Now that Russia has come proper out and mentioned it would solely transact in Rubles when promoting oil to “unfriendly” nations, I’m anticipating gold to be the following secure haven for the nation to fall again on, because it desperately tries to backstop each its foreign money and its financial system.

The backstopping of the Ruble with gold can are available many varieties and doesn’t need to be a direct peg from the Ruble to gold – it will probably additionally embody the much more seemingly situation of accepting fee for oil, the nation’s most ubiquitous and worthwhile useful resource, in gold.

A brand new directive from President Vladimir Putin noticed the Russian chief say in a televised authorities assembly yesterday:

“I’ve determined to implement … a sequence of measures to modify funds — we’ll begin with that — for our pure fuel provides to so-called unfriendly international locations into Russian rubles.”

I’ve been arguing for practically a month now that Russia would use its greatest commodity, oil, to assist backstop its foreign money.

I mentioned final month that Putin would push again on financial sanctions by “allying himself additional with China, and even discussing with China the prospects of a financial system exterior of the present international financial system.”

Tying the Ruble immediately to grease makes it “sound cash” of kinds, as a result of it’s tied to a commodity with demand which ostensibly will assist buoy demand for the foreign money.

In truth, OPEC’s agreeance to cost oil in {dollars} for the final 4 a long time has been a contributor in serving to assist the U.S. greenback because the world’s reserve foreign money in the very same means that Russia plans on utilizing oil to assist the Ruble. And as Russia is working to tie the Ruble to grease, the decades-old petrodollar settlement with Saudi Arabia seems to even be in danger.

The report about Russia accepting Rubles for oil, printed by NPR, ends by saying:

Russian leaders have additionally hinted at extra extreme penalties as members of the EU bloc have sought — so far unsuccessfully — to impose an outright embargo on Russian imports.

I can’t assist however suppose that if financial constraints on Russia proceed to tighten, or if the nation’s plan to salvage the Ruble doesn’t work as supposed, the following step decrease within the international financial safe-haven fortress then turns into gold.

This publish has been printed with no paywall as a result of I consider its content material to be far too essential. If in case you have the means, benefit from the work, and wish to assist the weblog, I’d be humbled and honored to have you ever as a paid subscriber.

Paid subscribers get detailed evaluation on my portfolio positions, evaluation of macro from my “Fringe” perspective, and my ideas on politics and present occasions, near-daily:

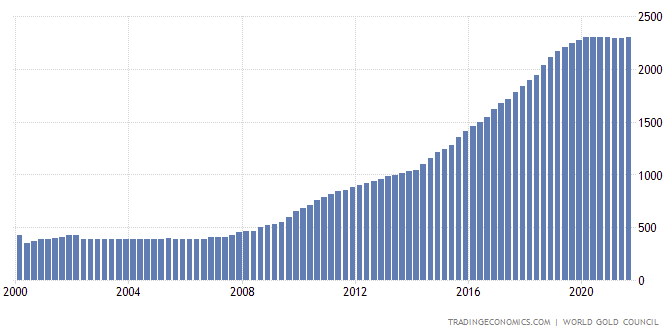

I’ve famous that previously decade, Russia and China have steadily constructed up their gold reserves (in my view, in preparation for an occasion like this, the place they are going to be compelled to de-dollarize).

Demand for gold in Russia might proceed to be voracious, particularly now that the West is contemplating sanctions on Russia’s gold, together with stopping the nation from promoting gold on worldwide markets.

Hilariously, the New York Occasions reported that U.S. Senators think about Russia’s gold to be a “loophole” in sanctions towards the nation:

The senators advised that Russia’s $130 billion price of gold reserves had been a loophole within the sanctions that had been imposed on Russia’s central financial institution. They mentioned that Russia was laundering cash via gold by shopping for and promoting it for high-value foreign money.

Nevertheless it isn’t a loophole: that is the rationale gold is a secure haven. There’s virtually all the time going to be a bid for it someplace – that’s a part of what makes it sound cash.

And so stopping Russia from promoting their gold truly does them a favor, of kinds, and encourages them to proceed to construct their stockpile. In truth, eradicating provide from the market could solely serve to assist gold’s value in greenback’s rise, probably

If the nation’s plan to backstop the Ruble with oil doesn’t work, Russia may also select to set a value per barrel for oil, in gold, and settle for gold for its oil. This could assist stockpile extra gold, which in flip would backstop the Ruble additional, and would assist the nation construct a firmer basis to attempt to rebuild its financial system off of, when the time comes for Russia to re-open and re-boot its financial system with out the assistance of the Western world.

This isn’t some complicated financial coverage evaluation, it simply appears to be the following step for Russia, based mostly on frequent sense. I stand by what I wrote in a March 10 article about why I like gold miners:

Not solely are individuals flocking to gold as a secure haven, however persons are seemingly paying attention to the truth that Russia appears to suppose it will probably defend the ruble – which has tanked towards different fiat currencies – with its commodities and its tons of of billions of {dollars} in gold reserves.

Discuss main a fucking horse to water for gold buyers.

The bull case for gold, as I see it, stays sturdy on three totally different fronts.

-

Russia might probably wish to begin transacting in gold and will peg it to the value of a barrel of oil. There’s all the time going to be a bid for gold someplace on the earth. Caught off guard, when Western nations understand that gold isn’t a “loophole” however is the principle software Russia (and sure China) will use to problem the greenback, demand for the secure haven will proceed to extend.

-

Inflation globally, particularly in power, will seemingly improve for so long as international stress on Russia’s financial system continues. “…further sanctions on Russian power might gas inflation expectations, which might be favorable for gold,” Stephen Innes, managing accomplice at SPI Asset Administration Pte., advised Bloomberg yesterday.

-

Inflation within the U.S. continues to be a “downside beneath the issue” of the geopolitical battle, and I’m nonetheless not satisfied now we have an answer that isn’t going to outcome within the Fed finally, as soon as once more, implementing extra QE and the value of gold responding by shifting considerably larger.

It was simply a few weeks in the past that I wrote an article arguing that the financial sanctions now we have solid upon in Russia, as a consequence of its invasion of Ukraine, seemingly mark the start of a interval the place China and Russia would bifurcate the worldwide financial system, main them to finally problem the U.S. greenback’s reserve standing.

Regardless of how this bifurcation occurs, I count on that gold will function the inspiration for what is going to in the end grow to be the soundest financial system going ahead.