Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Solana (SOL) is dealing with important promoting stress and struggling to carry key help ranges as all the crypto market stays beneath stress. Bulls have misplaced management, with SOL plunging over 37% for the reason that begin of March, reflecting the broader market’s risk-off sentiment.

Associated Studying

The downturn isn’t restricted to crypto—commerce conflict fears and macroeconomic uncertainty have pushed the crypto and U.S. inventory markets to their lowest ranges since late 2024. With investor confidence deteriorating, SOL stays in a weak place, failing to reclaim important worth ranges.

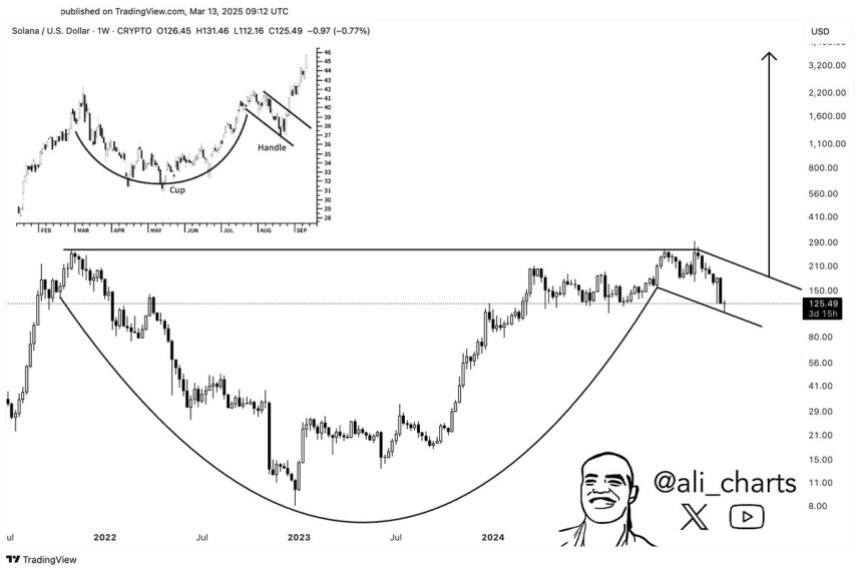

Regardless of the latest weak spot, some analysts see potential for a turnaround. High analyst Ali Martinez shared insights on X, highlighting that Solana is forming a textbook cup-and-handle sample, a bullish technical formation that might result in a breakout. If this sample performs out, SOL might reclaim greater worth ranges, reversing a few of its latest losses.

For now, Solana should overcome key resistance ranges earlier than confirming a bullish pattern. If market circumstances enhance, SOL might see renewed momentum, however failure to carry present help might lead to additional draw back. The subsequent few weeks might be important in figuring out Solana’s short-term route.

Solana Bullish Setup Hints at a Potential Breakout

Solana is at the moment buying and selling under the $130 mark, struggling to determine a basis for a restoration part. The broader market downturn continues to weigh closely on SOL, with volatility and hypothesis driving short-term worth motion. With bears nonetheless in management, Solana’s route stays unsure, and short-term sentiment stays bearish.

Regardless of the latest decline, many traders stay hopeful that SOL is poised for a big restoration as soon as the broader market begins trending upward. Optimism comes from historic patterns, the place Solana has proven sturdy comebacks following prolonged intervals of promoting stress.

Associated Studying

Martinez’s long-term technical evaluation on X highlights that Solana is forming a textbook cup-and-handle sample, a bullish formation that always precedes main breakouts. SOL might probably surge to $3,800 if worth motion confirms this sample, marking an astonishing 2,900% acquire from present ranges.

The subsequent few days might be essential as Solana and the broader crypto market try to determine native lows and construct momentum for a possible rebound. If market sentiment shifts and key resistance ranges are reclaimed, SOL may very well be one of many prime performers within the subsequent main bullish part.

Worth Struggles Round $125

Solana is at the moment buying and selling round $125, dealing with resistance on the $130 stage after a number of failed makes an attempt to reclaim it. With bears nonetheless in management, SOL stays beneath promoting stress, and bulls should act rapidly to keep away from additional declines.

For a restoration to take form, SOL wants to interrupt above the $130 mark and push towards $150. If bulls handle to reclaim this key stage, it’ll sign renewed shopping for energy, probably setting the stage for a bigger restoration rally. A transfer previous $150 might shift market sentiment and open the door for greater worth targets.

Nonetheless, if SOL fails to carry the present demand, an extra draw back is probably going. A drop under $125 might ship the value towards decrease help ranges between $100 and $105, a zone the place consumers might step in to stabilize the value.

Associated Studying

The subsequent few buying and selling classes might be essential in figuring out whether or not SOL can regain momentum or if additional promoting stress will drive it decrease. Traders are carefully watching key resistance and help ranges, as short-term route stays unsure amid broader market weak spot.

Featured picture from Dall-E, chart from TradingView