Monetary markets have had a bumpy journey currently, inspiring contemporary issues that this yr’s rebound from 2022’s sharp loss has run its course. It’s untimely to dismiss that chance, however a overview of a number of units of ETF pairs for markets nonetheless leaves room for debate primarily based on costs by yesterday’s shut (Sep. 5).

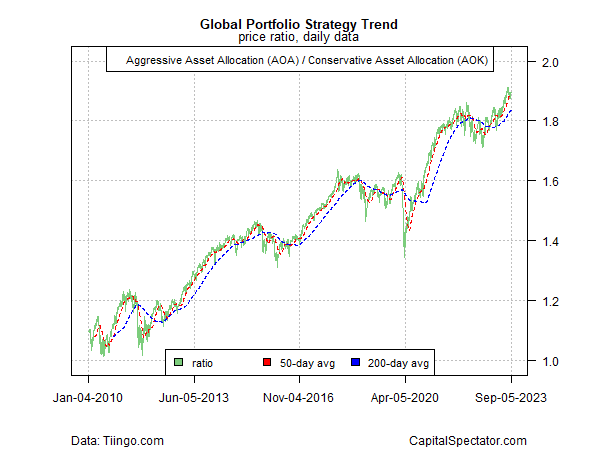

Let’s begin with the ratio for aggressive () and conservative () asset allocation ETFs. For the second, this world proxy of threat urge for food suggests {that a} bullish pattern stays intact. The newest downturn could flip right into a deeper rout, however for now, the upside bias endures.

International Portfolio Technique Pattern

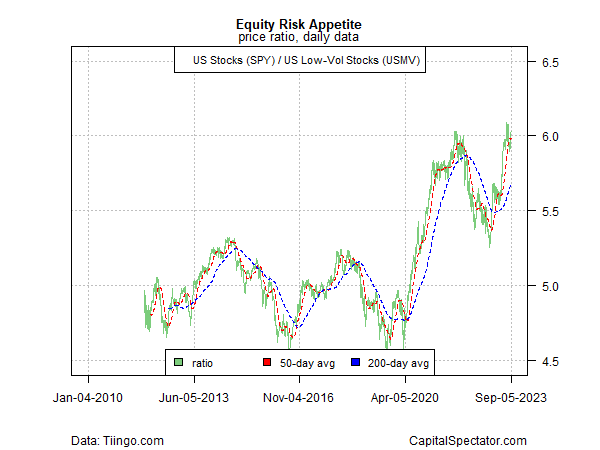

The chance urge for food for US shares additionally seems to be stable, primarily based on the ratio for US shares () vs. low-volatility shares (), the latter being a proxy of demand for a comparatively conservative/defensive equities technique.

SPY vs USMV Ratio Chart

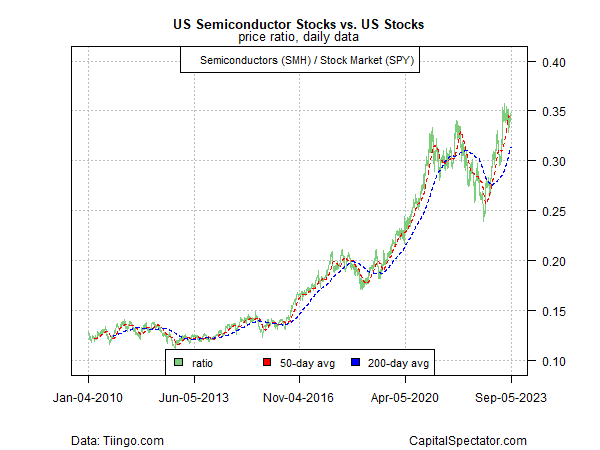

The bias in favor of risk-on can also be fairly robust primarily based on shares for semiconductor companies () vs. the broad US equities market (SPY). Semi-stocks are thought-about a proxy for the danger urge for food and the enterprise cycle.

SMH vs SPY Each day Chart

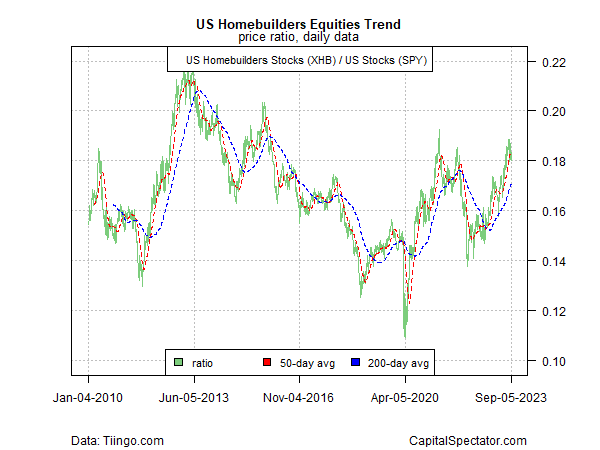

The relative power for cyclically-sensitive homebuilder shares () vs. the US equities market (SPY) additionally indicators ongoing power for the danger urge for food.

XHB vs SPY Each day Chart

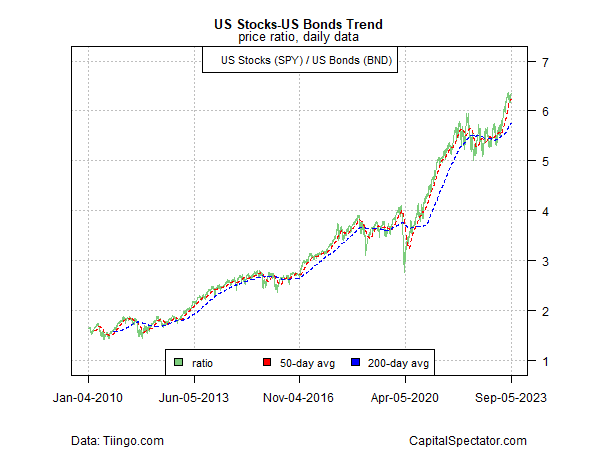

The rise in bond yields not too long ago means that the attract of fastened earnings threatens the outlook for shares. Why take the danger of the equities market when you may earn a protected yield in authorities securities?

That view is beginning to resonate, however the value motion of late has but to disclose a transparent reversal for the danger urge for food. Word that the relative power for US shares (SPY) vs. US bonds () continues to point a robust upside bias.

SPY vs BND Each day Chart

The caveat is that market tendencies finish ultimately, however calling the precise level when a real reversal begins is unimaginable. Solely with hindsight will main tops and bottoms turn into apparent.

For the second, it’s not clear that this yr’s restoration within the demand for threat has run out of highway. A turning level will turn into apparent in time, however for now, the pattern indicators for threat nonetheless skew optimistic.