The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, has predicted that a depression and civil unrest are coming. He also warned of the stock and bond markets crashing.

Robert Kiyosaki on Markets Crashing, Depression, and Civil Unrest

The author of Rich Dad Poor Dad, Robert Kiyosaki, has issued more warnings about the U.S. economy. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

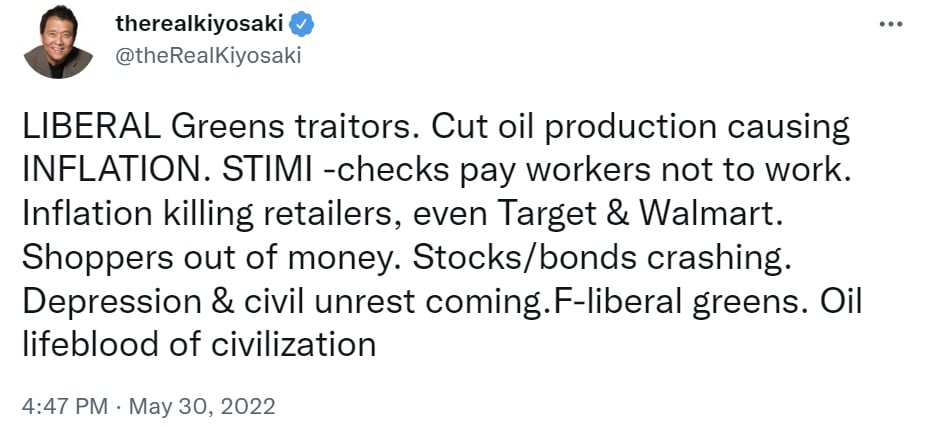

Kiyosaki claims that liberals and environmentalists are to blame for a reduction in oil production, which he said caused inflation, while stimulus checks paid workers not to work. Besides predicting that the stock and bond markets are crashing, he warned that a depression and civil unrest are coming.

The famous author also noted that inflation is killing retailers, even giant corporations like Target and Walmart, noting that shoppers are out of money. “Retailers are starting to reveal the impact of eroding consumer purchasing power,” Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, described earlier this month.

The Rich Dad Poor Dad author has been warning about an imminent depression for quite some time. In April, he cautioned that a depression and hyperinflation are here, advising investors to buy gold, silver, and bitcoin. On Friday, he tweeted:

Bad news. Depression coming.

In April, he explained that bonds are the riskiest investment in a global meltdown. “Tragically rookie investors follow rookie advice of 60 (stocks) 40 (bonds) mix,” he opined.

Earlier this month, he said he remained bullish on bitcoin and is planning to buy more BTC when the bottom is in. He expects it could be as low as $9K. The famous author wrote, “Bitcoin is the future of money.”

Kiyosaki also predicted earlier this year that the U.S. dollar is about to implode, stressing that the end of the dollar is coming. In March, he said we are in the biggest bubble in world history.

What do you think about Robert Kiyosaki’s warnings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons