[ad_1]

Really useful by Jun Rong Yeap

Get Your Free Equities Forecast

Market Recap

Following final Friday’s reversal, main US indices managed to carry onto their features this time spherical (DJIA +1.16%; S&P 500 +0.90%; Nasdaq +0.61%). However provided that earnings season ought to see some winding down forward, additional catalysts should be sought forward to proceed the rally. US Treasury noticed bigger strikes on the lengthy finish, with the 10-year yields up 5 basis-point (bp). The two-year yields had been primarily flat, alongside the US greenback, reflecting some wait-and-see forward of the US inflation knowledge this week.

In a single day financial knowledge noticed a optimistic shock in US client credit score (US$17.85 billion vs US$13 billion), which might counsel that client spending might stay supported, at the least for now. That will proceed to maintain sentiments basking in smooth touchdown hopes till situations are in a position to present a sharper deterioration to the draw back. To date, the US financial shock index continued to hover round its highest stage since March 2021

For the S&P 500, consumers have managed to defend its 4,500 stage in a single day however extra follow-through might must be seen as its relative power index (RSI) continues to hover round the important thing 50 stage on the each day chart. Since March this yr, dips within the each day RSI beneath the 50 stage have been short-lived, with one to observe if consumers can bounce in to defend the road this time spherical as effectively. Breaking again beneath the 4,500 stage for the index might doubtlessly depart the 4,300 stage on watch subsequent, the place a assist confluence arises from its Ichimoku cloud assist on the each day chart, together with its 100-day shifting common (MA).

Supply: IG charts

Asia Open

Asian shares look set for a optimistic open, with Nikkei +0.56%, ASX +0.38% and KOSPI +0.48% on the time of writing.

Financial knowledge this morning noticed some dampener in Japan’s nominal wage progress for June (2.3% vs 3.0% consensus) and accompanied with the sooner tempo of improve in inflation, wages in actual phrases registered a deeper contraction (-1.6% versus earlier -0.9%). The rapid response for the Japanese yen is to the draw back, with market pricing for a extra affected person normalisation course of from the Financial institution of Japan (BoJ). Family spending knowledge disappoints on a year-on-year foundation as effectively, handing over a -4.2% contraction vs the -3.9 anticipated. Nonetheless, continued transfer in wage progress above the two% forward might assist the BoJ’s standards of ‘sustainable wage progress’, which might see the central financial institution persevering with its push in direction of normalisation, albeit by intermittent tweaks.

Forward, China’s commerce knowledge will likely be in focus, with one other set of subdued learn because the consensus. Exports are anticipated to contract 12.5% from a yr in the past, largely unchanged from the earlier 12.4% in June. Imports are anticipated to register its fifth straight month of year-on-year decline, with forecast at -5% versus earlier -6.8%. One other weak displaying might possible dampen hopes for China’s financial system to show the nook quickly, which can drive a extra cautious threat tone throughout the area, provided that current stimulus efforts from authorities have been extra lukewarm.

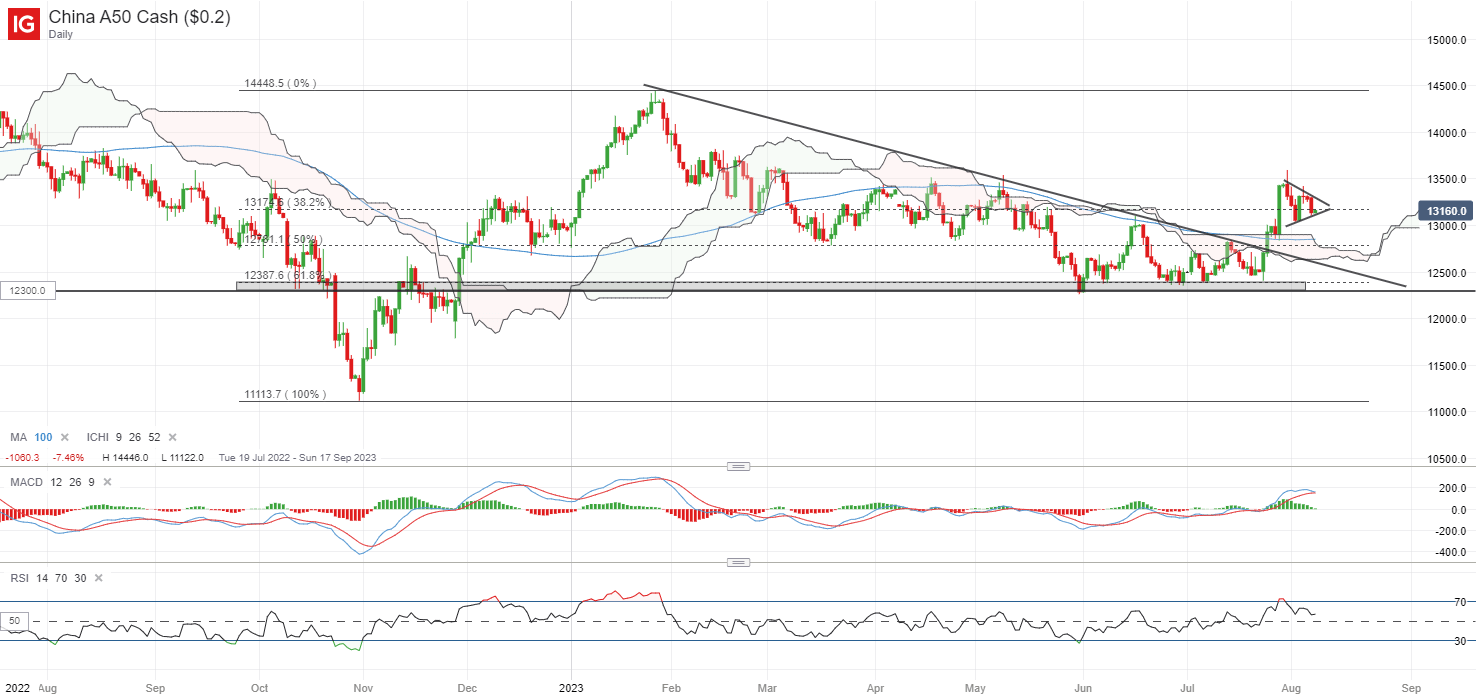

Nonetheless, for the China A50 index, a break above its descending triangle sample appears to counsel consumers making an attempt to take some management. A near-term bullish pennant formation remains to be in place on the each day chart, whereas its weekly RSI has risen above its key 50 stage for the primary time since February this yr. A lot to observe if the index might discover any optimistic follow-through with an upward break of the pennant as a possible continuation sample.

Really useful by Jun Rong Yeap

Get Your Free Prime Buying and selling Alternatives Forecast

Supply: IG charts

On the watchlist: Pure gasoline costs again on the rise

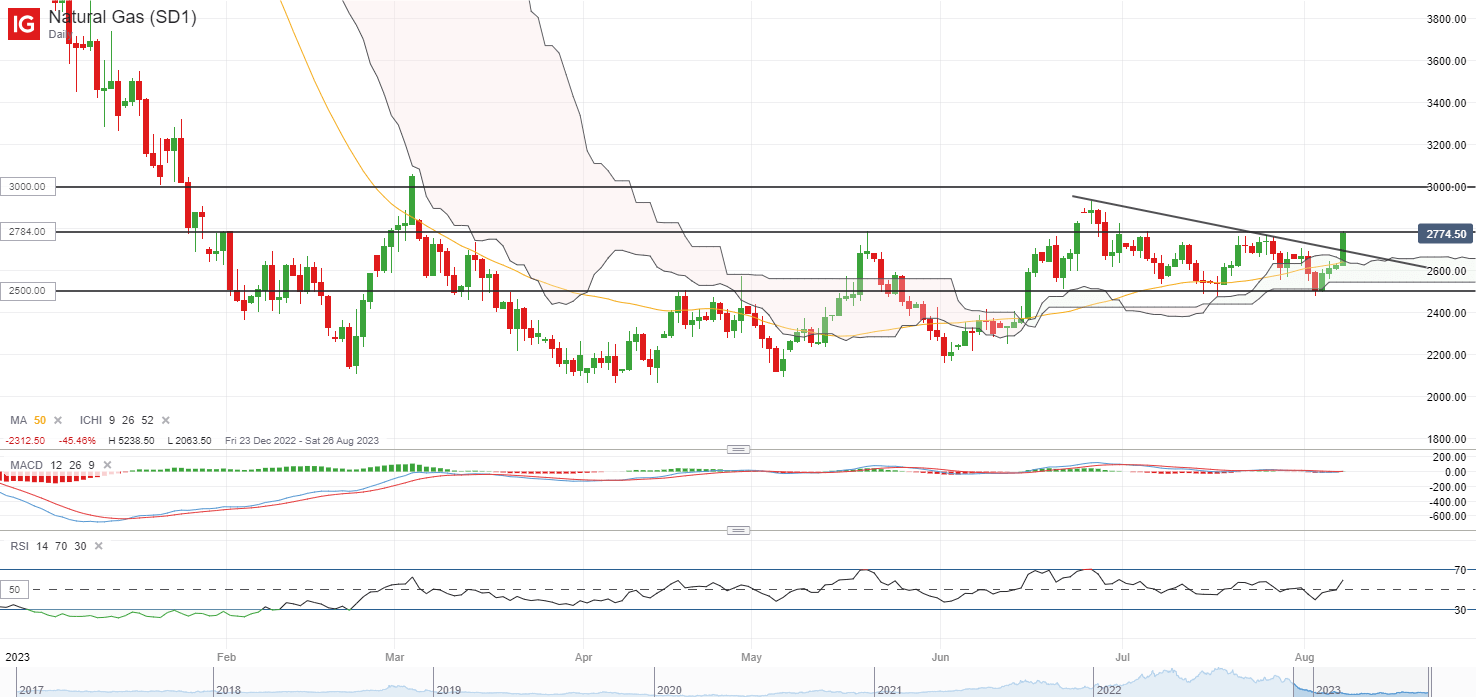

Pure gasoline costs proceed to move greater with one other 5.7% acquire in a single day, following by with its bounce after retesting its Ichimoku cloud assist on the each day chart final week. Over the previous months, costs have been making an attempt to construct a base after its earlier large sell-off, which can counsel that a lot of the promoting strain might have been finished for now. To recall, costs have seen a 78% sell-off since August 2022.

Latest worth motion additionally marked the primary time since September 2022 the place pure gasoline costs are buying and selling above its Ichimoku cloud on the each day chart, which provides some hopes of a possible pattern reversal. One to observe now will likely be on any transfer within the weekly RSI again above its key 50 stage. On the upside, heading above its US$2.784 stage of resistance might pave the way in which to retest the US$3.000 stage subsequent, whereas the US$2.500 will function an important assist to carry.

Supply: IG charts

Monday: DJIA +1.16%; S&P 500 +0.90%; Nasdaq +0.61%, DAX -0.01%, FTSE -0.13%

[ad_2]

Source link