The bears examined the 20-week EMA on the weekly chart. They should create follow-through promoting buying and selling far under the 20-week EMA to extend the percentages of a reversal down. The bulls see the transfer down as a minor pullback and wish at the very least a small retest of the July 27 excessive.

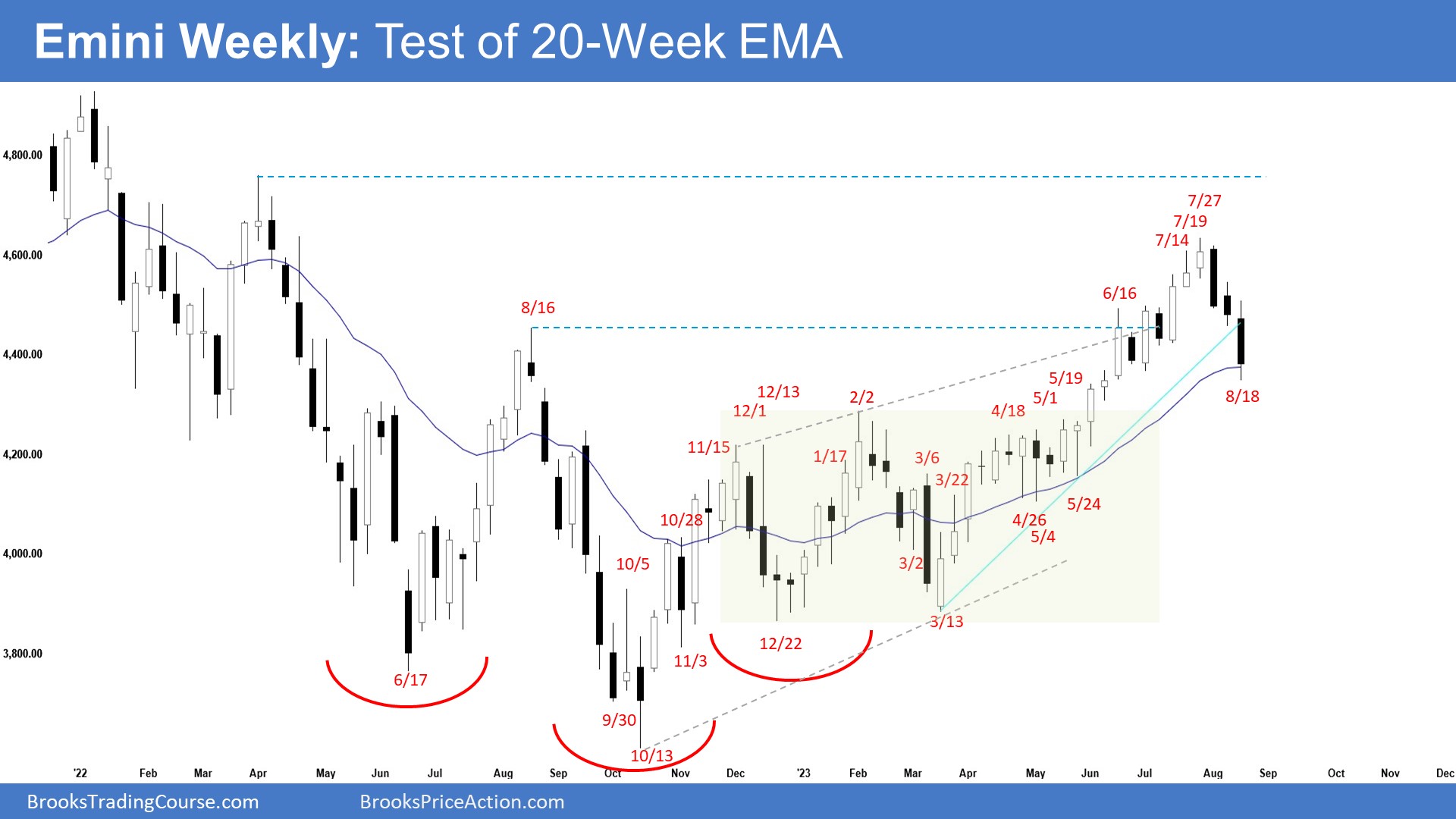

The Weekly Emini chart

- This week’s Emini candlestick was one other consecutive bear bar closing in its decrease half with a distinguished tail under.

- Final week, we stated that the percentages proceed to barely favor the market to nonetheless be within the sideways to down pullback part.

- The bears obtained a reversal down from a wedge sample (Dec 13, Feb 2, and Jul 27) and a micro wedge (Jul 14, Jul 19, and Jul 27).

- They need a bigger pullback from a climactic transfer.

- An inexpensive goal for the bears is the 20-week exponential transferring common they usually obtained it this week.

- They might want to proceed creating consecutive sturdy bear bars buying and selling far under the 20-week exponential transferring common (EMA) to persuade merchants {that a} reversal down could possibly be underway.

- The bulls obtained a robust leg up (since March) in a decent bull channel.

- They need a measured transfer utilizing the peak of the 6-month buying and selling vary which can take them to the March 2022 excessive space.

- The transfer up had lasted a very long time (4 months) and was climactic.

- The market wanted to commerce sideways to right down to work off the overbought situation. The minor pullback has begun.

- The bulls need any pullback to be shallow and weak (with overlapping bars, doji(s) and bull bars) and for the 20-week EMA to behave as assist.

- For now, odds are the pullback would seemingly be minor to be adopted by at the very least a small retest of the prior leg excessive (Jul 27).

- Since this week’s candlestick was a bear bar closing within the decrease half, it’s a promote sign bar for subsequent week.

- The chances barely favor at the very least a small second leg sideways to down after a small pullback.

- Merchants will see if the bears can proceed to create consecutive bear bars or will the pullback stall sideways across the 20-week EMA.

- If subsequent week is a shock bull bar about equal in dimension to this week’s candlestick closing close to its excessive, it may result in a retest of the July 27 excessive.

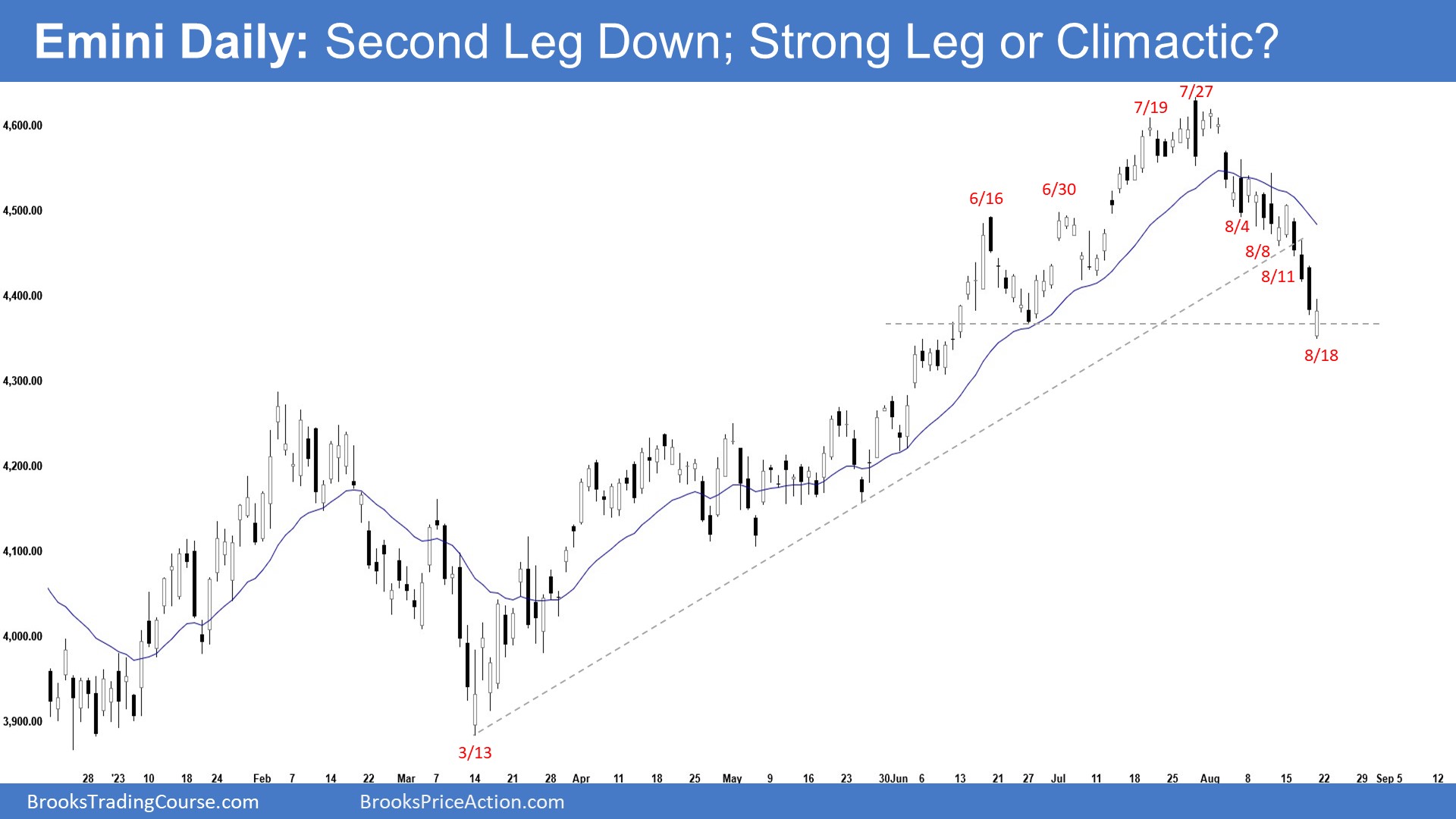

The Every day S&P 500 Emini chart

- The Emini traded decrease for the week. Friday gapped decrease however reversed to shut as a bull bar close to in its higher half.

- Final week, we stated that odds barely favor the market to nonetheless be within the sideways to down pullback part.

- The bears handle to create one other leg down this week. The transfer down is in a decent bear channel.

- They obtained a reversal from a climactic transfer, a wedge sample (Dec 13, Feb 2, and Jul 27), and a small wedge (Jun 30, Jun 19, and July 27).

- A pullback would normally final at the very least TBTL (Ten Bars, Two Legs). Thus far, the minimal requirement has been fulfilled.

- They might want to proceed creating sturdy bear bars closing close to their lows, buying and selling far under the bull trendline to extend the percentages of a reversal down.

- If there’s a pullback (bounce), they need at the very least a small second leg sideways to down.

- The bulls need a measured transfer up utilizing the peak of the 6-month buying and selling vary which can take them close to the March 2022 excessive.

- The transfer up since March 13 low is in a decent bull channel which implies sturdy bulls.

- Nonetheless, it additionally lasted a very long time and was climactic. A minor pullback has begun.

- The bulls need a retest of the July 27 excessive adopted by a breakout above and a continuation of the bull pattern.

- Since Friday was a bull bar closing within the higher half, it’s a purchase sign bar for Monday.

- The transfer down is barely climactic. The market might commerce barely larger early subsequent week.

- Nonetheless, it’s following a 5-bar bear microchannel. It will not be a robust purchase setup.

- Due to the tight bear channel down, odds barely favor at the very least a small second leg sideways to down after a pullback (bounce).

- General, odds barely favor the present sideways to down pullback to be minor and at the very least a small retest of the prior pattern excessive (Jul 27) after the pullback part.

- For now, merchants will see if the bears can create one other leg down after a pullback or will the bulls begin creating sturdy consecutive bull bars as a substitute.

- If the bulls handle to create consecutive bull bars closing close to their highs as a substitute, it may result in a retest of the July 27 excessive.