Gold Basic Forecast – Bearish

- Gold costs noticed worst weekly efficiency since June 2021, falling 3.5%

- Absent escalating Ukraine dangers, a rising price surroundings might damage XAU

- Fed Chair Jerome Powell and firm to be talking within the week forward

Gold costs weakened about 3.5% within the worst weekly efficiency since June 2021 regardless of a surge within the yellow metallic that originally occurred amidst the outbreak of Russia’s assault on Ukraine. Ongoing value motion in XAU/USD continues to underscore the difficult street forward for it to have the ability to achieve significant upside value motion, absent additional escalation round Ukraine.

With such excessive inflation permeating internationally, lately elevated by geopolitical tensions in Europe, central banks have been stepping up. This previous week, the Federal Reserve started its price hike cycle because the Financial institution of England continued its personal. Gold costs are sometimes considered as an anti-fiat instrument, on condition that the yellow metallic has no inherent yield for merchants holding on to it.

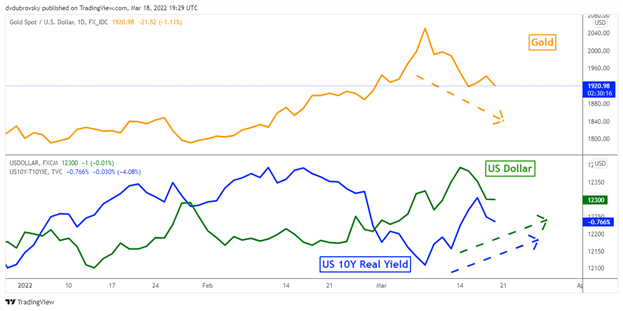

In a rising rate of interest surroundings, particularly globally, that makes holding XAU/USD comparatively much less interesting. On the chart beneath, gold might be seen aiming decrease in latest days because the US Greenback and 10-year actual yields climbed. The latter is generated by subtracting the distinction between nominal and breakeven charges, yielding the inflation-adjusted return.

The week forward is comparatively mild when it comes to financial occasion threat, putting the main target for gold on broader elementary themes. That is primarily a mixture of the place Ukraine and bond yields are heading. A slew of Fedspeak will cross the wires, starting from Chair Jerome Powell, to San Francisco department president Mary Daly, to St. Louis department president James Bullard.

Markets shall be intently gauging their ideas on inflation and Ukraine. In direction of the tip of final week, bets of a 50-basis level price hike on the Might assembly elevated to about 50%. In the meantime, China’s President Xi Jinping spoke along with his US counterpart, Joe Biden, saying that the invasion “shouldn’t be one thing we wish to see”. Absent rising Ukraine tensions, gold might battle to search out upside momentum forward.

Try the DailyFX Financial Calendar to see when Fed policymakers shall be talking this coming week!

Gold Versus US 10-12 months Actual Yield and US Greenback – Day by day Chart

Chart Created in TradingView

–— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter