It’s been clear for a while that US recession danger has been sliding in latest months, however this week’s updates of a broadly adopted nowcast printed by the Atlanta Fed has been revised up – quite a bit – for the third quarter.

In line with this mannequin, the US economic system isn’t simply rolling alongside at a average tempo — it’s surging.

US output is on monitor to extend 5.8% in Q3 for the actual, seasonally adjusted annual charge, the GDPNow estimate for Aug. 16 reveals. That follows the day gone by’s sharply upgraded estimate of 5.0%.

If the present forecast for five.8% is correct, the economic system’s progress charge is ready to extra greater than double from Q2’s rise and can mark the strongest achieve since 2021’s This autumn.

One other nowcasting mannequin printed by Economic system.com additionally reveals a powerful pickup in Q3 progress. This Aug. 15 estimate signifies output will rise 4.0% within the present quarter. Whereas that’s far decrease than the GDPNow estimate, it nonetheless ranks as a strong acceleration in financial exercise.

Is it time to pop the champagne corks? Not but. Though this pair of nowcasts paint a bullish image for the economic system that breaks to the upside vs. latest historical past, nowcasting fashions may be risky, so incoming knowledge might rapidly reverse the newest upgrades in a flash.

The important thing query: How will different Q3 estimates fare within the days and weeks forward?

My most popular nowcast monitoring instrument is combining a number of estimates and monitoring the modifications, which is a extra strong methodology for nowcasting than counting on anybody mannequin.

On that notice, the pair of sharply upgraded nowcasts cited above have but to maneuver the needle in CapitalSpectator.com’s median estimate for the present quarter, which remains to be 2.0% for Q3 – unchanged from Tuesday’s replace.

US Actual GDP Change

It might prove that Q3 knowledge is strengthening, however that’s nonetheless a dicey proposition. A extra convincing signal could be if the median estimate within the chart above rises and, extra importantly, stays elevated over the following a number of weeks.

A extra convincing view for the time being is that the case for anticipating a recession to start out within the present quarter is nearly nil. This autumn and past are much less clear, but it surely’s truthful to say that the outlook for the close to time period is brighter.

Remember, too, that the Federal Reserve will probably be watching. If financial exercise is selecting up, that will translate into extra charge hikes to head-off situations that might revive inflation strain and reverse the latest run of disinflation.

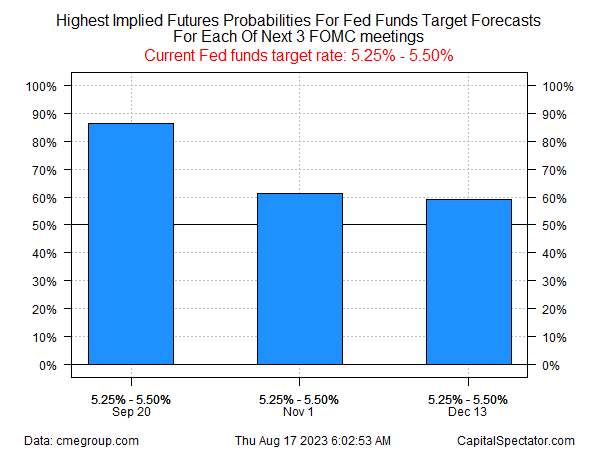

For the second, Fed funds futures are nonetheless pricing in excessive odds that the Fed will depart charges unchanged on the subsequent FOMC assembly on Sep. 20. Wanting additional out, nevertheless, it stays roughly a coin toss for anticipating charges to carry regular.

Fed Funds Futures Chances

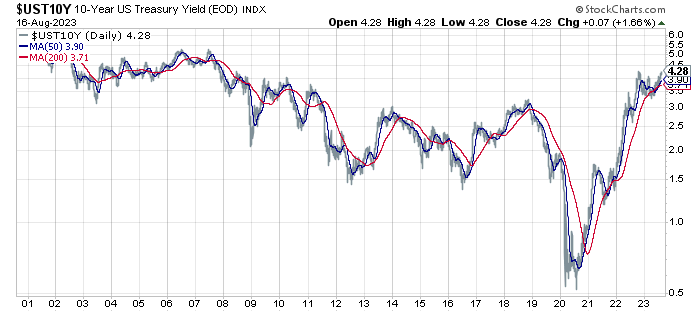

The bond market appears to be selecting up on the likelihood that progress could possibly be heating up and that the Fed could also be pressured to react. The policy-sensitive Treasury yield is buying and selling close to its excessive for the 12 months. In the meantime, the charge rose yesterday to a 15-year excessive.

Should you have been anticipating a quiet finish to the summer time on the macro entrance, now’s an excellent time to revise your forecast.