[ad_1]

Shares completed yesterday decrease as charges pushed greater once more and spreads widened. The climbed to 4.69%, and the assistance to unfold between the ten and the 2 widened to -42 bps, which is necessary.

Once more, the 10-year could be very near breaking out to a brand new degree as a result of, after 4.68%, I don’t see a lot standing in the way in which of a run to five%. There appear to be a number of combos that would take the 10-year greater, and the bull flag additionally seems to be one other one. Nonetheless, it appears to be getting stretched, and this kind of factor the place it might snap the opposite method, too. So it’s virtually as if it’s a must to take it day-to-day.

In the meantime, the additionally rose at present to 107.

Many of the transfer was pushed by the hotter-than-expected information.

At present, we get the JOLTS information; should you bear in mind, final month, the JOLTS information got here in cooler than anticipated, and we bought that large gamma squeeze greater, which took a couple of week or so to work off. So, one thing to pay attention to tomorrow if the JOLTS is available in cool once more and the market pops as a result of I’d assume charges and the greenback would transfer down.

The information tends to be very unpredictable and in addition tends to be topic to large revisions. Nonetheless, regardless of the massive surge in charges, the was flat and located some assist within the 4,270 space at present.

This degree for the is essential as a result of after this, once more, there may be a lot to assist the market till 4,210.

The equal-weight RSP S&P 500 traded down by roughly 1.1%. At present’s divergence with the market cap S&P was primarily as a result of mega-cap names, which managed to put up positive factors after Goldman famous it forecasted an earning-led rally. The equal-weight S&P 500 is now down on the 12 months, falling by greater than 10% since peaking on July 27.

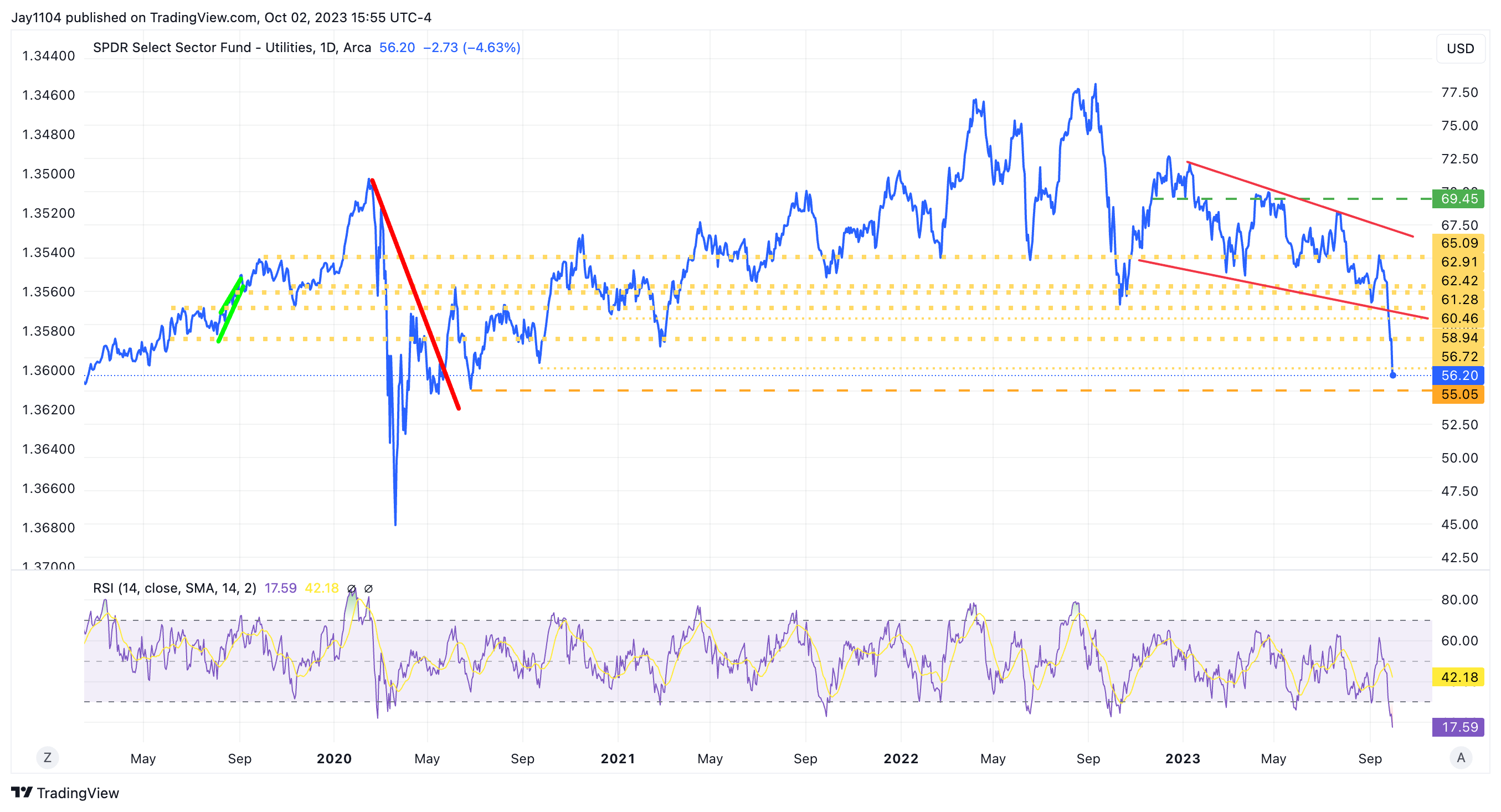

The utility sector was down virtually 5% at present, and the ETF is now nicely under its October lows and is again to its June 2020 ranges. These aren’t the kind of strikes you count on to see within the utility sector, which is meant to be low beta, however then once more, it isn’t typical for one to see charges surge on the lengthy finish of the curve like this.

This shall be a busy week with loads of information, and I believe there shall be fairly a little bit of volatility to return throughout all asset lessons.

Authentic Publish

[ad_2]

Source link