[ad_1]

Printed on November thirtieth, 2022 by Nikolaos Sismanis

Based in 2003, Scion Asset Administration, LLC is a non-public funding agency led by investing guru Dr. Michael J. Burry.

Scion Asset Administration has grow to be more and more well-liked attributable to Dr. Burry’s potential to establish undervalued funding alternatives all over the world. The fund solely has 4 shoppers. It expenses an asset-based administration payment that may be as excessive as 2% per 12 months, whereas it could additionally take as much as 20% of the worth of the appreciation from every shopper’s account.

The fund has round $291.7 million in property below administration (AUM), $41.3 million of which is allotted to the agency’s public fairness portfolio. Scion Asset Administration is headquartered in Saratoga, California.

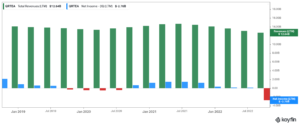

Traders following the corporate’s 13F filings over the past 3 years (from mid-November 2019 by mid-November 2022) would have generated annualized whole returns of 39.5%. For comparability, the S&P 500 ETF (SPY) generated annualized whole returns of 10.2% over the identical time interval.

Notice: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Scion Asset Administration’s present 13F fairness holdings under:

Maintain studying this text to be taught extra about Scion Asset Administration.

Desk Of Contents

Scion Asset Administration’s Fund Supervisor, Michael Burry

Michael J. Burry is thought by most because the “Huge Quick” investor as a result of eponymous film revolving round himself and his story throughout the days of the Nice Monetary Disaster, a task performed by Christian Bale. Nevertheless, Dr. Burry has a much wider monitor document within the investing world.

After attending medical faculty, Dr. Burry left to begin his personal hedge fund in 2000. He had already constructed a fame as an investor on the time by exhibiting success in worth investing. Particularly, his picks had been printed on message boards on the inventory dialogue website Silicon Investor again in 1996, with their returns being excellent! The truth is, Dr. Burry had showcased such nice stock-picking expertise that he drew the curiosity of firms similar to Vanguard, White Mountains Insurance coverage Group, and famend traders similar to Joel Greenblatt.

However, it’s Dr. Burry’s legendary performs previous to the Nice Monetary Disaster and the huge returns that adopted that pushed his title into the worldwide highlight. Notably, in 2005, Dr. Burry began to focus on the subprime market. Based mostly on his evaluation of mortgage lending practices utilized in 2003 and 2004, he precisely forecasted that the actual property bubble would come tumbling by 2007.

His evaluation resulted in him shorting the market by convincing Goldman Sachs and different funding companies to promote him credit score default swaps towards subprime offers he noticed as weak. Curiously sufficient, when Dr. Bury needed to pay for the credit score default swaps, he skilled an investor revolt, as some traders in his fund feared his prophecy was inaccurate, requesting to withdraw their funds. In the end, Burry’s evaluation proved proper. Not solely did he make a private revenue of $100 million, however his remaining traders earned greater than $700 million.

For example how profitable Dr. Burry’s picks had been from Scion Asset Administration to the Nice Monetary Disaster, the hedge fund recorded returns of 489.34% (web of charges and bills) between its inception in November 2000 to June 2008. As compared, the S&P 500 returned just below 3%, together with dividends, over the identical interval.

Michael Burry’s Funding Philosophy & Technique

Michael Burry’s complete funding philosophy will be summed as much as the idea of “Worth Investing”. He has acknowledged greater than as soon as that his funding model relies on Benjamin Graham and David Dodd’s 1934 ebook Safety Evaluation. In his phrases: “All my inventory selecting is 100% primarily based on the idea of a margin of security.”

Dr. Burry doesn’t differentiate between small-caps, mid-caps, tech shares, or non-tech shares. He solely seems for the undervalued parts in them, no matter their sector and sophistication. Exactly as a result of he doesn’t concentrate on a selected trade and since the essence of economic metrics shifts by trade and every firm’s place within the financial cycle, Dr. Burry makes use of the ratio of enterprise worth (EV) to EBITDA when researching funding concepts.

Accordingly, he disregards price-to-earnings ratios to dodge being deceived by an organization’s acknowledged metrics which will be deceptive primarily based on the underlying state of the economic system and macros which will profit or hurt the corporate at a given cut-off date. Relatively, he pays consideration to off-balance sheet metrics and pure, free money stream.

Scion Asset Administration’s Noteworthy Portfolio Modifications

Throughout its newest 13F submitting, Scion Asset Administration executed the next notable portfolio changes:

Noteworthy new Stakes:

- Qurate Retail Group Inc Class A (QRTEA)

- CoreCivic Inc. (CXW)

- Aerojet Rocketdyne Holdings, Inc. (AJRD)

- Constitution Communications Inc (CHTR)

- Liberty Latin America Ltd Class C (LILAK)

Noteworthy new Sells:

Scion Asset Administration’s Portfolio & 10 Largest Public Fairness Investments

Scion Asset Administration’s public-equity portfolio is closely concentrated. The portfolio numbers solely six equities, with The GEO Group accounting for 37.4% of its holdings. The truth is, aside from The GEO Group, which was Scion Asset Administration’s solely publicly-traded holding in Q2 2022, all different 5 holdings are totally new and had been added to the portfolio in Q3 2022.

Supply: 13F submitting, Creator

The GEO Group, Inc. (GEO) & CoreCivic, Inc. (CXW)

Personal jail giants The GEO Group and CoreCivic collectively account for 54.2% of Scion Asset’s administration public fairness holdings.

The GEO Group is a specialty REIT that owns, operates, and manages correctional, detention, and reentry amenities within the US, UK, South Africa, and Australia. The portfolio is made up of a complete of 102 amenities, together with 82,000 beds. Greater than 90% of the beds are situated within the US. The corporate’s working revenue will be divided into three segments: US Safe Providers, Digital Monitoring and Supervision Providers, Reentry Providers, and Worldwide Providers. They contribute round 66%, 13%, 11 and 9% of whole revenues, respectively.

CoreCivic’s operations are fairly related, with the REIT proudly owning and working 45 correctional and detention amenities with a complete design capability of roughly 68,000 beds. It additionally owns and operates 24 residential reentry facilities and eight properties for lease to 3rd events and utilized by authorities businesses, totaling 1.8 million sq. ft.

Each firms are at the moment going through heavy challenges, together with all main banks slicing ties with personal prisons and President. Biden’s orders, which directed the legal professional normal to not renew Justice Division contracts with privately operated legal detention amenities. That mentioned, each firms have navigated these challenges fairly competently, which, mixed with their deep-value traits, defined why Dr. Burry has closely betted on them.

Particularly, each firms have suspended their dividends, which has allowed them to deleverage quickly. In consequence, they are going to quickly be capable to self-fund their progress and total operations. Moreover, they’ve been using loopholes by third events, which primarily nonetheless permit them to cope with federal businesses.

Dr. Burry elevated Scion’s place in The GEO Group by 302%, with the fund now proudly owning round 1.64% of the corporate’s excellent shares. The place in CoreCivic was simply initiated, with the fund now proudly owning round 0.6% of the corporate’s excellent shares.

Qurate Retail, Inc. (QRTEA)

Qurate gives a variety of client merchandise, primarily by way of merchandise-focused televised purchasing applications. The corporate additionally operates as a web-based retailer promoting attire for all, amongst different merchandise, similar to residence, equipment, and wonder merchandise. Regardless of Qurate producing revenues near $14 billion every year, the corporate is at the moment valued at simply $919 million attributable to experiencing extended challenges in terms of producing sustainable earnings. The corporate can also be closely indebted, with $6.6 billion in long-term debt overloading the steadiness sheet.

However, Dr. Burry probably sees worth on this distressed fairness story, leading to him initiating a place within the inventory. Scion Asset Administration now owns 1.31% of Qurate Retail’s excellent shares.

Aerojet Rocketdyne Holdings, Inc. (AJRD)

Aerojet Rocketdyne develops and manufactures aerospace and protection merchandise and methods, which it gives to the Division of Protection, the Nationwide Aeronautics and House Administration, and aerospace and prime protection contractors. Nasa’s Orion Important Engine can also be been powered by Aerojet’s know-how. With the continued warfare in Ukraine benefiting protection firms nowadays and funding towards house exploration rising, the corporate is ideally positioned within the present market panorama. However, Aerojet’s web margins stay relatively skinny.

Aerojet is one other one among Scion’s brand-new holdings, accounting for 13.7% of the fund’s public fairness holdings.

Constitution Communications, Inc. (CHTR)

Constitution Communications is a broadband connectivity and cable operator firm serving residential and industrial clients throughout america. The corporate’s subscription-based video companies embrace video on demand, high-definition tv, and pay-per-view companies. Constitution additionally gives Web and WiFi companies.

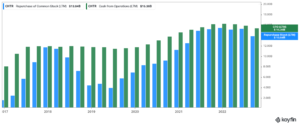

Because of the nature of telecommunication services and products, Constitution Communications is a extremely worthwhile enterprise whose revenues are largely recurring. Not like most of its friends, Constitution doesn’t pay dividends. As an alternative, the corporate deploys the vast majority of its free money flows to repurchase its personal shares. Since 2016, Constitution Communications has lowered its share depend by 42.7%.

Scion initiated a place in Constitution Communications in Q3 2022. The inventory now accounts for 8.2% of the fund’s portfolio.

Liberty Latin America Ltd. (LILAK)

Liberty Latin America gives operates TV networks in Latin America by its C&W Caribbean and Networks, C&W Panama, Liberty Puerto Rico, VTR, and Costa Rica segments. The corporate additionally owns a sub-sea and terrestrial fiber optic cable community.

Liberty LA seems to be one other deep-value case that matches Dr. Burry’s investing standards. The corporate generates revenues of practically $5 billion but trades at a market cap of practically $1.7. Nevertheless, the corporate has a tough time recording significant earnings. It’s additionally closely indebted, that includes a long-term debt place of $7.6 billion.

However, with free money stream bettering these days, Liberty Latin America could also be a deep-value alternative price trying out.

Liberty Latin is Scion Asset Administration’s smallest holding. The inventory occupies solely 2.7% of the fund’s portfolio.

Ultimate Ideas

Following the huge triumph he skilled by efficiently predicting the disaster of 2007-2008, Dr. Michael Burry has grown right into a dwelling legend on the planet of finance. His solemn investing philosophy has resulted in outsized market returns over the previous few years, beating the S&P 500 by a large margin.

Whereas Scion Asset Administration’s portfolio lacks diversification, its holdings include traits that replicate Dr. Burry’s rules. However, most shares within the fund appear to be bearing their justifiable share of dangers. Thus, be aware and conduct your individual analysis earlier than allocating your hard-earned cash to any of those names.

Further Assets

See the articles under for evaluation on different main funding companies/asset managers/gurus:

In case you are fascinated by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The foremost home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link