[ad_1]

georgeclerk

Thesis

Republic Bancorp, Inc. (NASDAQ:RBCAA) is enhancing its core mortgage guide regardless of a decline in earnings from the warehousing line, and as charges proceed to rise, we will see a rise in internet earnings over the subsequent 12 months. Moreover, on a P/B foundation, RBCAA is undervalued in comparison with friends, leading to round a 15-30% upside within the inventory from present costs.

Intro

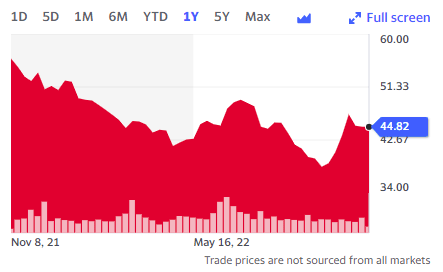

RBCAA is a regional financial institution based mostly in Louisville, Kentucky, with 42 braces providing conventional banking, warehouse loans, mortgage banking, and refund & credit score options. The corporate, regardless of being a financial institution and anticipated to achieve from larger rates of interest, has had depressed share worth efficiency over the previous 12 months, following the bear market of the S&P 500, presently sitting at round $45 USD.

SEC

(Supply: Yahoo Finance)

This share worth decline doesn’t mirror the outperformance of the corporate and the optimistic future outlook.

Monetary Evaluation

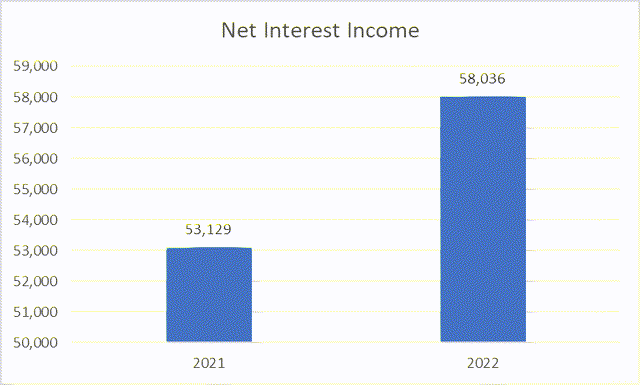

Primarily based on the corporate’s latest quarterly reviews (3 months ending September 2022), the corporate has gained from larger rates of interest in comparison with the earlier 12 months. For instance, whereas the entire mortgage guide decreased from $4.3bn to $4.2bn, internet curiosity earnings has been maintained.

SEC

(Supply: SEC)

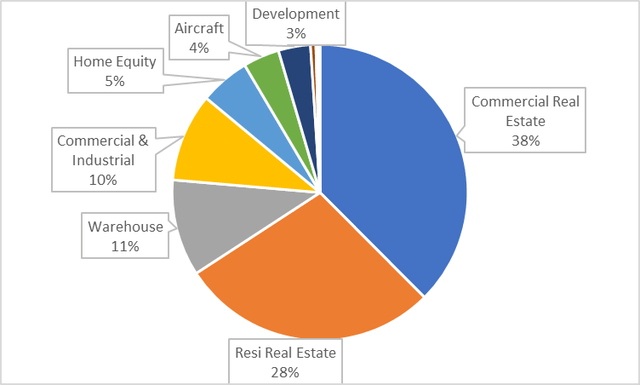

At present, the mortgage guide (as of September 2022) is properly diversified, with the vast majority of publicity from Business Actual Property and Residential Actual Property, adopted by Warehouse loans and Business/Industrial loans. The vast majority of the mortgage guide is predicted to carry out properly provided that rates of interest are on the rise. We will anticipate curiosity earnings to extend for Actual Property loans and Business loans. Nonetheless, the warehouse loans, regardless of the speed rise, may see a decline in revenues from lowered demand.

In regard to latest efficiency, general internet curiosity earnings for the quarter, internet curiosity earnings carried out properly, enhancing virtually 10% to succeed in $58m.

SEC

(Supply: SEC)

This was pushed by a strong efficiency from the standard banking phase, the core portfolio of loans that don’t embody the warehouse unit or the refund/credit score options. The phase elevated its internet curiosity earnings by 34% excluding PPP loan-related gadgets and elevated the online curiosity margin to three.62% for the standard banking unit.

Nonetheless, sadly, a few of these beneficial properties had been offset by a poor efficiency from the warehouse guide, the place there was a decline of 52% pushed by a lower in excellent balances from lowered mortgage refinancing demand because of the larger rates of interest. Whereas an rate of interest improve can enhance earnings for this phase, sadly, the lowered demand will offset this, so we will anticipate additional poor efficiency from this phase within the close to future whereas charges proceed rising and there’s lowered demand for mortgage loans. Fortunately warehousing loans are solely about 10% of the entire mortgage guide.

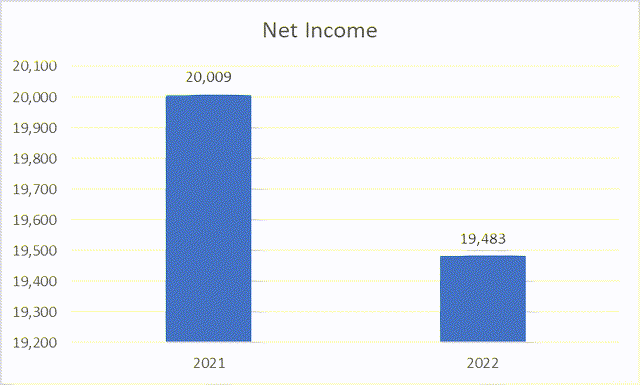

Whereas the biggest a part of the mortgage guide, from conventional banking, carried out properly, and improved internet curiosity margin from 3.61% to above 4%, internet earnings for the financial institution truly decline by just below -3%, from $20m to $19.5m

SEC

(Supply: SEC)

Which was pushed by poor efficiency from the non-interest earnings and bills phase. Non-interest earnings dropped by -20% and non-interest expense grew 4%, to $46m, a big portion of whole prices, amounting to virtually 80% of internet curiosity earnings within the quarter. This expense improve was pushed by inflationary pressures on basic expense gadgets, akin to salaries and overheads. Total, this has led to a static diluted EPS determine, which stays at $0.99.

Future Outlook

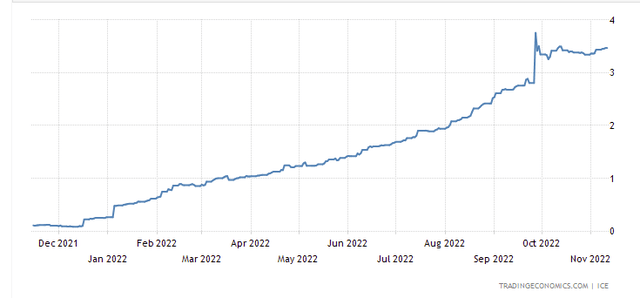

Now, as it is a financial institution, we will anticipate curiosity earnings to proceed rising as rates of interest proceed to extend, as proven by the 3-month LIBOR illustrated beneath.

Buying and selling Economics

(Supply: Buying and selling Economics)

The LIBOR is predicted to rise to above 5% subsequent 12 months, so we will see an extra enchancment in internet curiosity margin to doubtlessly larger than 5% subsequent 12 months if issues go easily.

Nonetheless, as a result of inflationary pressures, we will doubtlessly see non-interest bills proceed rising as properly, which can offset partial beneficial properties in curiosity earnings. Nonetheless, given the power of the portfolio, curiosity earnings ought to carry out properly, and internet earnings ought to enhance from its present degree.

Valuation

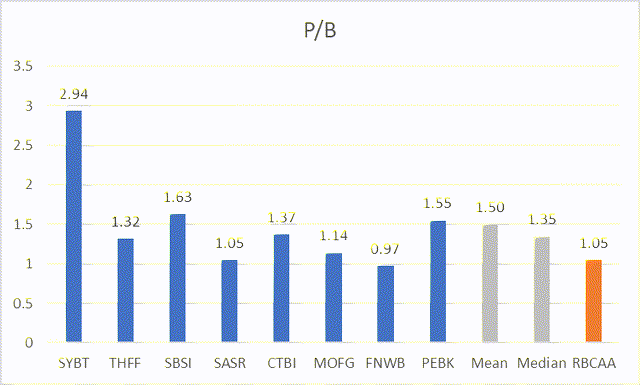

If we take a look at a set of peer group regional banks as comparable, we will perceive if RBCAA is undervalued on a price-to-book valuation

Yahoo Finance

(Supply: Yahoo Finance)

We perceive that the majority, if not all, these banks will profit from macro elements (ignoring micro degree elements), and achieve in curiosity earnings from larger charges (but in addition bills will rise from inflationary pressures)

Trying on the P/B comps, we will see that RBCAA is just barely undervalued in comparison with friends, giving a +15-30% potential upside. Not a big quantity, however nonetheless one thing and a sign of slight undervaluation.

Dangers

- The obvious threat can be no additional rises in rates of interest, which might cease the expansion in internet curiosity earnings. There can be additional harm if inflation had been to maintain rising, so prices would offset enhancements in earnings and result in an extra decline in internet earnings, and RBCAA would not be undervalued (or might result in them being overvalued)

- The second threat can be vital rises in non-interest bills as a result of additional inflationary pressures (akin to wage inflation), which might partially or totally offset beneficial properties in curiosity earnings. Nonetheless, it is a low threat.

- If comps had been to enhance their margins and hold their bills low in comparison with RBCAA (e.g. enhance income per department), then we may see outperformance of friends in comparison with RBCAA, as they might not be undervalued.

Conclusion

Total, RBCAA has benefited from the latest price rises of their core mortgage guide, however their warehouse line has suffered, and their non-interest bills have risen, resulting in a decline in general internet earnings. Regardless of this, curiosity earnings is predicted to proceed rising as rates of interest proceed to extend, which is able to finally result in an enchancment in internet earnings and EPS, anticipated subsequent 12 months. Trying on the comparability on a P/B valuation, RBCAA is undervalued in comparison with friends, subsequently, coupling this with an enchancment in internet earnings, RBCAA has the potential of a 15-30% upside from present costs.

[ad_2]

Source link