gorodenkoff/iStock by way of Getty Photographs

Over the past couple of years, Science Functions Worldwide Company (NYSE:SAIC) was bouncing round between roughly $80.00 per share to $95.00 per share till Could 16, 2022. From there it took off, reaching its 52-week excessive of $117.94 per share on December 5, 2022. Since then, it has been buying and selling in a variety of $101 per share to $109 per share.

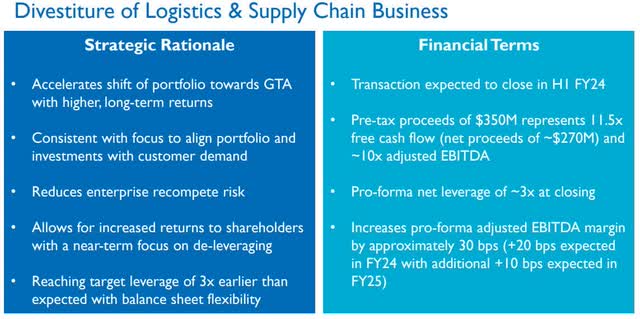

Though it hasn’t closed but, the upcoming divestiture of its logistics and provide chain enterprise has lowered the outlook for income however boosted the outlook for margins going ahead. Within the close to time period, it will additionally underperform due to there being 5 much less working days within the present quarter.

The corporate has first rate funded backlog, however a a lot bigger unfunded backlog that will not carry out as anticipated if the financial system goes bitter and firms change their spending priorities, which I consider is prone to occur.

I feel over the subsequent 12 months or so the corporate goes to face extra headwinds than tailwinds, which is prone to put downward stress on its share worth. Additional out, as soon as there’s extra visibility on the strikes of the Federal Reserve in response to inflation, and the financial fallout that usually accompanies increased rates of interest, SAIC is positioned for a long-term run that’s most likely going to reward shareholders over time.

On this article we’ll take a look at a few of its latest numbers, vital issue grades, and the way the inventory might be going to commerce within the close to and long run.

TradingView

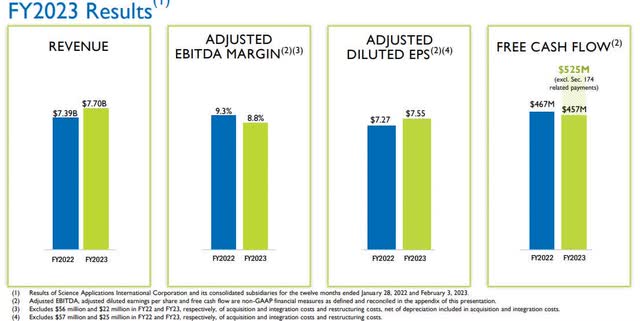

A few of the Numbers

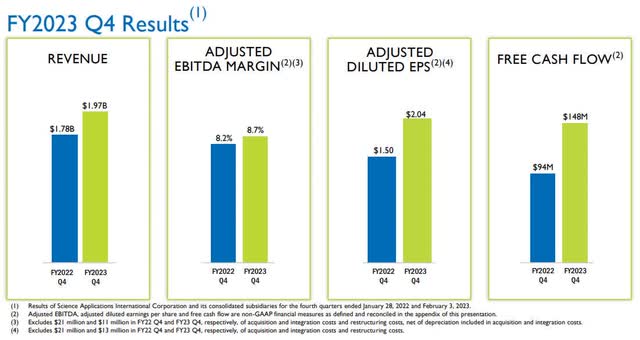

Income for the fourth fiscal quarter of 2023 was $1.97 billion, in comparison with income of $1.78 billion within the fourth fiscal quarter of 2022, up 10 p.c year-over-year, however up solely 2 p.c when making an allowance for 5 extra workdays within the reporting interval in comparison with the identical fiscal quarter of 2022. Income for full 12 months fiscal 2023 was $7.70 billion, in comparison with income of $7.40 billion for full 12 months fiscal 2022.

Investor Presentation

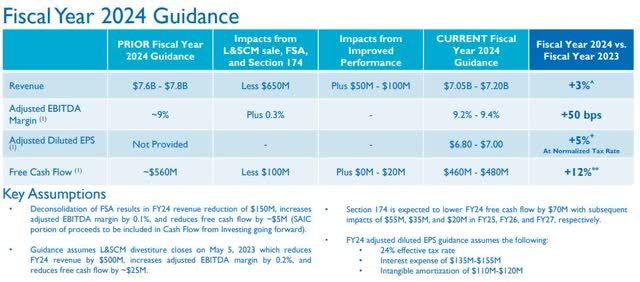

With the divestiture of its logistics and provide chain enterprise, which has but to shut, the corporate guides for full 12 months fiscal 2024 income to be in a variety of $7.05 billion to $7.20 billion.

Investor Presentation

Web revenue within the reporting interval was $74.00 million, or $1.34 per diluted share, in comparison with $43.00 million, or 0.76 per diluted share within the fourth fiscal quarter of 2022. Web revenue for full fiscal 12 months 2023 was $300.00 million, or $5.38 per diluted share, in comparison with $2.77 million, or $4.77 per diluted share for full fiscal 12 months 2022.

Free money circulate within the fourth fiscal quarter was $148.00 million, leading to free money circulate of $457.00 million for full fiscal 12 months 2023, decrease by $10.00 year-over-year. That was decrease than earlier steering of $500.00 million to $520.00 million as a result of a $70.00 million tax fee wasn’t included within the steering.

Money and money equivalents as of February 3, 2023, the top of its fiscal 12 months, was $109.00 million, in comparison with money and money equivalents of $106.00 million as of January 28, 2022.

The corporate held long-term debt of $2.34 billion on the finish of fiscal 2023, in comparison with $2.37 billion as of January 28, 2022.

The corporate had a funded backlog of $3.6 billion as of February 3, 2023, and an unfunded backlog of $20.25 billion.

Investor Presentation

A few of its Issue Grades

Profitability

Whereas SAIC had an honest total B- profitability grade, in some key metrics it underperformed the sector median, similar to a number of margin classes.

Its vital internet revenue margin metric was 3.58 p.c, in comparison with the sector median of 6.49 p.c, decrease by -(44.90) p.c.

EBIT margin was 6.76 p.c, in comparison with the sector median of 9.72 p.c, decrease by -(30.46) p.c.

EBITDA margin was 8.69 p.c, in comparison with the sector median of 13.29 p.c, decrease by -(34.63) p.c.

It was stronger with return on fairness and return on capital, beating the sector median by 16.85 p.c and 4.01 p.c. With return on belongings, it was decrease than the sector median by -(8.11) p.c.

The place it outperformed was in money from operations, which got here in at $490.00 million, in comparison with the sector median of $194.43 million, increased by 152.02 p.c.

Searching for Alpha

Development

Its development grade was poor compared to the sector median, with (YoY) income development of two.56 p.c, in comparison with the sector median of 15.02 p.c, decrease by -(82.83) p.c. Income development (FWD) is -(0.36) p.c, in comparison with the sector median of 8.55 p.c.

EBITDA development (YoY) was -(1.21), in comparison with the sector median of 15.61 p.c. EBITDA development (FWD) is 0.28 p.c, in comparison with the sector median of 9.53 p.c, decrease by -(97.01) p.c.

EPS diluted development (YoY) was -(5.44) p.c, in comparison with the sector median of 14.40 p.c. EPS diluted development (FWD) is 1.17 p.c, in comparison with the sector median of 10.51, decrease by -(88.92) p.c. EPS (FWD) long-term development (3-5Y CAGR) is 2.00 p.c, in comparison with the sector median of 11.17 p.c, decrease by -(82.09) p.c.

Valuation

The valuation grade of SAIC was low in comparison with the sector median, primarily from various its (FWD) metrics having low grades.

For instance, P/E GAAP (FWD) was 20.28, in comparison with the sector median of 18.04, increased by 15.48 p.c. One other was PEG Non-GAAP, which was 7.77, in comparison with the sector median of 1.52, increased by 411.14 p.c.

One valuation metric it did effectively in was Worth/Gross sales (FWD), coming in at 0.81, in comparison with the sector median of 1.23, decrease by -(34.10) p.c.

Based mostly upon the divestiture of its logistics and provide chain enterprise and fewer working days, income numbers will probably be decrease for now, however margin metrics ought to begin to enhance within the quarters forward, serving to to spice up its backside line.

Administration guides for margins in fiscal 2024 to be in a variety of 9.2 p.c to 9.4 p.c, in comparison with margin of 8.8 p.c in fiscal 2023. Then again, EPS steering for fiscal 2024 was for a variety of $6.80 to $7.00, decrease than the EPS of $7.55 for fiscal 2023. Larger tax and rates of interest are the main unfavourable catalysts there.

Investor Presentation

Conclusion

SAIC, whereas having fun with a strong 12 months in regard to its share worth, remains to be below some stress in various metrics compared to the sector median.

The mix of the sale of its logistics and provide chain enterprise and 5 much less working days, will put some stress on income throughout calendar 2023, and if the financial system worsens and spending tightens up, it’s going to worsen earlier than it will get higher, leading to a probably robust 12 months for SAIC.

But, if there’s a recession and the share worth corrects, it might be alternative to take a place within the firm due to its long-term prospects, even when it is not in a position to meet the potential of its hefty, unfunded backlog.

With the robust efficiency the inventory had in 2022, and the near-term headwinds it faces, I feel it is due for a correction, and that may be time to strike primarily based upon the long-term potential development potential the corporate has.