[ad_1]

Let’s assume we’re going to have a recession in 2023. I don’t know if we are going to, however everybody appears to assume so, so let’s simply say.

So what. What are you able to do to cease it? Not a lot. Can you modify your personal spending and psych your self as much as survive it? Completely. Are there modifications you would make to a portfolio with a purpose to gird your self for a worsening financial system? Sure. However do not forget that just about something you do to decrease your danger may even require accepting much less in return if the extensively prophesied financial slowdown doesn’t materialize. How a lot of this form of de-risking is price pursuing? Additionally, what if we’ve the recession however many of the related inventory market drawdown has already taken place? You’ll be able to’t know for certain.

All of those questions are why individuals rent monetary advisors – particularly, monetary planners. An authorized monetary planner can not inform you what’s coming, however they may also help you put together for the complete vary of outcomes in order that, it doesn’t matter what, you’ll nonetheless be on monitor for what you need to do financially sooner or later. We constructed the entire agency on this premise so you may take my phrase for it – that is the one factor that really issues.

I attempted to get these concepts throughout within the newest subject of Fortune Journal, the place they’d me again as a member of the year-end roundtable / look forward. It was me, one other advisor / RIA founder named Georgia Lee Hussey and the unbelievable Savita Subramanian (fairness and quant strategist for BofA previously generally known as Merrill Lynch).

It begins off with us being requested about how 2022 went for many buyers. I’d wager only a few individuals would decide to dwell by way of the final eleven months ever once more. It was the worst begin to a yr for inventory and bond buyers ever recorded. There have been some issues you would have carried out to keep away from among the ache, however nobody averted all of it…

Josh Brown: Our tactical mannequin is designed to react rapidly when it turns into statistically clear that we’re not in a bull market. So by the tip of February, we have been fully out of the Nasdaq. And by the tip of April, we have been fully out of the S&P 500.

It’s not your complete portfolio; it’s one particular technique in a much bigger portfolio. However that addresses the shoppers’ considerations as they see these decrease highs and decrease lows. And it offers us the choice to purchase again in later. With the large caveat of: We received’t name the market backside—we are going to most probably be considerably off the lows when that purchase sign will get triggered. That’s how technical evaluation works; it’s backward-looking.

If you wish to learn what we needed to say in regards to the coming yr on-line, the paywall free model is right here.

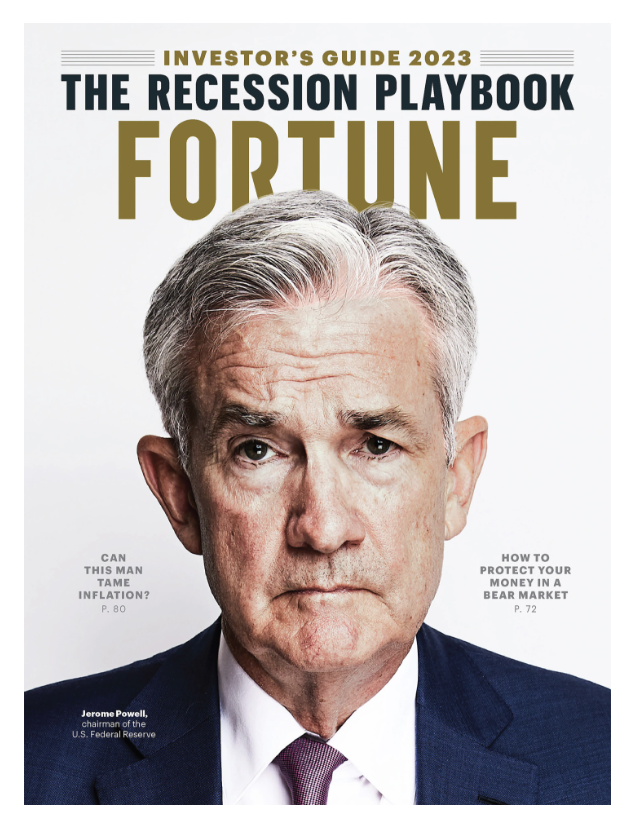

Or, if you wish to seize the print version, it appears to be like like this with Jay Powell on the quilt:

Thanks for checking it out!

And in the event you’re not feeling ready for the approaching yr otherwise you need somebody to speak to about it, let’s chat. Licensed Monetary Planners at my agency are standing by. That is what we do.

[ad_2]

Source link