[ad_1]

Shares completed yesterday flat after being down earlier for a lot of the session. A sell-off within the forward of at the moment’s was the principle catalyst for the bounce. The , for essentially the most half, has consolidated the final two buying and selling periods and failed for a second day at 4,270.

If the job report wasn’t at the moment, then the chart under exhibits a broadening wedge, which resembles a bear flag, and that may recommend that the following break within the S&P 500 can be decrease and in the direction of 4,150.

However the job report isn’t more likely to change a lot except it’s horrible or highly regarded. Whereas not extremely correlated to the official job report, the took a few of the edge off the bond market yesterday. I don’t assume we’re more likely to see charges on the again of the curve fall all that a lot from the place they’re at present, based mostly on the Fed’s projections for charges into 2024 and 2025. Which implies the prospects for decrease fairness values persist.

Charges have been rising largely as a result of better-than-expected financial knowledge and eventually shopping for into the Fed forecast. The information from the September 1 job report began this current leg greater within the .

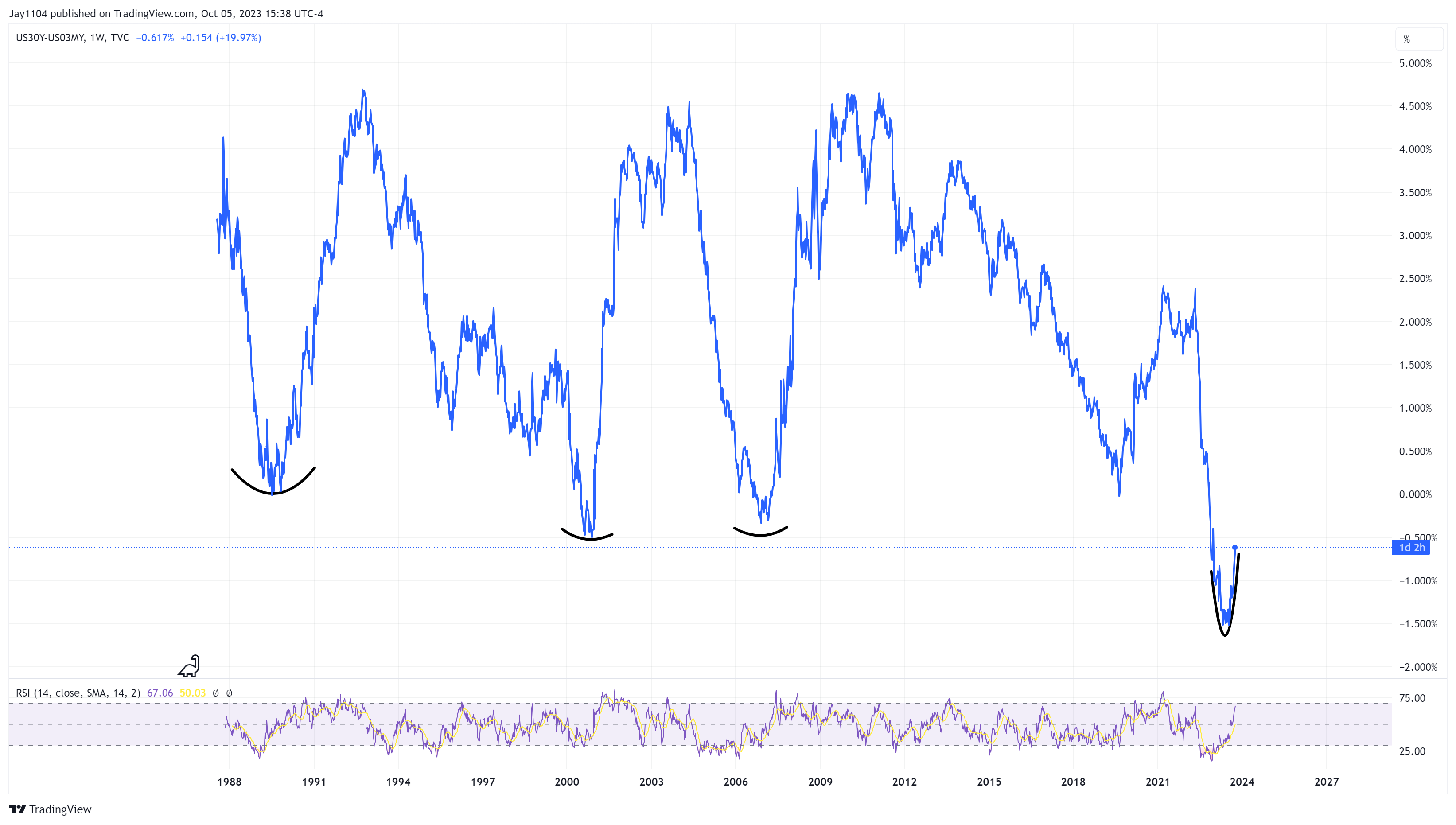

In the meantime, the is now steepening, and it’s very clear when trying on the minus the , and sometimes, as soon as it begins, it will probably occur fairly rapidly.

As soon as that course of begins, it appears to proceed till completion. This a part of the steepening is as a result of the fee is rising to the 3-month, and that’s as a result of the market thinks the economic system is on strong footing and the Fed forecasts. However rising charges and a steeper curve will imply that monetary situations tighten, and that can sluggish the economic system, and that won’t be good for shares, as we all know from all of final 12 months.

So, one would assume that except there’s some main shock to the draw back tomorrow within the jobs knowledge, the method of the yield curve steepening ought to proceed.

The chart of the iShares MSCI ACWI ETF (NASDAQ:) seems to be fairly unhealthy. It has fallen under resistance, turned assist at $93.25, and now sits simply above resistance round $90.50.

That area round $93.25 was such a troublesome stage for the ACWI to interrupt above, after which when it fell under it in late September, it tried to rebound and failed once more. Simply not a constructive growth. At this level, it doesn’t look like a lot is stopping it from falling again to $85.

Nvidia’s (NASDAQ:) days could also be numbered because the inventory consolidates, forming a bearish divergence on the RSI. The technical sample on the worth being shaped seems to be an incomplete reversal sample. Sadly, we should wait to see when and if that subsequent shoulder varieties. It means Nvidia might nonetheless go a bit greater first. It doesn’t need to; it might simply drop from right here, but when it ought to go greater first, a niche fill at $469 looks as if a spot to cease.

Unique Publish

[ad_2]

Source link