The ended the day up about 40 foundation factors yesterday, exhibiting little response to the rising , elevated 1-month implied correlation indexes, a steeper yield curve, and a weakening . This muted response highlights the affect of CTA flows, which have been steering the market just lately.

The 1-month implied correlation index, the VIX, the VVIX, and the S&P 500 is not going to typically rise on the identical day. But, that’s exactly what has been taking place over the previous few days. The implied volatility metrics usually commerce reverse to the money market.

The BLS reported yesterday that 818,000 fewer jobs had been created by March 2024 over the previous yr than initially estimated. This information initially pushed yields decrease to start out the day.

Then, the Fed had been launched at 2 PM ET, revealing that it might be acceptable to chop charges in September.

Unsurprisingly, this led to some steepening of the yield curve, however the steepening course of is simply starting, and there’s possible a lot additional to go.

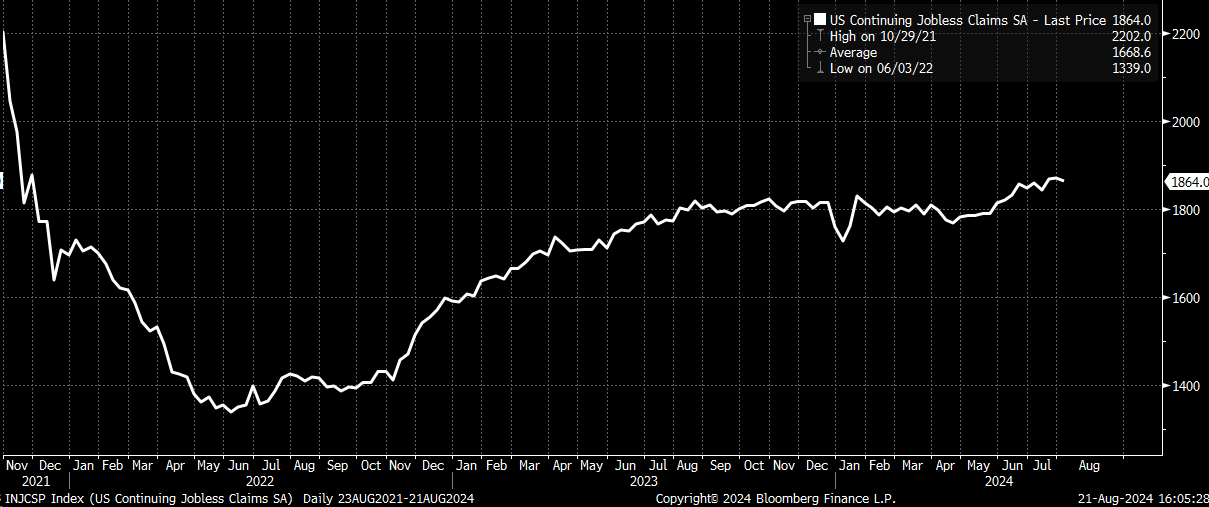

Jobless Claims to Get One other Market Response?

Right this moment is day, which may both assist or hinder the steepening course of. The final two weeks have seen some sturdy reactions to the info. Predicting the end result is unattainable, however the pattern for has usually elevated. Who is aware of, it’d even be forming a cup and deal with sample.

May this be why the implied correlation index, the VIX, and the VVIX had been up yesterday? Presumably, however with the VIX 1-day round 11.6, it doesn’t seem to be a powerful sufficient purpose; the VIX 1Day is just too low.

USD/CAD Appears to be like for a Backside – What It Means for S&P 500

In the meantime, the continues to be trying to find a backside across the help stage at 1.36. It appeared to seek out some stability round noon, however the pair surged sharply greater following the discharge of the Fed minutes.

It even fashioned a nice-looking double backside on the lows yesterday earlier than returning to the help/resistance stage. We all know that the USD/CAD has been one of many currencies that may assist us determine tops and bottoms within the S&P 500.

If the underside was certainly set yesterday, it may point out {that a} prime has been put in place for the S&P 500, we solely know with hindsight.

Nvidia Caught at $130

Lastly, the suspense builds for Nvidia (NASDAQ:), with earnings coming subsequent week. We are able to already see that the massive gamma stage for expiration throughout the week of August 30 is at $130, the identical as this week’s expiration. So, for now, that is still a key resistance stage.

Moreover, implied volatility (IV) for subsequent week is already over 80%, and likelihood is it is going to climb even greater as earnings method. This implies name choices will possible be inflated by IV heading into the occasion, suggesting that market makers may be over-hedged in opposition to the inventory shifting greater after the outcomes.

Authentic Submit