[ad_1]

The US inventory market has been present process inner rotations recently. We anticipated potential rotations to the extra cyclical areas like Power and Supplies, versus the Tech/Progress areas that Goldilocks has favored for many of the final 12 months (additionally as anticipated, a 12 months in the past).

But the inventory market as a complete is at excessive threat, as we now have been parroting week after bullish week. That’s the character of a manic bull section. Bullish with threat growing. However resulting from these inner rotations it’s best to make a stand in opposition to sectors you’re feeling will swing out of favor reasonably than in opposition to the broad . The rationale? Why, its very broadness. Its diversified composition, assuming inner rotations proceed.

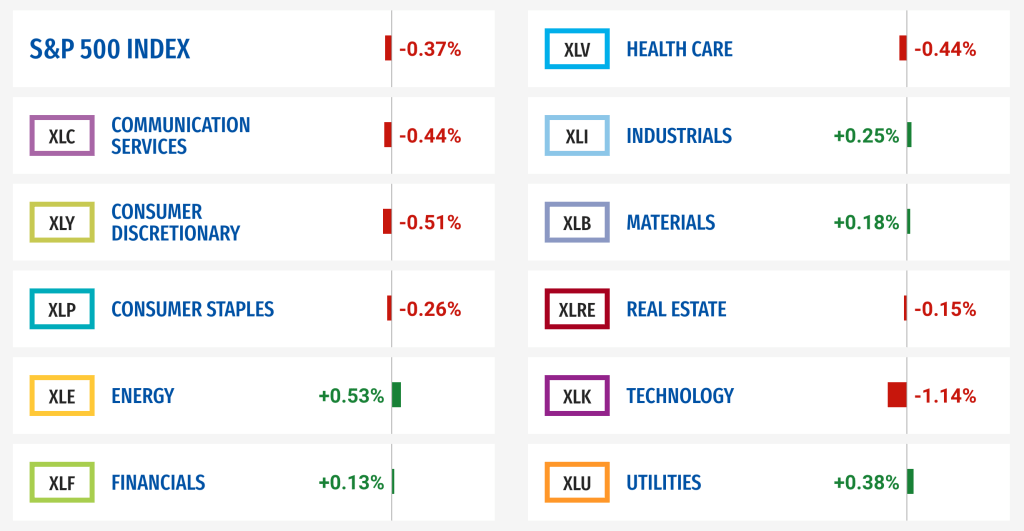

Right here is the sector breakdown of the S&P 500 per the SPDRs, which permit for granular sector choice reasonably than ‘one measurement suits all’ broadness.

Here’s a take a look at the sectors included together with at the moment’s efficiency (irrelevant to this text, however apparently aligned with the article’s theme on a micro view of someday).

I’m quick one of many market sectors proven above, per yesterday’s NFTRH Commerce Log. That sector is Expertise, which has been fading management per this public publish. Price a shot, says I. However as famous above I’m additionally lengthy Power and Supplies (though in a excessive threat market I’m married to nothing).

The problem is whether or not the federal government in energy can maintain this mess collectively into the presidential election. I usually don’t introduce politics into my evaluation, however have finished so fairly a bit recently resulting from work introduced in NFTRH that exhibits the Fed hawkish (however not likely) and the Biden administration holding its playing cards near the vest with former Fed chief Janet Yellen within the facet automotive.

The Yellen connection particularly hints of coordination with the Fed. It goes one thing like this: The Fed stays tight on the Funds Price however is monetizing bonds out the again door. Wouldn’t need to get too tight in an election 12 months, now would we? In the meantime, the administration nonetheless holds stimulative playing cards just like the Semiconductor CHIPS Act and no matter Inexperienced initiatives it could pursue in its again pocket.

Whereas the Semiconductor sector is a wild card (and one which I’ve lengthy been bullish on), areas like Power, Supplies and Industrials are thought-about extremely cyclical and attentive to fiscal stimulation in addition to inflationary market signaling (when market individuals should not cowering earlier than the Nice and Highly effective Fed of Oz).

Backside Line

I’d anticipate a market correction of some observe earlier than a last and probably bullish drive into This fall and the election. Nevertheless, this pig might additionally simply maintain rotating its option to November. For those who plan to be actively bearish, it’s best to take a severe take a look at the macro at any given time and resolve what sectors stand to be cycled out and what sectors maybe stand to be cycled in.

Disclaimer:

We don’t suggest you make investments or commerce based mostly upon our commentary, evaluation and opinion. Please see NFTRH.com and Biiwii.com phrases of service.

[ad_2]

Source link