, if it is available in as anticipated at 0.3%, could be a quantity not per the Fed 2% goal, and extra importantly, it does run the chance of coming in hotter than anticipated given the reset within the Well being Insurance coverage piece, which feeds into the Hospital and Associated providers and the broader Medical care providers.

The weighting for medical care providers is about 6.3% in headline CPI and better within the core CPI. That would be the sector to observe at the moment as a result of the times of medical insurance falling by 3 to 4% per 30 days will probably be gone, and we should always see medical insurance rise by 1 to 2% per 30 days.

Presently, with a weight of 0.545% in CPI, the Well being Insurance coverage will go from subtracting from Medical care providers and can develop into addictive. Medical providers did begin rising once more after months of falling, and the medical insurance part may add to this transformation in pattern if it ought to persist.

PoP Fee Index

S&P 500 Indecisive as OPEX Approaches

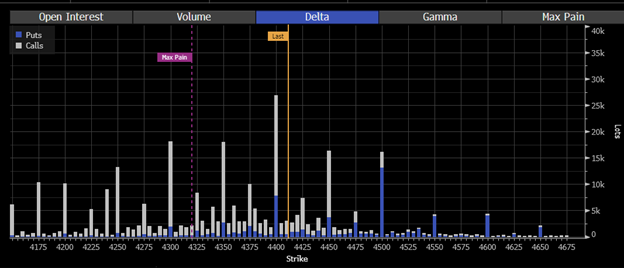

In the meantime, the stays pegged to the 4,400 area as we method opex, as gamma builds up on the 4,400 strike worth, making it onerous for the S&P 500 to flee from that area, at the least at the moment. That, in fact, may change at the moment, relying on the CPI report.

There may be numerous optimistic delta on the board for Friday’s OPEX, and if we do get a sizzling CPI report at the moment, and the indexes do begin to transfer decrease, the worth of name choices will begin decaying shortly, and that may imply there’ll market makers would have numerous inventory to unhedge, which means bringing it on the market.

SPX-Choices Exercise

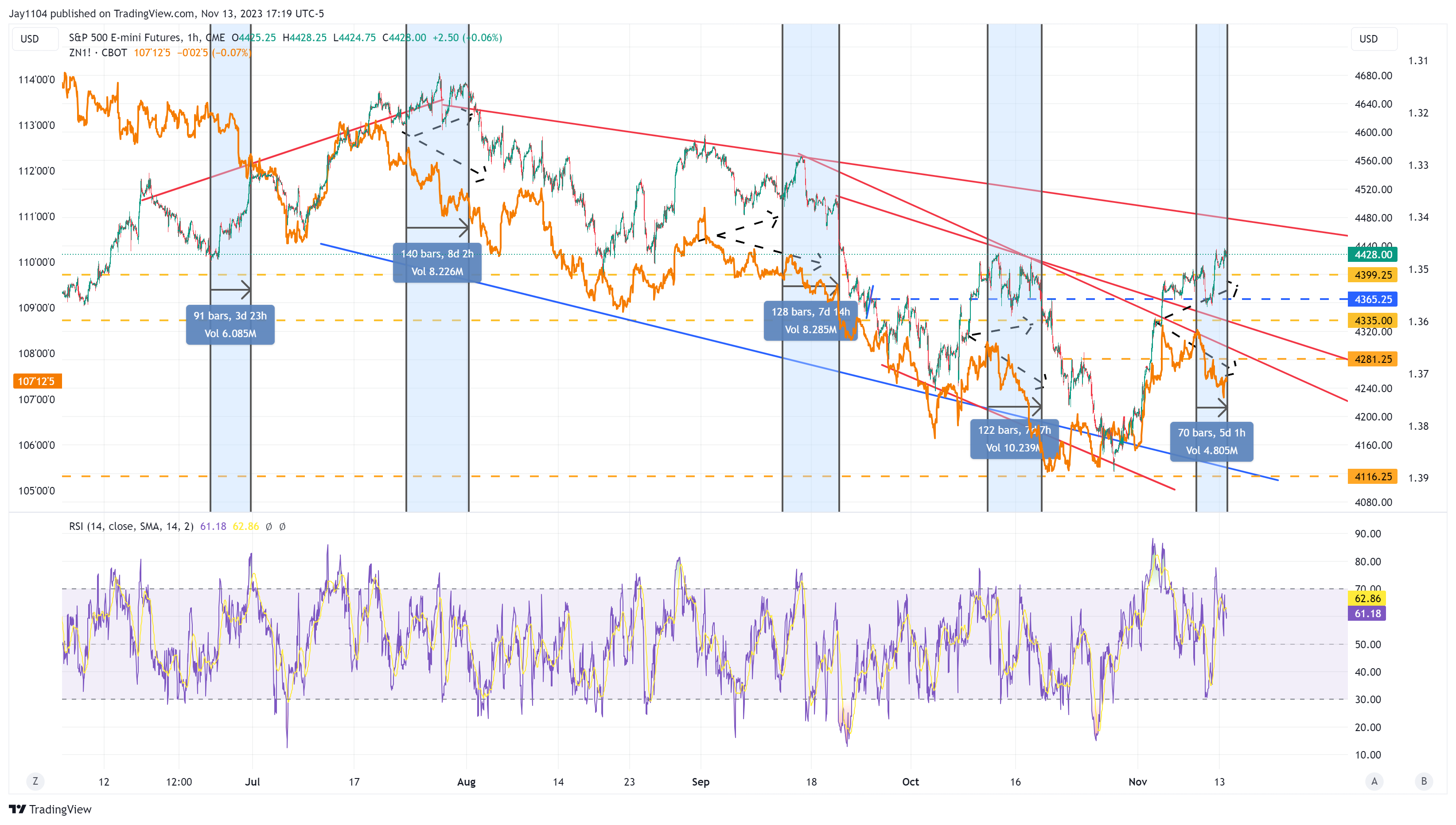

Technically, nothing modified for the S&P 500, and the gaps at 4,100 are nonetheless left to be stuffed; the technical sample of the cup with a rising deal with continues to be current, suggesting decrease costs to come back, whereas the 61.8% retracement nonetheless acts as resistance.

Anyway, we must see what at the moment brings. Once more, the setup for a reversal appears to be there, and the info level may favor it. Now, it’s only a query of whether or not it occurs or not.

10-Yr Fee Set to Head Greater?

In the meantime, charge seems to be able to go greater from present ranges, as they maintain the uptrend and help on the 4.5% stage. Within the meantime, a transfer above 4.7% may push the 10-year again to five%.

Moreover, the hole between 10-year bond costs and the S&P 500 has widened. This has occurred 4 instances already, and this could be the fifth. The prior 4 instances noticed the 2 diverge for about 5 to 7 days, and at the moment was day 5, so if they will come collectively, the hole ought to shut quickly.

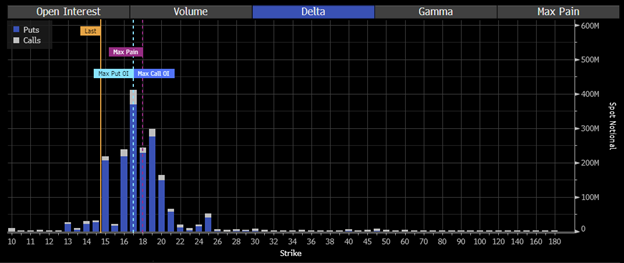

The inventory market doesn’t appear involved about at the moment’s inflation print with a sub-15. However with Vixperation on Wednesday morning, you need to marvel if the market will let all these places expire within the cash or if they’ll creep the VIX greater to burn off the delta and gamma beneath 18 and push the VIX up.

VIX Choices Exercise

Unique Publish

[ad_2]

Source link