Nastassia Samal/iStock by way of Getty Photos

Allocating capital in regular bull markets just isn’t typically very difficult. Most traders need a steadiness of whole returns and earnings, and when the market goes up yearly, traders can get away with pretty easy investing methods. Investing, nonetheless, is usually harder when markets are falling, or when you’ve an uneven market with pockets of power in sure sectors. Inflation makes investing harder as nicely, and earnings and dividend traders aren’t having a straightforward time getting inflation modify earnings and whole returns in this sort of an inflationary setting.

One main dividend and earnings fund is the Schwab US Dividend Fairness alternate traded fund (NYSEARCA:SCHD).

Markets proper now are risky for various causes, however the two fundamental the explanation why many of the broader indexes have been risky during the last 2 months are geopolitical tensions and inflation. Geopolitical tensions have clearly escalated with the Russian invasion of Ukraine, and inflation has been a serious challenge impacting the US and different international economies for a while now.

Geopolitical tensions come and go, however the inflationary setting we’re in nonetheless appears more likely to persist for a while for a number of causes.

Inflation has been a serious challenge within the US financial system, with worth will increase considerably impacting costs throughout the board for a number of years, and the speed of inflation has been 5% or greater each month since Might of 2021. Simply in February the patron worth index confirmed that inflation rose to 7.9%, the very best since 1982. The month-to-month charge of inflation within the US financial system has been 5% or greater since Might of 2021 as nicely, or for 9 consecutive months. Clearly, the Russian invasion of Ukraine has exacerbated current inflationary pressures, however inflation was already persistently operating at 5% and better earlier than the latest Russian invasion of Ukraine.

Regardless of the feedback from the Fed, there aren’t any indicators that inflation is more likely to be transitory. Provide chain points, labor shortages, important authorities spending, low rates of interest, and geopolitical tensions, are all driving inflation. Most of those elements driving inflation ought to persist for not less than one other yr.

The excessive threat of continued inflation makes this Schwab US dividend Fairness fund unlikely to supply inflation adjusted earnings or whole returns for a number of causes.

The primary main drawback this fund has within the present setting is that holdings are considerably underweight power and uncooked supplies. The breakdown of this fund are as follows; 22% financials, 18% industrials, 15% expertise, 15% shopper defensive, 12.5% healthcare, 7% shopper cyclical, 5% communication, and simply 2% uncooked supplies and a pair of% power.

This fund is designed to ship regular earnings with out volatility, and the fund’s holdings are considerably underweight cyclicals, power shares, and uncooked and primary materials holdings. This fund focuses on defensive and noncyclical corporations. Not one of many fund’s high holdings, a holding of 4% or extra, is a cyclical firm, an power firm, or a uncooked materials inventory. The present yield of the fund is simply 2.95%, which gives nothing near inflation adjusted earnings. This fund does have some holdings of firm’s with important worldwide operations resembling Coke and Pepsi, however as is predicted with the fund’s identify, this fund is targeted on the US financial system.

Along with successfully being underweight inflation, this fund additionally has some important holdings of persistently underperforming shares resembling IBM (IBM) and Verizon (VZ). IBM has persistently underperformed each the expertise sector and the broader indexes as an entire for a while, and this holding is almost 4% of the fund. IBM has been one of many worst performing giant cap tech shares available in the market since 2014. Verizon is one other giant holding of this fund, and this inventory has persistently underperformed the broader indexes during the last 5 years as nicely.

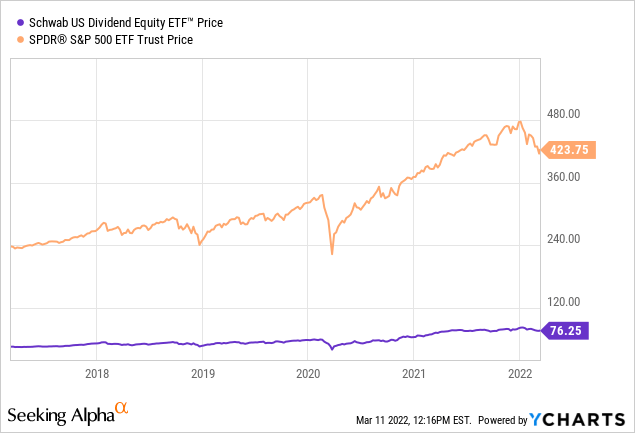

Lastly, this fund just isn’t reaching the 2 fundamental functions that the fund seeks to realize, regular earnings and decrease ranges of volatility. This fund at the moment yields 3%, nothing near inflation adjusted earnings, and the fund has nonetheless been risky at instances, regardless of additionally persistently underperforming the S&P 500 during the last 5 years.

There are different alternate traded funds are possible higher positioned to supply higher earnings and whole returns each short-term and long-term. Two alternate traded funds targeted on dividends and earnings which can be successfully obese inflation are the Wisdomtree U.S. Excessive Dividend Fund (DHS), and the Digital Actual Asset Revenue ETF (VRAI). Each these funds have a mixture of cyclical and defensive holdings, and each are considerably obese power shares.

Buyers like individuals are totally different, and traders targets typically additionally change at numerous factors in these people’ lifetimes. Nonetheless, portfolios ought to be capable of ship inflation adjusted earnings and whole returns over the long-term, and the Schwab U.S. dividend fairness fund has failed to do this for an prolonged time period. This fund has additionally nonetheless be extra risky than what traders would anticipate from a fund obese defensive corporations. Previous outcomes aren’t at all times predicate of future efficiency, however with inflation more likely to persist for a while within the U.S. and overseas, there are more likely to be higher positioned funds and investments for traders looking for inflation modify earnings and whole returns.