March Insanity is sort of upon us! It is a favourite sporting occasion for People, with thousands and thousands upon thousands and thousands tuning in for sport after sport over a span of some action-packed weeks.

And never simply watching, however filling out and protecting observe of a bracket, too. Final 12 months, in truth, some 36.7 million People accomplished a minimum of one NCAA event bracket.

Which bought us considering: Why do basketball groups and followers get to have all of the enjoyable?

The retail trade, in any case, is a fiercely aggressive enviornment as properly. And never simply retailer versus retailer, model versus model; the competitors extends to ways, strategies, and practices.

As an illustration…

- Which product shows are higher at driving retail gross sales: four-ways, endcaps, cart rails, or sidekicks?

- Which product-page options usually tend to convert consumers into prospects: product descriptions, images, movies, or opinions?

- Which strategies are almost certainly to persuade consumers to strive a product: rebates, coupons, in-store demos, or digital demos?

- Which actions, taken by a retailer, will entice extra gross sales: cleaner shops, fewer out-of-stocks, friendlier staff, or extra choice?

Nicely, who higher to ask than the consumers themselves?

And in true March Insanity trend…

On the Court docket: Retail Bracketology

To grasp which ways are almost certainly to win retail gross sales, we created 4 completely different mini-tournaments: in-store promotions, ecommerce, product trial, and retailer actions.

Then, we known as on the consumers—hundreds of them—to find out the winners. In all, we collected over 2,500 survey responses* throughout two rounds of surveys.

*All survey respondents have been U.S. adults a minimum of 18 years of age and smartphone homeowners. The surveys have been executed by way of the Subject Agent platform, February 27 – March 1, 2022, with a non-random pattern of consumers. Survey #1 demos: Gender – Feminine (51%), Male (49%), Age – 18-20 (1%), 21-29 (16%), 30-39 (34%), 40-49 (29%), 50-59 (14%), 60+ (5%); Race/Ethnicity – Caucasian/White (64%), Latino/Hispanic (16%), African American/Black (14%), Different (6%). Survey #2 demos: Gender – Feminine (51%), Male (49%), Age – 18-20 (1%), 21-29 (16%), 30-39 (34%), 40-49 (29%), 50-59 (14%), 60+ (5%); Race/Ethnicity – Caucasian/White (64%), Latino/Hispanic (16%), African American/Black (14%), Different (6%).

It is time for tipoff!

Listed below are the outcomes from Retail Insanity 2022…

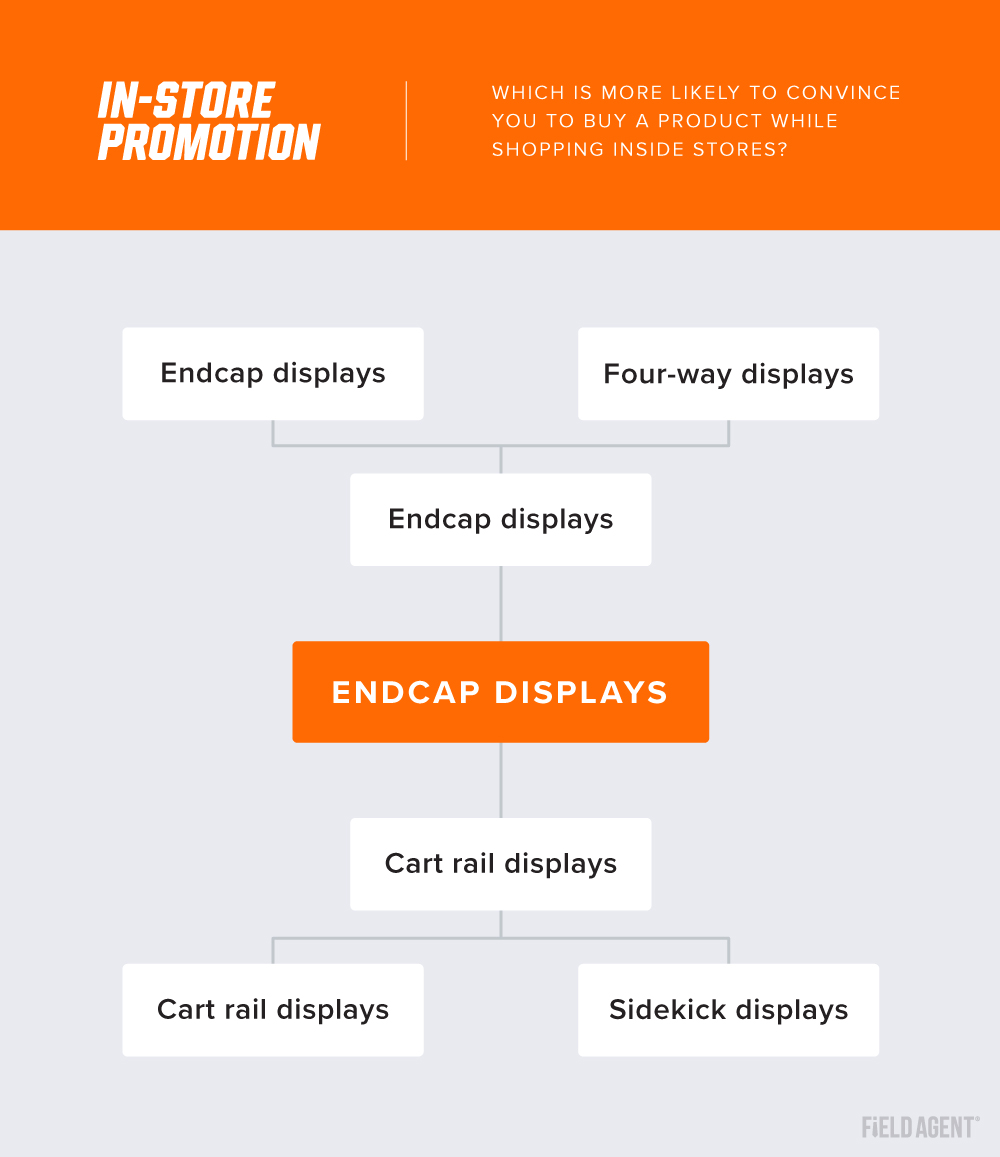

Tourney #1: Which product show is almost certainly to generate in-store, retail gross sales?

Shops typically comprise a colourful array of product shows and signage.

Yearly, manufacturers spend billions on point-of-purchase supplies to make sure their SKUs have the absolute best probability of successful in-store, retail gross sales—and product shows like four-ways, endcaps, cart rails, and sidekicks assist manufacturers command consumers’ consideration (and {dollars}).

Which is why profitable manufacturers take retail auditing critically, making certain their product shows are in-store, accurately assembled, correctly positioned, and adequately stocked. Easy auditing options like this one might help.

So we requested consumers, “Which [display] is extra more likely to persuade you to purchase a product whereas procuring inside shops for groceries/family consumables?” We offered descriptions and images of every show sort—to make sure survey respondents understood the distinction.

As you’ll be able to see, in first-round motion, endcaps (54%) bested four-ways (46%) in what turned out to be a relative nail-biter, whereas cart rails (65%) roundly defeated sidekicks (35%).

This pitted endcaps in opposition to cart rails within the championship matchup, and, regardless of a first-round scare, endcaps (63%) made fast work of cart rails (37%).

In response to the consumers themselves, then, endcap product shows have a relatively persuasive impact over their in-store buy selections.

Endcaps, FTW.

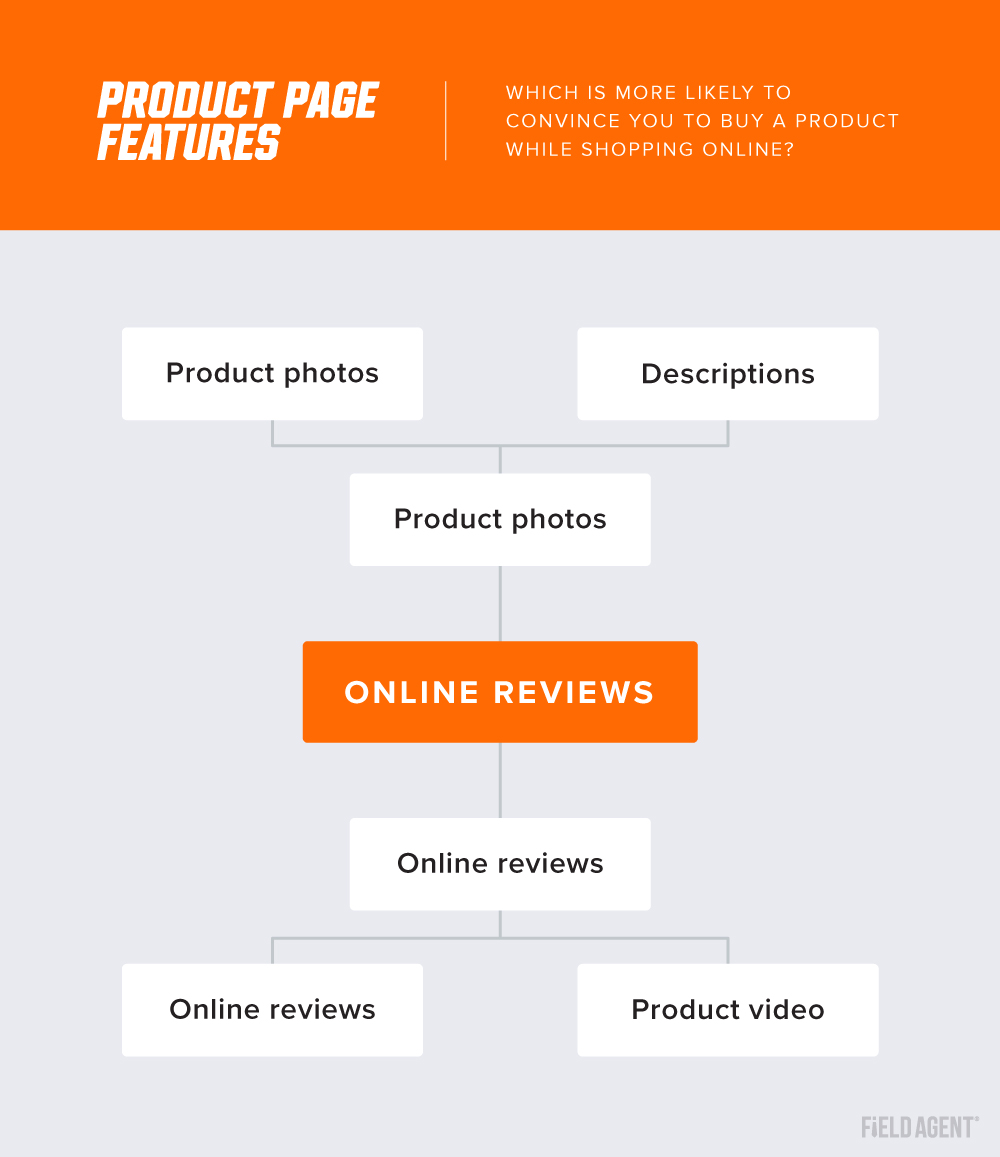

Tourney #2: Which ecommerce product-page characteristic is almost certainly to win on-line gross sales?

What an intriguing query. In any case, ecommerce gross sales proceed to say extra shopper {dollars}, and, by one estimate, will account for 25% of whole retail gross sales by 2025.

However which product-page options—product descriptions, images, movies, or opinions—are greatest at changing looking web shoppers into shopping for web shoppers?

Particularly, consumers have been requested, “Which is extra more likely to persuade you to purchase a product whereas procuring on-line…?” “Purchasing on-line,” we instructed respondents, contains every part from groceries to electronics, family consumables to family furnishings?

No contest. Product images (72%) completely annihilated product descriptions (28%) within the first spherical, whereas product opinions (78%) simply pushed apart product video (22%).

Which implies we bought a matchup of titans within the championship: product images versus product opinions. And we weren’t dissatisfied; the competition went proper all the way down to the wire.

In the long run, opinions (56%) beat images (44%) to say the title.

Given the sturdy showings by each product opinions and product images, the lesson right here is each clear and loud: manufacturers ought to guarantee each are on the high of their sport.

Which is changing into simpler by the day, with options like these assessment merchandise and this images package deal.

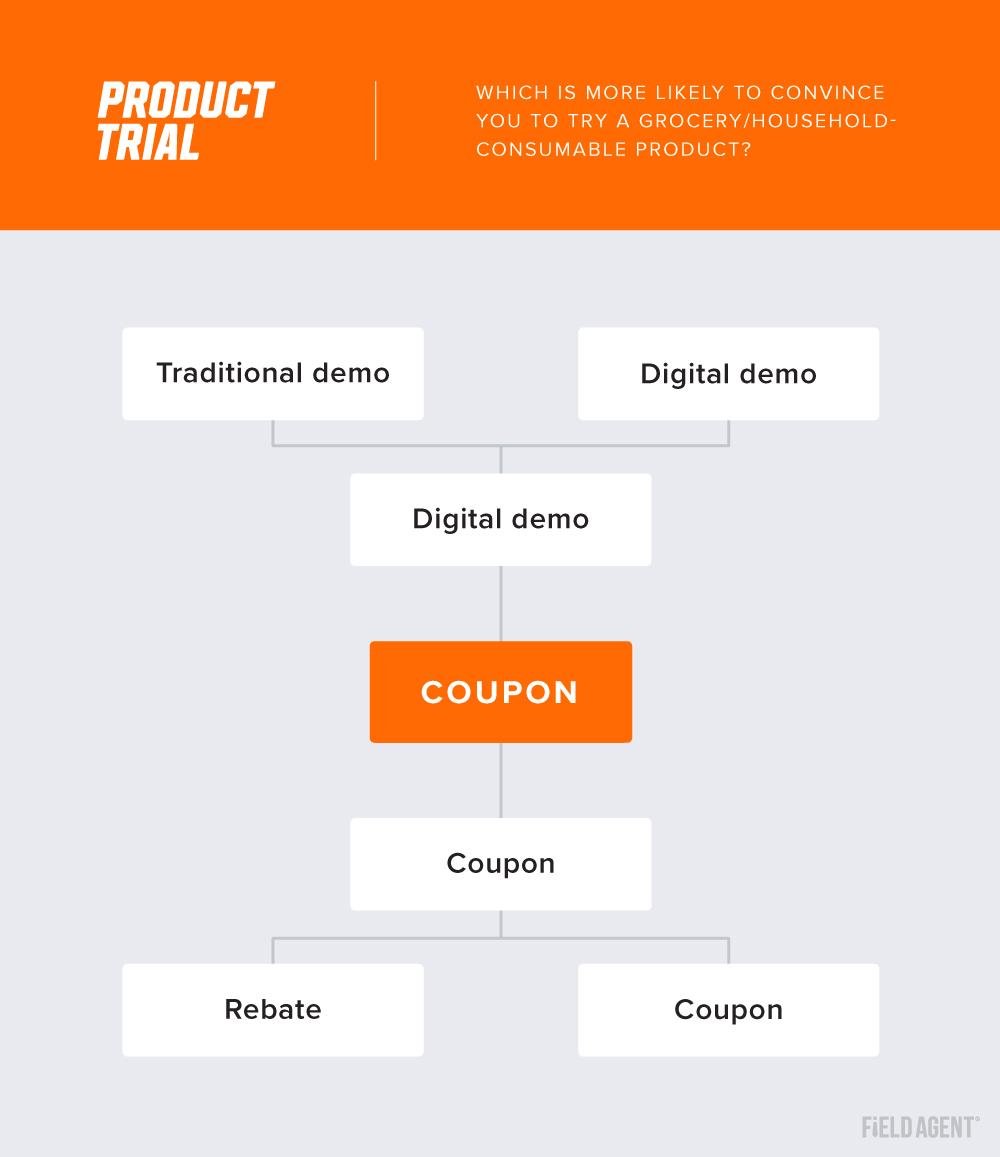

Tourney #3: Which exercise is almost certainly to drive product trial amongst consumers?

As we described in our article, How Do I Drive Product Trial, new merchandise at all times begin from behind, and so they should be capable of generate trial amongst consumers if they’re to succeed.

Right here, nonetheless, the query is: Which trial strategies are almost certainly to drive product trial?

Or, as we put it to consumers, “Which is extra more likely to persuade you to strive a grocery/household-consumable product?”

Rebates? Coupons? Conventional retailer demos? Or Digital Demos?

In spherical one, coupons (61%) simply dealt with rebates (39%), whereas Digital Demos (56%), described right here, bought the higher of conventional, in-store demos (44%).

And within the championship match-up, coupons (58%) defeated Digital Demos (42%) to hold residence the trophy.

In fact, coupons and demos are essentially other ways of driving first-time buy of merchandise. Right here, the underside line could also be that manufacturers have a few highly effective instruments—coupons and Digital Demos—for producing trial.

Tourney #4: Which retailer motion will lead to consumers shopping for extra merchandise?

However what in regards to the retailers? What can they do to earn extra {dollars} from retailer guests?

For this mini-tournament, we paired “protecting merchandise in-stock higher” in opposition to “friendlier, extra useful staff.” In-stocks received resoundingly, 81% to 19%, respectively.

Additionally within the first spherical, “cleaner, higher organized shops” went up in opposition to “wider choice of merchandise.” Cleaner/organized shops (54%) edged out wider choice (46%).

Organising a championship contest that includes “protecting merchandise in-stock higher,” which prevailed 60% to 40% over “cleaner, higher organized shops.”

For us at Subject Agent, the result right here was in all probability the least shocking of the 4 tournaments. Our analysis over time has discovered time and time once more how vital in-stocks are to retail consumers—and the way maddeningly irritating out-of-stocks are. Which is why we run a variety of on-shelf availability audits for manufacturers and retailers attempting to restrict OOSs.

Options for Your Retail Insanity

Oh, we get it. At occasions, retail is insanity. So many challenges; a lot unpredictability.

With a full suite of easy, quick, inexpensive instruments, the Subject Agent Market exists to assist firms of every kind reduce by way of the insanity and win at retail.

Our market incorporates the instruments you want—audits, opinions, insights, merchandising images, on-demand gross sales—to go on an actual successful streak. Test it out beneath.