[ad_1]

Emini each day chart

- The bears shaped a Low 1 brief yesterday, following a short two-bar pullback.

- The bears hope they are going to get pattern resumption at this time, and the market will discover sellers under yesterday’s low.

- The bulls will see the latest two-day rally as robust sufficient for a second leg up. Due to this fact, they anticipate consumers under yesterday’s low and for the Low 1 to result in a extra complicated pullback, corresponding to a Low 2 (second entry brief).

- Whereas the rally over the previous couple of buying and selling days is disappointing for the bulls, it’s not sufficient to finish the argument of a bear pattern.

- The bears nonetheless have the argument of final week’s breakout under the bear flag (July twenty seventh to August eleventh), resulting in a measured transfer all the way down to the February 2nd excessive.

- At this time, merchants will take note of what sort of entry bar the bears will get. The bears hope they are going to be robust sufficient to seek out sellers under yesterday’s low.

- The bulls need the precise reverse. They hope there are extra consumers under yesterday’s low and the market will get a second leg up after the rally that started final Friday.

Emini 5-minute chart and what to anticipate at this time

- Emini is up 10 factors within the in a single day Globex session.

- The Globex market rallied for a lot of the early morning hours. Nevertheless, it shaped a decrease excessive with yesterday’s selloff and not too long ago shaped a second leg down.

- The 60-minute Globex chart is forming a buying and selling vary and can most likely go sideways for a number of hours.

- Merchants ought to anticipate quite a lot of buying and selling vary value motion throughout the open of the U.S. Session. Because of this most merchants ought to think about being affected person on the open and never being in a rush to commerce.

- Most merchants ought to think about ready 6-12 bars earlier than inserting a buying and selling except they’re comfy with restrict order buying and selling.

- If at this time goes to result in a robust pattern day, there will probably be loads of time to enter the pattern’s path. A pattern should final for a number of bars, permitting a dealer loads of time to affix the pattern’s path.

- The very best factor a dealer can do on the open is be affected person.

- It’s straightforward for a dealer to overtrade on the open and take 1-2 large losses, inflicting the dealer to spend the remainder of the day making an attempt to get again to breakeven. The vary is commonly large on the open and contracts because the day progresses, making it much more difficult to get again to breakeven.

- Lastly, merchants ought to pay shut consideration to the day’s open and yesterday’s low. The bulls anticipate consumers under yesterday’s low. The bears hope at this time will result in a robust entry bar under yesterday’s low.

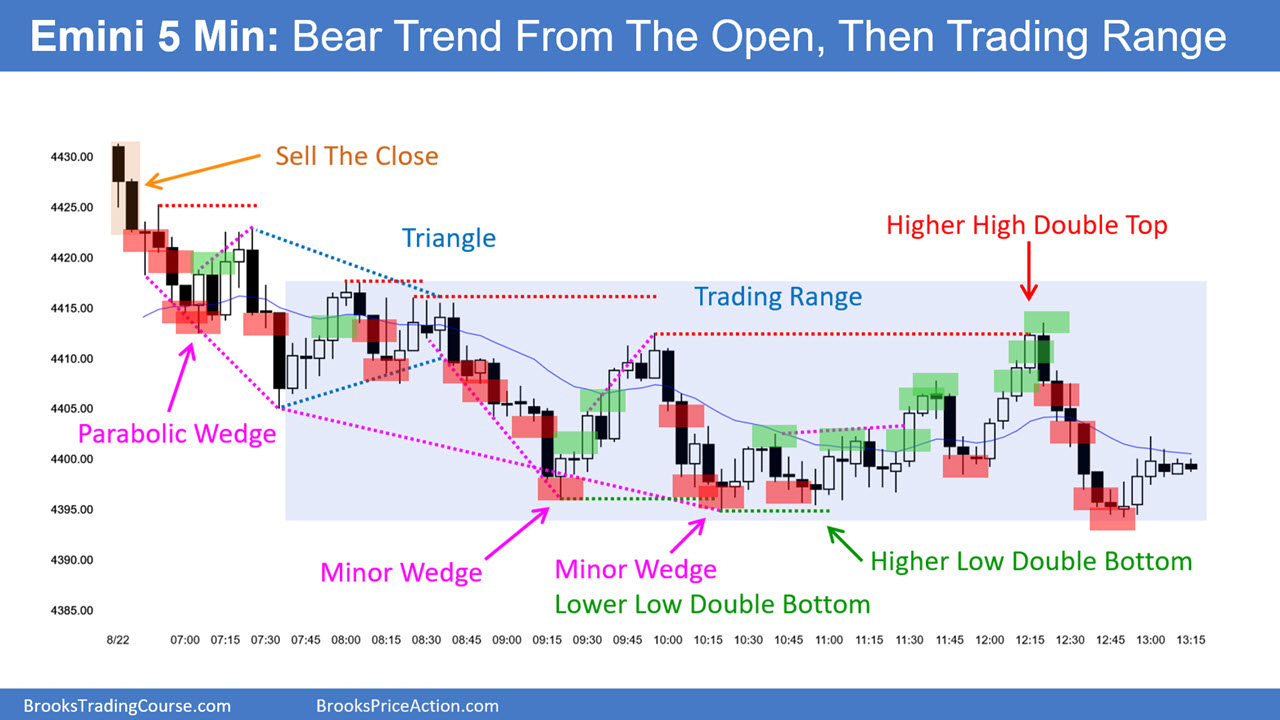

Yesterday’s Emini setups

Listed here are a number of cheap stop-entry setups from yesterday. I present every purchase entry with a inexperienced rectangle and every promote entry with a purple rectangle. Consumers of each the Brooks Buying and selling Course and Encyclopedia of Chart Patterns have entry to a close to 4-year library of extra detailed explanations of swing commerce setups (see On-line Course/BTC Every day Setups). Encyclopedia members get present each day charts added to Encyclopedia.

My purpose with these charts is to current an At all times In perspective. If a dealer was making an attempt to be At all times In or practically At all times Able all day, and he was not at the moment available in the market, these entries can be logical occasions for him to enter. These due to this fact are swing entries.

It is very important perceive that the majority swing setups don’t result in swing trades. As quickly as merchants are disenchanted, many exit. Those that exit choose to get out with a small revenue (scalp), however usually should exit with a small loss.

If the danger is simply too large on your account, it’s best to anticipate trades with much less threat or commerce another market just like the Micro Emini.

[ad_2]

Source link