[ad_1]

- At present marks a 12 months for the reason that S&P 500 ended its bear market

- Rather a lot has modified since then, however the US financial system nonetheless hasn’t entered recession

- The longer term would possibly look bleak due to the present headwinds, however shares nonetheless may finish the 12 months on a excessive

Precisely one 12 months in the past, the bottomed on the short-term bear market, which led it to fall by greater than 20% from January to October 2022. On the next day (October 14, 2022), shares reversed, closing with a +2.60% acquire, and didn’t look again since.

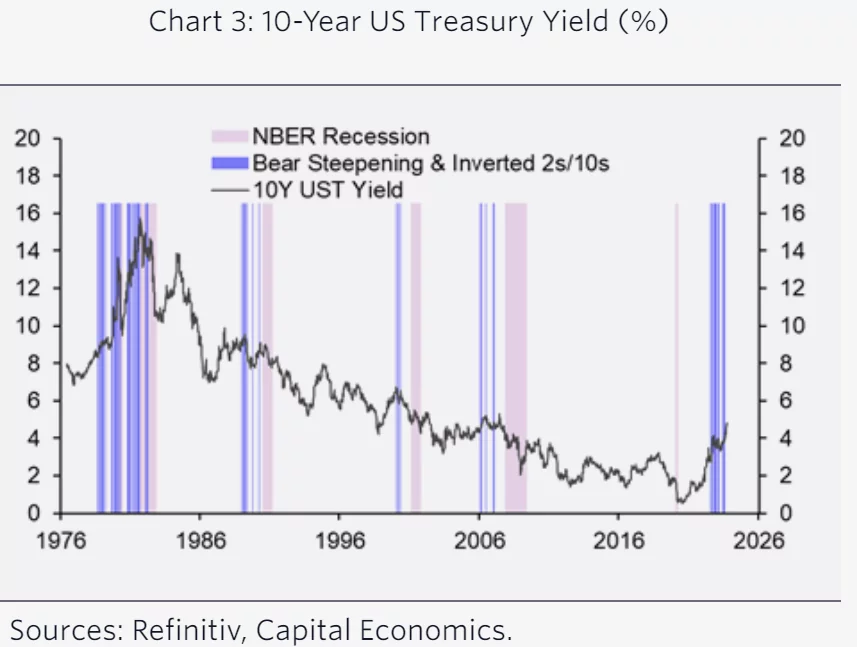

The U.S. bond market has since gone from signaling an impending recession to signaling that rates of interest will stay excessive for an extended interval. This is because of a steepening , which is attributable to long-dated yields rising quicker than short-term yields.

Bonds Are the Biggest Threat Now

Whereas a steepening yield curve is commonly seen as an indication of a recession, on this case, it’s probably because of the still-strong U.S. financial system and the Fed’s outlook for increased charges. This is called “bear steepening.”

In different phrases, the bond market is signaling that the financial system continues to be sturdy sufficient to resist increased rates of interest, however that these increased charges could finally result in a recession.

Visually, the steepening of the yield curve could seem as a constructive signal, suggesting that the financial system is at a comparatively decrease threat of a recession.

Nonetheless, historical past presents a special perspective. In actuality, when the yield curve experiences bear steepening, it usually implies that the market expects the Federal Reserve to delay rate of interest cuts.

Consequently, long-term yields, which replicate these expectations, rise at a quicker tempo in comparison with short-term yields.

Supply: Refinitiv, Cepital Economics

As depicted within the chart, this occasion is kind of unusual, and when it does occur, it has traditionally had a considerably increased chance of being adopted by a recession.

In truth, these earlier occurrences had been usually succeeded by substantial decreases in long-term U.S. authorities bond yields and extra stringent monetary circumstances.

Is the S&P 500 on Observe for a New All-Time Excessive?

Over the previous few months, the unfavorable correlation between shares and the U.S. greenback has been significantly strong. Those that have tried to go towards this pattern have typically confronted unfavorable outcomes.

Suffice it to say that the S&P 500 recorded new 52-week highs in July, precisely the identical interval when the greenback hit lows.

Subsequently, the has managed to file constructive features for 11 consecutive weeks, and this pattern, which has seen equities go down as a substitute, won’t abate till ranges return beneath 105.

As well as, different sectors have additionally taken a particular path, comparable to know-how. The Invesco S&P 500 Equal Weight Know-how ETF (NYSE:) index has damaged via a 3-year resistance relative to the Invesco S&P 500® Equal Weight ETF (NYSE:).

In truth, after lateralization, it recorded new highs in comparison with earlier highs of 2020-2021 breaking resistance on the 0.20 degree. If the pattern is confirmed, we may anticipate outperformance and momentum in equities from tech shares within the coming months.

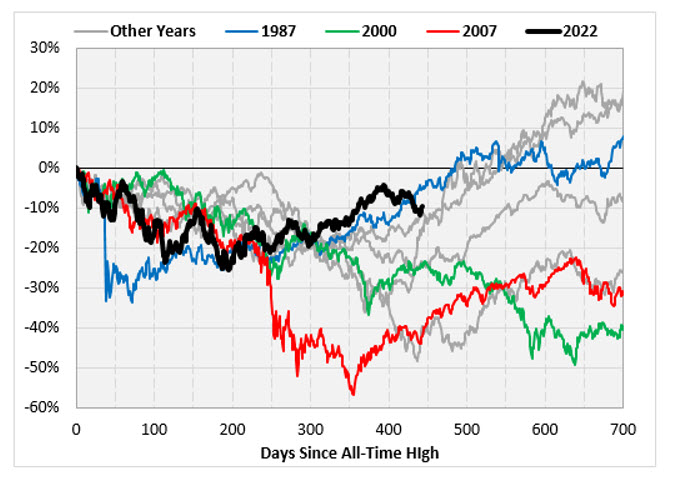

That is additionally doable statistically; actually, the S&P 500 Index has not recorded an all-time excessive since 2022. This era is equal to 445 buying and selling days, a sequence that has been repeated solely 7 different instances since 1955. After this, it took a median of 18 months (547 days) for brand spanking new all-time highs, and as of right this moment, there are about 3 months nonetheless to go.

So how is the market doing?

Issues should not as unhealthy as some may need you consider. Primarily based on this, it’s not unreasonable to be constructive for the approaching months.

***

Discover All of the Data You Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or suggestion to take a position as such it’s not supposed to incentivize the acquisition of property in any means. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link