[ad_1]

Baupost Group’s Portfolio & 10 Largest Public Equity Investments

Baupost’s public-equity portfolio is not heavily diversified. Instead, its holdings are concentrated, featuring high-conviction ideas. The portfolio numbers only 31 equities, the 10 most significant of which account for 75.1% of its total composition. The fund’s largest holding is Qorvo, Inc. (QRVO), occupying around 14.4% of the total portfolio.

Source: 13F filing, Author

Qorvo, Inc. (QRVO)

Qorvo develops and markets technologies and products for wireless and wired connectivity worldwide. It is the fund’s third-largest holding. If the forecasts regarding 5G are realized, the semiconductor industry (along with Qorvo) is likely to enjoy massive growth over the next few years.

At the same time, the company’s revenues are expanding, and Qorvo has started delivering sturdy profits as well. Shares are currently trading at around 11.6 times the company’s forward net income, which could be underappreciating Qorvo given its growth catalysts.

Baupost boosted its position by around 4% during the latest quarter. The company is now the fund’s largest holding.

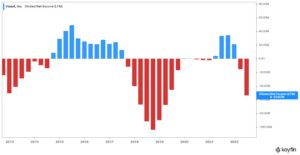

Viasat, Inc. (VSAT)

Media conglomerate Viasat is Baupost’s second-largest holding, accounting for roughly 12.1% of its portfolio. In the current landscape, the legacy media conglomerates have been in trouble as content creation is becoming increasingly decentralized.

Companies such as Netflix (NFLX), Amazon (AMZN), and even Apple (AAPL) have started producing their own content, while the news outlets have moved mostly online, generating sales through ads or a subscription fee.

In our view, Baupost holds a stake in Viasat as an activist investor due to the fund holding 21.8% of its total outstanding shares. This indicates the possibility that Baupost wants to have an active influence on how the company is run, with a potential aim towards modernizing.

For retail investors, the position could be a risky long-term bet, though an admittedly attractively priced one.

Veritiv Corporation (VRTV)

Veritiv Corporation functions as a B2B provider of value-added packaging products and services, as well as facility solutions, print, and publishing products and services internationally.

Note that while Veritiv’s shares have performed well over the past three years, the company’s business model suffers from extremely low margins. Net income margins over the past four quarters amount to just 3.64%. Hence the company’s ultra-low valuation multiple of 0.24X from a price/sales perspective.

The company is Baupost’s third-largest holding, and it was held steady during the quarter. Baupost holds around 24.2% of the company’s total shares, meaning it has an active influence on the company. The fund has been accumulating shares since Q3-2014.

Fiserv, Inc. (FISV)

Fiserv is a relatively new holding for Baupost. It was initiated in Q4 2021. Fiserv provides payment and financial services technology all over the globe, operating through its Acceptance, Fintech, and Payments segments. These include point-of-sale merchant acquiring and digital commerce solutions, security, and fraud solutions, among other services.

The company’s margin-rich business model is quite robust, resulting in consistent revenue and income growth. Shares are currently trading at a reasonable forward P/E of 15.2, while management has historically rewarded shareholders through stock repurchases.

Baupost trimmed its stake in the company by 11% during the latest quarter.

The Liberty SiriusXM Group (LSXMA) (LSXMK)

Baupost initiated a position in The Liberty SiriusXM Group in Q1-2020 and has since grown its equity stake steadily. The company specializes in the entertainment business in the U.S. and Canada. It offers music, comedy, talk, news, weather channels, podcast, and infotainment services via its proprietary satellite radio systems, streamed applications for mobile devices, and other consumer electronic products.

While the company has managed to gradually grow its revenues, net income margins have struggled to expand, leading to somewhat weak profitability.

Baupost boosted its position in the Liberty SiriusXM Group by 30% and 18% in each of Liberty SiriusXM Group’s different classes of shares during the previous quarter. The two classes of stock, A and K, account for 6.1% of its portfolio each.

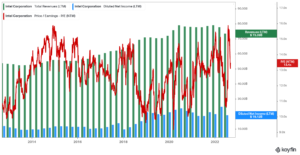

Intel Corp. (INTC)

Intel is Baupost’s seventh-largest holding, accounting for 5.9% of its total holdings. The semiconductor giant’s performance has been facing headwinds lately powered by competition advancing resulting in declining market share, supply chain constraints, and ongoing macroeconomic turmoil. These elements were evident in the company’s most recent earnings report.

For its Q2 results, the company reported a revenue decline of 22% to $15.3 billion/ On an adjusted basis, revenue fell 17%. Adjusted earnings-per-share came in at $0.29 compared to $1.24 in the prior year and was $0.41 less than expected. Revenue for the PC-Centric business decreased 25% to $7.7 billion for the quarter, primarily due to component shortages as well as the modem ramp down.

Datacenter and AI Group was lower by 16% to $4.6 billion. Network and Edge Group grew 11% to $2.3 billion due to the ongoing recovery from COVID-19. Mobileye and Accelerated Computing Systems and Graphics Group grew 41% and 5%, respectively. Intel Foundry Services fell 54%. The gross margin declined from 20.6% to 36.5%.

The company is now projected to earn $2.60 per share in 2022, down from $4.16 and $3.79 previously. This implies a P/E of just 11.9, According to analysts’ next-twelve-month EPS estimates, the forward P/E stands at 13.4.

Intel counts 8 years of consecutive annual dividend increases, with its most recent one being a 5.0% raise. The stock currently yields around 4.76% while the dividend itself is well-covered, as Intel is currently featuring a payout ratio of around 56%.

Baupost trimmed its position in Intel by 47% during the previous quarter.

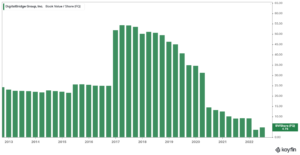

DigitalBridge Group, Inc. (DBRG)

DigitalBridge is an infrastructure investment firm. The company specializes in allocating capital and directing businesses across the digital landscape, comprising cell towers, digital infrastructure, data centers, edge infrastructure, real estate, fiber, and small cells, amongst others.

Judging by the deterioration of its book vale, the company’s investments have not been quite fruitful this far. Thus, Baupost is likely betting on a turnaround story.

DigitalBridge has been in The Baupost Group’s portfolio since Q3 2016. This implies that the company has lost a substantial amount of money on DigitalBridge thus far.

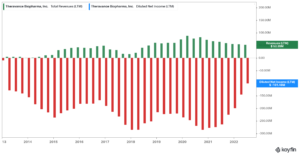

Theravance Biopharma, Inc. (TBPH)

Theravance Biopharma is a biopharmaceutical company focused on discovering, developing, and commercializing respiratory medicines worldwide. The company’s core offering is YUPELRI, a once-daily, nebulized long-acting muscarinic antagonist that can be utilized for the treatment of chronic obstructive pulmonary disease (COPD).

While Theravance has started generating sales, it remains widely unprofitable. Thus, only investors who thoroughly understand the space should consider it for their portfolios.

Theravance has had a place in the fund’s portfolio since Q2-2014. With shares near all-time lows, The Baupost Group has most likely lost quite a bit of money on the stock. The fund trimmed its position by 1% during the previous quarter. It’s worth noting that The Baupost Group owns around 17.7% of the company’s total outstanding shares.

Dropbox, Inc. (DBX)

With over 700 million registered users, Dropbox is the company behind one of the most well-known content collaboration platforms internationally. The company’s platform enables individuals, teams, and enterprises to collaborate and store data as smoothly as possible.

Dropbox’s revenues have been gradually expanding. As a result, Dropbox has been enjoying scaling economies, which has allowed the company to record profits lately. That said, there are multiple risks attached to Dropbox’s investment case, with the most significant being brutal competition. Bigger players in the space, such as Microsoft and Alphabet, offer similar products which they can bundle with the rest of their solutions for a lower price. Dropbox features robust customer retention, nonetheless.

Dropbox is Baupost’s tenth-largest holding, accounting for 3.6% of its total publicly-trading assets. The position was trimmed by 26% during the latest quarter.

[ad_2]

Source link