[ad_1]

Luke Chan/E+ via Getty Images

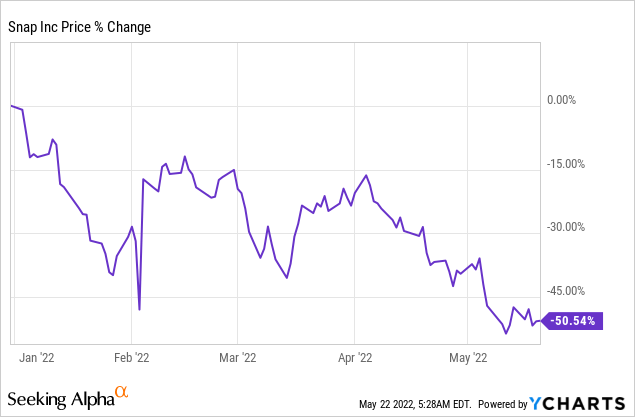

Shares of social media company Snap Inc. (NYSE:SNAP) have revalued lower in 2022 due to general market weakness and growing risks of a recession. However, Snap is making progress in its business: The company is growing daily active users and revenues rapidly and is now free cash flow profitable. Additionally, a strong revenue forecast has been submitted by the company for the second quarter and I expect Snap to grow its free cash flow margin going forward!

Key Metrics Show Business Strength

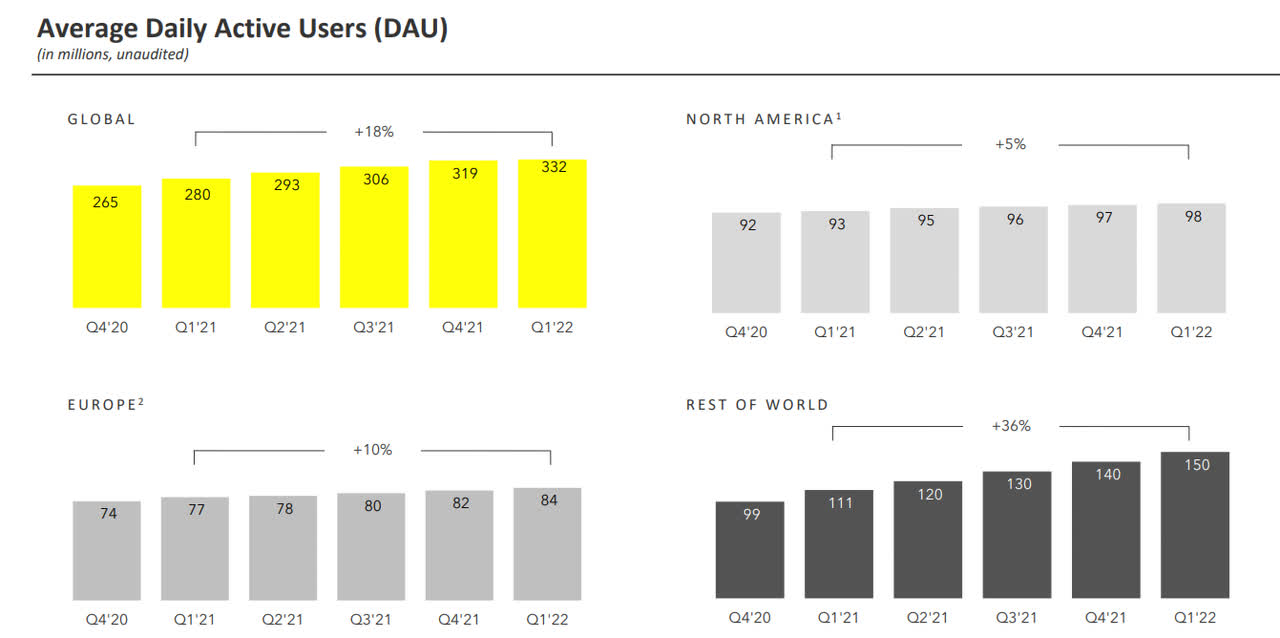

Snap saw continual strength on its platform in the first quarter. In Snap’s Q1’22 earnings card, the social media company revealed that its average daily active users — the most important key metric for platform businesses — surged to 332M, showing an increase of 18% year over year. Snap added 52M average daily active users over the last twelve months and also added 13M average daily active users just in the last quarter, with 10M of those users coming from markets outside North America and Europe. Average daily active user growth in North America and Europe kept moderating in Q1’22, implying that the majority of user and engagement growth will come from regions outside of these two saturated markets going forward.

Snap

Snap is expanding its content offering and developing its partner ecosystem to grow engagement. According to the social media company, 250 million Snap chatters engaged with Snap’s augmented reality every day on average in Q1’22. Augmented reality products are a way for Snap to engage especially younger users which make up the core audience for the platform: the majority of users are between 13 and 24 years of age. The use of Augmented Reality helps companies selling products on the Snap platform increase conversions and lower the rate of shipping returns.

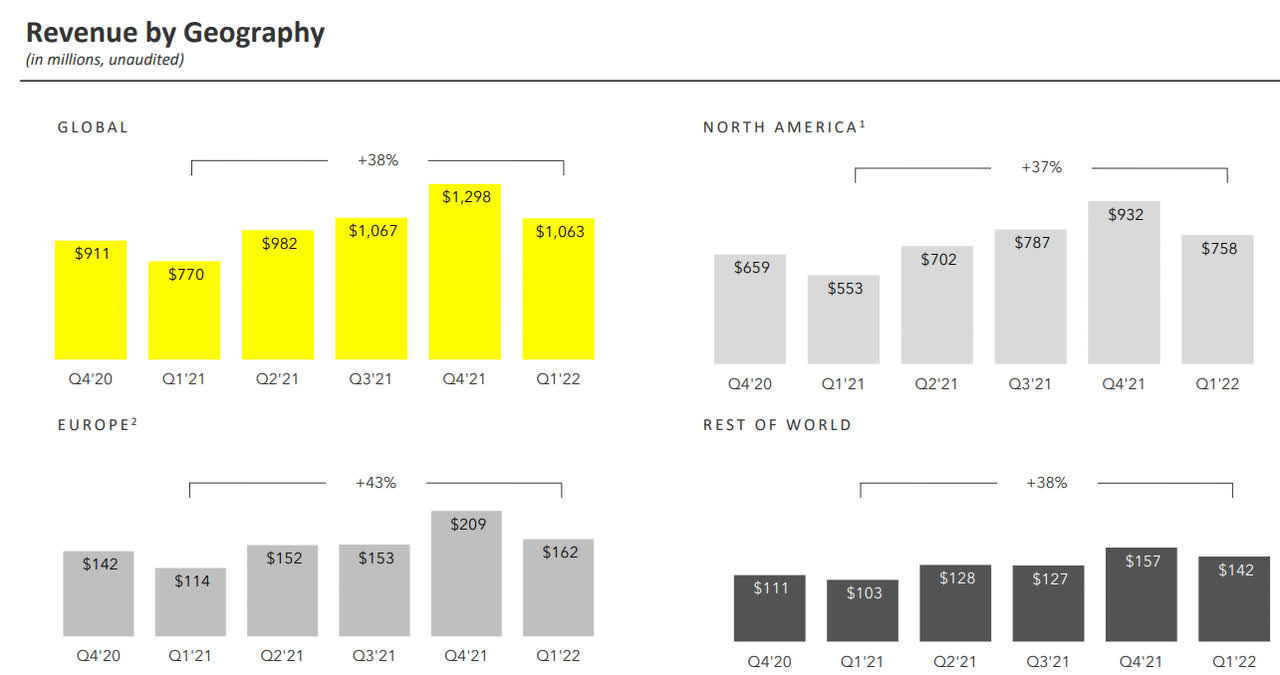

Snap’s revenues for Q1’22 surged 38% year over year to $1.06B with top line growth most pronounced in Europe at 43% year over year. However, Snap’s revenue performance was strong throughout the world, including North America and the rest of the world.

Snap

Strong Outlook For Q2 2022

Snap sees revenue growth of 20-25% year over year for Q2’22, which puts Snap expected revenues into a range of $1.18B to $1.23B. Momentum in revenue growth indicates that advertisers continue to see Snap as a strong advertising platform.

Average Revenue Per User

Snap’s average revenue per user/ARPU — the second most important metric after daily active users for social media companies — saw a deceleration in Q1’22 with growth slowing from 36% in the year-earlier period to 17% in the first quarter. Coming off a strong fourth quarter regarding ad spending, the first quarter typically sees weaker performance metrics.

Average revenue per user growth has been moderating in all of Snap’s geographies over the last year, but ARPU growth was still far from being weak at 17% in Q1’22. North America continues to be the most lucrative market for Snap as advertisers pay high ad rates to promote their products and services on the platform.

|

SNAP |

Q1’21 |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

|

ARPU |

$2.74 |

$3.35 |

$3.49 |

$4.06 |

$3.20 |

|

Growth YoY |

36% |

76% |

28% |

18% |

17% |

|

North America |

$5.94 |

$7.37 |

$8.20 |

$9.58 |

$7.77 |

|

Growth YoY |

66% |

116% |

49% |

33% |

31% |

|

Europe |

$1.48 |

$1.95 |

$1.92 |

$2.54 |

$1.93 |

|

Growth YoY |

36% |

76% |

34% |

33% |

30% |

|

ROW |

$0.93 |

$1.07 |

$0.98 |

$1.12 |

$0.95 |

|

Growth YoY |

(7)% |

20% |

3% |

1% |

2% |

(Source: Author)

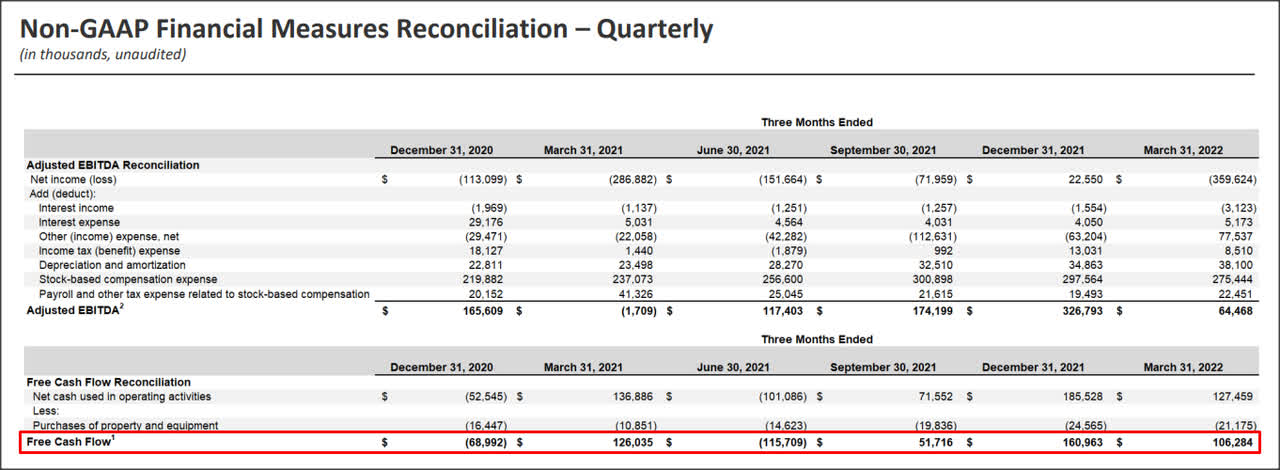

Free Cash Flow Is Positive

Despite declines in average revenue per user growth, Snap once again delivered positive free cash flow. Snap’s free cash flow in Q1’22 was $106.3M and the firm reported three consecutive quarters of positive FCF. Free cash flow on a last-twelve-months basis was $203.3M which calculates to a free cash flow margin of 4.6%. Since Snap’s free cash flow is ramping up, I expect FCF margins to improve going forward as Snap’s Augmented Reality products continue to see growing advertiser adoption.

Snap

Snap’s Growth Is Discounted Again

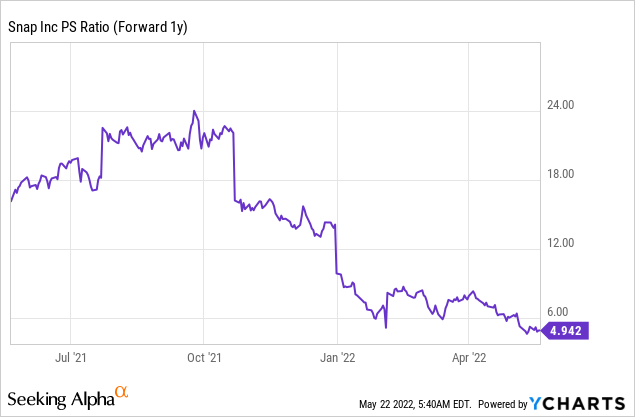

Snap has fallen back into a down-trend in 2022 which creates an opportunity to buy the social media company’s shares at a discounted valuation compared to its history. Based off of FY 2023 expected revenues, shares of Snap have a sales multiplier factor of 4.9 X and revenues are expected to grow at least 33% in each of the next three years.

|

SNAP |

FY 2022 |

FY 2023 |

FY 2024 |

|

Sales |

$5.47B |

$7.70B |

$10.48B |

|

YoY Growth |

32.9% |

40.8% |

36.1% |

|

P-S Ratio |

6.96 X |

4.94 X |

3.63 X |

(Source: Author)

Historically, Snap has achieved a much higher valuation based off of revenues.

Risks With Snap

Obviously, a deterioration in the growth outlook and cuts to advertising budgets represent big commercial risks for Snap’s platform business as well as the stock. A decline in daily active users and weakening ARPU trends also pose risks for the social media platform.

Final Thoughts

Shares of Snap have shown weakness again lately, which is largely the result of a deteriorating growth outlook for the global economy. However, Snap is seeing strong growth in three of its most important key metrics – daily active users, revenues, ARPU — and the firm is now a free cash flow positive enterprise with potential to grow its FCF margins. I believe the risk profile at this point is still heavily skewed upwards and shares of Snap are a buy!

[ad_2]

Source link